As a homeowner, you can reduce your taxable income by itemizing your deductions on Schedule A of Form 1040. Some of the common deductions you can claim are mortgage interest, property taxes, home office expenses, and home improvement costs.

However, these deductions have some limitations and rules that you need to follow. You also need to keep track of your expenses and receipts, and report any income from renting or selling your home. In this article, you’re going to learn how to file taxes if you’re a homeowner in the U.S., and what tax benefits you can take advantage of.

How to File Taxes If You’re Homeowner

- Know How Taxes Work for Homeowners

- Familiarize Yourself with the Pros and Cons of Filing Taxes as a Homeowner

- Prepare Important Documents

- Determine Your Filing Status

- Understand Homeownership Tax Benefits

- Report Mortgage Interest and Property Taxes

- Consider Home Office Deductions If Applicable

- Include Any Capital Gains or Losses from Home Sales

- Explore Energy-Efficient Home Improvements for Credits

- Be Aware of Potential Deductions for Home-Related Expenses

- Consult a Tax Professional If Necessary

1. Know How Taxes Work for Homeowners

To file taxes if you’re a homeowner, know how taxes work for homeowners. As a homeowner, you enjoy some tax benefits, such as the exclusion of imputed rent, the deduction of mortgage interest and property taxes, and the exclusion of home sale gains.

However, you also have to deal with some tax obligations and complexities, such as the limits on the deductions, the rules for the home office deduction, and the reporting of home sale transactions. One cool thing is that you can consult a tax professional or use a tax software to file your taxes correctly and take advantage of the tax breaks available to you.

>>>MORE: How to File Taxes If You’re Senior

2. Familiarize Yourself with the Pros and Cons of Filing Taxes as a Homeowner

To file taxes as a homeowner, familiarize yourself with the pros and cons of filing taxes as a homeowner.

Pros:

- Offers mortgage interest deduction: You can deduct mortgage interest payments, potentially lowering your taxable income.

- Provides property tax deduction: Property taxes you pay on the home are often deductible, reducing your overall tax burden.

- Offers opportunity for home office deductions: If you use part of your home exclusively for business, you can qualify for home office deductions.

- Is potential for capital gains exclusion: You can exclude profits from selling a primary residence from capital gains taxes up to a certain limit.

- Offers energy-efficient credits: If you qualify for energy-efficient home improvements, you can enjoy tax credits, providing additional financial incentives.

Cons:

- Does not factor in maintenance costs: Homeownership entails maintenance expenses, which are not tax-deductible.

- Is potential for property tax increases: Property taxes can rise over time, increasing your overall cost of homeownership.

- Features a complex process: Filing taxes as a homeowner can be more complex than for renters, requiring careful documentation and understanding of tax laws.

- Faces risk of market fluctuations: Property values can fluctuate, affecting your potential gains or losses when selling a home.

- Projects limited deductions for some expenses: Certain home-related expenses, such as homeowners insurance and utility bills, are generally not tax-deductible.

3. Prepare Important Documents

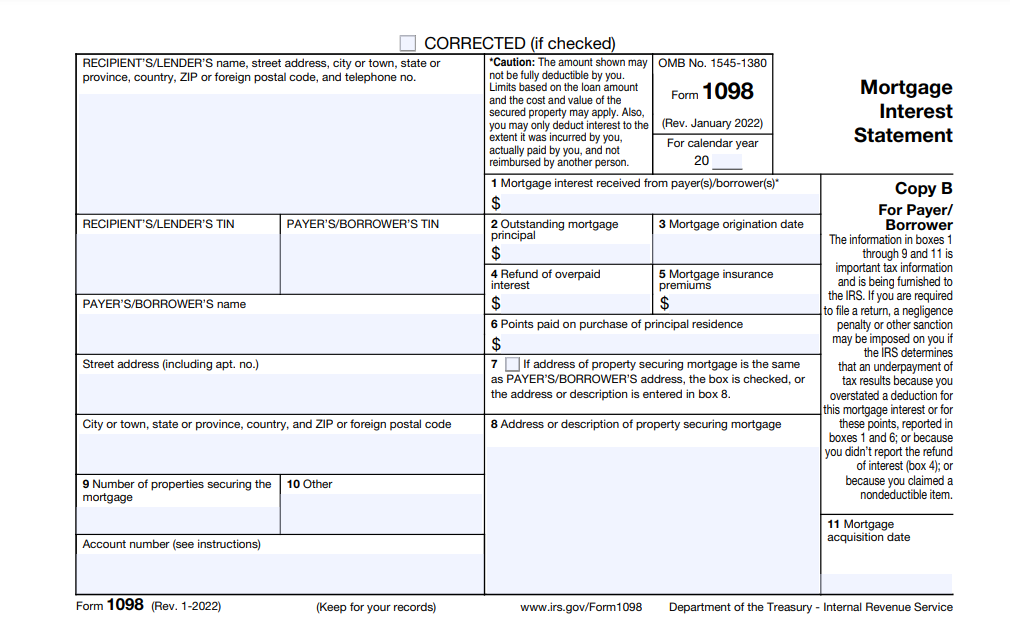

To file your taxes as a homeowner, prepare important documents. Collect documents such as your W-2 forms, which detail your income, as well as any 1099 forms for additional income sources. For homeownership specifics, gather records of mortgage interest you pay throughout the year and property tax statements.

