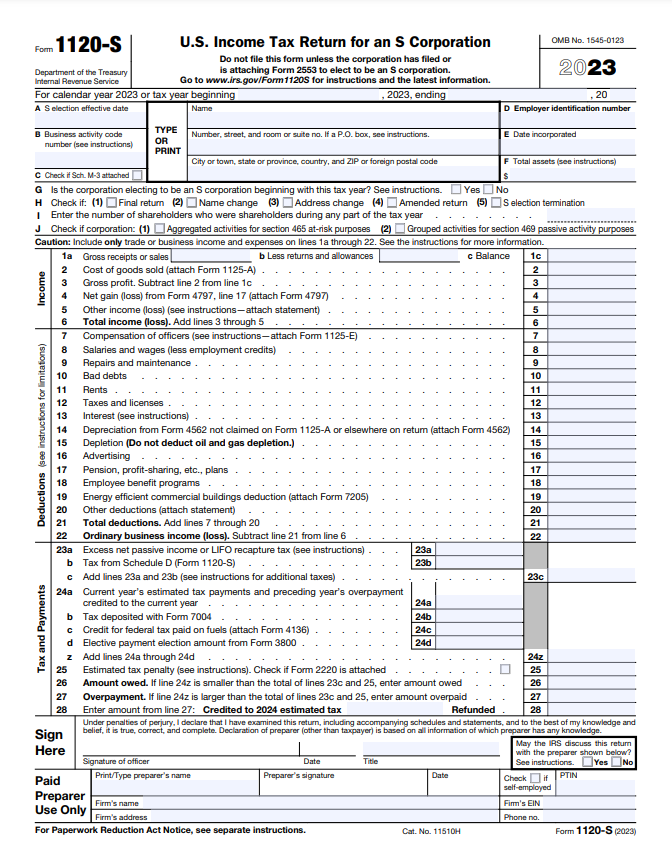

Welcome to the world of tax paperwork! Form 1120-S is like your S corporation’s annual financial report card for the IRS. It’s how you communicate the nitty-gritty details of your business’s finances.

Think of it as a snapshot of your financial health. In this form, you can spill the beans on everything—income, gains, losses, credits, deductions—the whole shebang. And it doesn’t go solo. Enter Schedule K-1, your trusty sidekick, breaking down who gets what share of the profits and losses among your individual shareholders.

Now, what goes into this financial snapshot? Picture it as a mix of your income details, deductions, taxes, and payments. It’s like laying out your business’s cards on the table.

Filing is a breeze; you can do it electronically or send it old-school via mail, whichever suits you best. So, tackle this tax adventure and make sure your Form 1120-S paints an accurate picture of your business’s financial success.

FORM 1120-S: What Paperwork Do I Need For Filing? (Comprehensive Tax Preparation Checklist)

- Gather Your Corporate Details

- Record Income and Expenses

- Get Shareholder Details

- Calculate Your Net Profit or Loss

- How to File Form 1120-S

- Important of Schedule K-1 With Form 1120-S

Recap

1. Gather Your Corporate Details

To kick off this tax journey, you need to gather some basic information about your company, like its official name, the Employer Identification Number (EIN), and when it officially came into existence. This is like setting the stage—you want everything in place before the tax performance begins.

The legal name and EIN are the main actors, and the incorporation date is like the plot’s starting point. It’s all about making sure you have the essential details ready for the tax show to unfold smoothly. So, grab these corporate details; it’s your script for the tax play, making sure your company takes the spotlight without any hiccups.

2. Record Income and Expenses

Gather your financial records—statements and receipts—for a crucial task: documenting income and expenses. Imagine it as a financial puzzle, where each piece matters. Income sources vary—sales, services, and investments.

Scrutinize every penny spent on your business. This breakdown yields a clear financial picture, aiding decision-making. Your attention ensures a solid foundation for strategic financial management, instilling confidence in navigating your business. It’s about creating a snapshot that guides you with clarity and authority.

