Thinking about a magical form that can put some extra cash back in your pocket during tax season? Meet Form 8880—the not-so-secret key to unlocking the saver’s credit. Dive in and demystify this form together.

Picture this: You’re filing your taxes, and suddenly you stumble upon Form 8880. It’s like finding a hidden treasure chest. This form is your gateway to the Saver’s Credit, a credit that rewards you for saving for retirement. Who doesn’t want a little extra cash while securing financial future?

Now, you might be wondering, “What’s the saver’s credit?” It’s a credit designed to encourage low- to moderate-income individuals to save for retirement. This credit can reduce your tax bill or increase your refund—sounds like a win-win, right?

So, how do you make this magic happen? Filling out Form 8880 is your first step. Don’t worry; it’s not rocket science. The form is user-friendly and walks you through the process of claiming the saver’s credit.

Before diving in, collect details about your retirement contributions. This includes contributions to a 401(k), IRA, or other qualified retirement plans.

As you navigate Form 8880, you may input your contributions and calculate the credit. It’s like piecing together a financial puzzle where the reward is real money in your pocket.

Just like any good detective, you want to make sure your findings are accurate. Double-check your entries and ensure you don’t miss any valuable information.

- What is Form 8880

- Who Qualify for Form 8880

- Tax Credits for Savings

- Maximizing Benefits

- Gathering the Required Information

- How to File Form 8880

Recap

1. What is Form 8880?

Form 8880, also known as the Credit for Qualified Retirement Savings Contributions, plays a crucial role in maximizing your tax benefits related to retirement savings. This form allows you to claim a valuable credit for contributions made to eligible retirement savings plans, such as IRAs or 401(k)s.

The importance is to cover contributions made to various retirement accounts, including IRAs and 401(k)s. It is essential to gather details about your contributions to these accounts for accurate filing.

2. Who Qualify for Form 8880

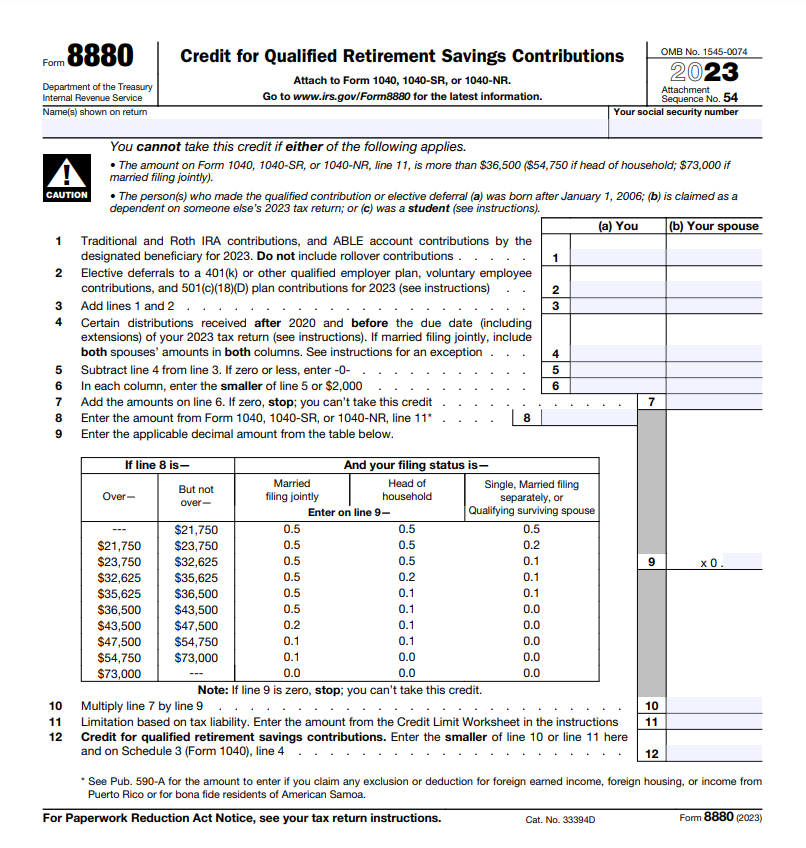

To determine eligibility for Form 8880, you must meet specific criteria to claim the Retirement Savings Contributions Credit, commonly known as the Saver’s Credit. Firstly, assess your filing status and income, ensuring you fall within the designated thresholds. If you contribute to a qualified retirement savings plan, such as a 401(k) or IRA, you may be eligible.

Consider your adjusted gross income and ensure it aligns with the outlined limits. As you explore these criteria, bear in mind that meeting these conditions enhances your qualification for Form 8880, allowing you to avail of the valuable Saver’s Credit for your eligible retirement savings contributions.

