Are you married and feeling overwhelmed by the process of filing taxes? If so, you’re not alone. Filing taxes as a married couple can be complicated, but this comprehensive guide will help simplify the process. Read this article to know the step-by-step process of filing your taxes, from determining your filing status to selecting the appropriate tax forms.

Whether you’re filing jointly or separately, we’ll cover everything you need to know to navigate the intricacies of filing taxes as a married individual or couple. So, let’s dive in and ensure you’re equipped with the knowledge and confidence to tackle your taxes together.

How to File Taxes If You’re Married:

- Determine Your Filing Status

- Gather the Necessary Documents

- Choose the Appropriate Tax Forms

- File Electronically or by Mail

- Understand the Potential Tax Deductions and Credits for Married Couples

- Know Common Mistakes to Avoid

Excited? Let’s go!

1. Determine Your Filing Status

To file taxes if you’re married, determine your filing status.

Choosing your filing status is a critical first step when filing taxes as a married individual or couple. The main options for married couples are “Married Filing Jointly” and “Married Filing Separately.”

Married Filing Jointly: This status allows married couples to combine incomes and deductions on a single tax return. To qualify, you must be legally married by the last day of the tax year.

Advantages:

- Lower Tax Rates: Joint filing often results in lower tax rates, potentially leading to tax savings.

- Increased Standard Deduction: Couples filing jointly benefit from a higher standard deduction. For example, in 2023, the standard deduction for joint filers is $27,700, while for separate filers it is $13,850 each.

- Eligibility for Tax Credits: Certain tax credits, like the Child Tax Credit and Earned Income Tax Credit, are more accessible when filing jointly.

Disadvantages:

- Joint and Several Liability: Both spouses share equal responsibility for the accuracy of the return and potential tax liabilities.

- Loss of Certain Deductions: Some deductions or credits available to separate filers may be limited.

To determine if filing jointly is the best option for you, consider the following factors:

- Income Disparity: If there is a significant difference in income between you and your spouse, filing jointly may provide more tax benefits.

- Shared Financial Responsibilities: If you and your spouse share financial obligations and assets, filing jointly may simplify the process by consolidating your tax situation.

- Open Communication: Discuss your individual financial situations and tax implications with your spouse to make an informed decision together.

Married Filing Separately: Each spouse files a separate return, reporting individual incomes, deductions, and credits. Legal marriage by the last day of the tax year is the only requirement.

Advantages:

- Individual Liability: Each spouse is responsible for their own return accuracy and liabilities.

- Preserving Deductions: May allow specific deductions or credits not available when filing jointly.

Disadvantages:

- Higher Tax Rates: Filing separately may result in higher tax rates, potentially increasing tax liability.

- Restricted Eligibility: Some deductions and credits may have limitations for separate filers.

- Potential Loss of Benefits: Certain tax benefits may be unavailable when filing separately.

Consider the following factors when deciding whether filing separately is the best option for you:

- Financial Independence: If you and your spouse have separate financial lives, filing separately may better reflect your individual financial situations.

- Legal or Financial Concerns: If you have concerns about your spouse’s tax reporting accuracy or legal issues, filing separately can help protect your interests.

- Consultation with a Tax Professional: If you are uncertain about which filing status is most advantageous for your specific circumstances, seeking advice from a tax professional can provide valuable insights.

Remember, it’s important to evaluate your unique financial situation and consider both the advantages and disadvantages of each filing status before making a decision.

2. Gather the Necessary Documents.

To submit taxes if you’re married, gather the necessary documents.

For a seamless tax filing process, collecting all the necessary documents is crucial. Here’s a breakdown of the documents required when filing taxes as a married individual or couple:

- Social Security Numbers: Provide you and your spouse’s Social Security numbers for accurate identification and income reporting.

- Full Names and Addresses: Include your complete legal names and current addresses on the tax return for communication purposes with tax authorities.

- W-2 Forms: Collect all W-2 forms from employers, reporting wages, salaries, and withheld taxes.

