Our Verdict

You Need A Budget (YNAB) distinguishes itself as a robust budgeting tool that enables you to manage your finances effectively through its zero-based budgeting system and envelope method. With a focus on proactive budget control, YNAB asserts it can help you save over $600 within the first two months and potentially up to $6,000 in the first year, making it a valuable investment for individuals dedicated to improving their financial habits.

Despite its higher cost and learning curve, the app’s comprehensive features, including real-time sync, goal tracking, and a 34-day free trial, garners commendation and placement on Forbes Advisors’ Best Budgeting Apps list.

Nonetheless, you need to anticipate hands-on management and the absence of features such as bill tracking, which can limit its appeal to you if you prefer a more automated or varied budgeting method.

Pros

- Empowers you to take control of your finances through zero-based budgeting.

- Provides a structured envelope method for effective budget management.

- Claims to help you save significant amounts within the first few months.

- Offers comprehensive features including real-time sync and goal tracking.

- Includes a 34-day free trial for users to test its effectiveness.

Cons

- Comes with a higher price point compared to some other budgeting tools.

- Requires a steep learning curve for new users to fully utilize its features.

- Demands hands-on management, which may not suit those seeking automation.

- Lacks features such as bill tracking, potentially limiting its appeal to some users.

Who YNAB Budgeting App Is Best For

Choose YNAB if you’re someone who:

- Looks to take control of your finances

- Has an interest in zero-based budgeting

- Commits to proactive budget management

- Wants to invest time in learning a new budgeting system

- Seeks comprehensive budgeting features

Who YNAB Budgeting App Isn’t Right For

Opt for other alternatives if you’re someone who:

- Prefers a completely automated budgeting approach.

- Seeks a budgeting tool with built-in bill tracking features.

- Is not willing to invest time in learning a new budgeting system.

- Does not prioritize actively managing your finances.

- Looks for a budgeting tool with a lower price point

What YNAB Budgeting App Offers

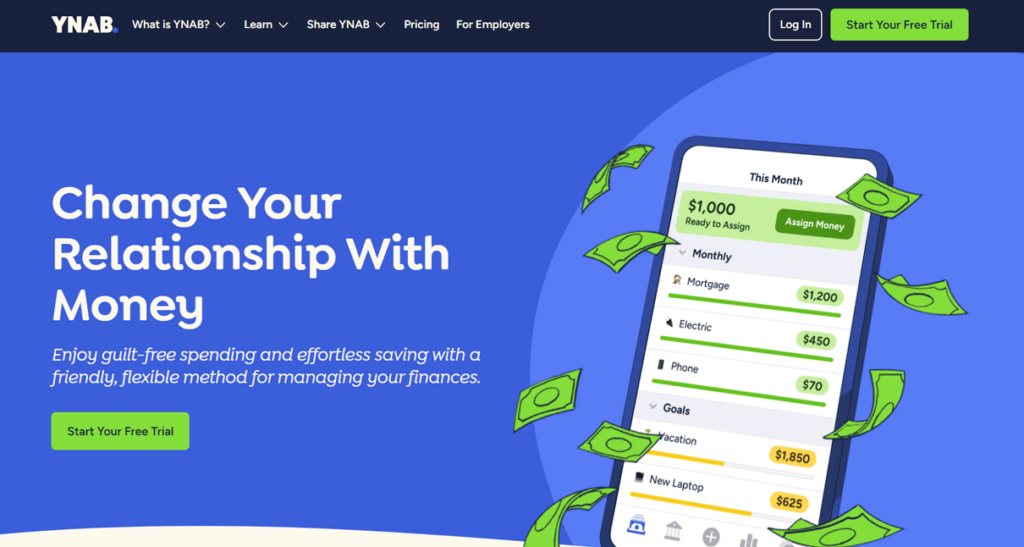

YNAB (You Need A Budget) is a budgeting app that focuses on helping you take control of your money and achieve your financial goals. It offers you a robust set of features including:

Zero-based budgeting

This is a core principle of YNAB. You assign every dollar of your income to a specific category, ensuring it covers all your expected expenses and savings goals. This approach forces you to be intentional about your spending.

