Are you a young adult starting your career, earning income from various sources, or even embarking on entrepreneurial ventures? Filing taxes may not be the most exciting task, but it is an essential responsibility that you need to understand and undertake.

This guide provides a comprehensive step-by-step overview of the tax-filing process specifically tailored to young adults like yourself. By mastering the tax-filing process early on, you gain valuable financial literacy skills that can greatly benefit you throughout your life.

To File Taxes If You’re Young Adult:

- Determine Your Filing Status

- Gather All Required Documents

- Understand Your Income

- Determine Your Eligible Deductions and Credits

- Choose the Right Tax Preparation Method

- Complete Your Tax Return

- Review and Submit Your Tax Return

- Follow Up and Stay Informed

Eager to read? Let’s go.

Lodge, report, submit, declare and file

1. Determine Your Filing Status

To declare taxes if you’re young adult, determine your filing status.

When it comes to filing taxes, the initial and crucial step is defining your filing status, as it dictates your tax rates and eligible deductions. Here are the various filing statuses and the criteria to guide you in selecting the most fitting one based on your unique circumstances.

- Single: If you are unmarried, legally separated, or divorced, you typically fall into the “Single” filing status. This applies when no other filing status qualifications are met, commonly fitting young adults who aren’t married.

- Head of Household: The “Head of Household” status is for unmarried individuals providing a home for a qualifying dependent. This is relevant for those financially responsible for a child or another dependent family member. To qualify, you must have contributed more than half the cost of maintaining a home for yourself and the dependent.

- Married Filing Jointly: For married individuals opting to file a joint tax return with their spouse, the “Married Filing Jointly” status is used. This combines both spouses’ income and deductions on a single tax return, with joint responsibility for accuracy and tax payment.

- Married Filing Separately: Alternatively, if married individuals prefer separate tax filings, the “Married Filing Separately” status is an option. This might be chosen for reasons like keeping finances distinct or expecting a lower tax liability. However, filing separately may limit specific tax benefits and deductions.

While determining your filing status may seem straightforward, careful consideration of factors such as marital status, dependents, and financial responsibilities is essential.

Choosing the right filing status is pivotal for your tax return, laying the groundwork for precise calculations, eligible deductions, and compliance with tax regulations.

If uncertain about your filing status, the IRS offers the Interactive Tax Assistant on its website, guiding you through questions to determine the correct filing status based on your circumstances.

>>>MORE: How to File Taxes If You’re Single

2. Gather All Required Documents

To lodge taxes if you’re young adult, gather all required documents.

When preparing to file your taxes, the initial step is gathering all the required documents. The following checklist outlines crucial documents to compile before commencing the tax-filing process:

