Filing taxes online is like sending your tax information through the internet using eligible software—it’s easy, secure, and quick. Imagine filing whenever and wherever you want, with the software checking for errors and doing the math for you.

Plus, you can get your refund in about 21 days! No need to print or mail anything, saving both money and paper. Just gather your documents, choose how you want to file (like using IRS Free File or tax software) and follow the prompts.

It’s that simple! Read on to learn more.

To file taxes online:

- Know What It Is to File Tax Online and Its Benefits

- Gather Your Documents and Relevant Information

- Choose Your Filing Status

- Decide How You Want to File Your Taxes Online

- Choose Between Standard Deduction and Itemized Deduction

- Fill out and Submit Your Tax Return Online

- Pay Your Taxes or Receive Your Refund

Recap

1. Know What It Is to File Tax Online and Its Benefits

Taxes are mandatory payments you and your business make to fund government services—social security, education, national defense, medical care, infrastructure, and other goods and services that benefit the community.

Filing taxes online is a hassle-free way to submit your tax return using suitable software or services on the Internet. It’s quick, secure, and offers several benefits:

- Convenience: File anytime, anywhere, with internet access and a compatible device. Use software or online services for guidance and calculations.

- Accuracy: E-filing reduces errors. It checks for common mistakes, verifies your information, and imports data from previous years easily.

- Security: It protects your personal and financial information with encryption. The IRS has measures in place to prevent fraud. You receive confirmation once it receives and accepts your return.

- Faster refunds: If you expect a refund, e-filing speeds up the process, especially with direct deposit. The IRS issues most refunds within 21 days, in comparison to six to eight weeks for paper returns. It’s a quicker, more secure way to handle your taxes!

>>>MORE: How to File Taxes If You’re Investor

2. Gather Your Documents and Relevant Information

To file taxes online, you need to gather your documents and other relevant information.

- W-2 Form: This shows your earnings and tax withholdings from your job. You get it latest on January 31 each year. If you have more than one job, you get a W-2 from each.

- 1099 Form: This reports income like interest, dividends, or self-employment. You get it every January 31 or February 15 yearly, depending on the type.

- Charitable Donations: Keep receipts for cash, property, or mileage you donate. You can deduct these from your taxes.

- Mortgage Interest: Deduct the interest you pay on your home loan. Your lender sends you a Form 1098 on January 31 every year.

Ask your employer or bank, or check its website, to get the documents. If you lose it, contact the IRS through the Get Transcript tool or call 1-800-908-9946.

A Few Tips

- Create folders for each tax year and label each with document names like W-2, 1099, and donations to organize your important documents.

- Scan and save your files as PDFs on your computer or in the cloud using services like OneDrive or Google Drive for easy access.

- Remember to use clear and consistent file names, and protect your data with a secure password.

- Shred your documents using a paper shredder or a shredding service when you no longer need a document. This helps prevent identity theft.

- Be aware of the IRS statute of limitations, usually three years for audits, and shred documents accordingly, especially if there’s fraud or significant underreporting of income.

3. Choose Your Filing Status

Your filing status is like a tax category that affects how you file your taxes. It impacts whether you need to file, your deductions, the credits you can get, and your tax rate.

The five types of filing statuses are:

- Single: If you are not married, divorced, or legally separated.

- Married filing jointly: Married couples filing together–you can combine income and deductions to potentially lower taxes.

- Married filing separately: Married couples filing separate returns–responsible for your taxes. May limit your eligibility for some tax benefits.

- Head of household: Unmarried individuals covering over half the cost of a home for yourself and a qualifying person, like a child, usually resulting in lower taxes than filing as single.

- Qualifying widow(er) with dependent child: If your spouse passes away in the last two years with a dependent child. You use the same tax rates as married filing jointly for two years after your spouse’s death.

Things to Note

- Filing Requirements: Depending on your status, you might have different income thresholds for filing. For example, if you’re single and under 65, you must file if you make at least $12,950. If you’re married filing jointly, it’s $28,700.

- Standard Deduction: This is a fixed amount that reduces your taxable income. Singles get $13,850, married couples get $27,700, and heads of households get $20,800.

- Credit Eligibility: Some tax credits depend on your filing status. For instance, the earned income tax credit (EITC) is for low to moderate-income workers. It varies based on status and has different rules.

- Tax Brackets: Your filing status determines your tax bracket, affecting the percentage of tax on your income. There are seven brackets. Married couples and widows generally have lower rates, than, heads of households, singles, and those married but filing separately.

If you’re unsure, the IRS has a handy tool, Interactive Tax Assistant on its website. Answer a few questions, and it guides you to the right filing status.

