If you are a taxpayer in the United States, be aware that you may need to access your tax information for various purposes, such as applying for a loan, filing an amended return, or verifying your income.

One way to do that is to request a transcript from the Internal Revenue Service (IRS), which is a document that shows your tax information for a specific year or period. To find detailed information about this topic, dive fully into this essay and start exploring.

- What Is an IRS Transcript?

- What Are the Different Types of Transcripts Available from the IRS?

- How Can You Request an IRS Transcript?

- What Are the Tips to Follow to Avoid Scams And Phishing Attempts?

- When Do You Need an IRS Transcript?

1. What Is an IRS Transcript?

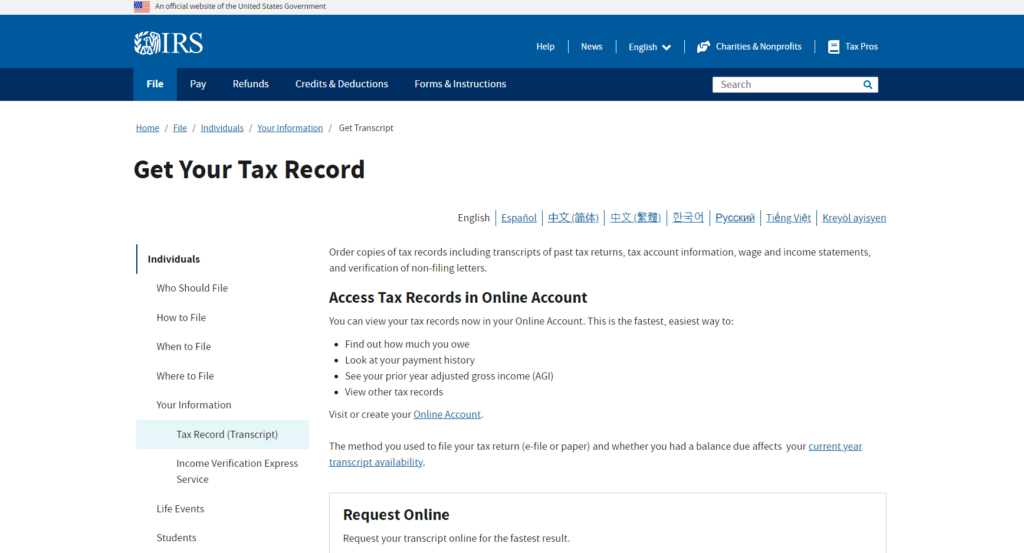

www.irs.gov/individuals/get-transcript

Now imagine you are a homeowner who wants to refinance your mortgage. You need to show your lender your current tax situation, and any changes that happen after you file your tax return. You can request a tax account transcript, which shows your filing status, payments, refunds, penalties, interest, and adjustments. It is like a statement of your tax account, with the most recent information.

You can get it online, by mail, or by phone, and it is also free.

Think of the IRS transcript as a snapshot of your tax information for a certain year or period. It shows what you report to the IRS, what the IRS does with your information, and what the IRS has on file for you. You can use it for different purposes, such as checking your tax history, proving your income, or fixing a tax problem.

2. What Are the Different Types of Transcripts Available from the IRS?

There are different types of transcripts available from the IRS, depending on what you need them for. These are:

- Tax Return Transcript: Use this transcript to show most of the information from your original tax return, such as your adjusted gross income, taxable income, tax credits, and deductions. You can use this transcript to file an amended return, verify your income for a lender, or prepare a state tax return.

- Tax Account Transcript: Note that this transcript shows your basic tax information, such as your filing status, income, tax liability, and payments. Use this transcript to check the status of your account, resolve any issues, or confirm your payment history.

- Record of Account Transcript: Use this transcript to get a complete overview of your tax situation, or to file an appeal or a claim for a refund.

- Wage and Income Transcript: This transcript shows the income that third parties such as your employer, bank, or other payer report to the IRS. It includes information such as your wages, interest, dividends, retirement distributions, and social security benefits.

- Verification of Non-filing Letter: This transcript shows that the IRS has no record of you filing a tax return for a specific year. It does not show any income or tax information but only confirms your non-filing status. You can use this transcript to prove that you do not file a tax return or comply with a request from a government agency or a lender.

3. How Can You Request an IRS Transcript?

Understand that there are different ways to order a transcript from the IRS, depending on your preference and availability. These are:

- Online: Request a transcript online through the IRS website, using the Get Transcript tool. You need to create an account or log in with your existing one, and provide some personal information, such as your social security number, date of birth, and address. You can then choose the type of transcript you want, and the year or period you need. You can either view or download your transcript online or have it mailed to your address within 5 to 10 days.

- By Mail: Request a transcript by mail, using the Form 4506-T (Request for Transcript of Tax Return). Fill out the form with your personal information, the type of transcript you want, and the year or period you need. You can then mail or fax the form to the IRS, and you can receive your transcript within 10 business days.

- By Phone: You can request a transcript by phone, using the automated service at 800-908-9946. Provide your social security number, date of birth, and address. You can then choose the type of transcript you want, and the year or period you need. You can receive your transcript by mail within 5 to 10 days.

>>>PRO TIPS: How to File Taxes When Living Abroad

4. What Are the Tips to Follow to Avoid Scams And Phishing Attempts?

When requesting a transcript from the IRS, be aware of the potential risks of identity theft and fraud. Some scammers may try to impersonate the IRS or other legitimate entities and ask you for your personal or financial information, such as your social security number, bank account number, or credit card number.

They may also try to trick you into clicking on malicious links or downloading harmful attachments, which may infect your device with malware or ransomware. To avoid these scams and phishing attempts, you should follow these tips:

- Verify the authenticity of any communication from the IRS

- Protect your personal and financial information

- Monitor your credit and your tax account

5. When Do You Need an IRS Transcript?

You may need an IRS transcript for various reasons, depending on your personal or professional situation. Some of the most common reasons are:

- To file an amended return if you made a mistake on your original tax return, or you need to change something, such as your filing status, your income, your deductions, or your credits.

- To verify your income for a lender.

- To prepare a state tax return.

- To resolve a tax issue or dispute.

Recap

Don’t forget that an IRS transcript is more than just a piece of paper. It is a powerful tool that can help you access, manage, and verify your tax information. Whether you need to file an amended return, apply for a loan, or resolve a tax issue, you can request a transcript from the IRS online, by mail, or by phone.

However, be careful to protect your personal and financial information from scammers and identity thieves. By following the tips and examples in this article, you can learn how to request and use an IRS transcript safely and effectively.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. . For comprehensive tax, legal or financial advice, always contact a qualified professional in your area. S’witty Kiwi assumes no liability for actions taken in reliance upon the information contained herein.

No Comment! Be the first one.