If you are a parent, you need to choose the right tax filing status because it impacts your tax liability and potential refund.

Options include Single, Married filing jointly, Married filing separately, Head of household, and Qualifying widow(er). Single status suits unmarried individuals but has lower deductions.

Married filing jointly offers high deductions for couples, while Married filing separately has some limitations. Head of household benefits unmarried individuals supporting a home. Qualifying widow(er) is for widowed parents with dependent children.

Use the IRS Interactive Tax Assistant or consult a professional to make a wise decision. The right choice optimizes your tax situation, ensuring you claim available credits and deductions for dependents, ultimately reducing your tax bill.

To file taxes as parent:

- Determine Your Filing Status

- Identify Your Dependents and Exemptions

- Claim Your Tax Credits and Deductions

- Report Your Income and Expenses

- Report Your Dependents and Exemptions on Your Tax Return

- File and Pay Your Taxes

Recap

1. Determine Your Filing Status

Choosing the right filing status is crucial in determining your tax liability and the potential refund. As a parent, your options include Single, Married filing jointly, Married filing separately, Head of household, and Qualifying widow(er).

Single status is for you if you are an unmarried individual without dependents that make you stand in as Head of household, offering the lowest standard deduction and highest tax rates.

Married filing jointly provides the highest standard deduction and lowest tax rates for married couples.

Married filing separately mirrors the single status but may limit certain benefits.

Head of household is for unmarried individuals who provide more than half the cost of maintaining a home for a qualifying person, offering higher deductions and lower tax rates.

Qualifying widow(er) is for widowed individuals with a dependent child, sharing the same benefits as married filing jointly.

To make an informed decision, compare tax implications for each status and consider advantages and disadvantages.

The IRS Interactive Tax Assistant tool can assist or consult with a tax professional or volunteer. Making the right choice ensures that you optimize your tax situation adequately.

What to Note

Single Status: Perfect if you’re unmarried or legally separated at the tax year’s end. It’s straightforward but comes with the lowest standard deduction and higher tax rates, potentially impacting your refund.

Married Filing Jointly: Ideal for married couples or anyone who loses a spouse during the tax year. Gain access to the highest standard deduction and lower tax rates. Joint filing brings perks like unique tax benefits but binds you and your spouse together in responsibility, requiring agreement on income, expenses, and more.

Married Filing Separately: Opt for this if married, but choose independent tax returns. You handle your taxes, and it’s beneficial for income imbalances or specific deductions. However, you lose out on some benefits available to joint filers.

Head of Household: If unmarried and you meet the criteria with a qualifying dependent, you qualify. Enjoy a higher standard deduction and lower tax rates, making it more favorable than filing as single. Rigorous rules exist for proving relationships and expenses.

Qualifying Widow(er): Apply if your spouse passes away in the last two years and you have a dependent child. Similar to joint filing benefits, but for a limited time.

>>>MORE: How to File Taxes If You’re Senior

2. Identify Your Dependents and Exemptions

If you financially support someone who qualifies as dependent on your taxes, it saves you money. There are two types: a qualifying child and a qualifying relative. A qualifying child is under 19 (or 24 if a full-time student) and lives with you for more than half the year.

A qualifying relative is not a qualifying child, earns less than $4,300, and gets over half the support from you. To claim a dependent, ensure the person is a U.S. citizen, has a valid Social Security number, and meets specific criteria. Use the IRS Interactive Tax Assistant for help or consult a tax professional.

The child must also pass a relationship test, whether as your son, daughter, stepchild, or descendant, among others. The residency test requires the child to live with you for over half the year, considering temporary absences. In cases of divorce or separation, the custodial parent is usually considered the one the child lives with.

For qualifying children, a support test mandates that you provide more than half of the person’s support, covering essentials like food, shelter, and education. The citizenship test demands your dependent is a U.S. citizen, national, resident alien, or a resident of Canada or Mexico.

3. Claim Your Tax Credits and Deductions

Reducing your tax bill involves two key things: tax credits and deductions.

Tax credits are direct, dollar-for-dollar deductions from what you owe. If you snag a $2,000 tax credit and face a $5,000 tax bill, now you’re looking at $3,000.

Tax deductions reduce your taxable income, but the impact on your tax bill depends on your tax rate. Say you cut $10,000 off your $50,000 income. If your tax rate is 20%, your tax bill shrinks to $8,000 ($40,000 x 0.2), saving you $2,000.

As a parent, you have some awesome tax breaks:

Earned Income Tax Credit (EITC)

If you earn income from working or running a business, you may qualify for the EITC. Your income and filing status must meet specific limits. The EITC can reduce your tax and increase your refund, ranging from $600 to $7,430, depending on your situation. It’s a refundable credit for working parents with a moderate income. You get cash back based on your income, family size, and qualifying kids. Use the IRS’s EITC Qualification Assistant to see if you qualify.