3. Get Shareholder Details

Who are the masterminds behind the corporation? Get a list of shareholders and their ownership percentages. It’s the cast of characters that plays a pivotal role in the tax saga. Include their names, addresses, and the number of shares those shareholders hold. It’s like introducing the main characters in a blockbuster movie.

>>>PRO TIPS: How to File Taxes When Living Abroad

4. Calculate Your Net Profit or Loss

To determine your net profit or loss, deduct all your expenses from your gross income. This straightforward calculation provides a clear picture of your financial performance. When dealing with an S corporation tax return, your business’s profit or loss is termed “ordinary income or loss.” This distinction is crucial for tax-reporting purposes.

Essentially, you’re assessing the financial health of your business by understanding the balance between what you earn and what you spend. By subtracting your total expenses from your gross income, you arrive at your net profit or loss figure.

Remember, on your S Corporation tax return, this is formally identified as “ordinary income or loss.” This accounting process ensures accurate financial reporting, aiding in effective business management and compliance with tax regulations.

5. How to File Form 1120-S

There are several schedules that you may need to fill out; this depends on your situation.

These includes:

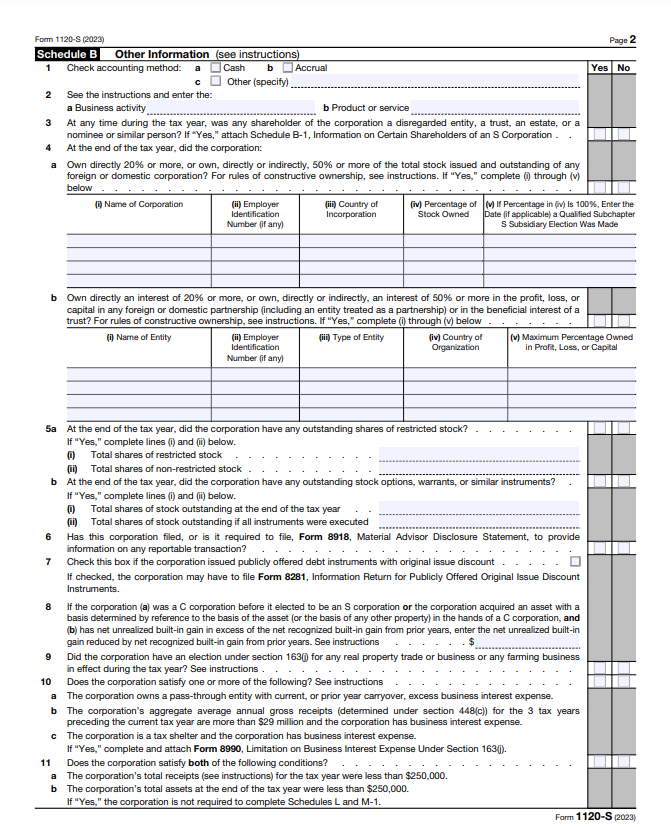

Schedule B

On Schedule B of Form 1120-S (Schedule B-1), detail the S Corporation shareholders, including disregarded entities, trusts, estates, nominees, or similar entities, during the tax year. This section ensures accurate reporting, capturing diverse shareholder scenarios.

By providing this information, you maintain transparency and comply with tax regulations, accurately representing the composition of your S Corporation’s shareholders throughout the year.

