Living abroad can be an exciting and rewarding experience, but it also comes with some challenges. One of them is filing taxes in both your home country and your host country. Depending on your situation, you are going to deal with different tax laws, deadlines, forms, and exemptions.

You also have to pay taxes twice on the same income, or face penalties for not reporting your foreign assets. How can you avoid these pitfalls and file your taxes correctly and efficiently? In this article, you’re going to walk through the basics of how to file taxes when living abroad.

Plus, you’re going to learn details such as residency status, foreign earned income exclusion, foreign tax credit, foreign bank account reporting, and more. By the end of this article, expect to have a better understanding of how to comply with your tax obligations and save money on your taxes.

How to File Taxes When Living Abroad

- Know How Filing When Living Abroad Works

- Review Your Residency Status

- Navigate Tax Treaties and Agreements

- Report Foreign Assets

- Claim Foreign Tax Credits

- Consider Social Security and Medicare

- Meet Filing Deadlines and Extensions

- Manage Currency Exchange Considerations

- Address Penalties for Non-Compliance

- Understand Foreign Earned Income Exclusion

- Master Foreign Bank Account Reporting

- Understand Tax Obligations

- Seek Professional Advice

1. Know How Filing When Living Abroad Works

To master how to file taxes when living abroad, know how the process works. This involves fulfilling your tax obligations in the country where you reside as well as addressing any obligations in your home country. This process often requires an understanding of specific rules, exemptions, and agreements that apply to you.

You can utilize the foreign earned income exclusion to exclude a certain amount of income from your home country’s taxation. Familiarize yourself with the foreign earned income exclusion, which allows you to exclude a certain amount of your foreign income from U.S. taxation. Research any tax treaties or agreements between your host country and home country to optimize your tax situation. Ensure accurate reporting of foreign assets to comply with tax regulations. Explore foreign tax credits to avoid double taxation.

>>>MORE: How to File Taxes If You’re Investor

2. Review Your Residency Status

To understand how to file taxes while living abroad, review your residency status. Begin by mastering the residency rules of both your home country and the country of residence. Many countries determine tax liability based on residency, and factors such as the number of days you spend in each country can influence this status.

You can qualify as tax residents in both countries, triggering the need to consider tax treaties or agreements that can mitigate double taxation. It’s essential to document your days abroad accurately, as this information is often pivotal in establishing your tax status. Failure to correctly assess and document your residency status can lead to unintended tax consequences, so it’s advisable to seek professional advice to ensure compliance with the tax laws of both your home country and your country of residence.

3. Navigate Tax Treaties and Agreements

To familiarize yourself with how to file taxes when you’re abroad, navigate tax treaties and agreements. These treaties are bilateral agreements between your home country and host country that help you prevent double taxation and address issues that relate to tax evasion. You must thoroughly examine the specific treaty between your home country and your country of residence to understand how the IRS is going to tax your income.

These treaties often outline provisions concerning the types of income, such as wages, pensions, and investment returns, ensuring that you don’t experience double taxation on the same income by both countries. Additionally, you can find relief through reduced withholding rates, tax credits, or exemptions the treaty specifies.

4. Report Foreign Assets

To file taxes when living abroad, report foreign assets. This includes bank accounts, retirement accounts, and other financial assets. The purpose is to ensure transparency and compliance with tax laws, as your country requires you to disclose offshore assets to prevent tax evasion. The reporting involves filing additional forms, such as the Foreign Bank Account Report (FBAR) in the United States.

It’s crucial to accurately disclose the value and nature of these assets, as failure to do so can lead to penalties. Seeking guidance from tax professionals familiar with international taxation can be beneficial to navigate the complexities of reporting foreign assets and ensure adherence to the specific regulations of both the home and host countries.