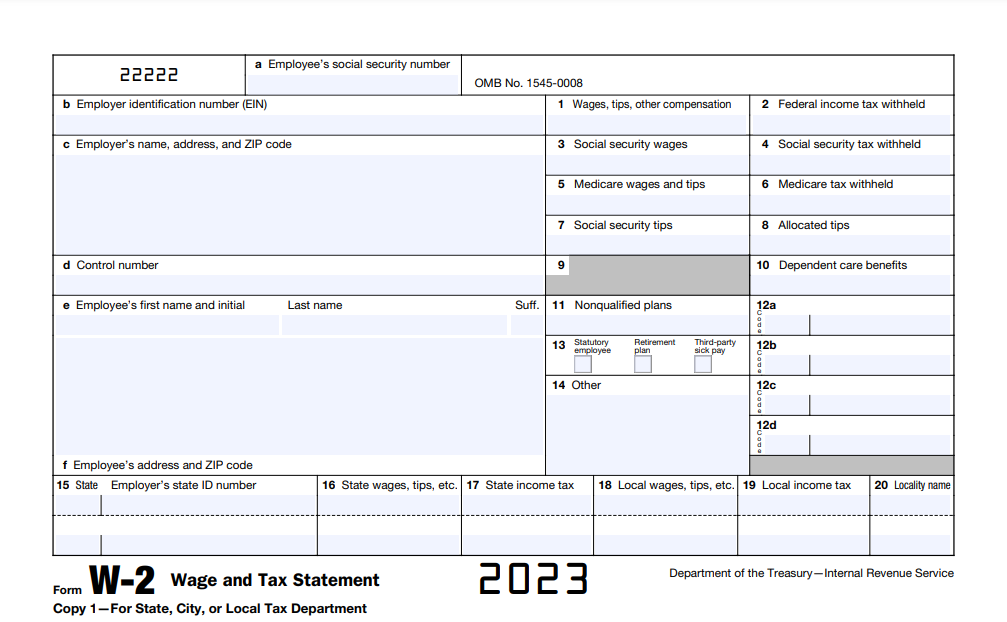

- W-2 Forms: Obtain W-2 forms from every employer, summarizing earnings and tax withholdings. Collect all relevant W-2 forms for accurate income reporting.

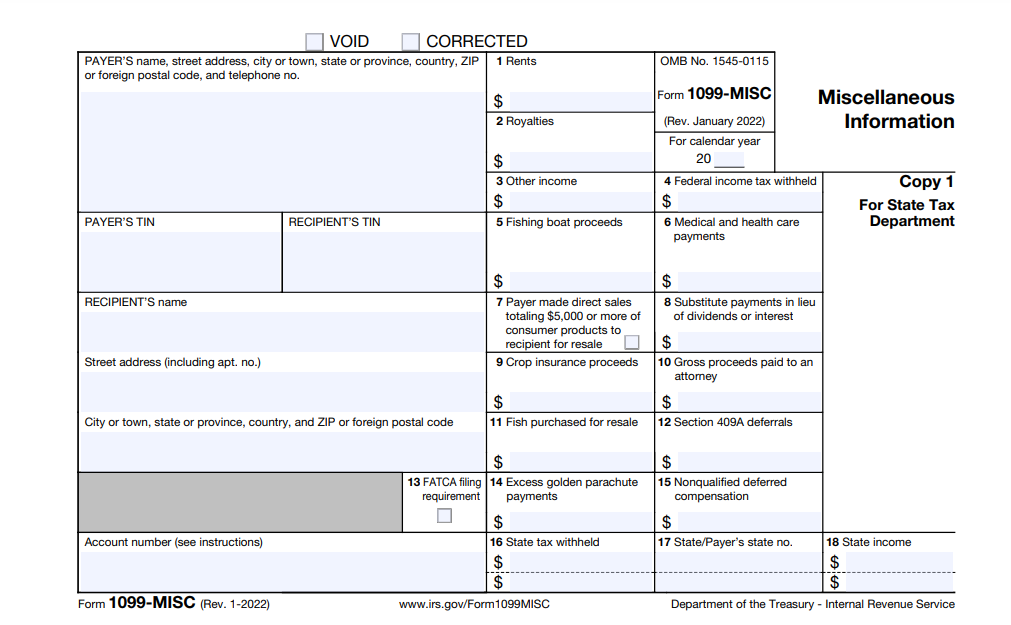

- 1099 Forms: If you earned income from freelance work, self-employment, or other sources, gather applicable 1099 forms, such as 1099-MISC or 1099-INT, reporting additional income.

- Income Statements: Include statements from investments, rental properties, or other income sources to ensure a comprehensive overview of your total income.

- Expense Records: For deductible expenses like business or education-related costs, compile supporting documents like receipts or invoices to substantiate your claims.

- Proof of Health Insurance: If you had health coverage, gather relevant documents (e.g., Form 1095-A, 1095-B, or 1095-C) as proof of insurance throughout the tax year.

- Social Security Number (SSN) or Employer Identification Number (EIN): Have your SSN or EIN readily available for accurate identification in your tax return.

Organize these documents efficiently before starting the tax-filing process to facilitate accurate income reporting, deduction claims, and compliance with tax laws. Establish a dedicated folder, both physically and electronically, categorizing documents by type and year for easy access during tax filing.

By methodically collecting and organizing essential documents, you set the groundwork for a smooth and accurate tax-filing experience.

3. Understand Your Income

To submit taxes if you’re young adult, understand your income.

