Do you think that taxes are boring? If you say yes, this article is here to tell you otherwise. Taxes are not only a way to fund the government and society, but also a way to express your values and preferences. But wait, have you heard of excise taxes before?

Excise taxes are taxes that the IRS imposes on specific goods, services, or activities that affect consumers, such as gasoline, tobacco, air travel, and indoor tanning. These taxes reflect the social and environmental costs and benefits of these products and services, and they can also influence your behavior and choices. If you sell any of these goods or services, you need to file Form 720, the Quarterly Federal Excise Tax Return, to report and pay the excise taxes that you owe to the IRS.

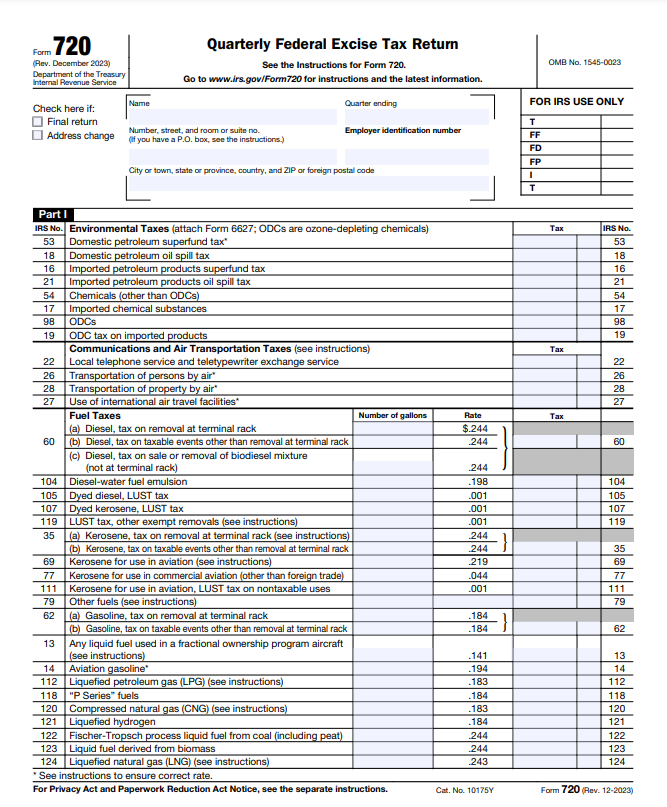

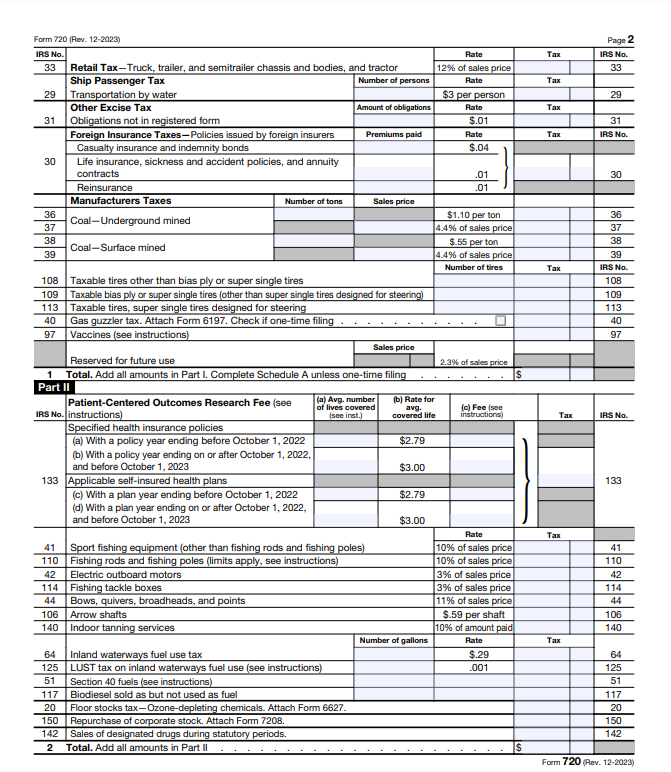

Form 720 covers more than 50 types of excise taxes, which are into three categories: Part I, Part II, and Part III. Do you want to know what Form 720 is? Who needs it? How to File it? And when it is due? You can find answers to these questions by continuing to read this article till the end. What are you waiting for? Dive in now!