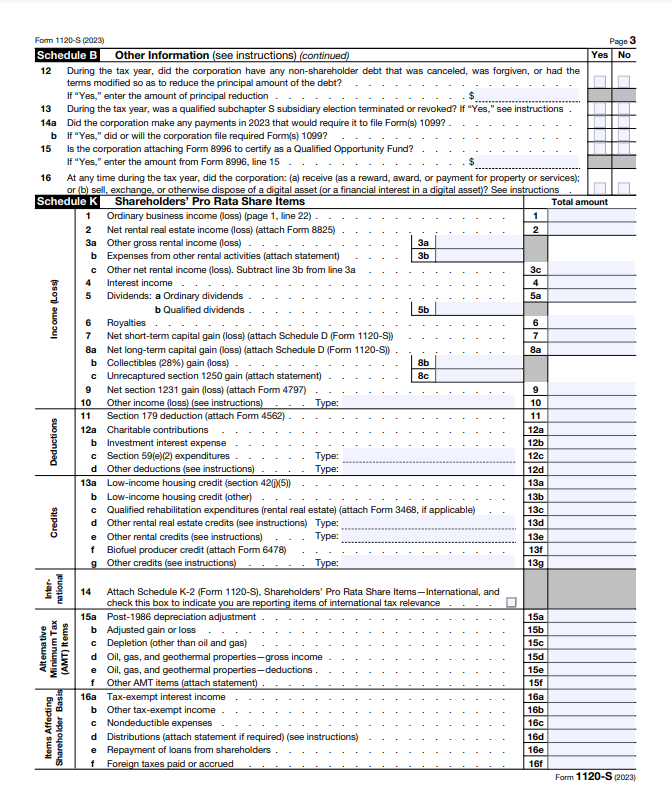

Schedule K

In Schedule K, you find details about your fair share as a shareholder in the S corporation. This document, submitted to the IRS, breaks down your portion of the corporation’s income, deductions, credits, and more.

It’s a crucial snapshot of your involvement in the financial aspects of the company, providing transparency to both you and the IRS. By reviewing this schedule, you gain insights into how the corporation’s financial matters directly impact your interests as a shareholder.

Schedule K-2

Schedule K-2 (Form 1120-S) serves as an extension to Form 1120-S, Schedule K. Its purpose is to detail internationally relevant tax aspects resulting from S corporation activities. This document is pivotal for elucidating the cross-border tax implications of your S corporation operations.

Ensure comprehensive reporting by utilizing Schedule K-2 (Form 1120-S) to expound on the intricacies of your S corporation’s global tax dynamics. Your diligent completion of this form ensures a thorough representation of international tax considerations.

Schedule K-3

You can receive Schedule K-3 when an S corporation wants to share its financial details with the IRS. This document reports your portion of the corporation’s income, deductions, credits, and other relevant information tied to international taxes. It’s like the company’s financial report card for the IRS. Your involvement in the S corporation’s financial picture is neatly summarized in this schedule, ensuring that everything is transparent and compliant with international tax regulations.

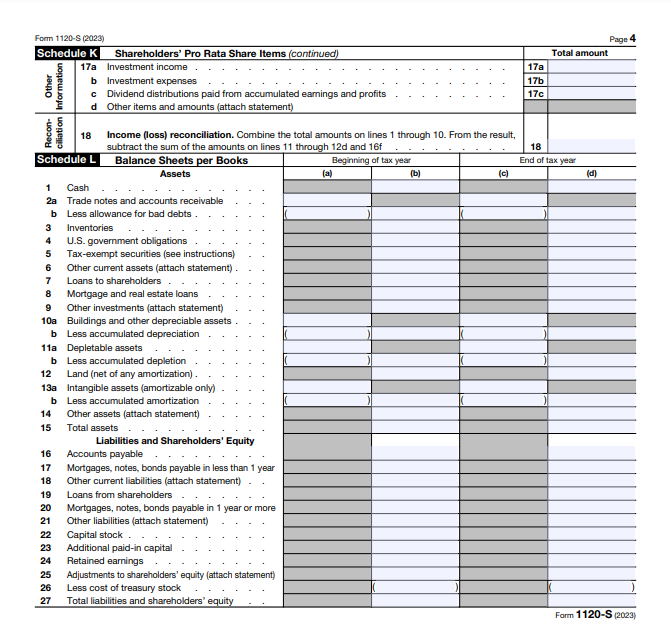

Schedule L

Schedule L: Balance Sheet per Book It’s a document to summarize your company’s financial position. It is a financial snapshot. This schedule outlines assets, liabilities, and equity, giving you a clear picture of what your company owns, what it owes, and its net worth.

