Introduction

Navigating partnership taxes is a crucial aspect of managing this joint venture’s financial responsibilities. You need to understand this intricate terrain to ensure compliance with tax laws and optimize financial outcomes for all involved parties.

In this guide, you’ll unravel the complexities of partnership taxation, empowering you to navigate each step with precision. You’ll explore the unique tax structures that partnerships entail, uncovering the implications for both the entity and its partners.

Additionally, you’ll delve into the allocation of profits and losses, essential tax forms, and the vital role of the partnership agreement in tax matters. By grasping the nuances within this realm, you equip yourself with the knowledge necessary to make informed decisions and ensure tax efficiency within your partnership.

Partnership Taxes: Full Guide

1. Partnership Tax Basics

2. Taxable Partnership Income

3. Partner’s Tax Liabilities

4. Allocation of Profits/Losses

5. Partnership Tax Forms

6. Special Tax Considerations

7. Partnership Agreement’s Role

8. Tax Planning Strategies

Recap

1. Partnership Tax Basics

Partnership tax basics are fundamentals you should know to navigate the intricate landscape of joint venture taxation. In the taxation structure of partnership business, the entity itself doesn’t pay taxes. Instead, the profits and losses “pass through” to you and other partners.

This pass-through nature means you (and every other partner) report your share of profits or losses on your personal tax return. As a partner, you’re liable for taxes based on your allocated share of partnership income, regardless of whether that income is distributed.

The partnership files an information return to provide the IRS with an overview of its financial activity, but the actual tax obligations lie with the individual partners. Make sure you take note of these fundamental concepts as it lays the groundwork for comprehending how partnership taxation functions and sets the stage for more detailed exploration within this realm.

>>>MORE: LLP Taxes: Full Guide

2. Taxable Partnership Income

The earnings and losses that flow through a partnership to you and every other partner is known as partnership income. This income isn’t taxed at the partnership level; instead, it’s allocated among partners based on the partnership agreement.

The types of income considered taxable include profits from the partnership’s operations, interest, dividends, rents, royalties, and any other gains. However, specific exclusions or deductions might apply, reducing the taxable income for you and other partners.

Your share of this income, whether distributed or not, becomes part of your personal tax return. It’s crucial you comprehend the income calculation, allocation, and ultimately how to report it on your tax form.

Stay abreast of any changes in tax regulations to ensure accurate reporting and compliance with tax laws regarding the taxable partnership income you receive.

3. Partner's Tax Liabilities

Take note of your liability as a partner because it helps you comprehend your financial responsibilities within a partnership. You’re accountable for taxes based on your share of the partnership’s income, regardless of whether that income is actually distributed to you.

This means that your allocated share of profits, losses, deductions, and credits factors into your individual tax obligations. The taxable income flows through to you, affecting your personal tax return and your overall tax liability.

Remember, your tax liabilities are not contingent upon the partnership’s distributions. It’s essential you accurately calculate and report these liabilities to ensure compliance with tax laws and avoid potential penalties or audits.

4. Allocation of Profits/Losses

The allocation of profits and losses enables you to know how a partnership divides its financial outcomes among partners. You’ll see this allocation outlined in the partnership agreement, detailing how profits and losses will be distributed among partners.

It’s not solely based on ownership percentage but can be adjusted according to the terms agreed upon. This allocation directly impacts each partner’s tax liability, as the share of profits or losses assigned to you affects your individual tax return.

Partnerships might employ various methods for allocation, such as sharing equally, based on capital contributions, or using a specific formula as outlined in the agreement. Make sure you’re aware of how these allocations work to ensure accurate reporting and fair distribution of partnership outcomes among members. Review and update the agreement regularly to adapt to changing circumstances within the partnership.

>>>PRO TIPS: LLP Had Losses Last Year: How to File Taxes?