- Know What Form 720 Is

- Know Who Needs to File It

- Understand the Main Categories of Excise Taxes You Need to Fill in Form 720

- Know How to File Form 720

1. Know What Form 720 Is

Think of Form 720 as a quarterly federal tax return that you use to report and pay the excise taxes that you owe to the IRS. Excise taxes are taxes the IRS imposes on specific goods, services, or activities that affect consumers, such as gasoline, tobacco, air travel, and indoor tanning. Don’t forget that these taxes help fund various government programs and initiatives, such as environmental protection, health care, transportation, and public safety.

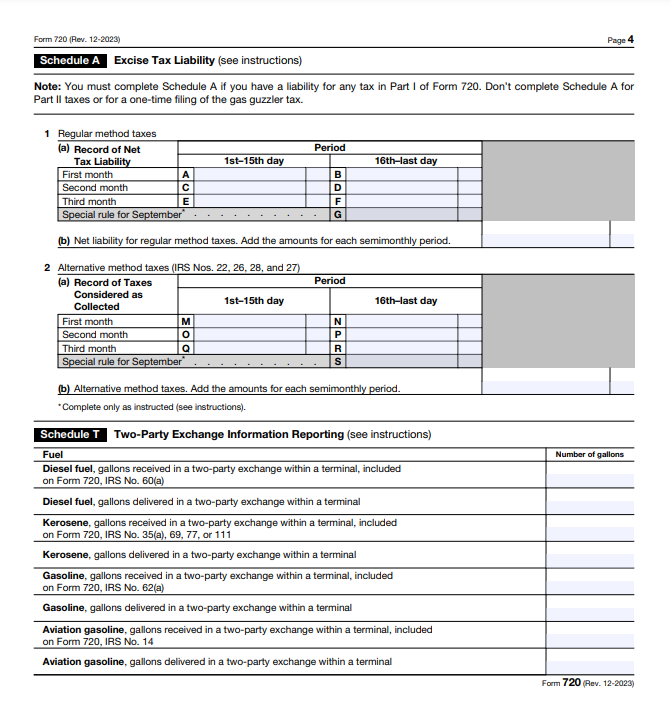

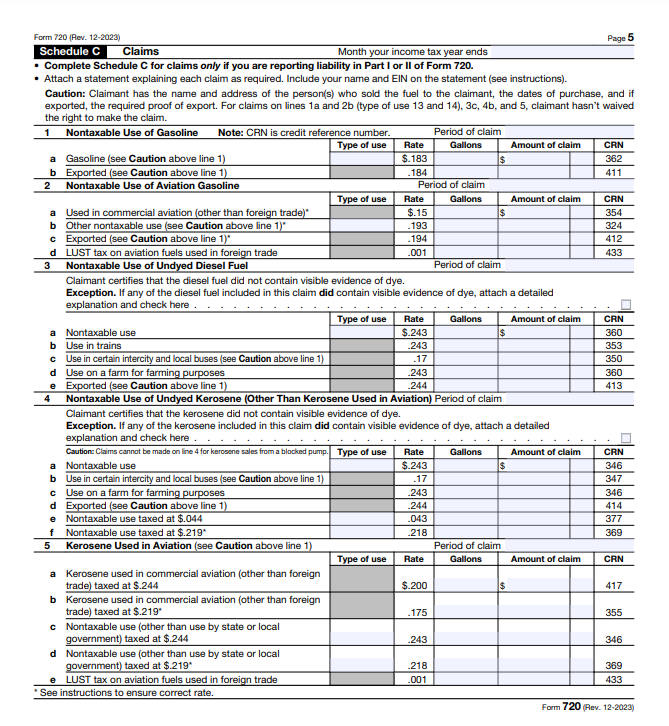

