Going through a divorce can be a difficult and stressful time, and taxes may not be at the top of your to-do list. However, understanding how to file your taxes after a divorce is important to ensure you’re making the most of your financial situation.

Read this article to understand the details about choosing the right filing status, claiming exemptions for your children, and navigating payments to an ex-spouse for tax purposes. Let’s get started on making your post-divorce tax filing as smooth as possible.

How to File Taxes If You’re Divorcee:

- Determine Your Filing Status

- Gather Relevant Documents

- Determine Child-Related Tax Benefits

- Address Alimony and Spousal Support

- Understand Property Division and Capital Gains

- Consider the Tax Implications of Retirement Accounts

- Address Tax Deductions and Credits

- File Your Tax Return

Excited? Let’s go.

1. Determine Your Filing Status

When filing your taxes as a divorcee, it is important to determine the correct filing status. The filing status you choose can affect your tax liability and eligibility for certain tax benefits. Here are the different filing statuses available for divorcees and the criteria for each one:

Single:

- You can file as single if you are legally divorced or separated by the end of the tax year and not remarried by December 31st.

- This status is straightforward and easy to understand.

Head of Household:

- You may qualify for this status if you are unmarried, have paid more than half the cost of maintaining a home for yourself and a qualifying person (such as a child), and meet other criteria.

- To qualify, you must have lived apart from your spouse for the last six months of the tax year and provide a separate household for yourself and your dependent(s).

- This status usually offers more favorable tax rates and a higher standard deduction compared to the Single filing status.

Married Filing Separately:

- You can file as Married Filing Separately if you are legally separated but not yet legally divorced by the end of the tax year.

- In this status, you and your former spouse each report your own income and deductions separately on your individual tax returns.

- Note that filing separately may result in higher tax rates and limitations on certain tax benefits compared to filing jointly.

To determine the most appropriate filing status, consider your legal marital status, whether you have dependent children and qualify as the custodial parent, and compare the potential tax liability and benefits of each filing status.

>>>MORE: How to File Taxes If You’re Senior

2. Gather Relevant Documents

When filing your taxes as a divorcee, it’s essential to gather all the necessary documents to ensure accurate reporting and support your tax return. Here is a checklist of documents you should gather:

Income Documents: Collect your W-2 forms from your employer(s) and any 1099 forms for additional income sources. Include any other income-related documents like rental property statements or investment earnings records.

Divorce-Related Documents: Keep a copy of your divorce decree, which outlines the terms of your divorce. Maintain records of alimony payments made or received, including dates and amounts.

Child-Related Documents: Gather the Social Security numbers of your children and dependents you plan to claim. Keep receipts or statements for childcare expenses, such as daycare or after-school care.

Deduction and Credit-Related Documents: Collect Form 1098 for mortgage interest payments if you own a home. Keep records of education expenses, including Form 1098-T from educational institutions.

By gathering and maintaining accurate records, you can confidently report your income, deductions, and credits on your tax return, ensuring compliance and providing protection in case of any future inquiries.

3. Determine Child-Related Tax Benefits

As a divorcee, it’s important to understand the rules for claiming dependents and the various child-related tax benefits available to you. To claim a child as a dependent, they must meet certain criteria based on their relationship to you, residency, age, and support. You may be eligible for the Child Tax Credit of up to $2,000 per qualifying child, or the Earned Income Credit if you have a qualifying child and meet certain income requirements.

Custody arrangements and support payments can impact tax benefits, so it’s important to communicate with your ex-spouse to determine who is eligible to claim the child as a dependent. By understanding these rules and benefits, you can reduce your tax liability and provide financial support for raising your children.

4. Address Alimony and Spousal Support

When going through a divorce, it’s important to understand the tax implications of alimony and spousal support. Alimony received is considered taxable income and must be reported on your tax return, while alimony paid may be tax-deductible for the payer.

The tax treatment of alimony changed under the Tax Cuts and Jobs Act (TCJA) that took effect in 2019, and the specific terms of your divorce agreement will determine the tax implications for you. It’s important to accurately report and comply with the requirements outlined in the agreement.

If you receive alimony, you should receive a Form 1099 from the payer, and if you make alimony payments, you should report the total amount paid on your tax return. Remember to plan accordingly and set aside funds to cover any potential tax liability.