Goal setting

YNAB allows you to set specific savings goals, like a dream vacation or a down payment on a house. You can then track your progress towards these goals and see how your budget decisions are impacting them.

Debt payoff

The app helps you develop a plan to tackle debt by showing you how much extra you can put towards your balances each month. It can also calculate the potential time and interest saved with increased payments.

Expense tracking

YNAB allows you to categorize your transactions and see where your money is going. This can help you identify areas where you can cut back and free up more money for your goals.

Sharing with partners

Up to six people can share a single YNAB budget, which is useful for couples or families working towards common financial goals.

Reporting

YNAB provides reports on your spending habits, net worth, and income versus expenses. This data can help you gain valuable insights into your financial health.

Mobile app and web access

YNAB is available on iOS, Android, and web browsers, allowing you to manage your budget from anywhere.

YNAB Budgeting App Details

You Need A Budget (YNAB) is a budgeting app that helps you take control of your finances. It works on the principle of zero-based budgeting, meaning every dollar you earn is assigned a specific job or category. Think of it like putting cash into separate envelopes for different expenses.

With YNAB, you have access to tools to track your spending, set savings goals, and prioritize your expenses. The app syncs in real-time across multiple devices, so you can always stay up-to-date with your budget.

Keep in mind that YNAB operates on a subscription model, so you need to pay a monthly or annual fee. But the investment is worth it due to the financial empowerment and support it provides.

Plus, there’s a whole community of users ready to offer advice and support as you work towards your financial goals. So if you’re ready to take control of your money, YNAB can be the tool for you.

Here’s the breakdown of YNAB pricing:

- Monthly Plan: $14.99 per month.

- Annual Plan: $99 paid annually, which comes to about $8.25 per month, offering a significant saving compared to the monthly plan.

Remember, the software offers you a 34-day free trial for you to experience its features if you’re a new user.

Where YNAB Budgeting App Stands Out

YNAB stands out in several ways:

Zero-Based budgeting

It adopts a zero-based budgeting approach, ensuring every dollar you earn has a specific purpose, leaving no room for financial ambiguity or waste.

Envelope method

By using the envelope method, YNAB helps you allocate funds to different spending categories, mirroring the traditional method of putting cash into envelopes for various expenses.

Proactive financial management

YNAB encourages proactive financial management by providing tools and resources to track spending, set goals, and prioritize expenses, empowering you to make the right financial decisions.

Real-time sync

The app offers real-time synchronization across multiple devices, ensuring you have access to your budgeting information whenever and wherever you need it, promoting seamless budget management.

Educational resources

YNAB provides comprehensive educational resources, including tutorials, webinars, and support articles, to help you understand and maximize the benefits of the YNAB system, facilitating continuous learning and improvement.

>>>PRO TIPS: The Ultimate Medical Expense Deductions Checklist

Where YNAB Budgeting App Falls Short

YNAB stands out in many ways. However, consider the factors below before deciding to choose the app:

Steep learning curve

YNAB has a relatively steep learning curve compared to some other budgeting apps. You’re likely going to find it challenging to grasp the zero-based budgeting system and envelope method, requiring time and effort to fully understand and utilize the app’s features effectively.

Hands-on management

The app requires active and hands-on management of your budget. Unlike some other budgeting tools that offer more automation, YNAB demands regular manual input and adjustment of budget categories, which may not suit you if you prefer a more hands-off approach to budgeting.

Higher price point

YNAB comes with a higher price point. While it offers a 34-day free trial, you need to subscribe to a monthly or annual plan to continue using the app, which may not be feasible for you if you’re on a tight budget or if you’re looking for a more cost-effective solution.

