Introduction

IRS Publication 590 is a comprehensive document issued by the Internal Revenue Service (IRS) that serves as a guide for Individual Retirement Arrangements (IRAs). It covers various aspects of IRAs, including traditional IRAs, Roth IRAs, and education savings accounts (ESAs).

You, as a taxpayer, can find valuable information in Publication 590 regarding eligibility criteria, contribution limits, distributions, rollovers, and conversions of different types of retirement accounts. This publication aims to assist you in understanding the rules and regulations governing IRAs, ensuring you comply with IRS guidelines when managing your retirement savings.

It’s a reliable resource you can use to clarify intricate details about contributions, withdrawals, penalties, and exceptions related to IRAs, providing you with a vital reference for making informed decisions about your retirement planning.

What Is IRS Publication 590?

1. Retirement Savings Guide

2. Account Types Covered

3. Contribution Guidelines

4. Distribution Details

5. Rollover and Conversion

6. Eligibility Criteria

7. Penalty Explanation

8. Tax Implications Explained

9. Accessing IRS Publication 590

Recap

1. Retirement Savings Guide

“Retirement Savings Guide” encapsulates IRS Publication 590, serving as a comprehensive roadmap for managing your retirement accounts. Within its pages, you’ll find a wealth of valuable information tailored to your retirement planning needs.

You’ll discover detailed insights into various Individual Retirement Arrangements (IRAs), encompassing traditional, Roth, and education savings accounts (ESAs). The guide clarifies contribution limits, eligibility criteria, and the nuances of different IRA types.

It provides a crucial understanding of distribution rules, penalties, and exceptions, ensuring you navigate your retirement savings with precision. Also, this authoritative document elucidates the tax implications, rollover procedures, and conversion processes, offering you a reliable reference for informed decision-making.

Always refer to the latest version so you can stay updated on IRS regulations governing your retirement savings strategies.

>>>MORE: What Is IRS Publication 502?

2. Account Types Covered

The IRS Publication 590 encompasses various account types crucial for your retirement planning. It provides you with an inclusive view of different Individual Retirement Arrangements (IRAs) available to you.

Within its pages, you’ll find detailed coverage of traditional IRAs, Roth IRAs, and education savings accounts (ESAs). Each account type is explained thoroughly and caters to different financial goals, offering you unique features, eligibility criteria, and contribution limits.

This comprehensive guide ensures you understand the nuances and benefits associated with each IRA variant. It helps you tailor your retirement strategy to match your specific needs and financial objectives.

Whether you’re exploring tax-deferred growth options in traditional IRAs or considering tax-free withdrawals in Roth IRAs or ESAs for educational expenses, this resource serves as a reliable reference to aid in your informed decision-making for building a secure retirement portfolio.

3. Contribution Guidelines

The Contribution Guidelines detailed in IRS Publication 590 are specific rules and limits dictating how much you can contribute to your Individual Retirement Arrangements (IRAs). These guidelines vary based on the type of IRA you have—be it traditional, Roth, or education savings accounts (ESAs).

For each IRA, there are maximum annual contribution limits that you should adhere to in order to stay within IRS regulations. Moreover, the publication elucidates how your contributions might qualify for tax deductions or credits, depending on your income and other factors.

Take note of these guidelines because it affects your retirement savings, tax advantages, and potential penalties for over-contributions. Read through this resource to ensure you’re making contributions in line with the current IRS regulations, helping you maximize your retirement savings efficiently.

4. Distribution Details

In IRS Publication 590, the Distribution Details section delves into the rules surrounding the withdrawal of funds from your Individual Retirement Arrangements (IRAs). This crucial section outlines when and how you can take distributions from your traditional, Roth, or education savings accounts (ESAs).

It explains the age thresholds and circumstances under which you may begin withdrawals without penalties, such as reaching retirement age or meeting specific qualifications. The publication also touches upon the required minimum distribution (RMD) rules that mandate the minimum amount you must withdraw annually from certain retirement accounts.

Understanding these distribution details is vital, as it impacts your tax liabilities, potential penalties for early withdrawals, and overall retirement income. Always refer to this resource to make informed decisions regarding your IRA distributions and avoid unnecessary tax implications.

>>>PRO TIPS: The 10 Most Overlooked Tax Deductions

5. Rollover and Conversion

Rollover and Conversion is another vital section in IRS Publication 590 for managing your retirement accounts. Here, you’ll find detailed explanations of how you can transfer funds from one retirement account to another without incurring taxes or penalties—a process known as a rollover.

Additionally, it outlines how you can convert funds from a traditional IRA to a Roth IRA, potentially allowing for tax-free growth and distributions in the future. It’s essential you comprehend these concepts as it offers you opportunities to consolidate accounts, adjust investment strategies, or take advantage of tax benefits.