Child Tax Credit (CTC)

For the CTC, you need a qualifying child under 17. The credit is $2,000 per child, with $1,600 being refundable. There’s a phase-out for higher incomes. To claim, use IRS tools or attach the required forms to your return. Use the IRS’s Schedule 8812 (Form 1040) to figure out your credit.

Child and Dependent Care Credit (CDCC)

If you pay for care to work, the CDCC can help. It’s a percentage of your work-related expenses, ranging from 20% to 35%. Maximum expenses are $3,000 for one person or $6,000 for two or more. It’s nonrefundable, so you get it only if you owe taxes. Score a nonrefundable credit if you pay for a child’s or dependent’s care. Use Form 2441 to crunch the numbers.

Adoption Credit (AC)

If you adopt a child, the AC can reduce your tax with qualifying adoption expenses, up to $15,950 per child. There’s a phase-out based on your income. It’s nonrefundable, but you can carry forward unused credit. Phase-out starts at $239,230 AGI and ends at $279,230. Use Form 8839 to sort out credits.

Education Credits and Deductions

For education, you can claim the American Opportunity Tax Credit (up to $2,500 per student, partially refundable) or the Lifetime Learning Credit (up to $2,000 per return, nonrefundable). Student Loan Interest Deduction (up to $2,500). Each has its own eligibility criteria and income limits. Use Form 8863 instructions and Form 1040 to tackle each one, respectively.

Remember to use the relevant IRS forms and documentation when claiming these credits and deductions on your tax return.

Example

- Kim and Lee, a married couple with two kids, pay $12,000 for daycare. The couple has an income of $40,000 and $50,000, respectively. Filing jointly, claim the Child Tax Credit, Child and Dependent Care Credit, and American Opportunity Tax Credit for a graduate program. Opting for the $25,100 standard deduction, correctly claiming credits on Form 1040 and associated forms, reducing the taxable income with $25,100, and receiving a $6,900 refund. Kim and Lee wisely choose the American Opportunity Tax Credit over the Lifetime Learning Credit, maximizing benefits.

4. Report Your Income and Expenses

- Wages: You report your earnings on Form W-2, Line 1 of Form 1040.

- Interest: Report the money you lend on Form 1099-INT, Line 2b of Form 1040.

- Dividends: State income from stock ownership, on Form 1099-DIV, Line 3b of Form 1040.

- Capital Gains: Profits from selling assets, reported on Form 1099-B, Schedule D, and Form 8949, Line 7 of Form 1040.

- Alimony: Report on Form 1040, Line 2a if you receive, or Line 18a if you pay.

- Child Support: Usually not taxable or deductible, but report if necessary on relevant forms.

- Retirement Income: State on various forms like Form 1099-R, Form SSA-1099, and Form W-2, Lines 4a, 4b, 5a, and 5b of Form 1040.

- Self-Employment: You put down income and expenses on Schedule C and Schedule F, with self-employment tax on Schedule SE, Line 8 of Form 1040 for income and Line 15 for self-employment tax.

- Declare all income unless the law exempts it, converting it to U.S. dollars using IRS exchange rates.

- Use the cash method, reporting income when you receive and expenses when you pay unless you follow the accrual method.

- Complete the right forms and schedules, attaching necessary documents like W-2s or 1099s.

- Ensure accurate filing status, dependents, and necessary Social Security numbers.

- Sign and date your return, include contact information, and pay the taxes you owe latest April 15 deadline.

- Explore IRS tools for assistance, like the Interactive Tax Assistant, Electronic Filing Options, and Payment Options. Stay on top of deadlines and consider an extension if you require it.

Example

-

- Meet Liam and Emma, a married couple who adopt a 4-year-old. Liam earns $60,000, Emma earns $40,000 and both spend $5,000 on adoption expenses. Filing jointly, Liam and Emma claim an adopted son as a dependent, eligible for the Adoption Credit and Child Tax Credit. Opting for the standard deduction, the couple saves $25,100 in taxable income and benefits from $7,000 in tax credits. A common mistake to avoid: claiming the Adoption Credit in the adoption process’s starting year, as it’s only available when the adoption is complete. Always check the adoption’s status and the child’s citizenship before claiming the credit.

>>>PRO TIPS: How to File Taxes If You’re Married

5. Report Your Dependents and Exemptions on Your Tax Return

To report your dependents, take the following steps;

- Complete the Personal Information section on Form 1040, the main tax form. Provide your name, address, Social Security number, and filing status. Check the box if you or your spouse claim to be dependent.

- Next, move to the Dependents section of Form 1040. List the name, Social Security number, relationship, and age of each dependent. Indicate if your child qualifies for the Child Tax Credit.

- In the Standard Deduction or Itemized Deductions section, decide between the fixed standard deduction or itemizing specific expenses. Use Schedule A to calculate itemized deductions. Choose the option of reducing taxable income for a higher refund.