- 1099 Forms: Gather any 1099 forms for additional income sources like freelance work or investments.

- Statements of Interest: If you earned interest from bank accounts, gather statements reflecting the earned interest.

- Self-Employment Documentation: For self-employed individuals, compile invoices, receipts, and expense records for accurate income reporting and eligible deductions.

Deductions and Credits:

- Itemized Deduction Receipts: If itemizing deductions, gather receipts for expenses like mortgage interest, property taxes, medical costs, and charitable contributions.

- Educational Expense Records: Collect documents such as tuition statements (Form 1098-T) or student loan interest statements (Form 1098-E) for education-related deductions or credits.

- Tax Credit Documentation: For eligible tax credits, like the Child and Dependent Care Credit or Earned Income Tax Credit, gather relevant information such as Social Security numbers of children and records of childcare expenses.

3. Choose the Appropriate Tax Forms

To report taxes if you’re married, choose appropriate tax forms.

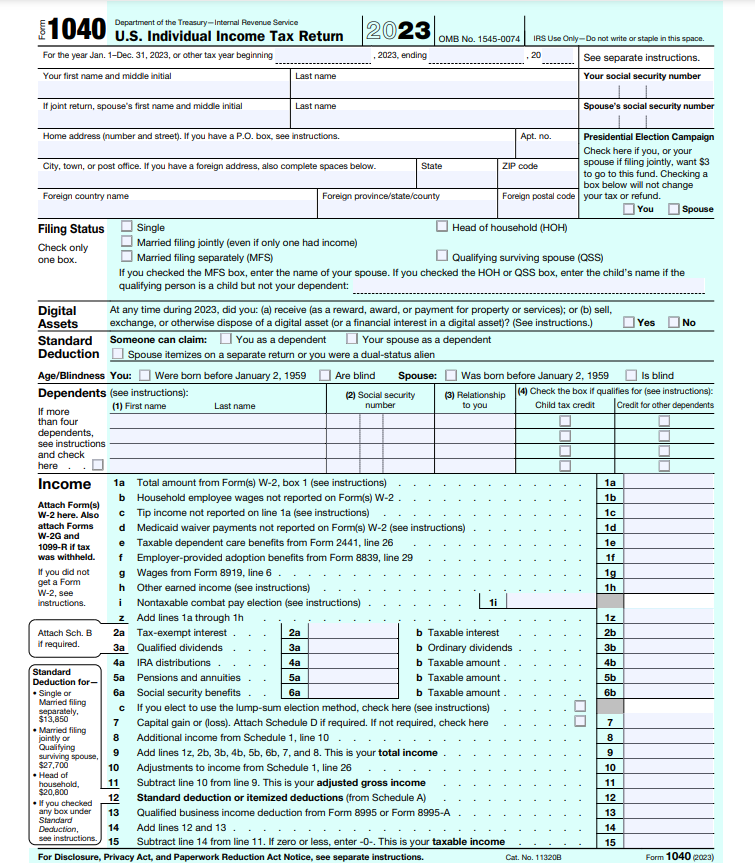

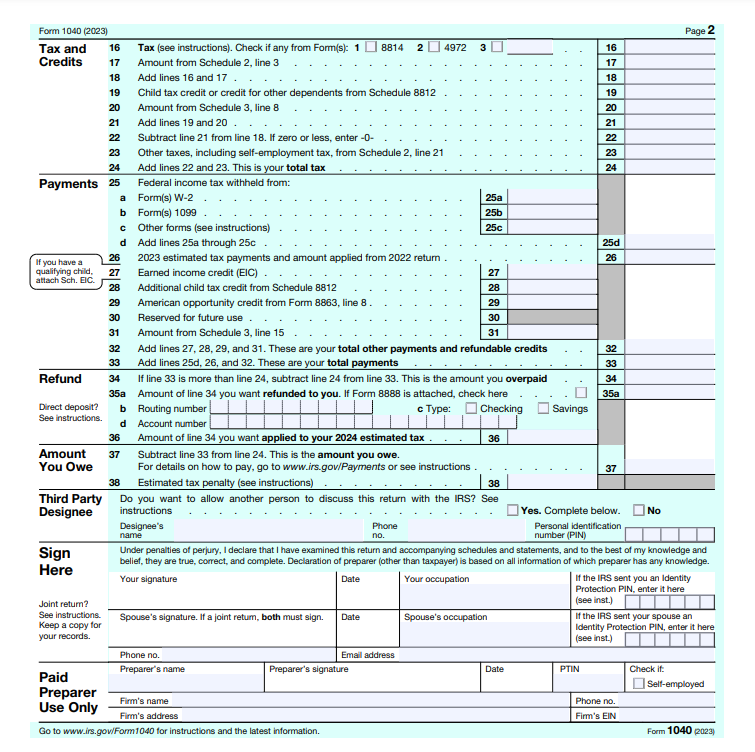

Form 1040 Overview for Married Couples:

- Personal Information: Provide full names, Social Security numbers, and current addresses.

- Filing Status: Indicate “Married Filing Jointly” or “Married Filing Separately.”

- Income: Report income sources like wages, self-employment, interest, and dividends. Attach supporting forms (W-2s, 1099s).

- Adjustments to Income: Report qualifying adjustments, e.g., contributions to a traditional IRA or student loan interest deduction.

- Deductions: Choose standard deduction or itemize (use Schedule A for itemized deductions).

- Tax Credits: Report eligible tax credits, such as Child Tax Credit or Earned Income Tax Credit.

- Calculate Tax Liability or Refund: Use provided tax tables or worksheets to calculate owed tax or refund.

Additional Forms and Schedules:

- Schedule A (Itemized Deductions): Use for itemizing deductions like mortgage interest, state taxes, medical expenses.

- Schedule C (Profit or Loss from Business): Report self-employment income and expenses.

- Schedule SE (Self-Employment Tax): Calculate and report self-employment tax if applicable.

- Schedule D (Capital Gains and Losses): Report capital gains or losses from investments or property.

