Imagine strolling through lush meadows, hearing the gentle rustle of leaves overhead, and hearing the soothing melody of birdsong in the air. It’s your own slice of nature, a refuge from the bustling world. Now, can you believe that this serene haven could not only offer solace to your soul but also bring substantial tax benefits? Intrigued? Now embark on a journey into the realm of tax deductions for conservation easements.

Picture this: a picturesque landscape, your very own piece of paradise. This Eden is more than a sanctuary; it’s an untapped treasure trove of tax advantages. Conservation easements, a powerful tool in your financial arsenal, can turn your passion for preserving nature into a strategic move for your wallet.

What exactly is a conservation easement? It’s a legal agreement between you and a land trust or government agency that permanently limits certain uses of your land to protect its conservation values. Now, here’s where it gets exciting: the Internal Revenue Service (IRS) rewards you for being an environmental steward.

As you stand on the precipice of this financial and environmental synergy, consider the immediate impact on your taxable income. The value of the easement, calculated by assessing the before-and-after value of your property, can be deducted from your income. This deduction isn’t a one-time wonder; it extends for up to 16 years, providing a steady stream of tax benefits.

Note that initiating this journey requires a certified appraisal of your property, determining its value pre- and post-easement. This appraisal serves as your golden ticket to tax deductions. It’s crucial to partner with a qualified appraiser well-versed in conservation easements to ensure a seamless process.

Here are some points about tax deductions for conservation easements that you should know:

- Understanding Conservation Easements

- Eligibility

- Charitable Contribution Deduction

- Get Certified Appraisal of Your Property

- Permanent vs. Temporary Easements

- The 50% Rule and Limitations

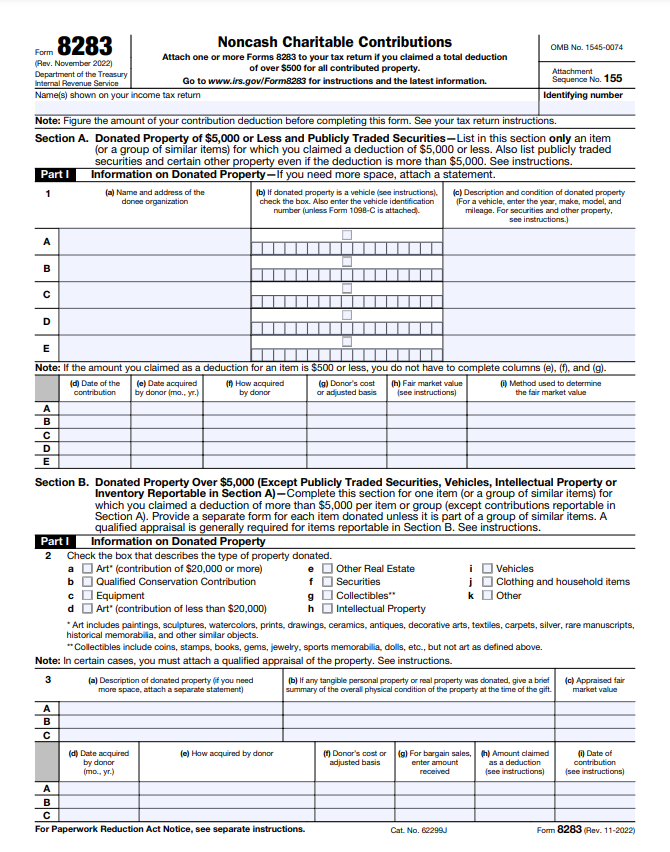

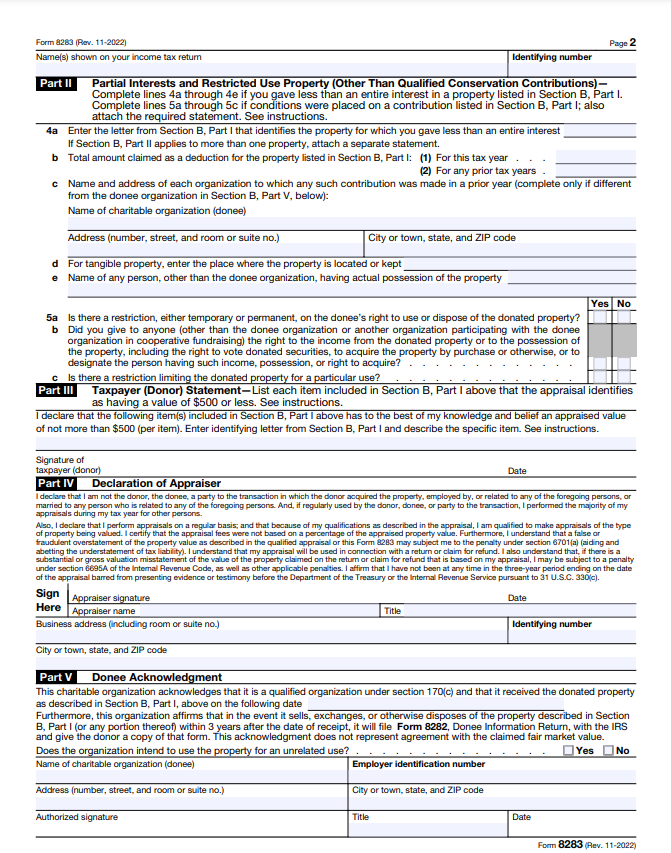

- File IRS Form 8283

- Stewardship Costs are Deductible

- Public Access Considerations

Recap

1. Understanding Conservation Easements

Conservation easements are legal agreements between property owners and land trusts or government agencies that restrict the development or use of the property to protect its natural, scenic, or historic features. By voluntarily placing a conservation easement on their property, owners can ensure its preservation for future generations.

Think of it as a legal agreement between a landowner and a conservation organization or government agency. This agreement restricts the development of a property to preserve its natural state.

Now, here’s where it gets interesting. When you decide to put a conservation easement on your property, you might be eligible for some serious tax benefits. Essentially, it’s the government’s way of saying “thanks” for helping preserve our environment.

>>>MORE: How Bonuses Are Taxed

2. Eligibility

To qualify for these deductions, your easement must serve a legitimate conservation purpose. This could involve protecting natural habitats, preserving open spaces, or maintaining scenic views. It’s all about keeping Mother Nature in good shape.

Note that not all conservation easements qualify for tax deductions. To be eligible, the easement must meet specific requirements set by the Internal Revenue Service (IRS). For example, it must be granted in perpetuity, meaning it lasts forever, and it must provide significant public benefit by preserving land for conservation purposes.

One of the significant benefits of donating a conservation easement is the potential for tax deductions. When you donate a qualified conservation easement to a qualified organization, you may be eligible for a federal income tax deduction. This deduction can help offset the costs associated with the easement and provide financial incentives for landowners to protect their properties.

3. Charitable Contribution Deduction

One major benefit is the charitable contribution deduction. By donating a conservation easement, you’re essentially giving up a part of your property rights for the greater good. The IRS recognizes this as a charitable contribution, and you can deduct the value of that easement from your income when it comes to tax time.

The amount of the tax deduction for a conservation easement is based on the fair market value of the easement. This value is determined by comparing the property’s value before and after the easement is placed. The difference between these two values represents the charitable contribution that can be deducted from your taxes.

4. Get Certified Appraisal of Your Property

Now, before you get too excited, you need to get your property appraised. Obtain a certified appraisal of your property. Picture this: your property’s value, both before and after an easement is established, holds the key to determining the deduction you can claim. This is where a certified appraiser becomes your strategic ally.

Now, don’t let excitement overshadow the significance of this process. Engaging a certified appraiser entails a thorough evaluation, meticulously considering the impact of easement restrictions on your property’s value. This expert not only determines the current value but also unveils the potential shift in value post-easement.

You, as the property owner, are in the driver’s seat of this process. It’s not just about meeting a requirement; it’s about securing the most accurate and advantageous appraisal for your specific property. So, ensure you embark on this journey with a certified appraiser by your side to navigate the complexities and maximize the deductions aligned with the true value of your property.

>>>PRO TIPS: Tax Tips for Bitcoin and Virtual Currency

5. Permanent vs. Temporary Easements

Talking about the duration. Conservation easements can be permanent or temporary. Imagine these easements as pathways toward preserving the land, and, in your case, you’re at a crossroads deciding which route to take. Permanent easements, much like their name implies, extend indefinitely. Opting for permanence not only safeguards the land for future generations but also unlocks more significant tax benefits. It’s a lasting commitment to conservation.