- Complete the rest of Form 1040, along with applicable forms and schedules. Report income, adjustments, credits, taxes, payments, and refunds or amounts you owe. Sign, date your return, and attach necessary forms like W-2, 1099, 8962, and 8332.

- File and pay taxes latest April 15. File electronically or via mail and pay online or use a check, money order, or cash. Explore IRS Electronic Filing Options and Payment Options for guidance on the best method.

If you are unable to pay in full, consider an installment agreement. Use the IRS’s resources for assistance throughout the process.

Example

- Harry and Sally, a married couple with three kids, correctly claim dependents on a joint tax return, ticking the “Someone can claim you as a dependent” box as both are dependents. Listing the children, each qualifies for Child Tax Credit and Child and Dependent Care Credit. Opting for a $25,100 standard deduction, the couple reports income and credits and attaches relevant forms. This precision results in a $3,177 refund, which reduces taxable income with $12,900 and cuts tax with $6,000.

6. File and Pay Your Taxes

There are various ways to file and pay taxes, catering to your preferences and situation:

- Paper Filing: The traditional method involves filling out paper forms and mailing to the IRS. It’s slower and has a higher error risk.

- Electronic Filing: The modern way uses online software or tax professionals to submit your return electronically. It’s faster, more secure, and allows easy tracking.

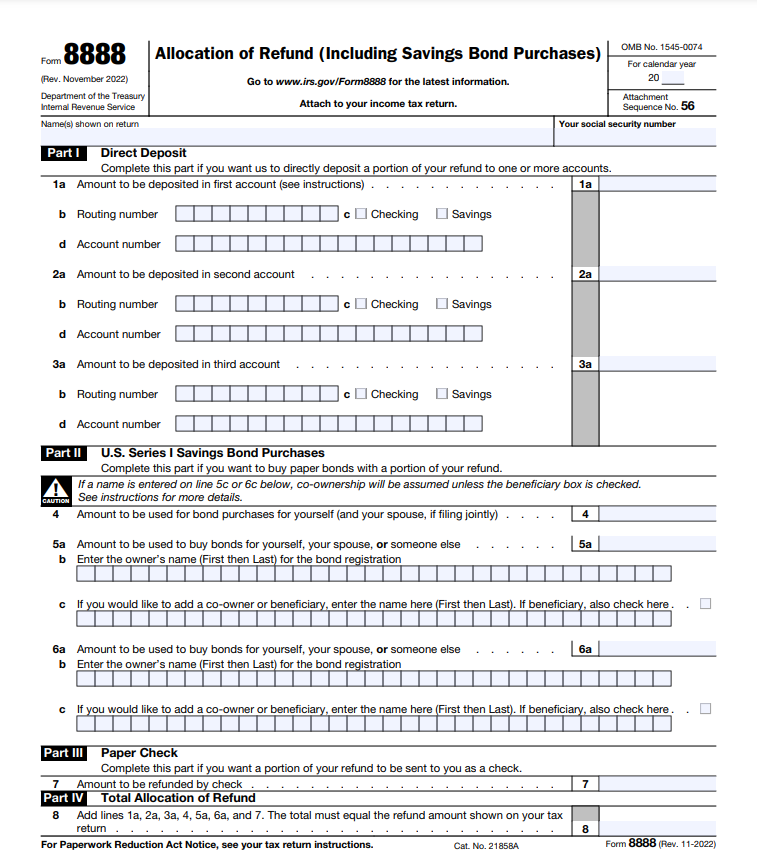

- Direct Deposit: Receive your refund directly into your bank account using Form 8888. It’s faster and safer than waiting for a paper check.

- Check or Money Order: Paying with a personal check, cashier’s check, or money order is an option. Include Form 1040-V and use the correct mailing address.

- Credit Card or Debit Card: Pay taxes using your credit or debit card online or via phone through eligible processors like Pay1040. Be aware of potential convenience fees.

- Installment Agreement: If you can’t pay in full, consider monthly payments. Apply online or with your phone, choosing the amount and date. Watch out for setup fees and interest.

Remember, these options provide flexibility, so choose what suits you best.

>>>GET SMARTER: How to File Taxes If You’re Business Owner

Recap

Parenting comes with diverse financial responsibilities, from reporting various incomes like wages, alimony, and self-employment, to claiming tax benefits like the Child Tax Credit and education deductions.

Going through this requires adherence to rules, using the right forms, and meeting eligibility criteria. Timely and accurate filing not only avoids IRS issues but also maximizes refunds, aiding personal and family goals.

Optimal filing methods, like electronic filing or direct deposit, expedite refunds. Explore IRS resources and the Taxpayer Advocate Service for assistance.

Low-income parents can benefit from free help through the Volunteer Income Tax Assistance program. Make sure you stay up to date, comply with tax laws, and secure your financial future.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. . For comprehensive tax, legal or financial advice, always contact a qualified professional in your area. S’witty Kiwi assumes no liability for actions taken in reliance upon the information contained herein.

No Comment! Be the first one.