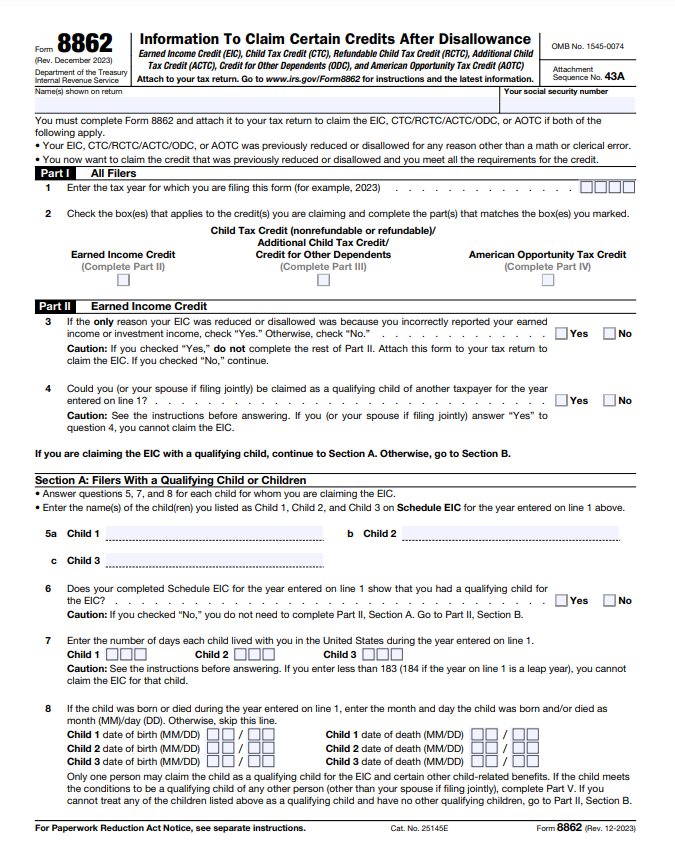

If you’ve faced a disallowance of the Earned Income Credit (EIC), you may need to file Form 8862. This form specifically allows you to reapply for the EIC after being denied in a previous tax year. You should only fill out this form if the IRS previously disallowed your claim and you want to reclaim the EIC in subsequent years.

Its purpose is to ensure that those eligible for the credit receive it while preventing improper claims. You need to provide detailed information about the disallowance, changes in circumstances, and any additional supporting documents with Form 8862.

Remember, accuracy and completeness are crucial when you’re completing this form, as it determines your eligibility to claim the EIC. This article will guide you on how to ensure your submission is correct and compliant.

Filing Form 8862: Information to Claim Earned Income Credit after Disallowance:

- Form Purpose: EIC Reclamation

- Prior Disallowance Details

- Changes in Circumstances

- Reclaiming EIC Eligibility

- Claiming Subsequent Years

- Supporting Documentation Needed

- How to File

- Timing for Submission

Recap

1. Determine if You Need to File Form 5405

Form 8862 serves as the vehicle enabling reclamation of the Earned Income Credit (EIC) denied in prior years. When the IRS disallows your EIC claim, this form becomes your key tool. It’s your way to reapply and assert your eligibility to receive the EIC.

By filling out Form 8862 correctly, you affirm your right to claim the EIC in subsequent tax years. This form specifically addresses your situation after a disallowance, allowing you to present the necessary details and documentation for reconsideration.

Without this form, your chances of reclaiming the EIC after disallowance are minimal. Take note that accuracy in completing Form 8862 is vital to ensure your eligibility and prevent further issues with your claim. Make sure you stay updated with the IRS guidelines to navigate this process effectively.

>>>MORE: Form W-4 and Your Take-Home Pay

2. Prior Disallowance Details

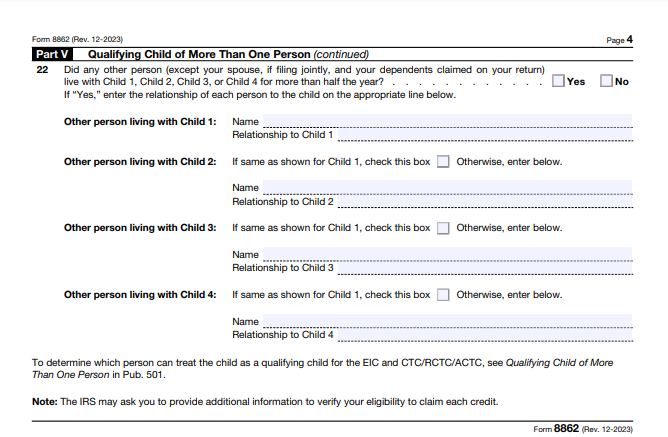

When you face an EIC disallowance, it’s crucial you detail the specifics of that denial. You’re required to provide detailed information about the prior disallowance incident. This means outlining why the IRS initially denied your Earned Income Credit claim.