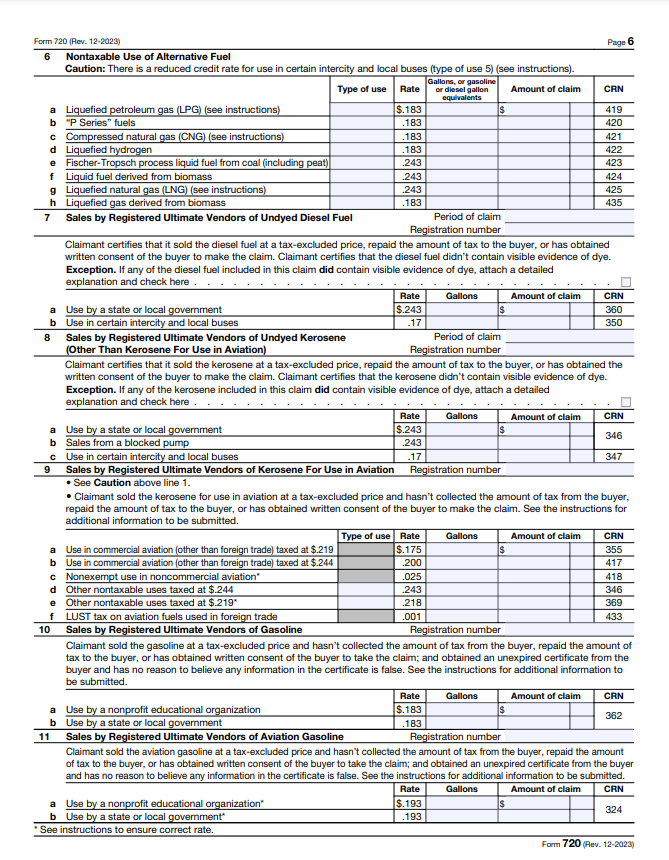

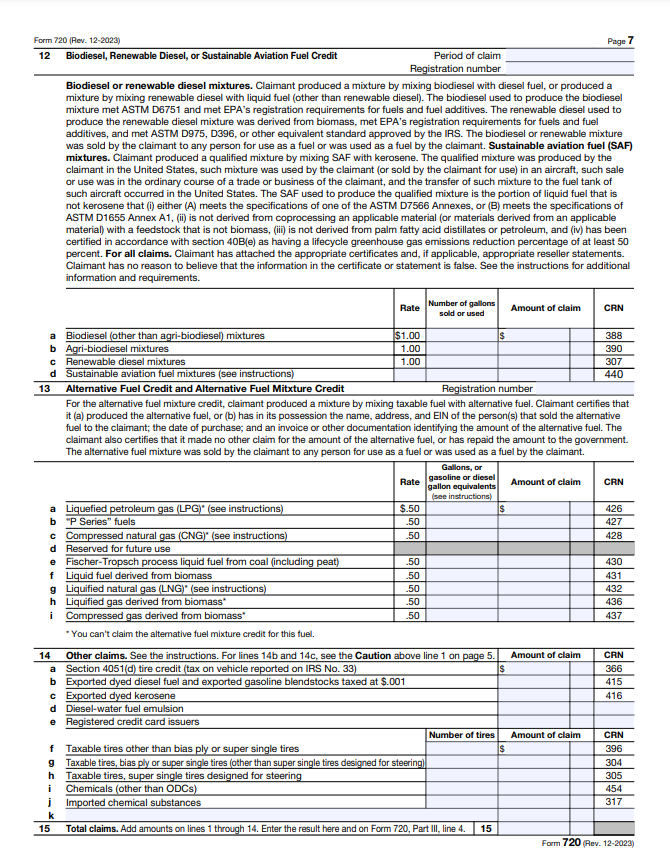

Be aware that Form 720 covers more than 50 types of excise taxes, which are into three categories: Part I, Part II, and Part III. Each category has its own rules, rates, and calculations. For example, Part I covers environmental taxes, communications and air transportation taxes, fuel taxes, retail taxes, and manufacturers taxes. Note that what determines taxes in this category are generally the quantity, weight, volume, or value of your taxable items or transactions. Part II covers patient-centered outcomes research fee, which is a fixed amount per covered life that applies to certain health insurance issuers and plan sponsors. Part III covers healthcare-related taxes.

