Do you ever consider fueling your car with electricity, hydrogen, or biodiesel? If you make the switch to an alternative fuel vehicle and install refueling equipment, the U.S. government wants to give you a tax break! Form 8911 unlocks access to the alternative fuel vehicle refueling property credit, potentially reducing your tax bill for installing home charging stations, commercial hydrogen pumps, or even propane tanks. Learn how to navigate this form and claim your green incentive in this comprehensive guide. Get your eco-friendly ride rolling with tax savings!

What Is Form 8911: Alternative Fuel Vehicle Refueling Property Credit

- Definition of Form 8911

- Eligibility Criteria for the Alternative Fuel Vehicle Refueling Property Credit

- Types of Alternative Fuel Eligible for the Credit

- Credit Calculation and Limitations

- How to Claim Form 8911 on Your Tax Return

- Record-Keeping Requirements for Claiming the Credit

- Common Mistakes to Avoid When Filling Out Form 8911

1. Definition of Form 8911

Form 8911: Alternative Fuel Vehicle Refueling Property Credit, is a tax document the Internal Revenue Service (IRS) issues in the United States. This form allows you to claim a credit for the eligible installation of alternative fuel vehicle refueling property.

The credit encourages the adoption of eco-friendly practices by providing financial incentives to individuals and businesses that invest in infrastructure supporting alternative fuels such as electricity, compressed natural gas, or hydrogen. If you’re seeking to benefit from this credit, you need to meet certain criteria the IRS outlines, and the form helps capture the necessary information to calculate and claim the credit on their federal tax return.

>>>MORE: How to File Taxes Online

2. Eligibility Criteria for the Alternative Fuel Vehicle Refueling Property Credit

To qualify for the alternative fuel vehicle refueling property credit, meet specific eligibility criteria the Internal Revenue Service (IRS) states. Generally, to be eligible, you must incur expenses that relate to the installation of qualified alternative fuel vehicle refueling property during the tax year. Make sure the property functions to dispense alternative fuels, such as electricity, compressed natural gas, or hydrogen, into vehicles. Additionally, use the vehicle for business or investment purposes, and certain restrictions can apply to personal uses.

3. Types of Alternative Fuel Eligible for the Credit

When filing Form 8911, types of alternative fuel eligible for the credit refers to the specific alternative fuels that qualify for the alternative fuel vehicle refueling property credit. The IRS designates certain fuels as eligible for this credit, and you can claim the credit for installing refueling property that supports these alternatives.

Common eligible alternative fuels include electricity, compressed natural gas, liquefied natural gas, liquefied petroleum gas, hydrogen, and any other fuel that the IRS determines to be an alternative fuel. It’s important for you to verify that the alternative fuel you’re using or installing infrastructure for is explicitly something the IRS recognizes in order to ensure eligibility for claiming the credit when completing Form 8911.