>>>PRO TIPS: How to File Taxes If You’re Young Adult

5. Understand Property Division and Capital Gains

During a divorce, property division can affect your tax obligations, particularly in relation to capital gains taxes. Here’s what you need to know:

Capital Gains Tax:

- Capital gains tax is a tax on the profit made from selling an asset, like real estate or investments.

- Property transferred as part of a divorce settlement is generally not subject to capital gains tax at the time of transfer, known as a tax-free transfer or transfer incident to divorce.

- However, if you sell the property received in the divorce settlement in the future, you may be subject to capital gains tax on any appreciation in value since the transfer.

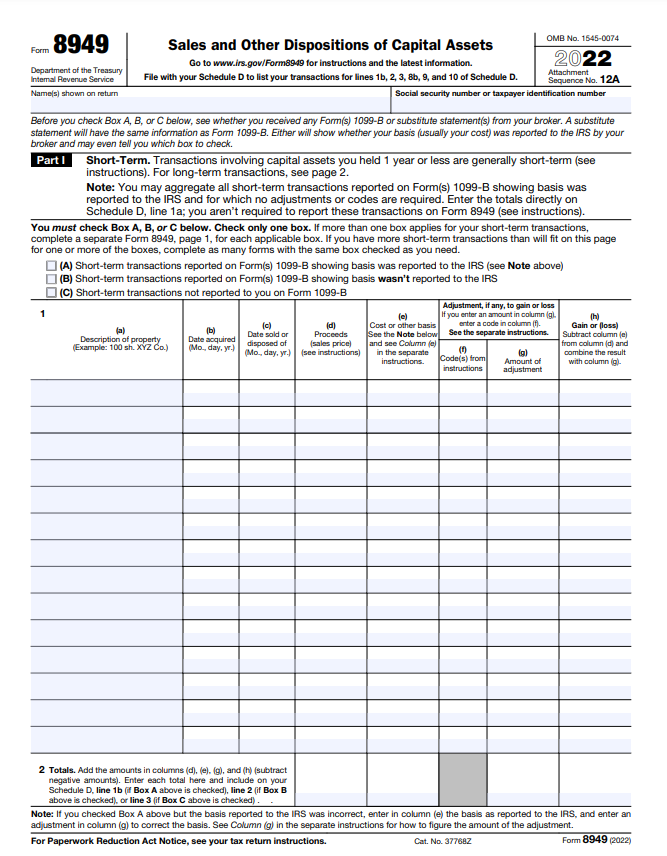

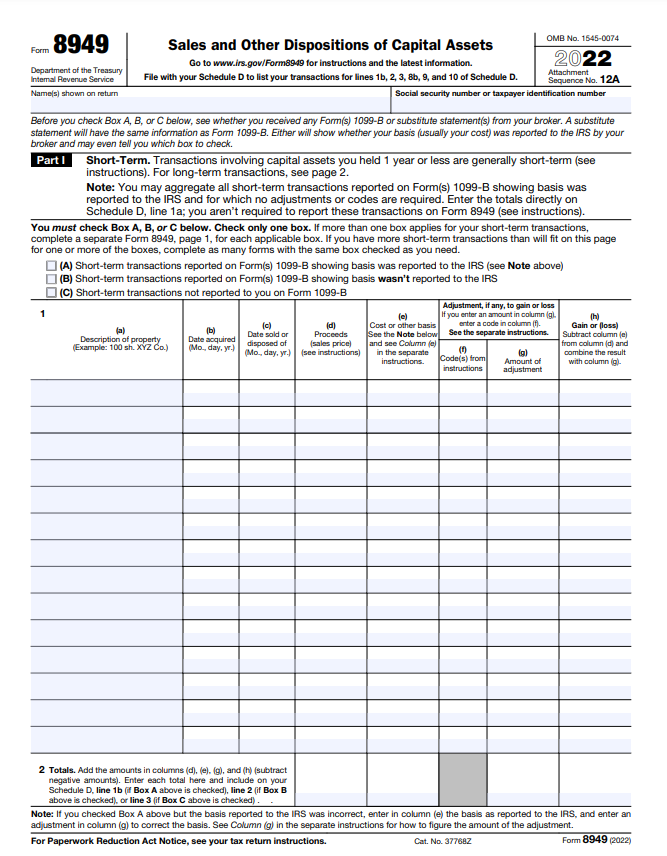

Reporting Gains or Losses from Property Sale:

- If you sell property received in a divorce settlement, report the transaction on your tax return.

