Donating to a tax-exempt organization, like a charity, through money or goods, qualifies as a charitable donation. While you shouldn’t expect anything in return for your contribution, this act has the potential to lower your taxable income, presenting a valuable opportunity.

To claim this deduction on your taxes, ensure you didn’t receive anything in return for your gift, and remember to itemize on your tax return by filing Schedule A of IRS Form 1040.

In general, the deduction for charitable cash contributions on Schedule A is usually limited to a percentage, often around 60 percent, of the taxpayer’s adjusted gross income (AGI). Qualified contributions are exempt from this restriction, allowing individuals to deduct up to 100 percent of their AGI, while corporations can deduct up to 25 percent of their taxable income.

This comprehensive guide will walk through everything you need to know to properly track, document, and claim charitable contributions on your federal tax return!

SUMMARY

- Determine Which Organizations Qualify to Receive Tax-Deductible Donations

- Itemize Your Deductions

- Receive Proper Written Acknowledgement

- Keep Detailed Records And Receipts

- Determine and Document the Fair Market Value (FMV)

- Obtain Form 1098-C

- Provide Details on Items Donated and Estimated (FMV)

- Calculate the Value Of Volunteer Time, Mileage, and Out-Of-Pocket Costs for Charitable Work

- Determine the Deductible Amount of your Contributions

- Report Charitable Donations Properly on Form 8283

Recap

1. Determine which Organizations Qualify to Receive Tax-Deductible Donations

To gain out of a charitable contribution, find out which organizations qualify. Most section 501(c)(3) charities, churches, nonprofit schools, hospitals, and government entities qualify.

Not all organizations qualify to receive tax-deductible charitable contributions. To claim a deduction for your donations, you must ensure you are giving to qualifying exempt organizations.

The primary type that qualifies are charities that are designated as 501(c)(3) nonprofit organizations by the IRS. This includes most traditional charities like food banks, habitat for humanity, goodwill, Salvation Army, United Way, Red Cross, etc.

Other qualified organizations include churches, temples, mosques, synagogues, and other religious organizations. Most nonprofit schools, colleges, museums, hospitals, and medical research organizations will also qualify.

Governmental entities like public schools, police departments, libraries, or volunteer fire departments can also receive deductible contributions. But always verify their status before donating.

Some donations that do not qualify include political organizations, country clubs, fraternal groups, chamber of commerce, social clubs, labor unions, Homeowner’s associations, and groups that discriminate. So check organization status carefully.

>>>MORE: Tax Deductions for Diabetes

2. Itemize your Deductions

To benefit from a charitable donation, itemize your deductions when filing your taxes to claim the charitable contribution deduction. You must itemize if claiming over $300 ($600 for joint return) in charitable donations.

To legally claim a tax deduction for your charitable contributions, you must itemize deductions on Schedule A of IRS Form 1040. You cannot claim a charitable deduction if taking the standard deduction.

This means for donations under $300 for single filers or $600 for married joint returns, there is no tax benefit since the standard deduction exceeds these small amounts.

3. Receive Proper Written Acknowledgement

To profit from a charitable gift, collect a written acknowledgement from the charity for any single donation of $250 or more. This must include the charity name, amount donated, and any goods/services received.

All cash or noncash charitable donations you claim of $250 or greater must be substantiated with written acknowledgement from the recipient organization. This requirement is mandated by the IRS tax code.

The acknowledgement must include the name of the charity, date they received the contribution, the amount donated, and a statement declaring whether any goods or services were provided to you by the charity in exchange for the donation.

This written acknowledgement could be a receipt, letter, email, or other verification from the charitable organization. It provides your documentation to prove the donation if ever audited.

4. Keep Detailed Records and Receipts.

To derive advantage from a charitable offering, keep records for all cash donations made, no matter the amount. Be sure receipts show the charity name, date, amount donated, and state that no goods or services were provided.

All cash contributions you make to qualified charities, no matter how small, should be supported by verifiable documentation to validate your deduction claims.

Keep receipts, letters, cancelled checks, credit card statements, or other reliable records that prove the name of organization, precisely when and how much you donated.

For direct cash donations, ensure the receipt includes a statement confirming that no goods or services were provided to you in exchange for the funds. This makes the contribution fully deductible.

If donations were made by check, be sure to record the check number, date written, charity name, and exact amount donated in your records. Retain your cancelled checks or images provided by your bank.

>>>PRO TIPS: What Are Disability Tax Credits?

5. Determine and Document the Fair Market Value (FMV)

To reap rewards from a charitable contribution, calculate the FMV of the items donated. Get an appraisal for donations valued at over $5,000.

Donating used goods or items other than cash to a charity also qualifies for a tax deduction, but you must determine and substantiate the fair market value (FMV) of each item to support the amounts claimed.

FMV is generally defined as the price that typical buyers and sellers would agree upon for the donated property. Value should be based on the item’s quality, conditions, and usefulness at the time of donation.