4. Credit Calculation and Limitations

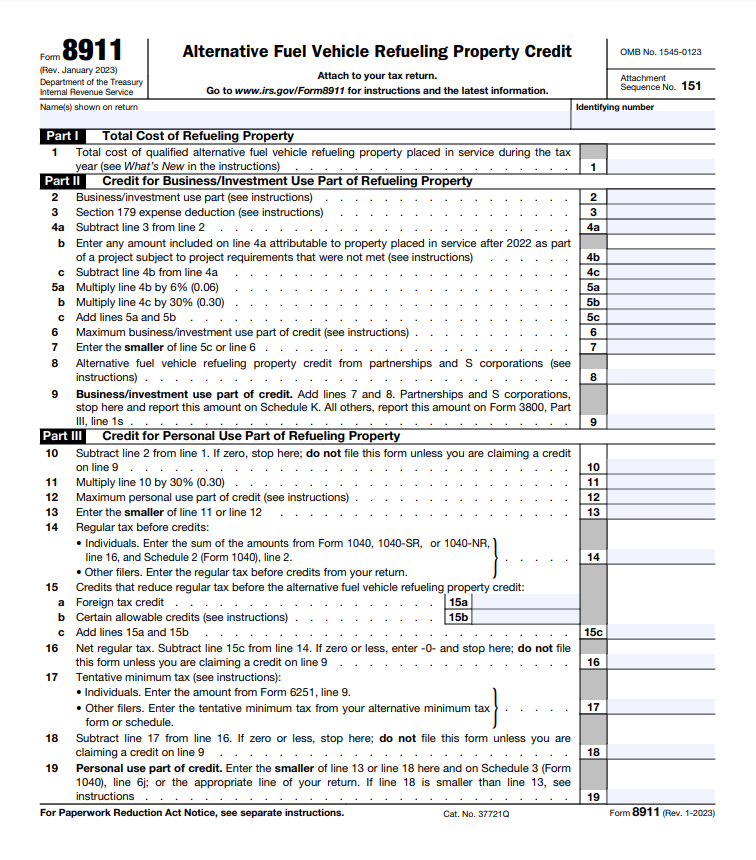

The credit calculation for Form 8911, the alternative fuel vehicle refueling property credit, involves determining a percentage of the cost you incur in installing qualified alternative fuel vehicle refueling property. Generally, the credit is equal to 30% of the eligible expenses, including the installation costs, up to certain maximum limits the IRS specifies.

However, there are limitations you need to be aware of. The maximum credit for business property caps at $30,000, and for residential property, it maxes at $1,000. Additionally, the credit can vary for different types of alternative fuels. Understand these limitations and perform the necessary calculations accurately when completing Form 8911 so that you can claim the appropriate credit amount based on your specific situation.

>>>PRO TIPS: How to File Taxes When Living Abroad

5. How to Claim Form 8911 on Your Tax Return

To claim Form 8911 on your tax return, provide the relevant information in the appropriate section of your federal tax form. When completing your tax return, typically on Form 1040 or the applicable business tax form, locate the section for credits and look for the specific area that has to do with energy-related credits.

Fill in the necessary details, including the eligible expenses for the installation of alternative fuel vehicle refueling property. Be sure to calculate the credit accurately based on the percentage of qualified expenses you specify, considering any limitations that can apply. Attach Form 8911 to your tax return when filing, providing all necessary supporting documentation and maintaining records in case of future audits or inquiries.

6. Record-Keeping Requirements for Claiming the Credit

Keep records that substantiate your eligibility and support the information you provide on the tax return. This can include invoices, receipts, or other evidence of the costs that relate to purchasing and installing the qualified refueling property. Additionally, maintaining records that associate with the type of alternative fuel, the capacity of the refueling property, and any certifications or safety standards you meet is crucial.

These records serve as documentation in case of an IRS audit or inquiry, demonstrating that you meet the necessary criteria for claiming the alternative fuel vehicle refueling property credit. Maintain these records for up to three years from the date of filing the tax return.

7. Common Mistakes to Avoid When Filling Out Form 8911

Common mistakes when filling out Form 8911 include miscalculating the credit amount by not considering the eligible costs that associate with installing qualified alternative fuel vehicle refueling property. Another error is failing to meet the specific requirements for the type of alternative fuel or overlooking compliance with industry safety standards and codes.

Inaccurate or incomplete information on the form, such as missing details about the property or providing incorrect identification numbers, can also lead to complications. You need to pay attention to thorough documentation of the installation costs and adhere to the IRS guidelines to prevent errors when claiming the alternative fuel vehicle refueling property credit. Additionally, overlooking recent updates or changes to the form’s instructions can result in overlooking new requirements or opportunities for the credit.

>>>GET SMARTER: How to File Taxes If You’re Divorcee

Recap

Filing Form 8911 entails understanding and adhering to a comprehensive set of guidelines. Beginning with the definition of Form 8911, it is crucial to grasp its purpose in facilitating tax credits for investments in alternative fuel vehicle refueling property. Eligibility criteria hinge on factors like property use and compliance with safety standards, while recognizing the various alternative fuels eligible for the credit is paramount. Carefully explore the credit calculation and limitations.

Plus, you need to follow specific procedures when claiming Form 8911 on your tax return. Equally important are stringent record-keeping requirements, ensuring that you maintain documentation supporting the credit you’re claiming for the required period. Lastly, avoiding common mistakes, such as miscalculations or oversight of eligibility criteria, is essential to a smooth filing process and maximizing the benefits of the alternative fuel vehicle refueling property credit.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. . For comprehensive tax, legal or financial advice, always contact a qualified professional in your area. S’witty Kiwi assumes no liability for actions taken in reliance upon the information contained herein.

No Comment! Be the first one.