Form 1040-V is very useful when paying what you owe from your tax return. It ensures the IRS handles your payment accurately and promptly.

To use it, just fill in your social security number, payment amount, name, address, and phone number on Form 1040-V. Make your check or money order payable to “United States Treasury” jot down your SSN and label it.

You send in your payment and Form 1040-V together.

Keep a copy of your payment and Form 1040-V for your records. Also, you pay no cash in the mail, and if you’re paying electronically or in cash, you don’t need Form 1040-V. Avoid including extra forms or letters, and always use the correct address.

- Know What Form 1040-V Is

- Fill out Form 1040-V

- Prepare Your Payment

- Send Your Payment and Form 1040-V

Recap

1. Know What Form 1040-V Is

If you owe taxes, use Form 1040-V when sending a check or money order to the IRS. It helps ensure the smooth and quick processing of your payment.

This minimizes the chance of errors or delays in handling your payment. It allows you to confirm that the IRS receives and credits your payment accurately. It also saves time and postage when you send your payment and Form 1040-V together.

To use Form 1040-V:

- Fill in your social security number, payment amount, name, address, and phone number.

- Address your money order or check payable to “United States Treasury.”

- Write your SSN and label the payment with “2023 Form 1040”.

- Mail it to the address on the back that corresponds to your state, or pay online through the IRS website.

>>>MORE: What Is IRS Form 720?

2. Fill out Form 1040-V

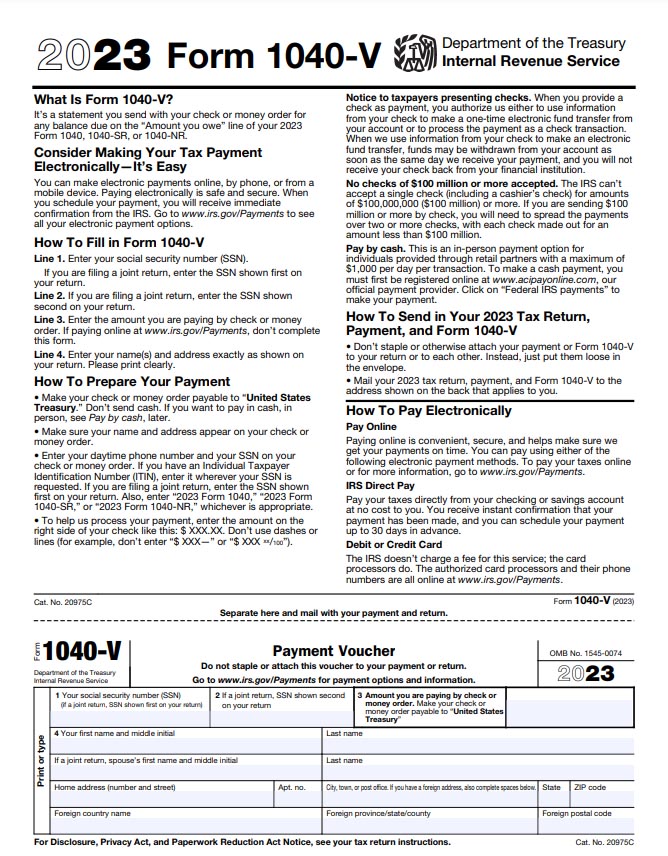

When filling out Form 1040-V, a payment voucher for the taxes you owe, you:

- Put your Social Security Number on line 1.

- Use the second SSN on line 2, if you’re filing jointly.

- Write the amount you’re paying using a check or money order on line 3

- Write your name and address exactly as it appears on your tax return on line 4.

Make your check payable to the “United States Treasury” – avoid sending cash. If you prefer paying in cash in person, you can register online at www.officialpayments.com/fed.

Do not staple anything. Place your payment and Form 1040-V in the same envelope and mail it to the address in the instructions based on your state.

Alternatively, you can make your tax payment online, with your phone, or from a mobile device. Visit www.irs.gov/Payments for electronic options. If you choose this method, there’s no need to file Form 1040-V. It’s a secure and quick way to handle your tax payment with immediate confirmation from the IRS.

3. Prepare Your Payment

To pay your taxes, follow these steps:

- Write a check or get a money order payable to the “United States Treasury.” Don’t use cash.

- Fill in the payment amount in numbers, like this: $###.##. Avoid using staples or paper clips.

- On your check or money order, make sure to provide your name, address, daytime phone number, and either your social security number or employer identification number. Also, mention the tax year and related form or notice number.

Important details: Write your social security number and label “2023 Form 1040” on the check or money order.

Here’s an example:

John and Jane Bishop

456 Main Street

Los Angeles, CA 10001

(555) 555-5555

- Pay to the order of: United States Treasury

- Amount: $500.00 (write as “Five hundred and 00/100 dollars”)

- Memo: 123-45-6789 2023 Form 1040

For more information or assistance, visit the IRS website or call the IRS toll-free at 1-800-829-1040.

