Form 6252: Installment Sale Income is an IRS tax form used to report income from an installment sale. An installment sale typically occurs when you sell property and receive at least one payment after the tax year in which the sale occurs. The installment sale method allows you to spread your gain on the sale over multiple years as you receive payments from the buyer.

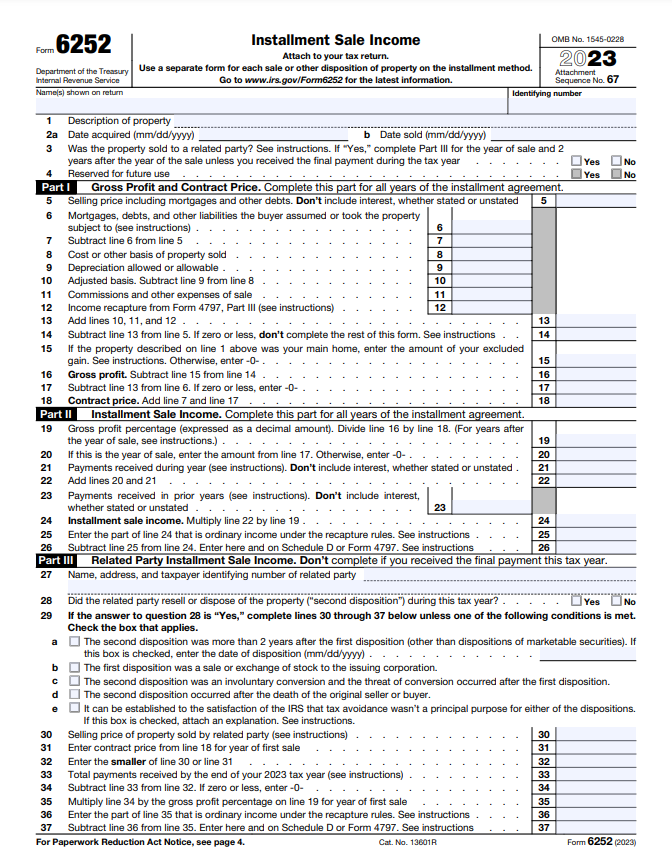

Form 6252 helps you calculate and report the correct amount of installment sale income to include on your tax return each year. It walks you through determining important figures like gross profit, contract price, and gross profit percentage. The form then uses these numbers to calculate your taxable installment sale income based on payments received.

Who Needs to File Form 6252?

Form 6252 must be filed if you sell property at a gain and receive payments from the buyer beyond the current tax year. Examples include real estate or business sales with deferred payments. Losses don’t require this form, and if you receive full payment in the sale year, reporting on Schedule D is simpler. Form 6252 helps report gains tied to amounts received in each tax year for transactions with future payments.

When to File Form 6252

Form 6252 is required annually for installment payments on a sale. File it in the sale year for payments received, continue annually until the agreement ends, and file a final Form 6252 in the last payment year to conclude the reporting. If, for example, you have a 5-year installment sale, you’ll file Form 6252 for 5 consecutive years.

SUMMARY

- Understand the Relevant Form 6252 Parts and Details

- Fill Out Top Sections

- Proceed With Part I (Gross Profit and Contract Price)

- Complete Part II (Installment Sale Income)

- Finish Up With Part III (Related Party Sales)

- Avoid Common Mistakes

- Submit the Form

Recap

1. Understand the Relevant Form 6252 Parts and Details

To gain a proper understanding of the form, read and absorb the details of the parts on form 6252. If you sold property to a related party, like a family member, Part III discloses additional details to prevent gains from shifting among related taxpayers.

For certain large installment agreements, interest on deferred tax may be owed. Form 6252 helps calculate yearly interest using IRS rates, reported separately on your tax return.

Using the installment note as security for a loan triggers a deemed payment. Form 6252 quantifies deemed payments, altering recognized gain.

Recapture income, like depreciation, is reported differently from capital gains on Form 6252, with clear separation across schedules.

Certain properties allow opting out of installment reporting, skipping Form 6252 entirely in the initial year. Specific procedures apply to make this election.

These complexities, including related party sales, interest calculations, pledge rule, recapture income, and electing out, can add intricacy to Form 6252 filing. Maintaining communication with your tax professional is vital for a smooth process.

>>>MORE: Crypto Tax Forms

2. Fill Out Top Sections

To start filling out form 6252, begin by including essential details at the top of each Form 6252.

This includes a sequence number for identification when filing multiple forms, the date of property sale, and specifying if it was sold to a related party.