Ensure you gather all the pertinent details about the disallowance, including any notifications or correspondence from the IRS regarding the denial. Be thorough when you’re explaining the reasons given for disallowance, as this information is vital for your Form 8862 submission.

By presenting a clear and comprehensive account of the prior disallowance, you increase your chances of successfully reclaiming the EIC. Make sure that your description of the prior denial is accurate and aligns with the facts surrounding the disallowance incident. This step plays a pivotal role in your efforts to claim the Earned Income Credit after a disallowance.

3. Changes in Circumstances

Before you reclaim the Earned Income Credit after a disallowance, you must acknowledge any changes in your circumstances. You should take a moment to reflect on any alterations in your situation since the prior disallowance.

Identify and document any changes that might impact your eligibility for the EIC. Have there been alterations in your income, family size, or living situation? Take note and detail these changes so you can demonstrate to the IRS how your circumstances have evolved.

Make sure you accurately portray these alterations in your Form 8862 submission. Being transparent about these changes enhances your chances of successfully reclaiming the Earned Income Credit.

4. Reclaiming EIC Eligibility

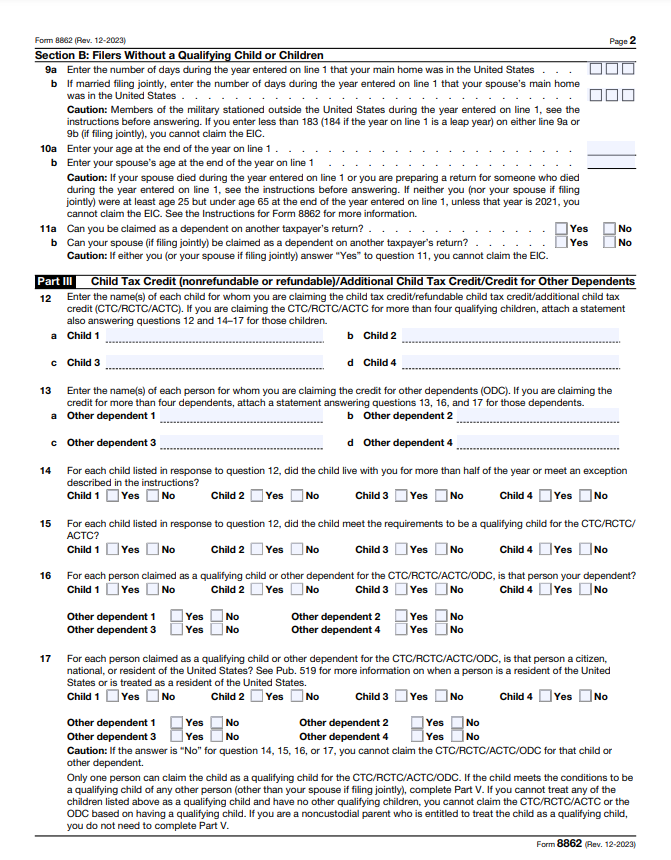

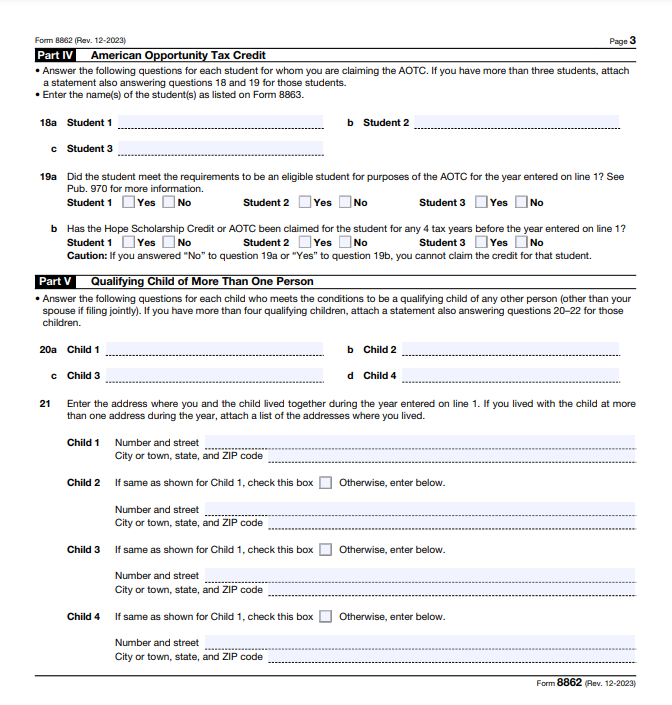

You must demonstrate your eligibility to reclaim the Earned Income Credit (EIC) after a disallowance. Present evidence that shows you meet the criteria set by the IRS to claim the EIC. This includes:

- Income Criteria: You must have earned income from employment, self-employment, or farming within IRS stipulated limits to reclaim EIC.

- Filing Status: If you’re married, you must file jointly with your spouse to reclaim the Earned Income Credit. This status is crucial.

- Qualifying Child: You must have a child who meets the EIC’s criteria to reclaim it. Your child must fulfill specific requirements.

- Residency in the U.S.: You should live in the United States for more than half the tax year to qualify for the EIC.

- Investment Income Limit: Ensure your investment income doesn’t exceed the IRS threshold to be eligible for EIC reclamation.

5. Claiming Subsequent Years

When it comes to reclaiming the Earned Income Credit (EIC) after a disallowance, your focus should extend beyond just this year. You need to consider the subsequent tax years.

After the initial disallowance, ensure you continue to meet all the eligibility criteria for the EIC in the following years. Stay vigilant about any changes in your circumstances, income, or family situation. Form 8862 is not a one-time solution; it’s your tool for future claims.

Each year, assess your eligibility and, if it applies, submit Form 8862 to reclaim the EIC. Be aware that reclaiming the EIC isn’t just about this year—it’s about maintaining eligibility and reclaiming it in the years ahead after a disallowance.

6. Supporting Documentation Needed

You need the following documents to accurately file IRS Form 8862 when reclaiming the Earned Income Credit (EIC) after a disallowance:

- Prior Disallowance Notice: You should provide any letters or notifications from the IRS stating your previous EIC disallowance.

- Income Documents: Include evidence of your earned income, such as W-2 forms or self-employment records to support your eligibility.

- Dependent Verification: Documents like birth certificates or school records to verify your child’s eligibility as a dependent for the EIC.

- Residency Proof: Utility bills, rental agreements, or other documents that establish your U.S. residency for more than half the tax year are essential.

- Any Change Documentation: If there have been changes in your circumstances since the disallowance, include supporting documents to validate those changes, such as updated income records or family status documents.

7. How to File

To reclaim the Earned Income Credit (EIC) after a disallowance, use the steps below to file Form 8862:

- Gather Your Documents: Collect your prior disallowance notices, income records, dependent verification, and residency proofs for accurate filing.

- Review Form’s Instructions: Read IRS Form 8862 instructions thoroughly to understand each section’s requirements and ensure accurate completion.

- Complete Form Details: Fill in your personal details, the prior disallowance reasons, and changes in circumstances on Form 8862.

- Double-Check Accuracy: Review your completed Form 8862 meticulously to avoid errors before you submit.

- File Electronically or Mail: Submit your filled Form 8862 either electronically through IRS-approved software or by mailing it to the designated IRS address.

- Keep Records: Maintain a copy of the filled form and all supporting documents for your records, and in case the IRS requests it later to support your claim.

8. Timing for Submission

Submitting Form 8862 at the right time is crucial when reclaiming the Earned Income Credit after a disallowance. It’s important you file this form in the tax year you’re seeking to claim the EIC. You must do this after the disallowance occurred and you want to reclaim the credit.

Make sure you submit it along with your tax return for that particular year. Timing matters significantly – file Form 8862 when you’re certain about your eligibility and have all necessary documentation.

Missing the submission deadline could delay the processing of your claim. Stay vigilant and aware of the specific tax year requirements to ensure you submit Form 8862 on time and in conjunction with your tax return for that year.

>>>GET SMARTER: Form 5498-ESA: What It Is, How to File It

Recap

You can reclaim the Earned Income Credit (EIC) after disallowance by using Form 8862. Make sure you provide prior disallowance details and any changes in circumstances. Submit it with your tax return for the specific year to reclaim the credit. Timing is crucial, so stay updated on IRS guidelines.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. . For comprehensive tax, legal or financial advice, always contact a qualified professional in your area. S’witty Kiwi assumes no liability for actions taken in reliance upon the information contained herein.

No Comment! Be the first one.