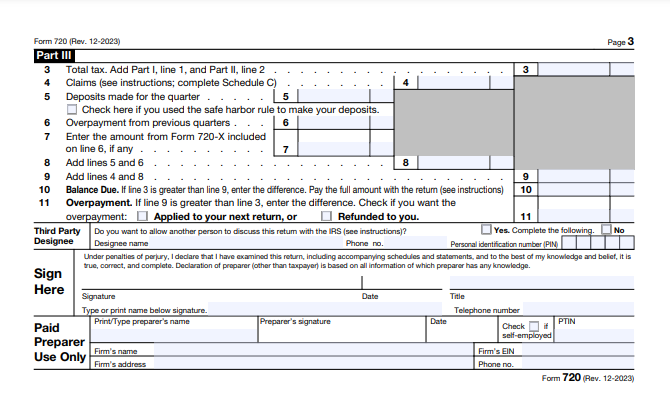

If you are liable for any of the excise taxes that the government lists on Form 720, you must file the form by the last day of the month following the end of each quarter. For example, the due date for the first quarter (January to March) is April 30. You must also pay the tax due by the same date.

2. Know Who Needs to File It

To know who must file Form 720, check if you sell goods or services that incur excise taxes. These products and services can include the following:

- Phone calls and internet access: The communications tax is 3% of the amount paid for the service.

- Flying in the sky or sailing on the sea: The air transportation tax is 7.5% of the amount you pay for domestic flights and $18.90 per person for international flights. The passenger ship transportation tax is $3.25 per person for voyages that begin or end in the United States.

- Gasoline and diesel for your car or truck: You may need fuel to get around, but the IRS needs fuel to fund the government. The fuel tax is $0.184 per gallon for gasoline and $0.244 per gallon for diesel.

- Coal and chemicals that may harm the environment or your luck: You may use these products for energy or industry, but the IRS uses them for environmental protection. The environmental tax is $0.45 per pound for ozone-depleting chemicals, $1.12 per ton for coal from underground mines, and $0.56 per ton for coal from surface mines.

- Fishing rods and reels, and electric motors too: Though you love fishing as a hobby or a sport, the IRS loves fishing for your money. The manufacturer’s tax is 10% of the sales price for sport fishing equipment and electric outboard motors.

- Indoor tanning beds that may give you a tan or a boo-boo: As you may want to look good for the summer, the IRS also wants to make you pay for the health risks. The indoor tanning services tax is 10% of the amount paid for the service.

- Bows and arrows for hunting or sport: The manufacturer’s tax is 11% of the sales price for bows, quivers, broadheads, and points, and $0.48 per arrow shaft.

- Tires and trucks that are heavy or short: The retail tax is 12% of the sales price for heavy trucks and trailers and $0.0945 per pound for tires.

- Vaccines and drugs that may cure or prevent: You may use these products for health or wellness, but the IRS uses them for health care reform. The excise tax is $0.75 per dose for vaccines and a fixed amount per year for branded prescription drugs.

- Medical devices that may help or augment: You may need these devices for treatment or enhancement, but the IRS needs them for funding the Affordable Care Act. The medical device excise tax is 2.3% of the sales price of the device.

Note that the list is not limited to the items above. You can find the complete list of excise taxes and their rates on the instructions for Form 720. Download Form 720 and its instructions from the IRS website.

3. Understand the Main Categories of Excise Taxes You Need to Fill in Form 720

Bear in mind that Form 720 has more than 50 excise taxes which are into 3 groups.