As a young adult, it’s important to understand the different types of income you may have and how to accurately calculate and report each type when filing your taxes. Here are the main types of income you should be aware of:

Wages and Salaries: If employed, your income likely comes as wages or salaries. Your employer issues a W-2 form, summarizing earnings and tax withholdings. When reporting, refer to your W-2 for precise details.

Freelance or Self-Employment Income: Self-employed individuals, freelancers, or business owners receive income differently. Track self-employment income and expenses, using 1099-MISC or related 1099 forms. Forms like Schedule C or Schedule C-EZ help calculate net profit or loss.

Investment Income: Income from investments, like dividends, interest, or capital gains, requires accurate reporting. Various forms, such as 1099-DIV for dividends or 1099-INT for interest, assist in reporting investment income.

Rental Income: Owners of rental properties must report rental income and related expenses. Utilize Schedule E to accurately report this income and associated deductions.

Other Income: Report additional income sources, such as side gigs, royalties, or alimony, to adhere to tax laws. Thoroughly review and report all income sources for compliance.

To report each income type accurately, gather relevant documents—W-2s, 1099s, and income statements. Enter these amounts in the appropriate sections of your tax return. If self-employed, use forms like Schedule C for accurate calculations.

4. Determine Your Eligible Deductions and Credits

To file taxes if you’re young adult, determine your eligible deductions and credits.

For young adults entering the realm of tax filing, grasping deductions and credits is pivotal. These provisions have the potential to lower your tax burden and increase your refund. Here’s an exploration of deductions and credits, including some common ones applicable to your situation.

Deductions: Deductions encompass expenses or amounts subtracted from your total income, diminishing the income subject to taxation. There are two types: standard and itemized.

- Standard Deduction: A fixed amount reducing taxable income, available to all taxpayers. It eliminates the need for itemizing. In 2023, for single filers, the standard deduction is $12,950.

- Itemized Deductions: Allow deduction of specific expenses incurred during the tax year, such as state and local taxes, mortgage interest, medical expenses, and charitable contributions. Accurate record-keeping is vital for supporting itemized deductions.

Credits: Tax credits directly reduce the amount of tax owed, providing a dollar-for-dollar reduction in tax liability. Common credits for young adults include:

- Student Loan Interest Deduction: Enables deduction of up to $2,500 of interest paid on qualifying student loans, reducing taxable income.

- Education Credits: The American Opportunity Credit (AOTC) and Lifetime Learning Credit (LLC) offset higher education expenses. AOTC offers a maximum credit of $2,500 per eligible student, while LLC provides up to $2,000 per tax return.

- Earned Income Tax Credit (EITC): A refundable credit aiding low-to-moderate-income individuals and families. Eligibility depends on earned income, filing status, and qualifying dependents.

To claim these deductions and credits:

- Review criteria and requirements for each deduction or credit to ensure qualification.

- Collect necessary documents like student loan interest statements or tuition statements (Form 1098-T).

- Use appropriate tax forms, such as Schedule A for itemized deductions or Form 8863 for education credits.

- Follow instructions to calculate the eligible deduction or credit, considering any income-based limitations.

- Transfer the calculated amount to the designated section, ensuring accuracy.

Understanding and utilizing deductions and credits can potentially reduce your tax liability and enhance your refund. Explore available options to ensure you capitalize on valuable tax benefits.

>>>PRO TIPS: How to File Taxes If You’re Married

5. Choose the Right Tax Preparation Method

To report taxes if you’re young adult, choose the right tax preparation method.

When preparing and filing your taxes, it’s essential to choose the right tax preparation method that suits your needs. Tax software, available both online and offline, offers convenience, accuracy, and cost-effectiveness—especially for those with straightforward tax situations. It guides you through the process, minimizing errors and ensuring you don’t miss important details.

Hiring a tax professional, such as a CPA or EA, is beneficial for complex situations, providing expertise, personalized advice, and support during audits. If you prefer a more traditional approach, filing by paper can be straightforward for simple tax situations, offering a tangible process.

Consider your comfort with technology, the complexity of your taxes, and your budget when deciding on the most suitable method. If in doubt, consulting with a tax professional can provide personalized guidance based on your circumstances.