- Schedule E (Supplemental Income and Loss): Report rental income, royalties, partnership income, etc.

- Schedule B (Interest and Ordinary Dividends): Report interest and dividend income from various sources.

4. File Electronically or by Mail

To submit taxes if you’re married, file electronically or by mail.

When filing your taxes as a married couple, you have the option to either electronically file (e-file) or file by mail. E-filing provides numerous advantages, including faster processing, increased accuracy with software guidance, immediate confirmation, and secure transmission of your information.

To e-file, choose a reputable tax software, gather your information, follow the software instructions accurately, review, and submit. On the other hand, if you prefer filing by mail, download the necessary forms, fill them out accurately, attach supporting documents, double-check for accuracy, sign, and mail the original tax return to the provided address. Remember to keep copies of all documents and proof of filing, whether you choose e-filing or filing by mail.

>>>PRO TIPS: How to Get a Credit Union Loan With Bad Credit

5. Understand the Potential Tax Deductions and Credits for Married Couples

To file taxes if you’re married, understand the potential tax deductions and credits for married couples.

Marriage-related Deductions:

– Deductions for Mortgage Interest: Married couples filing jointly can deduct mortgage interest paid on up to $1 million of mortgage debt on their primary residence and a second home. This is double the $500,000 limit for those filing separately. For example, if you and your spouse paid $10,000 in mortgage interest throughout the year, you can deduct the full amount on your joint tax return.

– Tax Benefits for Home Ownership: Owning a home can provide additional tax benefits for married couples. Some potential deductions and credits include:

- Property Tax Deduction: You can deduct the property taxes you paid on your primary residence and any additional properties you own.

- Mortgage Points Deduction: If you paid points to obtain a mortgage, you may be able to deduct them over the life of the loan.

- Home Office Deduction: If you or your spouse operate a business from your home, you may be eligible for a deduction for the expenses related to your home office.