On the flip side, there’s the option of temporary easements—a commitment for a specified period. While not eternally binding, these easements offer tax advantages. It’s akin to a conservation lease, providing benefits during the agreed-upon timeframe.

Now, in your decision-making process, consider the permanence that aligns with your conservation goals and financial aspirations. If you lean towards securing the land’s legacy permanently, the tax benefits reflect this enduring commitment. Alternatively, if a temporary approach suits your plans, you may enjoy advantages for the agreed-upon duration.

Ultimately, the choice between permanent and temporary easements is yours, with each path offering its own set of advantages tailored to your specific goals and timeframe.

6. The 50% Rule and Limitations

The deduction for a conservation easement is subject to certain limitations. The maximum deduction is generally limited to 50% of your adjusted gross income (AGI) for the year of the donation. However, if you are a qualified farmer or rancher, you may be eligible for a higher deduction of up to 100% of your AGI.

If the value of your conservation easement exceeds the deduction limit for the year, you can carry forward the excess deduction for up to 15 years. This allows you to spread out the tax benefits over multiple years and potentially maximize your overall tax savings.

>>>GET SMARTER: Energy Tax Credit: Which Home Improvements Qualify?

7. File IRS Form 8283

To claim a tax deduction for a conservation easement, you must file IRS Form 8283 along with your federal income tax return. This form requires detailed information about the location, purpose, and fair market value. It’s crucial to work with a qualified appraiser and consult with a tax professional to ensure you meet all the necessary requirements and properly document your deduction.

8. Stewardship Costs are Deductible

Don’t forget the ongoing costs. If you’re responsible for maintaining and enforcing the terms of the easement, those stewardship costs can be deducted too. It’s a nice way to offset some of the ongoing responsibilities that come with being a conservation-minded landowner.

Now, the good news is that these stewardship costs are not to be overlooked when considering tax deductions. In the realm of taxation, these ongoing expenditures become valuable assets. By adhering to your role in conserving the land, you not only contribute to environmental sustainability but also gain a financial benefit.

As you navigate the realm of deductible expenses, remember to include these stewardship costs. It’s a strategic and legitimate way to alleviate some of the financial burdens associated with your commitment to conservation. So, as you fulfill your role as a steward of the land, rest assured that your dedication is not only environmentally commendable but also financially savvy.

9. Public Access Considerations

If you’re thinking about claiming the maximum deduction, be aware that the IRS generally expects some level of public access to the protected area. This doesn’t mean buses of tourists traipsing through your backyard, but rather reasonable access for educational or recreational purposes.

Now, don’t conjure images of tour buses infiltrating your serene backyard; rather, envision a balanced access framework aligned with educational or recreational pursuits.

So, in your pursuit of the maximum deduction, consider weaving a narrative of responsible custodianship where public access aligns seamlessly with IRS expectations. This dance of accessibility and protection, when executed thoughtfully, transforms your enclave into a haven that not only shields but also enriches through judicious community engagement.

Recap

Tax deductions for conservation easements provide landowners with a unique opportunity to protect their properties while also enjoying potential tax benefits. By donating a qualified easement, you can contribute to the preservation of our natural and cultural heritage, reducing tax trust.

In a nutshell, diving into conservation easements isn’t just about protecting the environment; it’s a strategic move that can benefit both your wallet and the world around you. So, if you’re a property owner with a soft spot for nature, exploring conservation easements might just be your ticket to a greener—and financially smarter—future.

Getting into conservation easements can be a bit of a legal tango. Consult legal professionals who specialize in conservation law. This ensures that everything is done correctly, maximizing your tax benefits and avoiding any potential pitfalls. Keep an eye on tax laws’ tendency to change, and what’s beneficial today might not be as advantageous tomorrow. Staying informed ensures you make the most of available deductions.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. . For comprehensive tax, legal or financial advice, always contact a qualified professional in your area. S’witty Kiwi assumes no liability for actions taken in reliance upon the information contained herein.

No Comment! Be the first one.