Have you ever engaged in trading Section 1256 contracts or tried your hand at the “straddle game”? Well, if you have, the IRS is reaching out – via Form 6781. No need to fret; this isn’t rocket science, just tax terminology. Consider it your key to understanding gains and losses from these sophisticated financial instruments.

Forget the uncertainty about straddle losses or hidden 1256 contract profits. This guide is your reliable companion, demystifying mark-to-market rules and helping you conquer the Form 6781 challenge. By the end, you’ll be a tax-filing pro, confidently facing the IRS with a well-filled form. So, get ready, and unravel the secrets of Form 6781. Remember, knowledge is power (and in this case, potential tax savings).

- Understand What Section 1256 Contracts and Straddles Are

- Report Your Gains and Losses on Section 1256 Contracts and Straddles

- Learn About the Tax Implications of Section 1256 Contracts and Straddles

- Calculate The Fair Market value of Section 1256 Contracts and Straddles

- Meet The Deadlines for Filing Form 6781

Interested? Let’s roll!

1. Understand What Section 1256 Contracts and Straddles Are

If you are an investor who trades options, futures, or other financial contracts, you may need to file Form 6781 to report your gains and losses from these transactions. IRS uses this form to determine how much tax you owe on your income from these investments.

To understand what Section 1256 contracts and straddles are, you need to know the following:

- Section 1256 contracts require you to sell them at their fair market value by year-end, regardless of whether they are closed or not. This means that you have to report any profit or loss from these contracts as if you sold them at the end of the year.

- A straddle is a strategy that involves buying both a call option and a put option for the same underlying asset at the same time. This way, you can profit from a large price movement in either direction.

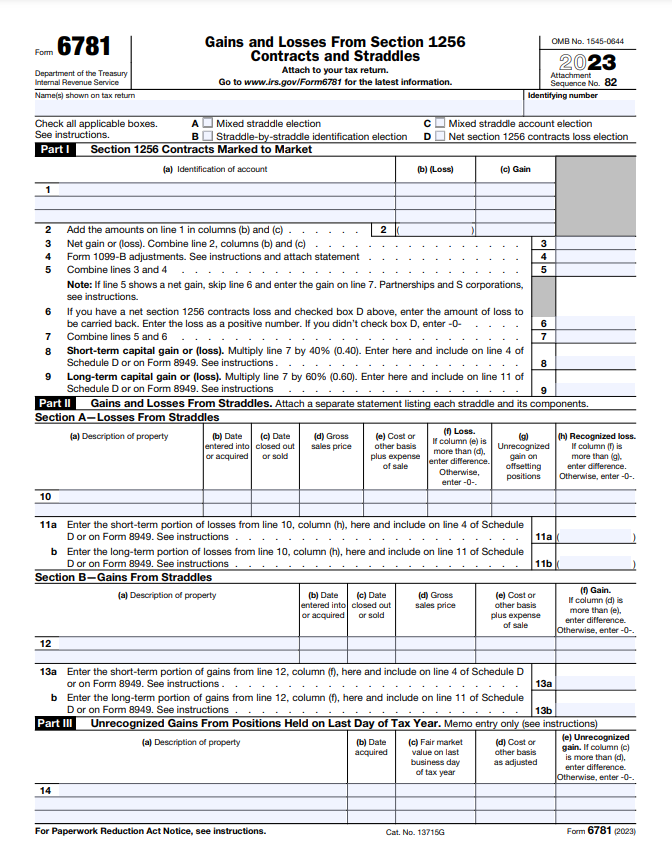

- To calculate your gains and losses from Section 1256 contracts and straddles, you have to use Form 6781, Part I. You have to enter the number of contracts, the contract type (options or futures), and the contract dates. You also have to enter the fair market value of each contract at the end of the year.

- Depending on how long you hold your contracts, your gains and losses may be classified as short-term or long-term capital gains or losses. Your ordinary income tax rate applies to short-term capital gains or losses, whereas lower tax rates apply to long-term capital gains or losses.

2. Report Your Gains and Losses on Section 1256 Contracts and Straddles

When dealing with Section 1256 contracts and straddles, reporting gains and losses is easy with Form 6781. First, gather all relevant information on your transactions. Don’t stress, just organize your data neatly. Now, head over to Form 6781 – it’s your financial ally in this tax game.

Start by entering your gains and losses from each Section 1256 contract or straddle in the appropriate sections. Be meticulous – accuracy is key here. The form provides a clear layout for your figures. It’s like a puzzle, and you’re putting together the financial picture of your gains and losses.

Once you’ve filled in the details, do a quick double-check. Accuracy ensures a smooth sail through tax season. With Form 6781, you’re not just reporting – you’re showcasing your financial expertise. File confidently, and let Uncle Sam know you’ve got this tax game under control!

3. Learn About the Tax Implications of Section 1256 Contracts and Straddles

To learn about the tax implications of Section 1256 contracts and straddles, Understand the taxation of these investments, and be aware of the special rules that pertain to them.

The tax implications of Section 1256 contracts and straddles are:

- You have to use Form 6781 to report your gains and losses from these investments every year.

- Regardless of the duration of ownership, treat each Section 1256 gain or loss as 60% long-term and 40% short-term. Long-term gains or losses incur lower tax rates compared to short-term gains or losses.

- If you have a straddle, you may have to defer or limit your losses until you dispose of all the offsetting positions. You may also have to follow the mixed straddle rules if some of your positions are Section 1256 contracts and some are not.

4. Calculate The Fair Market Value of Section 1256 Contracts and Straddles

To calculate the fair market value of Section 1256 contracts and straddles, you need to follow these steps:

- Identify the Section 1256 contracts and straddles that you held at the end of the year. These are investments that use leverage, such as options, futures, or foreign currency contracts.

- For each Section 1256 contract, determine its fair market value on the last business day of the year. This is the price at which you could sell the contract in the open market.

- For each straddle, which is a combination of a call option and a put option for the same underlying asset, determine the net gain or loss from the positions as if they were disposed of at their fair market value on the last business day of the year.

- Report the gains and losses from Section 1256 contracts and straddles on Form 6781, Part I. Enter the number of contracts, the contract type, the contract dates, and the fair market value of each contract.

>>>PRO TIPS: How to File Taxes When Living Abroad

5. Meet The Deadlines for Filing Form 6781

To meet the deadlines for filing Form 6781, check the due date for your federal income tax return. This is usually April 15, unless it falls on a weekend or a holiday, in which case it is the next business day. Attach Form 6781 to your tax return and file it by the due date. You can file electronically or by mail.

If you need more time to file your tax return, you can request an extension by filing Form 4868 by the original due date. This will give you six more months to file your tax return, but not to pay your taxes. Pay any taxes you owe on your Section 1256 contracts and straddle by the original due date, even if you file an extension. You can pay online, by phone, or by mail. Keep in mind that if you file late or pay late, you may face penalties and interest charges from the IRS.

Recap

To demystify Form 6781: Gains and Losses from Section 1256 Contracts and Straddles, first, grasp the concept of Section 1256 Contracts and Straddles. Report your gains and losses accurately on these transactions. Understand the tax implications associated with Section 1256. Calculate the fair market value for these contracts and straddles.

Stay on top of deadlines when filing Form 6781. Equip yourself with the knowledge to navigate this tax form seamlessly and ensure compliance. Take charge of your financial reporting and make Form 6781 work for you.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. . For comprehensive tax, legal or financial advice, always contact a qualified professional in your area. S’witty Kiwi assumes no liability for actions taken in reliance upon the information contained herein.

No Comment! Be the first one.