6. Complete Your Tax Return

To declare taxes if you’re young adult, complete your tax return.

Completing your tax return may feel overwhelming, but here’s a simplified guide based on your chosen method: tax software, hiring a professional, or filing by paper.

- Gather Information: Collect essential documents—SSN, W-2s, 1099s, and records of deductions or credits.

- Enter Personal Information: Input accurate details like name, address, and SSN.

- Report Income: Use tax software prompts for W-2s or 1099s. For instance, input wages from multiple jobs separately.

- Claim Deductions and Credits: Utilize available deductions and credits, such as the Student Loan Interest Deduction or Education Credits. Follow software prompts or form instructions. Say, if you paid student loan interest in the tax year, enter the details as guided by the software or tax forms to benefit from the student loan interest deduction.

- Calculate Tax Liability: Let the software or professional calculate your tax liability. For paper filers, follow provided instructions.

- Review and Submit: Double-check all details, including personal information, income, deductions, and credits. Software often includes a review process.

- File and Pay: Follow instructions to file. Pay owed taxes by the deadline to avoid penalties.

Remember, specifics may vary. If uncertain, consult your tax software, a professional, or official tax resources. Despite initial complexity, accurate completion ensures compliance and potential benefits.

7. Review and Submit Your Tax Return

To lodge taxes if you’re young adult, review and submit your tax return.

After completing your tax return, carefully review it to ensure accuracy before submission. Check:

- Personal Information: Verify your name, address, and SSN for accuracy to prevent delays.

- Income Reporting: Ensure reported income aligns with W-2s, 1099s, and other statements.

- Deductions and Credits: Confirm accurate claims for student loan interest, education credits, etc.

- Mathematical Accuracy: Double-check calculations for precision, especially if filing manually.

- Signatures: Sign and date paper returns; follow electronic signing instructions for digital submissions.

- Attachments: Include required supporting documents if filing by paper.

For Submission:

- Electronic Filing: Use tax software guidance for secure and efficient electronic submission.

- Mailing a Paper Return: If filing manually, send your return and attachments to the correct address via certified mail.

Retain copies of your return and documents for future reference. This meticulous approach ensures tax law compliance and minimizes potential errors or delays.

8. Follow Up and Stay Informed

To file taxes if you’re young adult, follow up and stay informed.

After filing your taxes, ensure a smooth process with these steps:

- Track Your Return: If filed electronically, use the IRS “Where’s My Refund?” tool to monitor its status. Be patient with paper returns.

- Monitor Refund: Keep an eye on your expected refund, verifying accurate direct deposit information through the same tool.

- Stay Updated on Tax Laws: Regularly check the IRS website or consult tax professionals to stay informed about any changes affecting future filings.

- Note Important Deadlines: Mark April 15th and state-specific deadlines on your calendar to avoid penalties.

- Maintain Records: Keep copies of returns, W-2s, 1099s, receipts, and other documents for future reference or potential audits.

- Seek Professional Help: If facing complexities or major life changes, consider consulting a tax professional for personalized guidance.

Remember that specifics can vary, so refer to official IRS resources for accurate information. By staying proactive and informed, you can navigate future tax obligations confidently.

>>>GET SMARTER: How to File Taxes If You’re Senior

Conclusion

Exploring the tax landscape as a young adult can be less daunting with these key steps. Begin by understanding your filing status—Single, Head of Household, Married Filing Jointly, or Married Filing Separately—ensuring it accurately reflects your situation.

Gather essential documents, including W-2 and 1099 forms, income statements, and proof of health insurance.

Learn to differentiate your income sources, such as wages, freelance earnings, investment income, and rental income. Identify eligible deductions and credits, like student loan interest, education credits, or the Earned Income Tax Credit, to optimize your tax liability.

Finally, choose a tax preparation method—software, professional assistance, or paper filing—that aligns with your situation and comfort level, ensuring a smooth and informed tax-filing experience.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. . For comprehensive tax, legal or financial advice, always contact a qualified professional in your area. S’witty Kiwi assumes no liability for actions taken in reliance upon the information contained herein.

No Comment! Be the first one.