Additionally, keep track of any relevant receipts for home improvements that can qualify for tax credits. Organize documentation for home office expenses, if applicable. It’s essential to have accurate records to claim eligible deductions and credits, making the process smoother and ensuring compliance with tax regulations.

4. Determine Your Filing Status

To prepare your taxes as a homeowner, determine your filing status. Assess your marital status and family situation. The options include Single, Married Filing Jointly, Married Filing Separately, Head of Household, and Qualifying Widow(er) with Dependent Child. Your filing status affects your tax rates, deductions, and eligibility for certain credits.

For example, if you’re married, you can choose to file jointly with your spouse for potential tax advantages. If you’re a homeowner and qualify as Head of Household, you can benefit from a lower tax rate and a higher standard deduction. Accurately determine your filing status, as it lays the foundation for the rest of your tax return and can impact the overall amount you owe or receive as a refund.

>>>PRO TIPS: How to File Taxes If You’re Young Adult

5. Understand Homeownership Tax Benefits

To file taxes as a homeowner, understand homeownership tax benefits. The most significant deduction often relates to your mortgage interest payments. You can typically deduct the interest you pay on your mortgage loan, which can result in substantial tax savings.

Additionally, property taxes you pay on the home are usually deductible. In certain cases, you can qualify for tax credits if you link them to energy-efficient home improvements, such as solar panels or energy-efficient windows. Don’t forget to stay up-to-date on the potential tax benefits, as they can significantly impact your overall tax liability and contribute to a more advantageous financial outcome during your tax filing process.

6. Report Mortgage Interest and Property Taxes

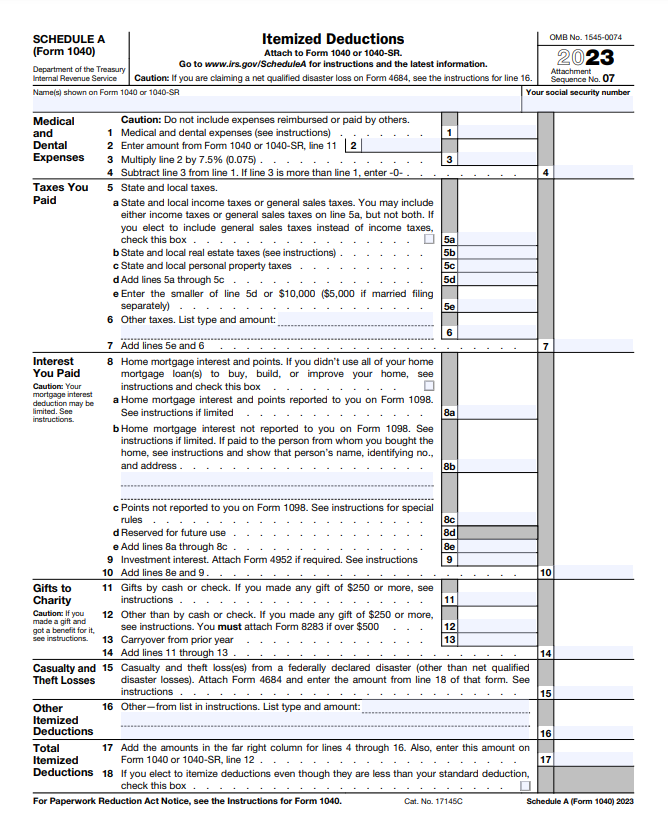

To master how to file taxes as a homeowner, report mortgage interest and property taxes. To claim the mortgage interest deduction, you need to collect Form 1098 from your mortgage lender, which outlines the total interest you pay throughout the tax year. Additionally, property taxes you pay on your home are deductible.

Ensure you have records or receipts documenting the property tax payments you make during the year. Include these amounts on Schedule A of your Form 1040 when itemizing deductions.

It’s important to note that the Tax Cuts and Jobs Act introduced changes to the mortgage interest deduction, such as limiting the eligible loan amount, so staying up-to-date about the current tax regulations is essential.

7. Consider Home Office Deductions If Applicable

To file taxes as a homeowner, consider home office deductions if applicable. If you operate a legitimate home office for your business, you can be eligible for home office deductions when filing your taxes as a homeowner in the United States. To qualify, use your home office exclusively and regularly for business purposes.

The deduction allows you to write off a portion of your home-related expenses, such as mortgage interest, property taxes, utilities, and maintenance costs, based on the percentage of your home you use for business. The simplified method calculates the deduction based on a standard rate per square foot of the office space. Alternatively, the regular method involves detailed calculations of actual expenses. Keep accurate records and adhere to IRS guidelines in order to ensure compliance and maximize your eligible deductions.