>>>PRO TIPS: How to File Taxes If You’re Young Adult

5. Claim Foreign Tax Credits

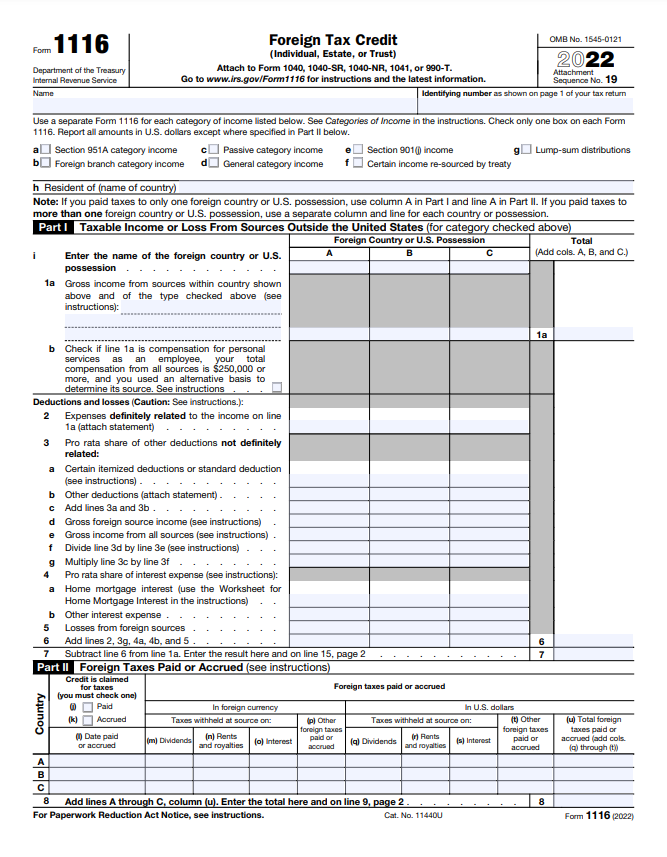

To learn how to file taxes when living abroad, claim foreign tax credits. Foreign tax credits allow you to offset U.S. tax liability by the amount of income tax you pay to a foreign government on the same income. To claim this credit, you need to file Form 1116 with your U.S. tax return.

This form helps you determine the amount of foreign tax credit you can claim based on various factors, including the type of income, the foreign country’s tax rate, and any applicable limitations. When you claim foreign tax credits, you avoid double taxation on the same income and ensure that you are not bearing any undue burden by the tax policies of both the United States and your country of residence. It’s essential to carefully follow IRS guidelines and seek professional advice to navigate the complexities of claiming foreign tax credits accurately.

6. Consider Social Security and Medicare

To understand how to file taxes when living abroad, consider social security and Medicare. If you’re a U.S. citizen working abroad, you still need to pay Social Security and Medicare taxes on your foreign income unless a Totalization Agreement exists between the United States and the host country.

The Foreign Earned Income Exclusion (FEIE) typically exempts foreign-earned income from federal income tax, but it doesn’t exempt you from Social Security and Medicare taxes. It’s essential to understand the specific regulations that relate to Social Security and Medicare in your country of residence, ensuring compliance with both U.S. tax laws and any applicable international agreements to avoid potential penalties or double taxation.

7. Meet Filing Deadlines and Extensions

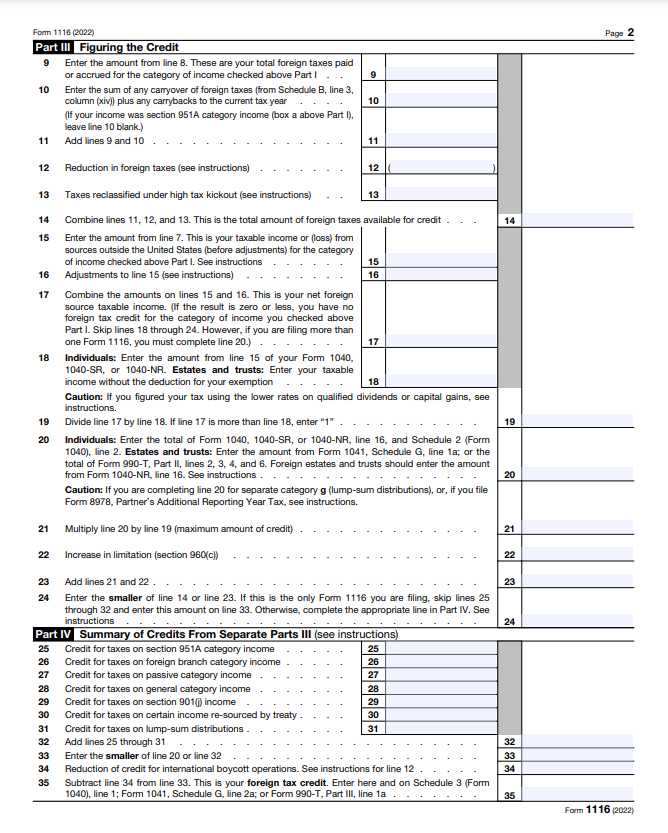

To discover how to file taxes when living abroad, meet filing deadlines and extensions. Stay up-to-date about both U.S. and host country deadlines, as they are likely to differ. If you’re an expat, you receive an automatic extension until June 15th, but any taxes you owe are still due by April 15th to avoid interest charges.

To further extend the deadline, you can fill Form 4868, providing an additional four months until October 15th.

However, it’s important to note that while an extension gives more time to file, you must pay any taxes you owe by the original deadline to prevent penalties. Keeping track of these deadlines and understanding the extension process ensures compliance with tax regulations and helps you avoid unnecessary financial complications.

>>>GET SMARTER: How to File Taxes If You’re Divorcee

8. Manage Currency Exchange Considerations

To file taxes when living abroad, manage currency exchange considerations. It is crucial to accurately convert these amounts using the appropriate exchange rates for each transaction. You need to be aware of any currency fluctuations that can impact your tax liability.