5. Partnership Tax Forms

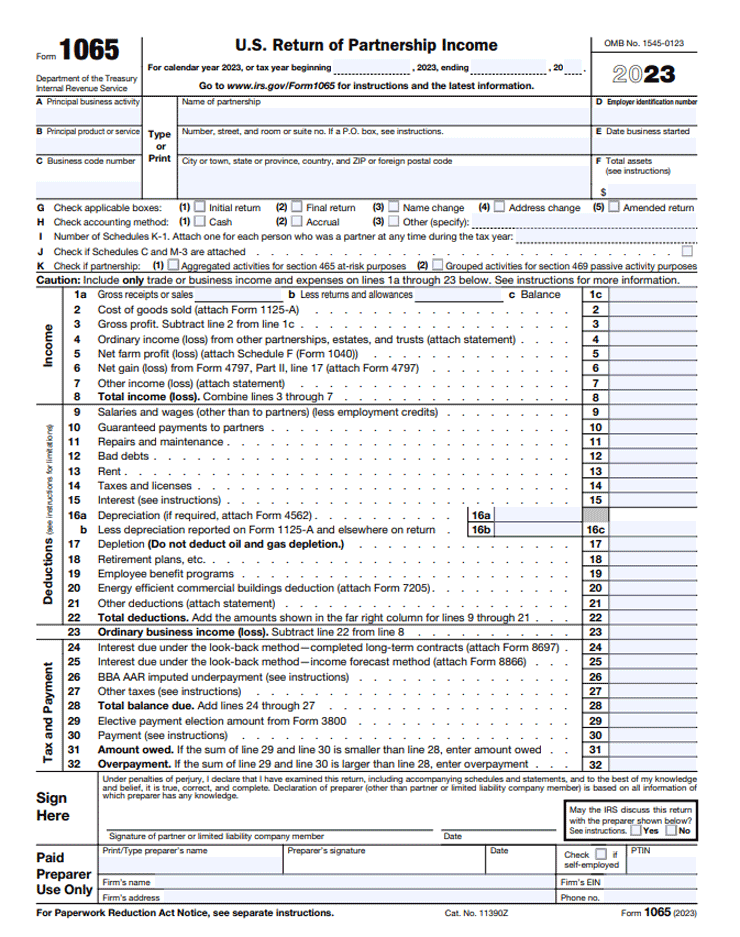

Partnering with the understanding of tax forms helps you to fulfill your tax obligations accurately. The primary form utilized by partnerships is Form 1065, also known as the U.S. Return of Partnership Income.