>>>PRO TIPS: Federal Tax Credit for Residential Solar Energy

3. Tax Credits for Savings

Form 8880 presents a valuable opportunity for you, focusing on individuals with lower to moderate incomes and emphasizing the importance of saving for retirement. This form acts as a tool to reward your commitment to responsible financial planning, specifically targeting people who prioritize building a nest egg for later years.

The credit percentage fluctuates according to income, serving as a tangible financial incentive to encourage and support your efforts in securing a stable retirement. By filling out Form 8880, you’re not just navigating tax procedures but actively participating in a system designed to recognize and reinforce your dedication to sound financial choices, ensuring a brighter financial future.

4. Maximizing Benefits

Filing Form 8880 allows you to maximize the benefits of your retirement savings by potentially reducing your overall tax liability. It’s a strategic tool for individuals looking to optimize their financial well-being.

Ensure accurate reporting of your contributions on the form, as this directly influences the credit amount you may qualify for. Thoroughly review your records to include all eligible contributions.

Filing this form not only acknowledges your commitment to securing your financial future but also aligns with the government’s encouragement of responsible retirement planning. It’s a proactive step toward achieving long-term financial security.

>>>GET SMARTER: Form 8917: What It Is, How to File It

5. Gathering the Required Information

To ensure a seamless process, begin by comprehending the essential details for Form 8880. This involves grasping the intricacies of eligible retirement savings contributions. Your focus must be on documenting these contributions meticulously. This step is crucial as it lays the foundation for the accurate and efficient completion of Form 8880. Take note of the specific requirements and guidelines associated with qualified contributions.

By understanding and following these nuances, you establish authority in handling the information-gathering phase. Your attention to detail is pivotal in ensuring that the data you collect aligns precisely with the criteria outlined for this form. As you navigate through this process, consider seeking guidance or clarification on any points that may appear intricate, underscoring the importance of clarity and precision in this administrative endeavor.

6. How to File Form 8880

To file Form 8880, begin by providing personal details, specifying your filing status, understanding credit calculations based on income, detailing contributions, and seamlessly transferring earned credits to your tax return.

Personal Information

Start by entering your basic details. Provide your full name, Social Security number, and address. This ensures the form is correctly attributed to you.

Filing Status and Exemptions

Indicate your current filing status, such as single, married filing jointly, etc. Also, specify the number of exemptions you are claiming, if any. This step establishes your tax situation.

Retirement Savings Contributions Credit Calculation

Determine the percentage of the credit you qualify for based on your adjusted gross income (AGI). It’s crucial to understand the contribution limits and credit rate thresholds associated with your income.

Retirement Contributions Details

List the specifics of your eligible contributions for the tax year. Clearly state the types of retirement plans involved, whether it’s a traditional IRA, Roth IRA, or others. This step provides a comprehensive overview of your savings.

Credit Computation

Utilize the worksheet provided to calculate the retirement savings contribution credit. Take your time and ensure precision in your calculations. Accuracy is key at this stage, so double-check your work.

Credit Transfer

Once you’ve determined the credit amount, smoothly transfer this calculated figure to your individual income tax return, be it Form 1040 or 1040A. This final step ensures that your eligible credit contributes to your overall tax benefits. Make sure you avoid common mistakes when completing Form 8880.

Remember, this process aligns with your unique financial situation, enhancing the accuracy of your tax return.

Recap

In the grand maze of tax forms, Form 8880 stands out as your ticket to smart savings. By mastering this seemingly magical document, you unlock the door to the saver’s credit, a reward for your commitment to securing your financial future.

Remember, this isn’t just about filling in the blanks; it’s about claiming what’s rightfully yours. As you file Form 8880, you’re not just navigating tax season; you’re strategically positioning yourself to keep more of your hard-earned money.

Note that the earlier you start contributing to your retirement accounts, the more you can potentially claim on Form 8880. Time is your ally in building both savings and credits. Don’t limit yourself. Investigate different retirement savings options to find the best fit for your financial goals. Whether it’s a 401(k), IRA, or another plan, diversity is key.

Now armed with pro tips for maximizing your savings, you’re not merely a taxpayer; you’re a financial superhero, making the most of every opportunity to bolster your financial well-being. So, go ahead, claim those credits, and let your money work for you. Here’s to a future filled with smart savings and financial success!

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. . For comprehensive tax, legal or financial advice, always contact a qualified professional in your area. S’witty Kiwi assumes no liability for actions taken in reliance upon the information contained herein.

No Comment! Be the first one.