Additionally, understanding how to convert and report foreign income, deductions, and credits accurately in the home country’s currency is essential. Failure to manage currency exchange considerations properly can lead to discrepancies in the income and expenses you report, potentially resulting in tax issues or penalties. Therefore, dare to stay current as you live abroad about exchange rates, use reliable sources for currency conversion, and ensure consistency in your tax filings across different currencies.

9. Address Penalties for Non-Compliance

To know how to file taxes when living abroad, address penalties for non-compliance. Do a thorough research in order to be aware of the specific tax requirements in both the host country and the home country. Failure to adhere to these regulations can result in penalties, such as fines or additional taxes.

To mitigate these risks, you need to stay up-to-date about filing deadlines, reporting obligations, and any special considerations the tax authorities outline. Additionally, some countries offer amnesty programs if you voluntarily disclose past non-compliance, providing an opportunity to rectify errors and avoid severe penalties.

10. Understand Foreign Earned Income Exclusion

To file taxes when living abroad, understand foreign earned income exclusion. The foreign earned income exclusion allows you—if you’re eligible—to exclude a specific amount of your foreign-earned income from your U.S. taxable income.

To qualify, you must meet either the bona fide residence test or the physical presence test, demonstrating a sustained presence in a foreign country. You can exclude an amount up to $108,700 if you qualify.. Understanding the intricacies of this exclusion is essential, as it directly impacts the taxable income, potentially reducing your tax liability.

11. Master Foreign Bank Account Reporting

To grasp how to file taxes when living abroad, master foreign bank account reporting. This process involves disclosing financial accounts you hold in foreign countries to the U.S. government. If you have a total aggregate value of $10,000 or more in foreign accounts during the calendar year, you need to mandatorily file FinCEN Form 114, commonly known as FBAR.

It is essential to meticulously identify and report each qualifying account, including bank accounts, investment accounts, and even certain types of cryptocurrency holdings. Failing to comply with FBAR requirements can result in substantial penalties. Therefore, you have to stay vigilant, maintain accurate records of your foreign financial holdings, and ensure timely submission of FBAR forms to avoid potential legal and financial consequences.

12. Understand Tax Obligations

To learn the nitty-gritty of filing taxes when living abroad, understand tax obligations. This includes grasping the concept of residency for tax purposes, determining which income is subject to taxation, and comprehending any applicable tax exemptions or credits.

You often need to be aware of filing requirements both in your country of residence and your home country, which can involve dual tax filings. Staying up-to-date about changes in tax laws, treaties, and agreements between the two countries is crucial to ensure compliance.

13. Seek Professional Advice

To explore how to file taxes when living abroad, seek professional advice. Tax regulations vary significantly between countries, and the nuances of international tax law can be challenging to navigate. A tax professional with expertise in international taxation can provide tailored guidance based on your specific situation, ensuring compliance with both your host country’s tax regulations and those of your home country.

Consider an expert who can help you identify eligible deductions, credits, and exemptions, maximizing your tax efficiency. Additionally, professionals can assist in addressing intricate issues such as foreign bank account reporting, tax treaties, and potential pitfalls that can lead to penalties if you fail to properly manage them. Given the potential financial implications and the need for precision in international tax matters, consulting a tax professional is a prudent step to ensure accuracy and compliance.

Tips to What Out For

- Verify your tax obligations in both your host country and your home country before initiating the filing process.

- Consult with a tax professional experienced in international taxation to ensure accurate and compliant submissions.

- Organize your financial records, including income, expenses, and relevant documents, to facilitate a smoother filing process.

- Plan ahead and be mindful of filing deadlines in both countries, allowing ample time to address challenges and explore potential tax-saving opportunities.

Recap

To successfully navigate the intricacies of filing taxes while living abroad, it’s crucial to begin by comprehending how the process works in your host country and staying informed about your home country’s (U.S.) tax obligations. Reviewing your residency status is pivotal, ensuring that you adhere to the tax regulations applicable to your specific situation.

Navigate tax treaties and agreements so that you can optimize your tax position while ensuring compliance with international tax laws. Then Report your foreign assets, claim foreign tax credits, and consider aspects like social security and Medicare as they further contribute to a comprehensive approach. Meeting filing deadlines and understanding extensions are imperative to avoid penalties, as is managing currency exchange considerations.

You also want to address potential penalties for non-compliance as well as pay attention to keeping tax regulations. Utilizing the foreign earned income exclusion and mastering Foreign Bank Account Reporting are critical for optimizing tax benefits. Throughout this process, you can seek professional advice in order to enjoy tailored guidance that helps you navigate the complex landscape of international taxation successfully.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. . For comprehensive tax, legal or financial advice, always contact a qualified professional in your area. S’witty Kiwi assumes no liability for actions taken in reliance upon the information contained herein.

No Comment! Be the first one.