Introduction

If you suspect someone has used your identity for fraudulent purposes with the IRS, Form 14039, the Identity Theft Affidavit, is a crucial document for reclaiming your identity and resolving potential tax issues.

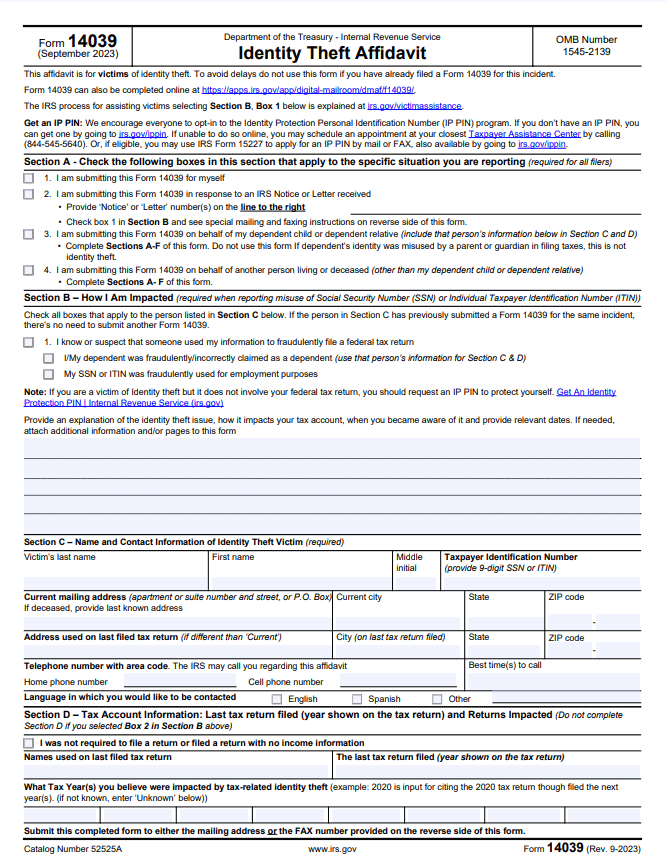

When you believe you’ve been a victim of identity theft in relation to your taxes, this form is your tool to alert the IRS and start the process of rectifying the situation. It’s specifically designed for you if you encounter unauthorized or erroneous use of your Social Security number or other personal information connected to tax-related matters.

This form helps the IRS track and investigate instances of identity theft, providing a detailed account of the fraudulent activity. Completing Form 14039 enables you to flag potential issues swiftly and begin the resolution process, protecting your finances and ensuring the accurate filing of your taxes.

Guide to IRS Form 14039: Identity Theft Affidavit:

1. Purpose of Form

2. Identifying Information

3. Incident Details

4. Fraudulent Activity Description

5. Supporting Documents Required

6. Tax-Related Impact

7. How to File

8. IRS Contact Information

9. Follow-Up Process

10. Impact on Tax Return

Recap

1. Purpose of Form

The purpose of IRS Form 14039, the Identity Theft Affidavit, is to empower you in reporting suspected identity theft connected to tax-related matters. By filling out this form, you provide vital information to the IRS, alerting the IRS to potential fraudulent use of your Social Security number or other personal details.

You’re initiating a crucial step in safeguarding your identity and rectifying any potential tax issues resulting from identity theft. Make sure you detail the unauthorized use of your information so you can assist the IRS in investigating and resolving these matters. Through Form 14039, you’re actively contributing to protecting your financial well-being and ensuring you file your taxes correctly.

>>>MORE: What is IRS Form 1040 Schedule 2?

2. Identifying Information

In the section “Identifying Information” on IRS Form 14039, you’re prompted to provide essential details about yourself. Here, you fill in your name, Social Security number, date of birth, address, and other pertinent personal information.

It’s crucial you ensure accuracy in this section, as it forms the foundation for the IRS to investigate and resolve the reported identity theft. Make sure you double-check each detail you enter, ensuring it aligns precisely with your official documents to avoid any delays or complications in the process.

Providing accurate information about your identity lays the groundwork for the IRS to initiate the necessary actions to rectify the identity theft situation efficiently.

3. Incident Details

The “Incident Details” section of IRS Form 14039 allows you to outline the specifics of the suspected identity theft incident. Here, you provide a detailed account of when and how you became aware of the unauthorized use of your personal information.

Be comprehensive and precise in describing the circumstances surrounding the incident, including any relevant dates, events, or notifications you received regarding the identity theft. Clearly articulate the situation, detailing how you discovered or were informed about the fraudulent activity linked to your taxes.

This section’s accuracy and thoroughness are critical in helping the IRS comprehend the scope and nature of the identity theft, facilitating the IRS investigation and resolution processes efficiently. Always ensure the information you provide is factual and up-to-date for the most effective response from the IRS.

4. Fraudulent Activity Description

Another vital section of IRS Form 14039 is the “Fraudulent Activity Description” where you provide a comprehensive overview of the fraudulent use of your identity concerning tax matters. Here, you detail the specific instances of unauthorized use, such as incorrect tax filings or notices indicating income you didn’t earn.

Explain any suspicious or unexplained alterations to your tax records or notifications from the IRS that don’t align with your actual financial activities. Make sure you describe any peculiarities, discrepancies, or irregularities you’ve noticed, and include all relevant details.

Being meticulous and precise in this section helps the IRS to further understand the nature and extent of the fraudulent activity, enabling the IRS to take appropriate actions to address the issues effectively. Always verify and update the information you provide for accuracy and relevance.

>>>PRO TIPS: What is IRS Form 6252: Installment Sale Income

5. Tax-Related Impact

The “Tax-Related Impact” section on Form 14039 addresses the consequences of identity theft on your tax situation. Here, you outline how the unauthorized use of your identity has affected or could affect your tax obligations.