4. Decide How You Want to File Your Taxes Online

When filing your taxes, you have two main options: e-filing and filing via mail. E-filing means submitting your tax returns online, and it’s a recommendation the IRS has for several reasons.

There are different e-filing options:

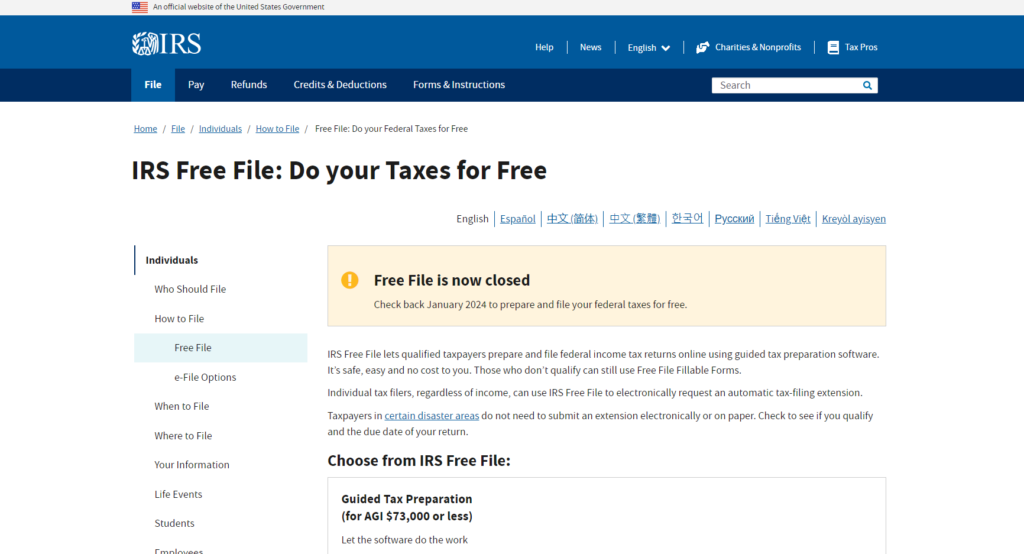

- IRS Free File: If your income is $73,000 or less, you can use this free service in partnership with tax software companies.

- Commercial Tax Software: Companies like TurboTax and H&R Block offer these services. You pay for federal and state returns, with online or in-person assistance available.

- Volunteer Tax Assistance Programs: Free help is available through programs like VITA, TCE, and AARP Foundation Tax-Aide, catering to specific income levels and demographics.

What to Consider

- Income Level: Some providers offer free filing if your income is $39,000 or less. Check if you qualify for free filing based on your income or Earned Income Tax Credit eligibility. For example, TaxSlayer.

- Tax Situation Complexity: If your situation is complex (self-employment, investments, rentals), choose software that supports it. Look for features like Schedule C support or deduction finders fit for your needs. For example TurboTax Deluxe

- Cost: Prices vary, and complexity often comes with a higher cost. Compare features and prices to find the best value. Watch for extra charges for state filing, audit protection, or live support.

- Convenience: Pick user-friendly software with features like importing previous returns or mobile filing. Ensure it supports fast and secure e-filing and direct deposit, and consider options to pay fees from your refund.

- Customer Support: Choose software with accessible customer support. Look for live chat, phone, or email support. Some offer access to tax experts for additional guidance, though this may come at an extra cost.

>>>PRO TIPS: How to File Taxes If You’re Young Adult

5. Choose Between Standard Deduction and Itemized Deduction

When you file your taxes, you have two options: take the standard deduction or itemize your expenses.

Standard Deduction: This is an amount you can subtract from your income to reduce your taxes. It’s available to you unless you choose to itemize deductions. The deduction varies based on your filing status, age, and if you’re blind or a dependent.

Here are the standard deduction amounts:

- Single – $13,850

- Married (Joint) – $27,700

- Head of Household – $20,800

- Qualifying Widow(er) – $27,700

- Dependent – Varies

If you’re 65 or older or blind, there’s an additional amount.

For example, if you’re single and 65, your deduction is $13,850 + $1,850 = $15,700.

If you’re married and both of you are 65 and blind, it’s $27,700 + $3,000 + $3,000 = $35,200.

Itemized Deduction: Itemizing means listing specific costs like medical expenses, state taxes, mortgage interest, and charitable donations to reduce your taxable income. If these itemized expenses are higher than the standard deduction for your filing status, it makes sense to itemize.

For example, if you’re single with an income of $50,000 and your itemized deductions total $9,500, it’s better to take the standard deduction of $13,850.

On the other hand, if you’re married and earning $100,000 and your itemized deductions add up to $29,000, you should itemize and save $1,300 in taxable income.