The main categories of excise taxes that you need to fill in Form 720 are:

- Part I: Be aware that this category covers environmental taxes, communications and air transportation taxes, fuel taxes, retail taxes, and manufacturers taxes. Can you imagine that the IRS bases these taxes on the quantity, weight, volume, or value of your taxable items or transactions? For example, the environmental tax on ozone-depleting chemicals is $0.45 per pound of the taxable substance, the communications tax on local telephone service is 3% of the amount you pay for the service, the fuel tax on gasoline is $0.184 per gallon, the retail tax on heavy trucks is 12% of the sales price, and the manufacturers tax on firearms is 10% of the sales price.

- Part II: Remember this category is about a fee that you have to pay if you own a health insurance company or you are an employer. The fee is based on how many people you cover with your health plans. For example, if you cover 100 people in your health plans, you have to pay $266 for the fee. The fee changes every year. The fee for the year 2022-2023 is $2.66 for each person you cover.

- Part III: This category covers healthcare-related taxes, such as the indoor tanning services tax, the branded prescription drug fee, and the medical device excise tax. These taxes are generally based on the gross receipts, sales, or fees of the taxable items or transactions.

>>>PRO TIPS: How to File Taxes When Living Abroad

4. Know How to File Form 720

To file Form 720, you need to follow these steps:

- Determine if you are liable for any of the excise taxes listed on Form 720.

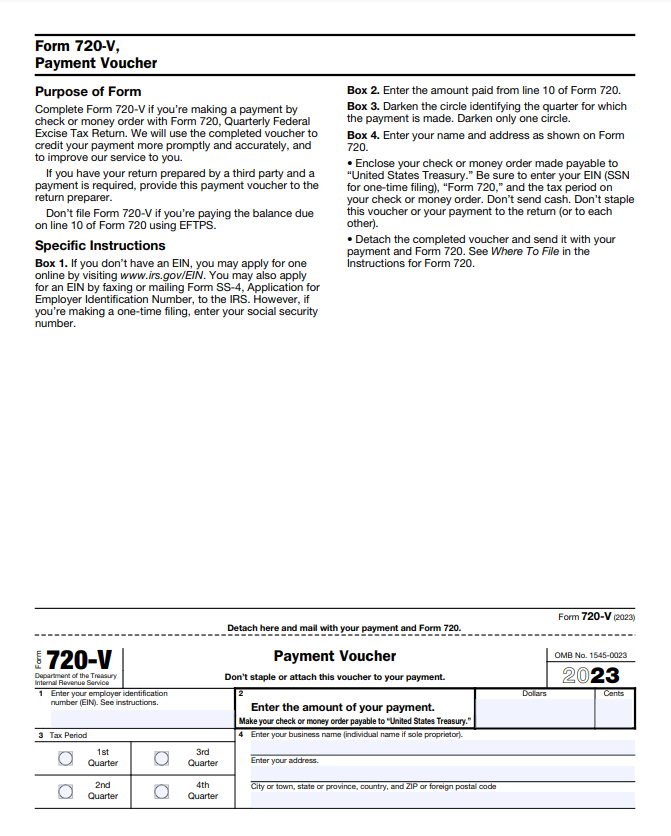

- Gather the information and documents that you need to complete Form 720. You will need your name, address, employer identification number (EIN), and the quarter for which you are filing.

- Fill out Form 720 and its attachments. You can download Form 720 and its instructions from the IRS website. You only need to fill out the parts that apply to your tax liability.

- File Form 720 and pay the tax due. You must file Form 720 by the last day of the month following the end of each quarter. For example, the due date for the first quarter (January to March) is April 30. You must also pay the tax due by the same date.

Recap

Don’t forget that Form 720 is a quarterly federal tax return that you use to report and pay the excise taxes that you owe to the IRS. The government imposes these taxes on specific goods, services, or activities that affect consumers, such as gasoline, tobacco, air travel, and indoor tanning. By filing Form 720 correctly and timely, you can avoid penalties and interest and comply with your tax obligations. Thank you for reading this article on Form 720.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. . For comprehensive tax, legal or financial advice, always contact a qualified professional in your area. S’witty Kiwi assumes no liability for actions taken in reliance upon the information contained herein.

No Comment! Be the first one.