- Determine your basis in the property, usually the fair market value at the time of the divorce. This will be used to calculate the gain or loss on the sale.

- Use Form 8949 and Schedule D to report the sale and calculate the capital gain or loss. Include details like the date of sale, sale price, and your basis.

6. Consider the Tax Implications of Retirement Accounts

Amid the complexities of divorce, understanding the tax implications of dividing retirement accounts is crucial for your financial journey. Consider these key insights:

Tax Consequences of Retirement Account Division:

- Qualified Retirement Plans: Plans like 401(k)s and traditional IRAs follow specific tax rules during divorce.

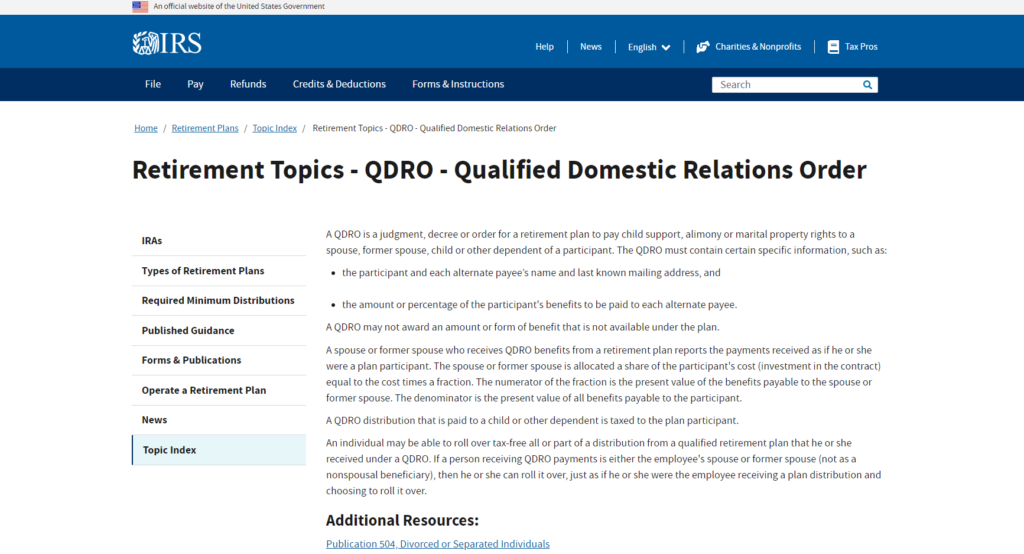

- Qualified Domestic Relations Order (QDRO): Picture a QDRO as your passport to a tax-free transfer of retirement assets. It establishes the ex-spouse’s right to a share without immediate tax implications.

- No Immediate Tax Liability: Good news – transferring funds via a QDRO doesn’t trigger immediate taxes. Your ex-spouse won’t owe taxes when the division occurs.

- Taxation upon Withdrawal: Brace for impact when withdrawing. The recipient spouse assumes responsibility for taxes on future withdrawals, typically under ordinary income tax rates.

Reporting Retirement Account Distributions:

- Form 1099-R: Keep an eye out for this form if you receive a distribution. It details the amount and any taxes withheld.

- Tax Return Reporting: Be diligent in reporting the distribution on your tax return. The distributed amount is added to your taxable income, potentially incurring income taxes.

Penalties and Exceptions:

- Early Withdrawal Penalties: Caution – withdrawing funds before 59½ may trigger a 10% penalty, plus income taxes. Exceptions, like QDRO distributions, can be your lifeline.

- Rollovers: Consider the 60-day rollover option. Moving a distribution to another qualified retirement account within this window can sidestep immediate taxation and potential penalties.

7. Address Tax Deductions and Credits

As a divorcee, you may be eligible for various tax deductions and credits that can help reduce your tax liability. Here are some common deductions and credits to consider:

- Mortgage Interest Deduction: As a homeowner post-divorce, you might be able to lighten your tax load by deducting mortgage interest. Don’t forget to keep tabs on those mortgage interest statements (Form 1098) from your lender. It’s your ticket to lowering taxable income.