8. Include Any Capital Gains or Losses from Home Sales

To easily file taxes as a homeowner, include any capital gains or losses from home sales. If you sell a home during the tax year, you need to calculate the capital gain or loss by subtracting the property’s adjusted basis from the sale price. The adjusted basis includes the original purchase price, certain settlement costs, and any qualified improvements you make to the home.

If the sale results in a capital gain, you qualify for the home sale exclusion, which allows you to exclude up to $250,000 of the gain (or $500,000 if you and your spouse file jointly) from your taxable income, provided you meet certain ownership and usage requirements. However, if there’s a capital loss, it can be deductible, subject to specific rules and limitations. Reporting these details accurately is paramount for a comprehensive and accurate tax filing.

9. Explore Energy-Efficient Home Improvements for Credits

To file taxes as a homeowner, explore energy-efficient home improvements for credits. Identify and claim tax credits for qualifying upgrades that enhance your home’s energy efficiency. The federal government offers incentives for certain improvements, such as installing energy-efficient windows, doors, insulation, or energy-efficient heating and cooling systems.

These credits aim to encourage environmentally friendly practices and can lead to tax savings. Ensure that the improvements meet the eligibility criteria the IRS specifies, keep records of the expenses, and claim the appropriate credits on your tax return to maximize potential benefits. Additionally, state and local governments offer their own incentives (depending on your location), so it’s worthwhile to research and take advantage of any available opportunities for energy-efficient upgrades.

10. Be Aware of Potential Deductions for Home-Related Expenses

To understand how to file taxes as a homeowner, be aware of potential deductions for home-related expenses. This includes expenses such as mortgage points, which can be deductible in the year of payment. Additionally, if you take out a home equity loan or line of credit, the interest you pay on these loans can be eligible for deduction under certain conditions.

(You can generally deduct the interest on a home equity loan or line of credit if you use the amount you borrow to buy, build, or substantially improve the home that secures the loan.)

Property tax payments are generally deductible, and it’s essential to accurately report these figures. Keep meticulous records of all relevant expenses and consult the IRS guidelines or a tax professional to ensure you maximize your eligible deductions while staying compliant with tax regulations.

>>>GET SMARTER: How to File Taxes If You’re Business Owner

11. Consult a Tax Professional If Necessary

To file taxes as a homeowner, consult a Tax professional if necessary. Tax professionals possess a comprehensive understanding of the ever-changing tax laws and can provide tailored advice based on your individual circumstances. You need a tax expert who can help you navigate complex tax codes, maximize eligible deductions, and ensure accurate and efficient filing.

Meeting with a tax professional is particularly important, as the tax landscape can be intricate, involving various deductions and credits that relate to mortgage interest, property taxes, and home improvements. You get valuable insights, receive answers to specific queries, and optimize your tax return while ensuring compliance with current tax regulation when you visit a tax professional.

What to Watch Out For

- Organize the documents you need: Gather all relevant documents, including mortgage interest statements, property tax records, and receipts for home improvements.

- Maximize deductions: Explore and take full advantage of available homeowner tax benefits and credits, such as deductions for mortgage interest and eligible home improvements.

- Document your spending: Keep thorough records of expenses related to your home, including receipts for energy-efficient upgrades, as these can contribute to tax savings.

- Consult an expert: Seek guidance from a qualified tax professional to ensure you are optimizing your deductions and complying with the latest tax regulations.

- Review your tax returns: Double-check your tax return for accuracy, paying special attention to details specific to homeownership, such as property tax amounts and any capital gains or losses from home sales.

- Plan your payment: Consider future tax implications when making financial decisions that relate to your home, and stay aware of any changes in tax laws that can affect you as a homeowner.

Recap

Filing taxes as a homeowner involves several key steps to ensure a smooth and accurate process. Firstly, have a fundamental understanding of how taxes work for homeowners, grasping the nuances and benefits specific to property ownership. Familiarizing yourself with the pros and cons of filing taxes as a homeowner enables you to make informed decisions throughout the process. Preparation is key, so gather all necessary documents, from mortgage interest statements to records of home improvements.

Determine your filing status to establish the appropriate tax framework. Recognize and leverage homeownership tax benefits, including deductions for mortgage interest and eligible home improvements. Reporting mortgage interest and property taxes accurately is vital, as is considering home office deductions if applicable. Additionally, account for any capital gains or losses from home sales.

Exploring energy-efficient home improvements can lead to valuable tax credits. Be vigilant about potential deductions related to homeownership expenses. If navigating these complexities becomes overwhelming, it’s wise to consult a tax professional for personalized guidance, ensuring you optimize your deductions and adhere to current tax regulations.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. . For comprehensive tax, legal or financial advice, always contact a qualified professional in your area. S’witty Kiwi assumes no liability for actions taken in reliance upon the information contained herein.

No Comment! Be the first one.