Lack of built-in bill tracking

Unlike some competing budgeting apps, YNAB does not offer built-in bill tracking features. Are you looking for a tool to automatically track and manage your bills alongside your budget? Kindly look elsewhere.

Limited diverse budgeting approaches

While YNAB excels in zero-based budgeting, it doesn’t offer as diverse a range of budgeting approaches as some other tools.

How to Qualify for YNAB Budgeting App

To use the YNAB budgeting app, there are no specific qualification requirements in terms of income, credit score, or financial status. However, there are some practical considerations and prerequisites:

- Device compatibility: Ensure that you have a compatible device (such as a smartphone, tablet, or computer) with an internet connection to download and access the YNAB app.

- Payment method: You need a valid payment method (credit card, debit card, or PayPal account) to sign up for the YNAB subscription after the free trial period ends.

- Budgeting mindset: While not a strict requirement, having a willingness to actively engage with your finances and adopt a proactive budgeting mindset is going to significantly enhance your experience with YNAB.

- Budgeting goals: It’s helpful to have clear financial goals or objectives that you want to achieve using the app, whether it’s paying off debt, saving for a specific purchase, or building an emergency fund.

- Time commitment: Be ready to invest time in learning how to use the YNAB app effectively, especially if you’re new to budgeting or unfamiliar with zero-based budgeting principles.

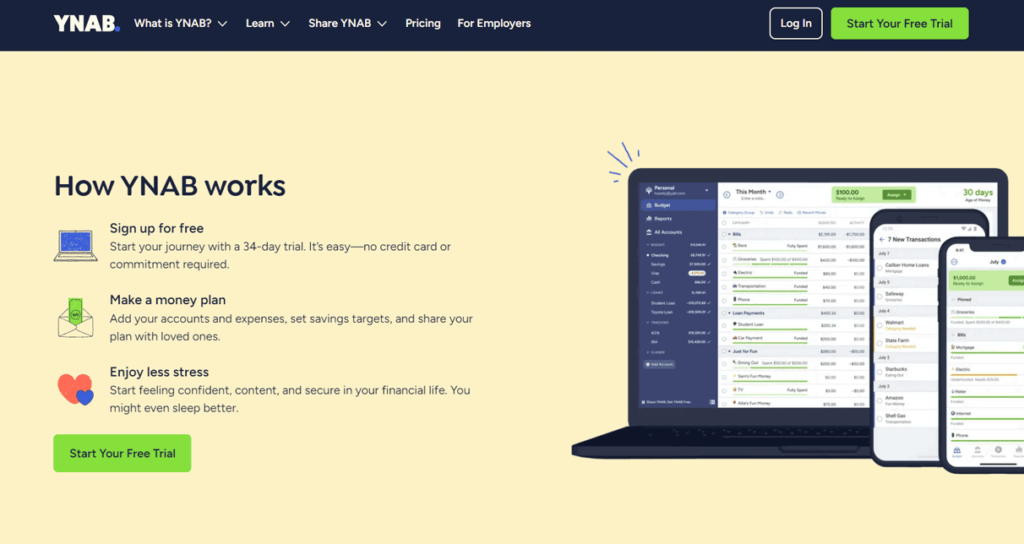

How to Apply for YNAB Budgeting App

To apply for the YNAB budgeting app, follow these steps:

- Visit the website: Go to the YNAB website (ynab.com) using a web browser on your computer or mobile device.

- Start free trial: Look for the option to start a free trial on the website’s homepage or pricing page. Click on the “Start Free Trial” button.

- Create an account: You’re going to get a prompt to create an account by providing your email address and creating a password. Alternatively, you have the option to sign up using your Google or Apple account.

- Download the app: After creating your account, download the YNAB app on your device. You can find the app on the Apple App Store for iOS devices or the Google Play Store for Android devices. You can also access YNAB via a web browser on your computer.

- Set up your budget: Once you download the app, follow the on-screen instructions to set up your budget. This typically involves entering your income, expenses, and financial goals.

