Taxes in Michigan can be complicated to navigate, but staying up-to-date on the latest changes is important for you and your business or businesses operating in the state. Major tax policy revisions were enacted in 2023 that directly impact retirement income, tax credits for low-income families, corporate tax revenue allocation, and even triggered an automatic income tax rate reduction.

This guide will walk you through all of the need-to-know 2023 updates to Michigan’s state tax structure in clear, actionable steps.

Follow along and break down exactly what’s changed, who and what it impacts, and what you need to do to ensure you have the latest 2023 information on Michigan state taxes for your personal or business tax situation.

SUMMARY

- Get Up to Speed on Public Act 4 of 2023

- Review How Retirement Income Exemptions Are Changing

- Understand Increased Tax Credits for Working Families

- Review Corporate Tax Revenue Shifts

- Get Details on the Temporary Income Tax Rate Cut

- Catch Up on Other Recent Michigan Tax Changes

- Stay Informed on Michigan Taxes

Recap

1. Get Up to Speed on Public Act 4 of 2023

To stay ahead of Michigan state taxes, read and understand the public act 4 of 2023. Michigan’s new legislative majority passed sweeping tax changes in Public Act 4 early in 2023. This law rolls back parts of a 2011 tax overhaul that happened under Republican control of the governor’s office and legislature.

Some of the major elements you need to understand include the fact that it phases in more generous retirement income exemptions over 4 years, reaching pre-2011 levels in 2026. However, limits full public pension exemption to certain public safety retirees.

It increases the state’s Earned Income Tax Credit (EITC) for low-income working households from 6% to 30% of the federal credit. This more than doubles the previous level. Also, reallocates $500 – $600 million in corporate tax revenue to new business attraction funds and community/housing development over 3 years, and cuts state general fund revenue by around $1.4 billion annually in fiscal years 2024 and 2025.

2. Review How Retirement Income Exemptions Are Changing

To keep abreast of Michigan state taxes, review the retirement income exemptions. One main component of Public Act 4 is phasing in more generous retirement income exemptions by 2026:

- 2023: $35,570 exemption single filers, $71,140 joint

- 2024: $47,440 single, $94,900 joint

- 2025: $59,340 single, $118,700 joint

- 2026: Full exemption restored

However, there is an important caveat – the full exemption for public pension income now only applies to certain public safety retirees. For other public employees and all private retirement income, exemption limits will align with private levels.

Here’s an action step for you: Calculate your estimated retirement income exemption for 2023-2026 based on the above threshold levels and whether you have public or private income sources.

3. Understand Increased Tax Credits for Working Families

To stay in the lead regarding Michigan state taxes, understand the increase in tax credits for working families. Another major impact of Public Act 4 is increasing the state’s EITC to 30% of the federal EITC, after it had been cut to just 6% in 2011.

For example, a single parent with 2 children earning $20,000 would see their credit jump from $370 to $1,849.

Take these steps:

- Calculate your eligibility for the Michigan EITC based on your federal EITC amount.

- Review eligibility requirements like having investment income below $3,650 if unmarried.

- Determine how much additional tax relief you can expect based on the roughly 5x increase.

>>>PRO TIPS: How to File Taxes When Living Abroad

4. Review Corporate Tax Revenue Shifts

To stay well-informed about Michigan state taxes, know the shifts in corporate tax revenue. Public Act 4 also redirects $500 million to $600 million in corporate income tax revenue to other state funds over 3 years:

- Up to $500 million from 2023-2025 to new business attraction incentive funds

- $50 million annually to community development and housing

- $50 million annually to placemaking projects

This reallocation of revenues previously going to Michigan’s general fund will impact future budget and spending decisions.

Understand that this corporate tax revenue redirection means fewer general fund resources for other budget areas like infrastructure, health programs, education, and public safety unless replaced from other tax hikes or economic growth.

5. Get Details on the Temporary Income Tax Rate Cut

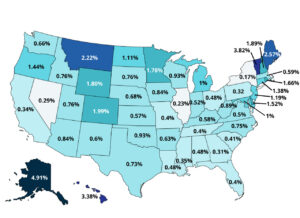

To stay ahead in understanding Michigan’s tax responsibilities, build your knowledge around the temporary income tax rate cut. Due to higher-than-expected 2022 state tax revenue, an automatic income tax rate reduction trigger tied to 2015 road funding legislation took effect for 2023 only. The rate cut is from 4.25% to 4.05%

However, based on a March 2023 attorney general opinion finding the trigger only requires a one-time 2023 cut, the rate will likely revert in 2024 absent a successful legal challenge.

Don’t worry, do the following below and keep track:

- Recalculate your 2023 state tax liability using the 4.05% rate.

- But tentative budget using the old 4.25% rate again starting in 2024.

- Monitor legal challenges to the interpreted temporary nature of the cut.

6. Catch Up on Other Recent Michigan Tax Changes

To stay vigilant regarding compliance with Michigan’s tax regulations, don’t be afraid to gain more knowledge regarding other recent changes.

While the 2023 Public Act 4 changes and income tax rate cut trigger were most substantial, you should be aware of other recent tax amendments as well like the 2021 flow-through entity tax allows your business if it is eligible to pay 4.25% entity-level tax instead of personal liability for owners to avoid federal deduction limits, exempted feminine hygiene products from 6% sales and use taxes in 2021, a raised industrial/commercial personal property tax exemption from $80,000 to $180,000 in true cash value for you, a small taxpayer in 2021 and an authorized new first-time homebuyer savings account income tax deductions in 2022.

Take these steps to have accurate information and which affects you:

- Consult an accountant on flow-through elections for your business.

- Factor sales tax exemption into purchases.

- Review property tax liability if you have a small business.

- Open a homebuyer savings account if you qualify.

7. Stay Informed on Michigan Taxes

To keep ahead of Michigan state tax regulations, always stay informed. Taxes in Michigan are complex and frequently changing, as evidenced by the 2023 updates covered here. To stay up-to-date:

- Bookmark and regularly review the state’s tax site

- Read the annual tax outline published by Michigan’s Citizens Research Council

- Follow relevant bills in the state legislature

- Create news alerts on major Michigan media site for tax related stories

- Meet with a trusted tax professional at least annually to review your situation

Following the steps outlined here will help ensure you have the latest information on Michigan taxes for 2023 and don’t miss critical details that could cost you money or create legal headaches. Of course, every person and business’ tax situation is different too. By pairing these general guidelines with personalized tax advice, you can feel confident you are current on what you owe and how new tax laws impact you.

Recap

Navigating Michigan’s intricate tax landscape becomes crucial with the sweeping changes introduced by Public Act 4 in 2023. This legislation reshapes retirement income exemptions, enhances tax credits for working families, reallocates corporate tax revenue, and initiates a temporary income tax rate cut. Whether an individual or a business, staying informed is key.

From understanding the phased-in retirement income exemptions to grasping corporate tax shifts, this guide provides actionable steps to help you adapt to the evolving tax scenario. Regularly checking the state’s tax site, keeping an eye on legislative updates, and seeking professional advice will ensure compliance and avoid potential financial and legal challenges.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. . For comprehensive tax, legal or financial advice, always contact a qualified professional in your area. S’witty Kiwi assumes no liability for actions taken in reliance upon the information contained herein.

No Comment! Be the first one.