To figure out which option is best, you can use the IRS’s Interactive Tax Assistant tool. It asks questions and helps you choose the right deduction method for your situation.

6. Fill out and Submit Your Tax Return Online

To use the IRS Free File, go to the IRS website and click “File,” then select “File Your Taxes for Free.”

You can use the IRS Free File Online: Lookup Tool to find the right software option based on your eligibility.

Pick a software provider, create an account, and follow the instructions to enter your:

- Personal information (name, address, Social Security number, etc.).

- Income details (W-2, 1099, etc.).

- Deductions and credits (like medical expenses, taxes, etc.).

- Bank information if you want direct deposit.

After completing your tax return, review it and e-file it to the IRS. You get a confirmation. Check your refund/payment status on the IRS website.

Helpful Tips to Help You File Your Taxes Online

- Verify Your Identity: Provide accurate personal information like your birthdate, Social Security number, and last year’s income. Use a secure connection.

- Choose Reliable Tax Software: Pick IRS-authorized software with a good reputation to avoid hidden fees, outdated advice, or identity theft risks.

- Double-check Numbers and Spelling: Carefully review your entries to avoid mistakes. Use built-in tools and compare with your previous return to catch errors.

- Enter Bank Information Carefully: If you are expecting a refund or paying electronically, enter your bank details accurately to avoid delays, fees, or lost payments.

- Keep Records: Save your return and confirmation number. It proves your filing is acceptable. Handy for reference or if necessary, to confirm your filing status later on.

7. Pay Your Taxes or Receive Your Refund

If you owe money to the IRS, you have a few ways to pay:

- Electronic Funds Withdrawal: Pay directly from your bank account when e-filing your tax return. It’s free, fast, and secure. Choose the date and amount, and you get a confirmation number.

- Credit or Debit Card: Pay online, using your phone, or with a mobile device. Various processors charge a fee based on your payment amount. It’s convenient and secure, and it’s available with IRS Free File or tax software.

- Check or Money Order: Mail a check or money order to the IRS. Include your details and a Form 1040-V. Simple and low-cost, but processing takes longer, and you might not get a confirmation.

- Installment Agreement: Pay in monthly installments. Apply online, with your phone, mail, or in person. There’s a setup fee, and you pay interest and penalties until you pay in full. Helpful if you can’t pay in full on the due date.

To avoid penalties, try paying in full latest on the April 15 deadline. If that is not possible, pay as much as you can on the due date and request an extension for the rest, up to 120 days.

You still pay some interest and penalties, but less than without an extension. You can also apply for an offer in compromise if you meet certain criteria, allowing you to settle for less than the full amount you owe. Use the IRS website to check your eligibility.

To get your IRS refund, you have a few options

- Direct Deposit: Fastest and easiest. Enter your bank details when filing your taxes, and the refund goes straight to your account.

- Paper Check: Traditional method. Receive a check in the mail, but it takes longer than direct deposit.

- Savings Bonds: Save for the future, using your refund to buy U.S. Series I Savings Bonds, low-risk investments.

To keep track:

- Use “Where’s My Refund?” online or the IRS2Go app.

- Check your bank account or mailbox.

Tip: Adjust your withholding to avoid a big refund. Large refund? You’re giving the IRS an interest-free loan, use Form W-4 to reduce withholding. Small refund or owe tax? Avoid penalties when you increase withholding using Form W-4.

>>>GET SMARTER: How to File Taxes If You’re Divorcee

Conclusion

To file your taxes online, choosing your filing status is a key step in your tax journey, impacting everything from your deductions to eligibility for credits. The Interactive Tax Assistant is your guide, making it easier to decide on the status that suits your situation best.

For a smoother and quicker tax return experience, opt for e-filing. Whether through IRS Free File, Free Tax Preparation Sites, Commercial Software, or IRS-Authorized e-file Providers, going digital is not just faster but also safer and more accurate than the traditional mail-in method using Form 1040.

However, if you still prefer the old-school approach, you can mail your tax return using Form 1040. Just keep in mind that this method takes a bit longer to process, up to 6 – 8 weeks.

Once you file, the anticipation for your refund begins. Stay in the loop—track your refund status through the Where’s My Refund? tool on the IRS website or the IRS2Go mobile app. All you need is your Social Security number, filing status, and the exact refund amount.

To empower yourself with more tax knowledge, explore the resources available on the IRS website and USA.gov website.

Additionally, the IRS2Go mobile app offers handy features like checking your refund status, making payments, and accessing tax tips. It’s your go-to toolkit for smoother tax filing.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. . For comprehensive tax, legal or financial advice, always contact a qualified professional in your area. S’witty Kiwi assumes no liability for actions taken in reliance upon the information contained herein.

No Comment! Be the first one.