- Start budgeting: Once your budget is set up, you can start using the YNAB app to track your spending, allocate funds to different categories, and work towards your financial goals.

- Subscribe: After the free trial period (usually 34 days), you need to subscribe to a paid plan to continue using the app.

- Enjoy the features: Explore the various features of the YNAB app, such as real-time syncing, goal tracking, and reporting tools, to help you manage your finances effectively.

Alternatives to YNAB Budgeting App

EveryDollar

EveryDollar is a budgeting app that the personal finance expert Dave Ramsey created and designed to help you take control of your finances through the principles of zero-based budgeting.

With EveryDollar, you can create monthly budgets by allocating every dollar to specific categories, ensuring that no money goes unaccounted for. The app allows users to track your expenses, monitor your spending habits, and adjust your budgets as needed.

EveryDollar offers both free and paid versions, with the paid version providing additional features such as bank account syncing, customized budget reports, and priority customer support. Available on both iOS and Android platforms, EveryDollar provides a user-friendly interface and intuitive budgeting tools to empower you on your financial journey.

PocketGuard

PocketGuard is a comprehensive personal finance app that helps you manage your money effectively. With PocketGuard, you can link your bank accounts, credit cards, loans, and investments to get a holistic view of your financial situation in one place. The app automatically categorizes transactions, tracks spending, and identifies opportunities to save money. PocketGuard also provides personalized budgeting recommendations based on users’ income, bills, and financial goals, making it easy to create and stick to a budget.

Additionally, the app offers features such as bill tracking, subscription monitoring, and savings goals to help you stay on top of your finances and make informed financial decisions.

With its intuitive interface and proactive approach to financial management, PocketGuard empowers you to take control of your finances and achieve your financial goals.

>>>GET SMARTER: Best Credit Cards for Home Improvement

Customer Reviews

YNAB receives an excellent rating of 4.7 out of 5-star based on 1,774 customer reviews on TrustPilot. The reviews are overwhelmingly positive as happy customers praise the app for its quality of service, simplifying budgeting, useful tools, and so on. Users also commend the app for changing their financial well-being positively.

Pro Tips

- Set realistic goals: Before diving into budgeting, take some time to identify your financial goals, whether it’s paying off debt, saving for a vacation, or building an emergency fund. Use your budgeting app to set specific, measurable, achievable, relevant, and time-bound (SMART) goals to keep you motivated and focused on your objectives.

- Track your spending: Make it a habit to regularly track your spending within the budgeting app. Categorize transactions accurately and review your spending patterns to identify areas where you can cut back or reallocate funds. This awareness helps you make the right financial choice and stay within your budget.

- Utilize automation features: Take advantage of automation features offered by your budgeting app, such as recurring expense tracking, bill reminders, and savings goals. Automating routine tasks can save you time and ensure that you stay on top of your finances without having to manually input every transaction.

- Review and adjust regularly: Budgeting is not a one-time task but an ongoing process. Set aside time each week or month to review your budget, track your progress towards your goals, and make any necessary adjustments. Life circumstances and financial priorities may change, so be flexible and adapt your budget accordingly.

- Stay consistent and accountable: Consistency is key to successful budgeting. Make a habit of regularly updating your budgeting app, sticking to your spending limits, and holding yourself accountable for your financial decisions. Consider sharing your budgeting goals with a friend, family member, or accountability partner to help stay motivated and accountable for your financial progress.

Recap

You Need A Budget (YNAB) app is your go-to solution for taking charge of your finances and reaching your financial goals. With YNAB, you assign every dollar you earn a specific purpose, ensuring that your money works for you in the most effective way possible. While there is a learning curve initially, the app’s robust features, including real-time sync and goal tracking, guide you toward financial success.

Remember, investing in YNAB is an investment in your future financial well-being, so don’t let the price point deter you.

With dedication and commitment, you’re going to find that YNAB is an invaluable tool for transforming your financial habits and securing your financial future.

No Comment! Be the first one.