Confused by Kentucky’s ever-shifting tax landscape? Feeling lost like a squirrel in a corn maze? Worry not, Kentucky friends! This 2023 update serves as your guide, providing straightforward information to lead you through the recent changes.

Get ready to delve into the positive news of a reduced income tax rate, unravel the complexities of sales tax, and pinpoint crucial updates impacting your tax bill. Whether you’re an experienced Kentucky taxpayer or a newcomer exploring the Bluegrass state, this serves as your roadmap for a seamless and well-informed tax journey.

- Understand the Kentucky State Tax System

- Familiarize Yourself with Changes in Tax Laws

- Determine Your Filing Status

- Calculate Your Kentucky State Taxable Income

- Identify Deductions and Credits Available to You

- Review Kentucky State Tax Forms and Instructions

- File Your Kentucky State Tax Return Electronically

Motivated? Let’s go!

1. Understand the Kentucky State Tax System

To get a grip on the Kentucky State Tax System, it’s crucial to understand how it all works. Dive into the nitty-gritty details of tax laws, exemptions, and rates. Figure out which taxes you’re subject to, like income tax, sales tax, or property tax. Familiarize yourself with the different forms and filing requirements.

Get to know how deductions and credits can save you some hard-earned cash. Don’t forget to stay up-to-date on any recent changes! So, buckle up and get ready to conquer the Kentucky State Tax System like a boss. It’s time to become a tax-savvy superstar!

2. Familiarize Yourself with Changes in Tax Laws

If you are a resident of Kentucky, you should familiarize yourself with the changes in tax laws that affect your state income tax for the 2023 tax year. Here are some of the main changes that you need to know:

- The individual income tax rate has been lowered from 5% to 4.5%, retroactive to January 1, 2023. This means that you will pay less tax on your taxable income for 2023.

- The standard deduction has been increased from $2,770 to $2,980, after adjusting for inflation. This means that you can deduct a higher amount from your adjusted gross income before calculating your tax liability.

- The treatment of Restaurant Revitalization Grants has been aligned with the federal tax law. This means that if you received a grant under this program, you do not have to include it in your gross income, and you can still deduct the expenses paid with the grant.

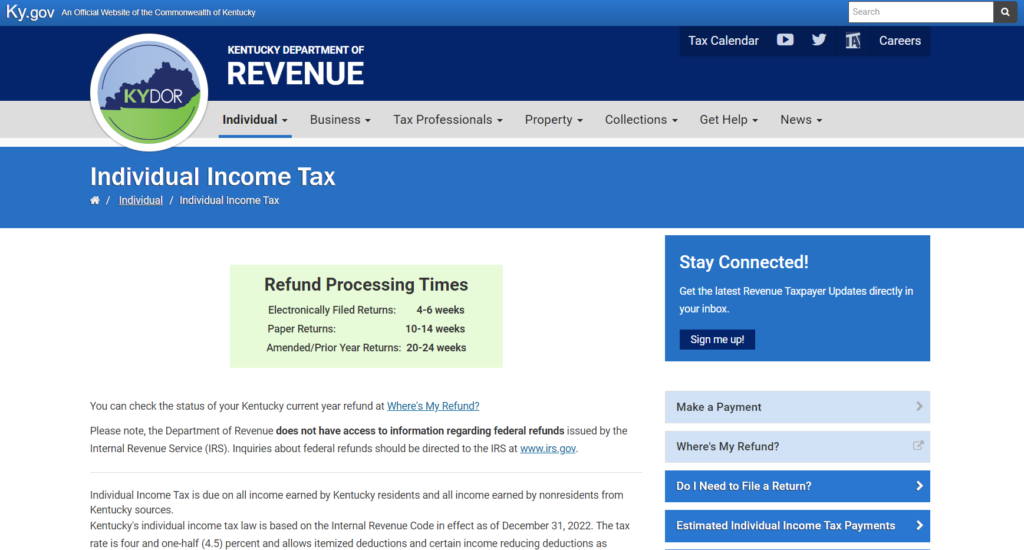

These are some of the major updates to the Kentucky state tax laws for 2023. You can find more information on the Department of Revenue website or consult a tax professional for specific guidance.

3. Determine Your Filing Status

To get a grip on the Kentucky State Tax System, you need to determine your filing status. Consider your marital status, dependents, and residency (resident, part-year resident, or nonresident) to select from these options: Single, Married filing jointly, Married filing separately, Head of household, Qualifying widow(er) with dependent child.