More Details:

- On the memo line, write your Social Security Number (SSN) and the form number (1040, 1040-SR, or 1040-NR). For example: 123-45-6789 2023 Form 1040.

- In the upper right corner, write the tax year, like 2023.

- Make sure your check or money order includes your name and address.

When filling in the amount:

- Write the numerical amount like this: $500.00.

- On the line below the payee’s name, write the amount in words, such as “Five hundred and 00/100 dollars.”

Remember, don’t use dashes or lines to fill a space.

Note:

The IRS may use your check information for a one-time electronic transfer.

If you want to pay in cash (up to $1,000 per day), register online at Official Payments to find a participating retailer.

4. Send Your Payment and Form 1040-V

If you’re looking to send your payment and Form 1040-V to the IRS, follow these easy steps:

Fill Out Form 1040-V: Put in your social security number, the amount you’re paying, your name and address, and your phone number.

Prepare Your Check or Money Order: Make your check payable to “United States Treasury” and include your name, address, and phone number on it. Write the amount, both numerically and in words (e.g., $500.00 and “Five hundred and 00/100 dollars”).

In the memo line, note your social security number and “2023 Form 1040.”

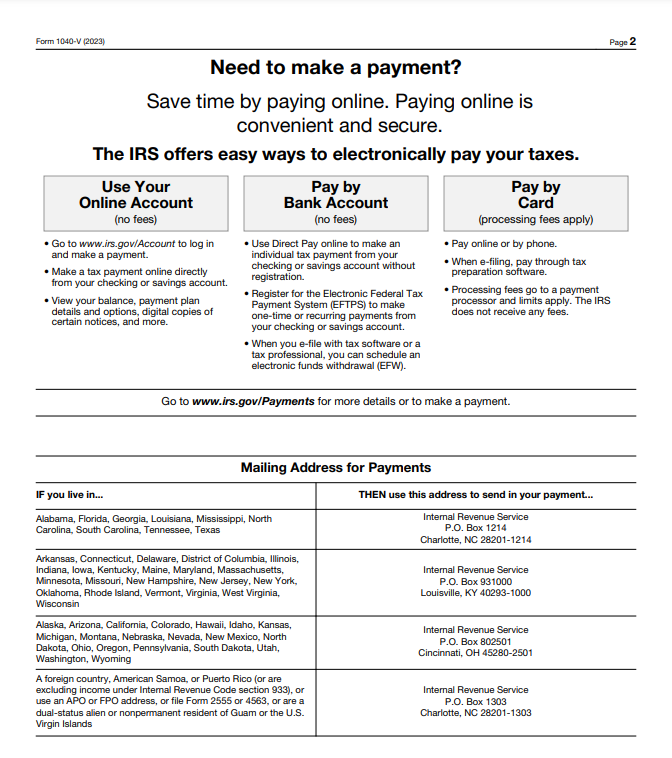

Choose the Right Mailing Address: Flip to the back of Form 1040-V and find the address for your state. Alternatively, check the IRS website at www.irs.gov/payments.

Mail Everything Together: Stick your payment and Form 1040-V in the same envelope. Don’t staple anything together, and don’t send it to the address on your tax return.

Remember, don’t include any other forms or letters.

If you’re wondering about the right address for your state and form number, here’s a quick guide:

- Find Your State on Form 1040-V: Look at the back of Form 1040-V to find a list of states and addresses.

- Pick the Right Address: Choose the address that matches your form number (1040, 1040-SR, or 1040-NR).

- Write and Mail: Write the chosen address on the envelope, and send it off with your payment and Form 1040-V.

For electronic payment, use options like IRS Direct Pay, credit/debit cards (with a small fee), Electronic Funds Withdrawal, or an Online Payment Agreement. Check out www.irs.gov/payments for more details on these electronic methods.

>>>GET SMARTER: Form 5498-ESA: What It Is, How to File It

Recap

Form 1040-V is what you send with your check or money order when you owe some taxes from your previous return. Why bother? Well, it helps the IRS handle your payment smoothly, avoids errors, and lets you double-check it gets your money. Plus, it saves you time and stamps!

To use it, just fill in your SSN, the amount you’re paying, your name, address, and phone number. Post your check out to “United States Treasury” and write your SSN and label “2023 Form 1040” on it.

Ensure you pick the right mailing address from the back of Form 1040-V or the IRS website, and put your payment and Form 1040-V in the same envelope. Don’t send it with your tax return, any other documents, or to the address on your tax return.

You can pay online on the IRS website. Super convenient! And remember, using Form 1040-V ensures your payment is on the fast track, dodging late fees and interest.

Don’t hesitate to talk to a tax professional or check out the tools on the IRS website. Reach the IRS at 1-800-829-1040.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. . For comprehensive tax, legal or financial advice, always contact a qualified professional in your area. S’witty Kiwi assumes no liability for actions taken in reliance upon the information contained herein.

No Comment! Be the first one.