It’s like a financial compass, guiding you through the company’s economic landscape. So, when you come across “Schedule L,” remember, it’s your guide to understanding a company’s financial story.

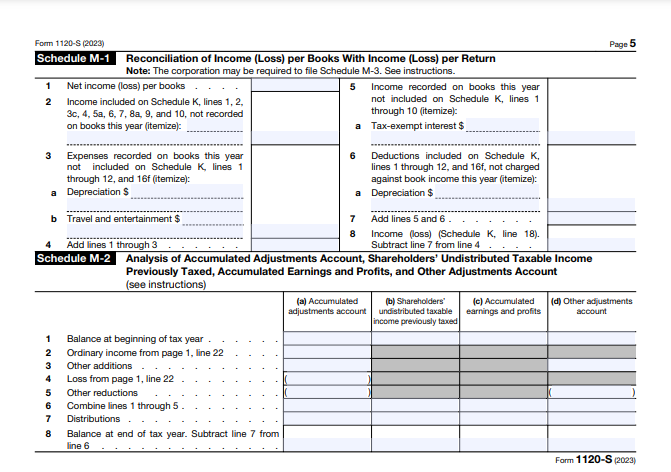

Schedule M-1

Schedule M-1 addresses your corporation’s financial statements, aligning global net income with the income statement for U.S. tax purposes. Think of it as a detailed comparison, ensuring your financial data aligns with the income reported for tax reasons.

This step clarifies any disparities, offering a clear view of your company’s financial health for tax purposes. It’s like connecting the dots between your financial statements and U.S. tax obligations for a comprehensive financial overview.

Schedule M-2

Think of Schedule M-2 as a financial road map for your business. It helps us navigate through key areas like accumulated adjustments, shareholders’ income, and other financial details.

It specifically focuses on making sure the income reported in your financial statements aligns seamlessly with what you report for taxes on Form 1120S, Schedule K. It’s like making sure the numbers on your business journey match up, avoiding any detours or discrepancies along the way.

Schedule D

You, in navigating corporate tax matters, employ Schedule D (Form 1120-S) when opting for S corporation status. This form facilitates the disclosure of important information:

- Capital Gains and Losses: Documenting profits or losses from the sale or exchange of capital assets.

- Sales or Exchanges of Capital Assets: Detailing transactions involving capital assets.

- Gains on Distributions: Reporting gains resulting from the distribution of appreciated capital assets to shareholders.

This process ensures transparent financial reporting in alignment with S corporation regulations.

6. Important of Schedule K-1 with Form 1120-S

Note that when submitting Form 1120-S, you must include Schedule K-1. This schedule, tailored for each shareholder, serves an important role.

- Shareholder Identification: Schedule K-1 lists every individual involved with the S corporation.

- Financial Allocations: It details each shareholder’s share of income, profits, losses, credits, and deductions.

- Tax Return Integration: The data from Schedule K-1 directly influences the individual tax returns of shareholders.

In essence, Schedule K-1 ensures accurate distribution and reporting of financial aspects among S corporation shareholders.

Recap

In summary, getting all the right paperwork together for Form 1120-S is super important for smooth tax filing. Think of this checklist as your handy guide; it helps you gather everything you need to submit your Form 1120-S accurately and without stress.

Following these steps ensures a successful end to your tax season. Just imagine it as a roadmap that leads you to a confident finish. The key is to stick to the checklist so you’re organized and avoid any mistakes. It’s your go-to tool for hassle-free and successful completion of your tax obligations.

So, go ahead, gather your paperwork, and let the tax adventure begin!

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. . For comprehensive tax, legal or financial advice, always contact a qualified professional in your area. S’witty Kiwi assumes no liability for actions taken in reliance upon the information contained herein.

No Comment! Be the first one.