Each status comes with distinct tax rates, brackets, and standard deductions. Opt for the status with the lowest tax liability, unless there are specific reasons for married individuals filing separately. Utilize the Kentucky Income Tax Calculator for comparison and estimate your tax refund or balance due.

>>>PRO TIPS: Texas State Taxes: 2023 Update

4. Calculate Your Kentucky State Taxable Income

Keep in mind that calculating your Kentucky State taxable income is easy and essential for accurately filing your state taxes. Start by gathering all your income documents, such as W-2 forms, 1099 forms, and any other relevant income statements. Subtract any allowable deductions from your total income. These deductions may include student loan interest, educator expenses, or contributions to retirement accounts.

Next, subtract any applicable exemptions. Exemptions are deductions based on your filing status and the number of dependents you have. Review the Kentucky tax brackets for the 2023 tax year to determine your tax rate. Multiply your taxable income by the corresponding tax rate to calculate your state tax liability. Don’t forget to consider any tax credits you may be eligible for. Tax credits directly reduce your tax liability, so take advantage of any credits that apply to your situation.

5. Identify Deductions and Credits Available to You

If you are a Kentucky resident who pays state income tax, you may be eligible for some deductions and credits that can lower your tax bill. Remember, deductions reduce your taxable income, which means you pay less tax. The standard deduction for 2023 is $2,980, which means you can subtract this amount from your income before calculating your tax.

You can also deduct certain expenses, such as mortgage interest, medical expenses, and charitable contributions if you itemize your deductions instead of taking the standard deduction.

Credits reduce your tax liability, which means you pay less tax or get a refund. Some credits are refundable, which means you can get money back even if you owe no tax. Some credits are nonrefundable, which means they can only reduce your tax to zero. Kentucky offers various credits, such as the family size tax credit, the decontamination tax credit, and the Kentucky entertainment incentive credit, depending on your eligibility and qualifications.

6. Review Kentucky State Tax Forms and Instructions

To review Kentucky state tax forms and instructions for 2023, you can follow these steps:

- Visit the Forms page on the Department of Revenue website and select the tax year 2023 from the drop-down menu. You will see a list of forms and instructions for various types of taxes, such as individual income tax, sales and use tax, and corporate income tax.

- Choose the form or instruction that applies to your tax situation. For example, if you are a full-year resident of Kentucky, you will need Form 740 and its instructions. If you are a nonresident or a part-year resident, you will need Form 740-NP and its instructions.

- Download the form or instruction as a PDF file and print it out. You can also fill out the form online using the KY File portal, which is a free and simple way to file your return electronically.

- Read the instructions carefully and fill out the form accurately. You may need to attach additional schedules or documents, such as Schedule ITC for tax credits or Schedule P for pension income exclusion.

- Sign and date the form and mail it to the address provided in the instructions. You can also pay your tax online using the ePay system or by check or money order.

>>>GET SMARTER: New Jersey State Taxes: 2023 Update

7. File Your Kentucky State Tax Return Electronically

Keep in mind that filing your Kentucky state tax return electronically is easy and convenient. First, you need to complete your federal tax return before you can file your state return. You can use any IRS-approved software or service to do this. Next, you have two options to file your state return electronically: you can use one of the Free File offers if your income is $69,000 or less, or you can use KY File, the new Kentucky filing portal if you prefer to fill out your forms and schedules without software help or assistance.

Either way, you will need to select the appropriate forms and schedules for your tax situation, such as Form 740 for full-year residents or Form 740-NP for nonresidents or part-year residents. You will also need to enter your tax information online and perform basic calculations.

Finally, you will need to electronically sign and e-file your state return. You can also pay your tax online using the ePay system or by check or money order.

Recap

To learn about Kentucky State Taxes in 2023, get to know how it works. Stay updated on new tax laws. Figure out your filing status. Add up your Kentucky income that gets taxed. Find deductions and credits you can use. Look at Kentucky tax forms. Then, go online to file your Kentucky taxes. Follow these steps to handle your 2023 taxes in Kentucky easily!

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. . For comprehensive tax, legal or financial advice, always contact a qualified professional in your area. S’witty Kiwi assumes no liability for actions taken in reliance upon the information contained herein.

No Comment! Be the first one.