Navigating the ever-changing landscape of New Jersey state taxes can be daunting, even for seasoned residents. This comprehensive guide aims to demystify the 2023 tax updates, presenting them clearly and concisely.

Whether you’re a seasoned filer or a newcomer to Garden State’s tax system, this resource will equip you with the knowledge and practical strategies to navigate your tax obligations with confidence. So, put aside the worry and anxieties, and let’s embark on this journey together, ensuring a smooth and stress-free tax season.

- Understand the New Jersey State Tax Structure

- Familiarize Yourself with New Jersey State Tax Forms

- Determine Your Tax Filing Status in New Jersey

- Calculate New Jersey State Income Tax

- Be Aware of New Jersey State Sales Tax Rates

- Navigate New Jersey State Tax Audits and Appeals

- Learn About New Jersey State Tax Penalties and Interest

Curious, right? Let’s get started!

1. Understand the New Jersey State Tax Structure

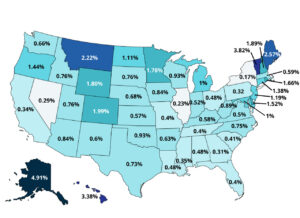

To understand the New Jersey State Tax Structure for 2023, start by grasping the basics. New Jersey has a progressive income tax system, which means that the tax rate increases as your income increases. There are seven or eight tax brackets, depending on your filing status, with rates ranging from 1.4% to 10.75%. The highest rate applies to income over $5 million.

New Jersey also has a sales tax of 6.625%, which applies to most goods and services. Some items, such as clothing, groceries, and prescription drugs, are exempt from sales tax. Some counties and cities may impose an additional sales tax of up to 3.5%.

New Jersey residents may be eligible for various deductions, exclusions, and credits on their income tax returns. For example, there is a new child tax credit of up to $1,000 for each dependent who is age 5 or younger. There is also a credit for taxes paid to other jurisdictions, such as Philadelphia.

2. Familiarize Yourself with New Jersey State Tax Forms

Prepare yourself for the task at hand – it’s time to delve into the intricacies of New Jersey’s state tax forms, your indispensable tools for navigating the tax landscape of 2023. Kick off your journey with the essentials: the NJ-1040, your go-to for individual income tax. As you traverse the tax terrain, explore Schedule NJ-COJ for potential credits, such as the Homestead Benefit and other valuable rebates.

If your expertise lies in the realm of business, acquaint yourself with the CBT-100, the essential form for corporate taxes. Homeowners, don’t overlook the PTR-1, which guides you through the intricacies of the Property Tax Reimbursement program. For in-depth information, the NJ Division of Taxation website awaits your exploration. Remember to opt for the efficiency of e-filing to expedite your return. So, equip yourself, settle in, and confidently conquer those forms.

3. Determine Your Tax Filing Status in New Jersey

To determine your tax filing status in New Jersey for the 2023 tax year, check your federal filing status. You can use the same filing status on your New Jersey return as you do for federal purposes unless you are a partner in a civil union.

If you are a partner in a civil union, you must file as a married or civil union couple, either jointly or separately. You cannot file as single, head of household, or qualifying widow(er)/surviving civil union partner.

If you are not sure which filing status to use, you can compare the tax rates and benefits for each option. Generally, filing jointly is more beneficial than filing separately, and the head of household is more beneficial than single.

>>>PRO TIPS: Texas State Taxes: 2023 Update

4. Calculate New Jersey State Income Tax

To calculate your New Jersey State Income Tax, determine your filing status, such as single, married, or civil union partner. Your filing status affects your tax rates and deductions. Calculate your gross income, which is the total amount of money you earned from all sources. Then, subtract any retirement contributions, such as 401(k) or IRA, to get your adjusted gross income.

Also, subtract any itemized deductions and exemptions from your adjusted gross income to get your state-taxable income. Itemized deductions include medical expenses, property taxes, and alimony payments. Exemptions include personal exemptions and dependent exemptions.

Apply the state tax rate to your state taxable income to get your state tax liability. The state tax rate depends on your filing status and income level. It ranges from 1.4% to 10.75%. Check if you qualify for any tax credits, such as the earned income tax credit or the child and dependent care credit. Tax credits reduce your tax liability dollar for dollar. Remember to subtract any tax credits from your state tax liability to get your final state income tax amount. This is the amount you owe or get refunded by the state.

5. Be Aware of New Jersey State Sales Tax Rates

Keep in mind that New Jersey has a state sales tax of 6.625% that applies to most purchases of goods and services in the state. Some items, such as groceries, clothing, and prescription drugs, are exempt from the sales tax. Some counties and cities may charge an additional local sales tax of up to 3.5% on top of the state rate.

To be aware of the New Jersey State Sales Tax Rate, check the New Jersey Division of Taxation website for the latest information on sales tax rates, exemptions, and rules. Look at your receipts or invoices to see how much sales tax you are paying for your purchases. Use a sales tax table or a sales tax calculator to estimate how much sales tax you will owe or get refunded on your purchases or returns. Keep track of your sales tax payments and report them on your state income tax return.

6. Navigate New Jersey State Tax Audits and Appeals

If the New Jersey Division of Taxation notifies you of an audit on your tax return, don’t panic. Cooperate with the auditor and provide the requested records and information. The auditor will verify that you reported and paid the correct amount of tax. If you disagree with the audit results, you can request a conference with the auditor’s supervisor or the Conference and Appeals Branch. You can also appoint a representative to act on your behalf.

If you are still not satisfied, you can file an appeal with the Tax Court of New Jersey within 90 days of the final determination. You can use the online platform eCourts to file and manage your case. If you lose the case in the Tax Court, you can appeal to the Appellate Division of the Superior Court and then to the Supreme Court of New Jersey.

>>>GET SMARTER: West Virginia State Taxes: 2023 Update

7. Learn About New Jersey State Tax Penalties and Interest

To discover the ins and outs of New Jersey State Tax Penalties and Interest, unravel the complexities, and safeguard your financial standing by staying informed. First off, understand the types of penalties you might encounter—late payment penalties, underpayment penalties, and more.

Get a grip on the factors influencing penalty amounts and interest rates to avoid any surprises. Explore the specifics of the 2023 updates to ensure you’re ahead of the game. Don’t let penalties and interest catch you off guard—be in the know, take charge, and navigate the tax landscape with confidence.

Recap

To master the New Jersey State Tax landscape, understand the tax structure, settle in with the forms, and nail down your filing status. Crunch those income tax numbers and keep a close eye on sales tax rates. Learn the ropes for audits and appeals, and don’t let penalties and interest catch you off guard. Stay proactive, stay informed, and own your New Jersey State Taxes like a pro this year!

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. . For comprehensive tax, legal or financial advice, always contact a qualified professional in your area. S’witty Kiwi assumes no liability for actions taken in reliance upon the information contained herein.

No Comment! Be the first one.