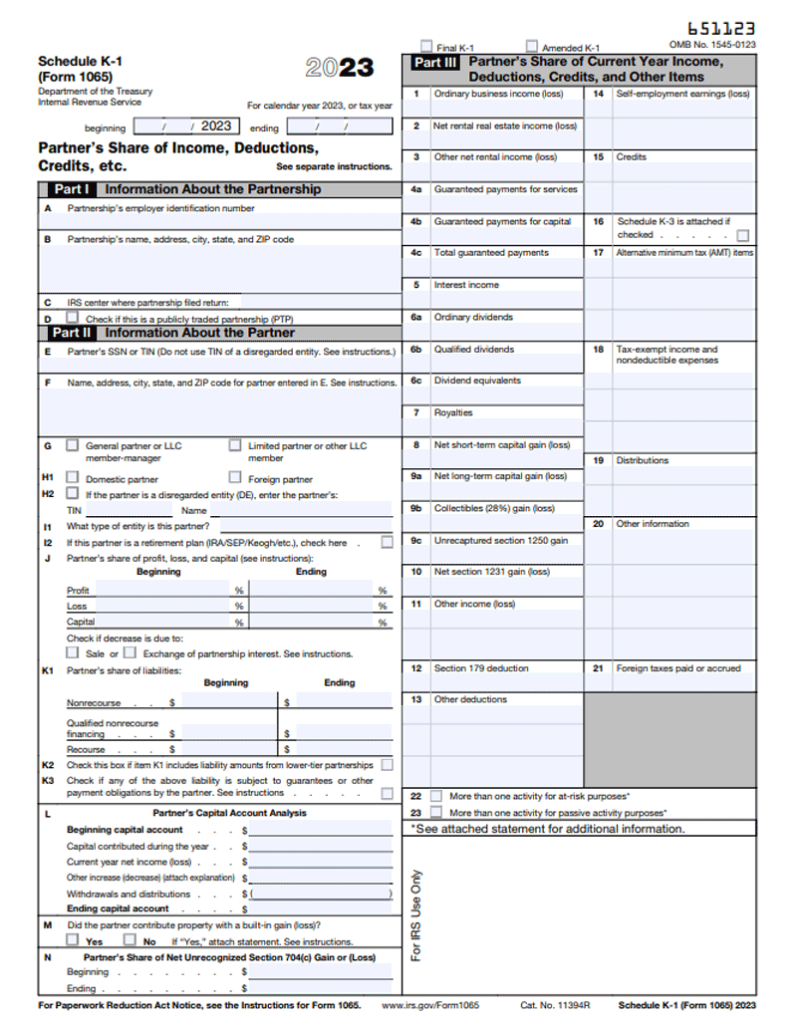

This form provides a comprehensive overview of your partnership’s financial activities, including income, deductions, credits, and distributions made to partners. Additionally, you and every other partner receive a Schedule K-1, which details your share of profits, losses, deductions, and credits from the partnership.

You must include this information on your personal tax return using Form 1040. These forms are critical for the IRS to track partnership activity and ensure proper taxation of both the partnership entity and its individual partners. Take note of these forms and its accurate completion to maintain compliance and avoid potential penalties or audits.

6. Special Tax Considerations

Be aware of special tax considerations in partnership as it is crucial for navigating unique tax situations that may impact your financial obligations. Your partnership might encounter special circumstances, such as international operations, changes in ownership, or specific industry-related tax rules.

These situations require careful attention as it might affect tax reporting, deductions, or credits. For instance, if your partnership conducts business abroad, you may need to adhere to international tax laws and reporting requirements. Changes in ownership structure or mergers can also trigger specific tax considerations.

Moreover, certain industries benefit from specialized tax deductions or credits. Being aware of these considerations helps you anticipate potential tax implications, ensuring compliance and maximizing tax benefits within your partnership’s operations. So, make sure you stay updated on these special tax aspects to ensure accuracy and proactive management of your partnership’s tax obligations.

>>>GET SMARTER: How to File Taxes If You’re Married

7. Partnership Agreement's Role

The Partnership Agreement’s role is pivotal in shaping the framework for your partnership’s financial and tax matters. This legal document outlines crucial aspects of your partnership, including profit-sharing arrangements, ownership percentages, allocation of losses and gains, decision-making processes, and more.

It serves as a roadmap, defining how your partnership operates, distributes profits, and handles tax-related issues. Your partnership agreement determines how profits and losses are allocated to you and other partners, directly influencing each partner’s tax liabilities.

It’s essential you ensure that this agreement accurately reflects the partnership’s intentions and evolves to accommodate changes within the business or among its members. Regularly reviewing and updating the partnership agreement ensures alignment with current business objectives, clarifies tax responsibilities, and helps avoid potential disputes or misunderstandings in the future.

8. Tax Planning Strategies

You need tax planning strategies to optimize your partnership’s financial health while minimizing tax liabilities. As a partner, you have various avenues to strategically manage taxes. Consider maximizing deductions by staying updated on eligible business expenses and taking advantage of available tax credits.

You can also evaluate the timing of income and expenses, as it may also impact tax obligations; adjusting these timings might optimize your tax position. Implement retirement plans or explore different entity structures that can potentially reduce tax burdens.

Regularly review and adjust your tax strategies to align your partnership’s financial goals with tax-efficient practices. Make sure you collaborate with tax professionals to get valuable insights into specific strategies tailored to your partnership’s unique circumstances, ensuring compliance while maximizing savings within the confines of tax laws and regulations.

Recap

You’ve explored partnership tax basics, taxable income, partner liabilities, profit allocation, tax forms, special considerations, agreement’s role, and tax planning. Make sure you apply this knowledge to ensure compliance and strategic financial management within your partnership business, optimizing tax responsibilities while navigating the legal landscape reliably.

No Comment! Be the first one.