You need this guide to navigate the complexities of rollovers and conversions effectively so you can make informed decisions that align with your long-term retirement goals.

6. Eligibility Criteria

Within IRS Publication 590, you’ll find the Eligibility Criteria section that outlines the essential requirements you need to meet in order to contribute to different Individual Retirement Arrangements (IRAs).

It specifies the factors determining your eligibility for traditional IRAs, Roth IRAs, and education savings accounts (ESAs). This section details income limitations, age restrictions, and other criteria that determine whether you qualify to make contributions to these retirement accounts.

Be aware of these criteria as it directly impacts your ability to save for retirement and also utilize tax benefits associated with IRAs. You can make strategic decisions regarding your retirement savings plan within the bounds of IRS regulations.

>>>GET SMARTER: What Is IRS Form 8379: Injured Spouse Allocation

7. Penalty Explanation

There is a section in IRS Publication 590 that explains the consequences or penalties you might face for not adhering to the rules governing Individual Retirement Arrangements (IRAs).

It details the penalties imposed for various violations, such as excess contributions, early withdrawals, or failure to take required minimum distributions (RMDs) at the appropriate age. Ensure you take note of these penalties because it impacts your retirement savings and tax obligations.

For instance, early withdrawals before reaching a certain age threshold may incur additional taxes and penalties. Consult this resource regularly to ensure you’re well-versed in IRA regulations, so you can navigate your retirement savings journey without incurring unnecessary penalties or financial setbacks.

8. Tax Implications Explained

You can also explore the section in IRS Publication 590 that outlines the various tax implications associated with managing your Individual Retirement Arrangements (IRAs). It delves into how your contributions, distributions, and withdrawals from different types of IRAs—like traditional, Roth, or education savings accounts (ESAs)—impact your taxes.

Being aware of these implications is crucial as it affects your taxable income, potential deductions, and overall tax liabilities. For example, your contributions to traditional IRAs may qualify for tax deductions, while distributions from Roth IRAs could offer you tax-free growth and withdrawals.

Consistently referring to this guide helps you to be well-informed about the tax implications of your IRA decisions, empowering you to make strategic choices aligned with your financial goals and minimizing unexpected tax burdens.

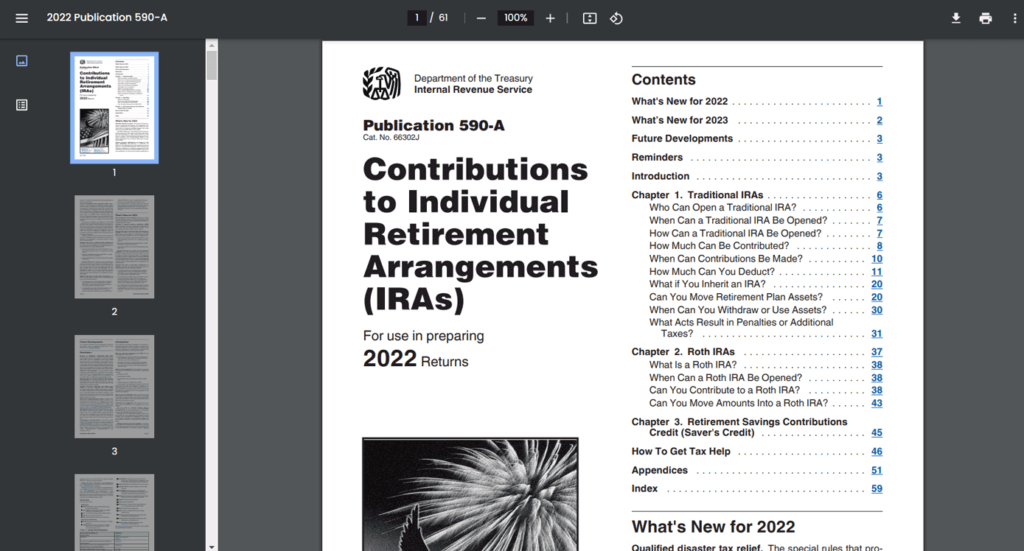

9. Accessing IRS Publication 590

You can easily access IRS Publication 590 directly from the official IRS website. The IRS provides a digital copy for download or online browsing. Alternatively, you can order a printed copy through the publication ordering platform.

It’s an authoritative resource available to you at no cost, offering you comprehensive insights into managing your Individual Retirement Arrangements (IRAs). Ensure you have the latest version as it guarantees accurate and updated information, providing you with a reliable reference for your retirement planning.

Recap

IRS Publication 590 is an essential guide that details the rules and nuances of Individual Retirement Arrangements (IRAs). It covers different account types like traditional, Roth, and ESAs. You’ll also find the contribution limits, eligibility, tax implications, penalties, and distribution rules for these account types. Make sure you continuously consult it to ensure your retirement planning aligns with IRS regulations.

No Comment! Be the first one.