- Education Credits: If you or your dependents pursued higher education, dive into potential education-related tax credits like the American Opportunity Credit and the Lifetime Learning Credit. Up to $2,500 per eligible student or $2,000 per tax return could be waiting for you. Check out IRS Publication 970 for the nitty-gritty.

- Child and Dependent Care Credit: Juggling work and childcare expenses? You might be eligible for the Child and Dependent Care Credit. It’s a lifeline for offsetting costs incurred for childcare, day camps, or after-school programs. Keep a record of expenses and provider details for a seamless claim.

- Medical Expense Deduction: If significant medical expenses hit post-divorce, a portion might be deductible. Medical bills, insurance premiums, and qualifying expenses count. Keep organized records and remember, the threshold is typically 7.5% of your adjusted gross income.

To Maximize Your Claims:

- Stay organized. Keep records, receipts, and supporting docs neatly filed.

- Decide whether itemizing or taking the standard deduction suits your financial picture.

- Pick the right tax forms and schedules. Consult IRS guidelines or a tax pro for precise instructions.

Remember, tax rules can be tricky. For the latest insights and accurate claims, consult the IRS playbook or tap into the expertise of a tax professional. Don’t miss out on the deductions and credits that could lighten your tax burden.

8. File Your Tax Return

Filing your tax return accurately and on time is an important responsibility. Here are step-by-step instructions to help you file your tax return:

Gather Your Documents:

- Collect all the necessary documents, including W-2 forms from your employer, 1099 forms for any additional income, and any other relevant tax forms such as 1098 for mortgage interest or 1098-T for education expenses.

- If you received a divorce settlement, gather any documents related to alimony, child support, or property division.

Choose the Correct Tax Form:

- Determine the appropriate tax form to use based on your filing status and financial situation. The most common forms are Form 1040, Form 1040A, and Form 1040EZ.

- Form 1040 is the most comprehensive form and allows for itemized deductions, while Form 1040A and Form 1040EZ have more limited options.

Report Your Income:

- Enter your income information on the appropriate lines of the tax form. This includes wages, salaries, tips, and any other income received during the tax year.

- If you have multiple sources of income, ensure that you report each one accurately.

Claim Deductions and Credits:

- Determine whether you will take the standard deduction or itemize your deductions. The standard deduction is a predetermined amount that reduces your taxable income, while itemized deductions allow you to deduct specific expenses such as mortgage interest, medical expenses, or charitable contributions.

- If you qualify for any tax credits, such as the Child Tax Credit or the Earned Income Credit, ensure that you claim them correctly. Follow the instructions provided on the tax form or consult IRS publications for guidance.

Calculate Your Tax Liability:

- Use the tax tables or the tax calculation worksheet provided with the tax form to determine your tax liability based on your taxable income and filing status.

- If you made estimated tax payments throughout the year or had taxes withheld from your paycheck, report these amounts accurately to calculate any refund or additional tax owed.

Sign and Submit Your Tax Return:

- Sign your tax return using the appropriate method indicated on the form. For electronic filing, you may need to provide an electronic signature or use a personal identification number (PIN).

- If you are mailing a paper return, ensure that you include all necessary forms, schedules, and supporting documentation. Use certified mail or a reputable delivery service to track your return.

Remember to review your tax return carefully before submitting it to ensure accuracy and completeness. If you need assistance or have specific questions, consult IRS publications or seek guidance from a tax professional.

>>>GET SMARTER: How to File Taxes If You’re Business Owner

Conclusion

If you’re a divorcee, filing your taxes correctly is crucial. Start by gathering all necessary documents, such as W-2 forms and 1099 forms. Choose the appropriate tax form based on your situation, report your income accurately, and claim any deductions and credits you’re eligible for, such as mortgage interest or education credits.

Consider electronic filing for faster processing and the convenience of receiving your refund through direct deposit. Remember to review your tax return carefully before submitting it, and consult IRS publications or seek guidance from a tax professional if needed.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. . For comprehensive tax, legal or financial advice, always contact a qualified professional in your area. S’witty Kiwi assumes no liability for actions taken in reliance upon the information contained herein.

No Comment! Be the first one.