Online seller valuations through eBay, Craigslist, or other quotation services can provide reasonable FMV support. Take photos of all items donated.

For more valuable contributions like art, collectibles, jewelry, etc., consider getting a professional appraisal.

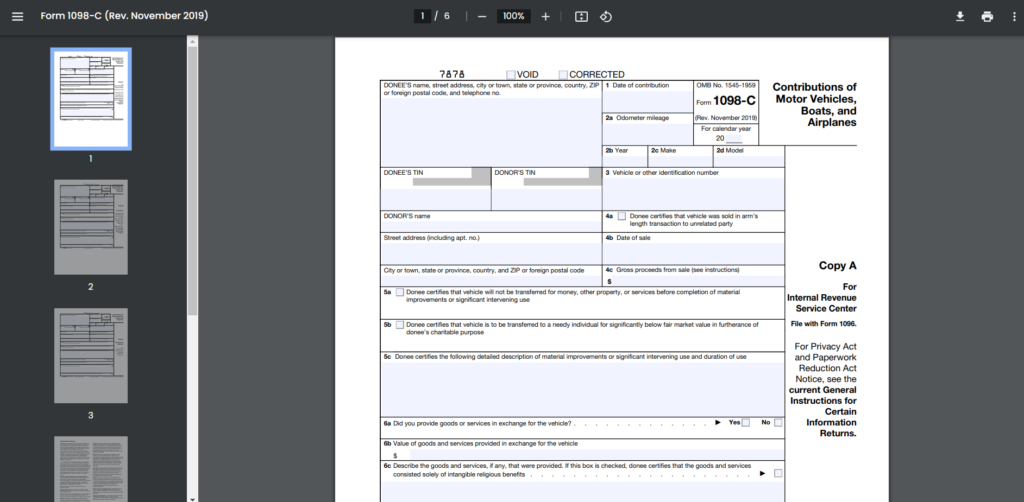

6. Obtain Form 1098-C

To obtain advantages from a charitable donation, fill form 1098-C documenting the FMV from the charity. Comply with additional rules for vehicle donations.

Special rules apply if you donate a motor vehicle like a car, truck, RV, motorcycle, or boat to a charity. In this case, the charity handling the donation will provide Form 1098-C documenting the sale proceeds or FMV if the vehicle was not sold.

You must attach Form 1098-C to your tax return. Form 1098-C replaces the need for an independent appraisal.

7. Provide Details on Items Donated and Estimated (FMV)

To acquire from a charitable gift, take photos documenting any donations of property or large quantities of goods.

If you claim deductions for contributing significant amounts of clothing, household goods, toys, computers, inventory, or other miscellaneous property, take photos or videos confirming all items you donated.

Provide lists describing each piece of property donated along with your reasonable and good faith estimate of each item’s fair market value.

While professional appraisals are not required here, you need to show diligence in estimating FMV for diverse donated property. Retain your documentation for at least 3 years.

>>>GET SMARTER: Estimated Taxes: How to Determine What to Pay and When

8. Calculate the Value of Volunteer Time, Mileage, and Out-Of-Pocket Costs for Charitable Work

To attain benefits from a charitable donation, know the time, mileage and out-of-pockets costs.

Deductible charitable contributions are not limited to just money and property. You can also claim a deduction for:

9. Determine the Deductible Amount of your Contributions

To harvest rewards from a charitable contribution, determine the deductible amount of your contributions based on your adjusted gross income and the type of organization receiving funds.

Tax law imposes deduction limits based on the total amount of your contributions and your adjusted gross income (AGI) for the year.

In general you can deduct cash donations to public charities up to 60% of your AGI for the tax year. Appreciated property donations are limited to 30% of AGI.

Once you exceed these AGI limits, any excess charitable amounts can be carried forward up to 5 additional years.

For donations to private foundations, the maximum deduction is typically 30% of AGI regardless of type.

10. Report Charitable Donations Properly on Form 8283

To enjoy the benefit of a charitable donation, fill form 8283 and any other required forms when filing your taxes. Include detailed information regarding your contributions on Schedule A and Form 8283, following the guidelines provided for proper documentation. Additionally, adhere to any other necessary forms or documentation requirements to ensure comprehensive reporting of your charitable donations when filing your taxes.

Recap

Qualified charitable donations present significant tax-saving opportunities if guidelines are diligently followed concerning eligible organizations, valuations, income thresholds, and accurate documentation. Consult a tax advisor for maximizing allowable deductions.

Making qualifying charitable donations can provide substantial tax deductions to lower your income tax bill. But be sure to follow all guidelines on eligible recipient organizations, written acknowledgements, valuation rules, income limits, and proper tax form reporting.

With diligent documentation, your generous giving can also give back on your taxes. Consult a tax advisor with any questions or for guidance on maximizing allowable deductions.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. . For comprehensive tax, legal or financial advice, always contact a qualified professional in your area. S’witty Kiwi assumes no liability for actions taken in reliance upon the information contained herein.

No Comment! Be the first one.