Family-related Deductions and Credits:

– Child Tax Credit: The Child Tax Credit allows eligible families to claim a credit of up to $3,000 per qualifying child under the age of 17. For joint filers, the credit begins to phase out at a modified adjusted gross income (MAGI) of $400,000, while for separate filers, the phase-out begins at $200,000. For example, if you have two qualifying children and meet the income requirements, you can claim a total Child Tax Credit of $6,000 on your joint tax return.

– Child and Dependent Care Credit: This credit helps offset the costs of child care or care for other dependents while you and your spouse work or look for work. The credit can be up to 35% of qualifying expenses, depending on your income. The maximum qualifying expenses are $3,000 for one child or dependent and $6,000 for two or more. For example, if you paid $4,000 for child care expenses for your two children, you can claim a credit of up to $1,400 on your joint tax return.

– Adoption Tax Credit: If you and your spouse adopted a child, you may be eligible for the Adoption Tax Credit. The credit can help offset qualified adoption expenses, such as adoption fees, court costs, and travel expenses. For 2023, the maximum credit is $14,890 per eligible child. The credit begins to phase out for joint filers with a MAGI of $254,520 and is not available for separate filers.

It’s important to note that these deductions and credits have specific eligibility criteria and limitations. Consult the official IRS guidelines, specific tax forms, and instructions for detailed information on how to claim these deductions and credits.

6. Know Common Mistakes to Avoid

To report taxes if you’re married, know common mistakes to avoid.

When it comes to filing your taxes, there are common mistakes that you should avoid. Here are some important details to keep in mind:

Filing Status Errors:

- Your filing status determines the tax rates and deductions you are eligible for. It’s important to understand the different filing statuses, such as Single, Married Filing Jointly, Married Filing Separately, Head of Household, etc. Choose the filing status that accurately reflects your situation. For example, if you are married, you can generally choose to file jointly with your spouse or separately. Choosing the wrong filing status can result in incorrect tax calculations and potential penalties or delays in processing your return.

- Filing under the wrong status can have various consequences. For instance, if you are eligible to file as Head of Household but mistakenly file as Single, you may miss out on certain tax benefits and credits. Additionally, filing under an incorrect status can trigger an IRS audit or result in penalties if the error is discovered. It’s important to carefully review the requirements for each filing status and choose the one that best fits your situation.

Incorrectly Reporting Income:

- Review your W-2 forms from your employer and any 1099 forms you receive for income from other sources. Ensure that the information reported on these forms matches your records. Mistakes in reporting income can lead to discrepancies between your tax return and the information reported to the IRS, potentially triggering an audit or additional tax assessments. If you notice any errors, contact the issuer to correct them before filing your tax return.

- It’s essential to report all sources of income accurately on your tax return. This includes income from employment, self-employment, investments, rental properties, and any other taxable income. Failure to report all income can result in penalties and interest on the unreported amounts. Keep accurate records of your income sources and consult tax forms and instructions to ensure you report the correct amounts.

For example, if you have multiple jobs or freelance income, make sure to report all the income you earned from each source. Use your W-2 forms, 1099 forms, and other income statements to accurately report your income.

>>>GET SMARTER: How to Get a Large Personal Loan With Fair Credit

Conclusion

Navigating the tax filing process as a married individual involves key steps to optimize benefits and avoid common pitfalls. Begin by carefully selecting the appropriate filing status—either Married Filing Jointly or Separately—weighing the advantages and disadvantages of each. Gathering essential documents, such as W-2s and 1099s, ensures a smooth filing process.

Choosing between electronic filing and mailing requires an understanding of the benefits of each method. Lastly, steer clear of common mistakes, such as filing under the wrong status or inaccurately reporting income, by maintaining organized records and, if needed, seeking guidance from tax professionals or reliable software. Taking these steps will help ensure a hassle-free and financially advantageous tax filing experience for married individuals.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. . For comprehensive tax, legal or financial advice, always contact a qualified professional in your area. S’witty Kiwi assumes no liability for actions taken in reliance upon the information contained herein.

No Comment! Be the first one.