3. Proceed With Part I (Gross Profit and Contract Price)

To continue providing the required information on your form 6252, fill in part I. Begin part I to calculate key figures that will drive the rest of the form.

This section will calculate the key profitability metrics used throughout the form.

Start by describing the property sold, indicating the asset type with specific codes. For line 5, input the full selling price, encompassing mortgages and liabilities assumed by the buyer.

Line 6 specifies the buyer’s assumed debts, excluding new debts from other parties. Calculate the net selling price on line 7 by subtracting assumed debts from the selling price. Line 8 requires entering the property’s original cost, including improvements and deducting tax credits. Line 9 accounts for previously claimed depreciation.

Determine the adjusted basis on line 10 by subtracting the total depreciation claimed from the cost. Line 11 covers expenses like commissions and legal fees. For line 12, enter income recapture calculated on Form 4797 line 31. Sum lines 10, 11, and 12 on line 13 for the total adjusted basis. Calculate gain before exclusions on line 14 by subtracting line 13 from the net selling price.

If the property was your primary residence, enter the excluded home sale gain on line 15. Line 16 calculates gross profit by subtracting excluded gain from the gain before exclusions. Re-enter buyer liabilities assumed on line 17. Line 18 determines the contract price by adding the net selling price and buyer liabilities assumed. This total is crucial for allocating each payment received in the installment sale.

>>>PRO TIPS: Real Estate Tax Tips for the Owner of Record

4. Complete Part II (Installment Sale Income)

To make accurate calculations on your form 6252, fill part II which the gains from part I are used to calculate taxable installment income. Line 19 involves determining the gross profit percentage by dividing the gross profit from line 16 by the contract price from line 18, expressed as a decimal rounded to at least 4 digits. Line 20 accounts for payments to offset liabilities, with the year of sale reflecting the amount from line 17 and subsequent years entering zero. Line 21 requires entering all payments related to the sale received during the tax year, excluding interest reported elsewhere.

Line 22 sums up the totals from lines 20 and 21, creating a payment pool against which taxable income will be allocated and recognized in the current tax year. In line 23, amounts reported on prior year Form 6252 line 22 are entered to capture payments recognized across time. Line 24 calculates taxable installment sale income by multiplying the total payment pool on line 22 by the gross profit percentage from line 19. Line 25 addresses ordinary income recapture, and line 26 determines the taxable capital gain by subtracting line 25 from line 24. The final figure is reported on Schedule D.

5. Finish Up With Part III (Related Party Sales)

To finish up with your form, addresses the specific reporting obligations for installment sales involving related parties to prevent income shifting in part III.

If the related party question was answered affirmatively, lines 27-28 necessitate providing details such as the related party’s name, tax ID, and information on any resale of the property received through installments in the current or prior years. In the case of a resale, lines 29-37 require a recalculation of gains retained or shifted, following instructions to quantify the impact of the second disposition by the related party. The report should include amounts still matchable to you on lines 35-37.

6. Avoid Common Mistakes

To prevent issues with the IRS due to irregularities on your form 6252, be cautious of common pitfalls when filing annually, such as:

- forgetting to file for payment years after the initial sale,

- using incorrect percentages for gross profit or contract price on payments,

- misclassifying ordinary income and capital gain amounts,

- neglecting to track excluded main home sale gain,

- inaccurately accounting for interest owed,

- overlooking disclosures and deemed payments in related party transactions, and

- ensuring administrative details like addresses and sequence numbers remain consistent from year to year.

Reporting installment sale income across multiple tax years involves administrative burden and complex calculations. Engaging tax professionals can save time and stress while also uncovering planning opportunities.

For difficult transactions or high dollar amounts, the benefits strongly outweigh nominal fees. Even for smaller deals, the convenience of outsourcing paperwork can be worthwhile.

>>>GET SMARTER: How Bonuses Are Taxed

7. Submit the Form

To send in your form 6252, file the form with a tax return. The completed form 6252 must accompany your form 1040 and related schedules. Continue filing a Form 6252 each tax year as long as payments remain due to you from the installment sale.

Recap

Form 6252 is the IRS tax form for reporting income from property sales with payments extending beyond the sale’s tax year. Key sections include calculating gross profit, determining taxable installment income, and addressing related party sales.

Filing annually is crucial, and common pitfalls, like misclassifying income, should be avoided. Engaging tax professionals, especially for complex transactions, ensures accurate and efficient filing.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. . For comprehensive tax, legal or financial advice, always contact a qualified professional in your area. S’witty Kiwi assumes no liability for actions taken in reliance upon the information contained herein.

No Comment! Be the first one.