You describe any erroneous tax filings made under your name due to the identity theft, highlighting the discrepancies between your actual finances and those misrepresented on these filings. It’s essential you detail any notices from the IRS about income or taxes you didn’t earn or owe.

This information helps the IRS to know the financial ramifications of the identity theft, enabling the IRS to rectify discrepancies and ensure the accuracy of your tax records. Make sure the information you provide precisely depicts the impact on your taxes.

6. Supporting Documents Required

You need the following documents to report identity theft on Form 14039:

- Proof of Identity: Include a copy of your government-issued ID, like a driver’s license or passport, verifying your identity.

- IRS Notice or Letter: Attach any correspondence you received from the IRS regarding the suspected identity theft incident.

- Supporting Financial Documents: Provide any relevant tax returns, W-2s, or 1099 forms demonstrating discrepancies.

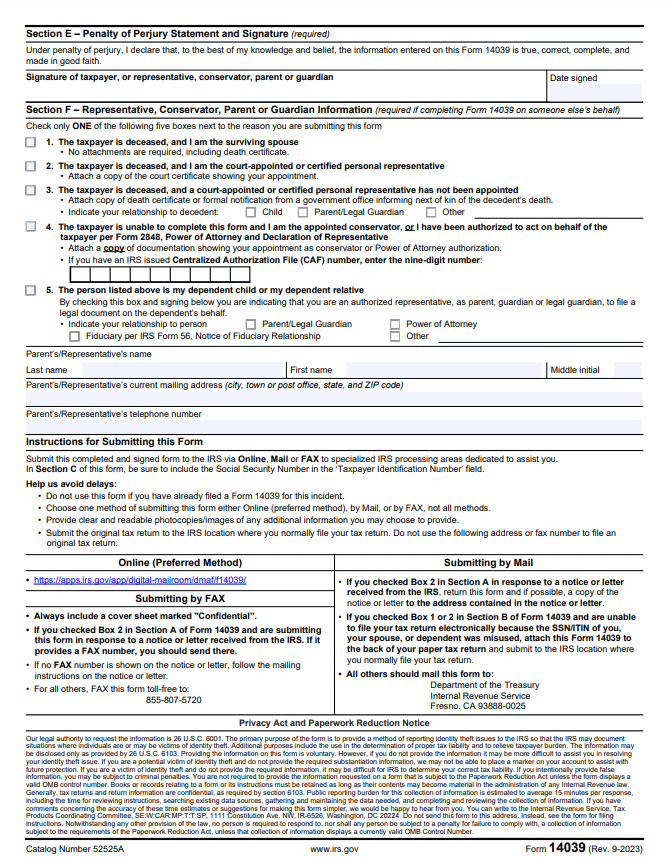

7. How to File

Here’s a detailed step by step process on how to file Form 14039:

- Download the Form: Access Form 14039 from the IRS website or request it by calling the IRS.

- Complete the Form: Fill in your personal details accurately and thoroughly.

- Provide Details: In the designated section of Form 14039, describe the circumstances and specifics of the identity theft incident comprehensively.

- Attach Supporting Documents: Gather and attach all required supporting documents, like proof of identity and IRS notices.

- Mail or Fax: Submit the completed form and documents to the IRS address or fax number provided on the form’s instructions.

- Await Confirmation: Wait for acknowledgment or confirmation from the IRS regarding the receipt of your Form 14039.

8. IRS Contact Information

There is a section labeled “IRS Contact Information” on Form 14039. This is where you find details about reaching out to the IRS for assistance regarding identity theft. This section often contains addresses, phone numbers, or online resources specifically dedicated to handling identity theft-related concerns.

You can locate guidance on where to send your completed Form 14039 or find contact details for specific IRS departments trained to address identity theft issues. Take note of the accuracy of this information because it is crucial for successful communication with the IRS.

Always verify these contact details, as it may change periodically, ensuring you’re using the most up-to-date information to reach the IRS promptly for assistance in resolving identity theft matters.

9. Follow-Up Process

The “Follow-Up Process” section on Form 14039 outlines what happens after you submit the affidavit to the IRS. Once received, the IRS begins its investigation into the reported identity theft.

The IRS will review the information you provided, verify the details, and work toward resolving the issues. Expect to receive an acknowledgement receipt of your form, providing confirmation that the IRS is handling your case.

Also, the IRS might reach out to you for additional information or clarification if needed. Throughout this process, keep track of any communication with the IRS and promptly respond to inquiries to facilitate a swift resolution.

Stay vigilant and patient as the IRS works to rectify the identity theft issues you’ve reported, ensuring your financial matters are corrected accurately. Always verify the current follow-up procedures for any updates or changes.

10. Impact on Tax Return

“Tax Return Impact” is a section on Form 14039 that addresses how identity theft affects your tax returns. When someone illicitly uses your information for tax purposes, it can lead to erroneous filings under your name, impacting your returns. You might notice discrepancies in reported income, deductions, or credits that you didn’t authorize.

This can affect your tax liability, potentially resulting in incorrect tax bills or refunds. It’s crucial you report such discrepancies promptly to rectify any inaccuracies in your tax records. By detailing these impacts on your tax return, you help the IRS understand the extent of the identity theft’s effect on your tax situation, aiding the IRS in correcting these errors and ensuring accurate tax filings for you.

Recap

Form 14039, the Identity Theft Affidavit, empowers you to report identity theft to the IRS. You provide crucial details about the incident, its tax impacts, and supporting documents. Filing this form initiates the resolution process, safeguarding your financial integrity. Ensure accuracy and follow-up for effective resolution of identity theft concerns.

No Comment! Be the first one.