Feel like Texas taxes are big and confusing? Don’t worry! Pay attention to the 2023 Texas State Tax Update, where you’ll learn all the latest changes and important dates in simple terms. Whether it’s property taxes or other financial matters. So, put on your boots and get ready to tackle those taxes with confidence!

- Understand the Tax Rate Changes in Texas for 2023

- Learn How to File Your Texas State Taxes for 2023

- Discover the Texas State Tax Deductions and Credits Available for 2023

- Stay Informed About Important Texas State Tax Deadlines in 2023

- Explore the New Texas State Tax Laws and Regulations for 2023

- Find Out How Texas State Taxes Affect Different Income Brackets in 2023

- Understand the Impact of Texas State Taxes on Small Businesses in 2023

Ready? Let’s go

1. Understand the Tax Rate Changes in Texas for 2023

https://comptroller.texas.gov/taxes

To understand changes in the Texas Tax Rate, start by keeping track of the updated income tax brackets, as they can impact the amount you either owe or receive as a refund. Take a moment to review the new deductions and credits available, as these could potentially save you some hard-earned cash.

Stay on top of any changes in property taxes as well; homeowners must understand the implications of their expenses. Make sure to consult updated tax forms and guidelines to ensure accurate filings. Don’t forget to explore any new incentives or exemptions that might apply to your specific situation.

2. Learn How to File Your Texas State Taxes for

To file your Texas state taxes for 2023, start by gathering all necessary documents, including W-2s, 1099s, and receipts for deductions. Visit the official Texas Comptroller of Public Accounts website and choose an online filing option for a convenient process. Create an account if you haven’t already. Follow the step-by-step instructions, entering accurate information to ensure your return is error-free.

Explore available deductions and credits that apply to your situation, such as education expenses or homeownership benefits. Double-check your entries, review the summary, and submit your return electronically for faster processing. If you prefer a traditional approach, printable forms are also available. Don’t forget to keep a copy of your filed return for your records. For any queries, the Comptroller’s office provides resources and assistance. Stay informed about deadlines to avoid penalties and enjoy a stress-free tax season!

3. Discover the Texas State Tax Deductions and Credits Available for 2023

To uncover potential savings, explore Texas state tax deductions and credits for 2023. Begin with education expenses – if you’ve been hitting the books, there might be credits waiting for you. Homeowners, rejoice! Check out deductions related to property taxes and mortgage interest.

Don’t overlook energy-efficient upgrades – they could translate into tax breaks. If you’ve been a champion of the community, charitable contributions might be your ticket to deductions.

Self-employed? Investigate business-related deductions to keep more of your hard-earned money.

Families, explore child-related credits for extra relief. Medical expenses can also lead to deductions, so keep those receipts handy. Dive into the details on the Texas Comptroller of Public Accounts website or consult a tax professional for personalized advice. Maximize your savings by making the most of these deductions and credits – it’s your money, so keep more of it where it belongs!

>>>PRO TIPS: Massachusetts State Taxes: 2023 Update

4. Stay Informed About Important Texas State Tax Deadlines in 2023

To stay informed about important Texas state tax deadlines in 2023, mark your calendar or set reminders for the key dates. Don’t let them sneak up on you! Next, regularly check the Texas Comptroller of Public Accounts website for any updates or changes to the deadlines. They have all the information you need to stay on top of your tax obligations.

Additionally, sign up for email notifications from the Comptroller’s office to receive timely reminders directly in your inbox. It’s a convenient way to ensure you never miss a deadline. Then, consider consulting with a tax professional who specializes in Texas state taxes. They can provide valuable guidance and help you navigate the complexities of the tax system. By staying informed and proactive, you can avoid unnecessary penalties and ensure a smooth tax season.

5. Explore the New Texas State Tax Laws and Regulations for 2023

To explore the new Texas state tax laws and regulations for 2023, follow these steps. First, visit the official website of the Texas Comptroller of Public Accounts. They provide comprehensive information on the latest tax laws and regulations. Take your time to read through the relevant sections and familiarize yourself with any changes that may affect you. If you have any specific questions or need clarification, don’t hesitate to reach out to the Comptroller’s office for assistance. Also, consider consulting with a tax professional who specializes in Texas state taxes.

They can provide expert guidance tailored to your specific situation. Stay proactive by staying informed about any updates or amendments to the tax laws throughout the year. By understanding and complying with the new tax laws and regulations, you can ensure that you are fulfilling your tax obligations accurately and avoid any potential penalties.

6. Find Out How Texas State Taxes Affect Different Income Brackets in 2023

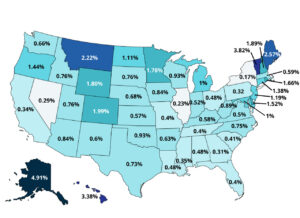

To find out how Texas state taxes affect different income brackets in 2023, you can follow these steps. First, gather information about the income brackets and tax rates set by the Texas Comptroller of Public Accounts. These details can usually be found on their official website. Take note of the different income thresholds and the corresponding tax rates for each bracket. Next, determine your annual income and identify which income bracket you fall into.

This will help you understand the specific tax rate that applies to your income level. Finally, calculate your estimated tax liability based on the applicable tax rate for your bracket. You can use online tax calculators or consult with a tax professional for assistance. By understanding how Texas state taxes are structured for different income brackets, you can better plan and manage your tax obligations for 2023.

>>>GET SMARTER: West Virginia State Taxes: 2023 Update

7. Understand the Impact of Texas State Taxes on Small Businesses in 2023

Understanding the impact of Texas state taxes on small businesses in 2023 is crucial for entrepreneurs. First, familiarize yourself with the different types of taxes that may apply to your business, such as the franchise tax, sales tax, and employment taxes. Each tax has its own rules and requirements, so make sure you understand them thoroughly. Next, consider the potential deductions and credits available to small businesses.

These can help reduce your overall tax liability. It’s also important to stay updated on any changes to tax laws and regulations that may affect your business. This can be done by regularly checking the Texas Comptroller of Public Accounts website or consulting with a tax professional. Keep accurate records of your business income and expenses to ensure accurate reporting and compliance with tax laws. By understanding and managing your tax obligations effectively, you can navigate the impact of Texas state taxes on your small business in 2023.

Recap

To enjoy a smooth tax journey in Texas, learn the ropes of Tax Rate Changes and how to file your 2023 taxes. Dive into the world of Deductions and credits, and stay ahead with key deadlines. Uncover the latest laws affecting different income brackets and small businesses. Don’t forget to grasp exemptions and exclusions!

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. . For comprehensive tax, legal or financial advice, always contact a qualified professional in your area. S’witty Kiwi assumes no liability for actions taken in reliance upon the information contained herein.

No Comment! Be the first one.