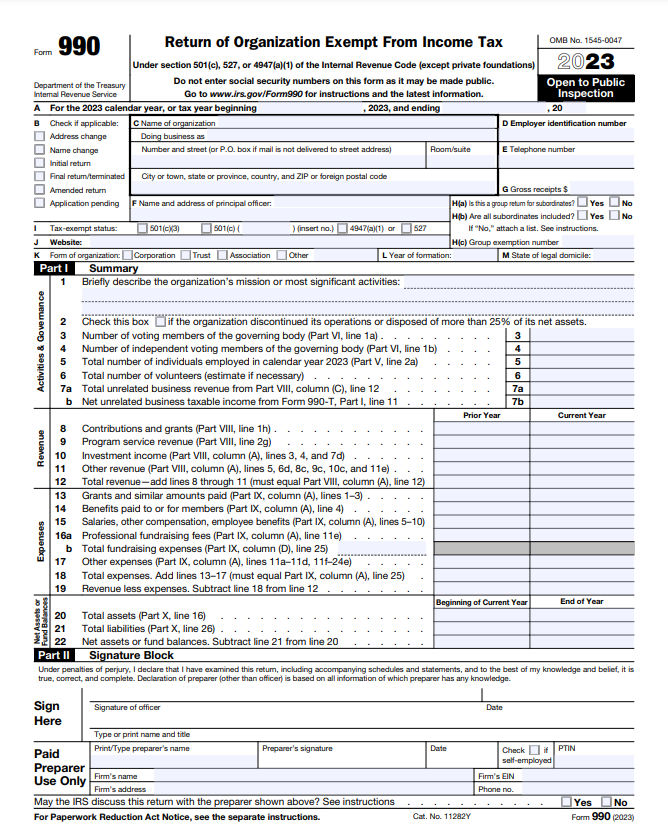

The IRS Form 990 is a vital document for tax-exempt organizations. It’s not just another piece of paperwork—you’ll find it instrumental in understanding how these organizations operate.

If you’re navigating the world of nonprofit entities, you’ll encounter the Form 990 frequently. It’s a comprehensive report that provides a wealth of information about the organization’s finances, activities, and governance. You’ll rely on it to make informed decisions, whether you’re a donor, a board member, or even a curious observer.

This form is more than just a formality; it’s a window into the inner workings of these tax-exempt entities. Make sure you understand it because it empowers you to assess the organization’s accountability, mission, and financial health. As you delve into the Form 990, you uncover the transparency that underscores the integrity and responsibility of these nonprofits.

What Is the IRS Form 990?

- Nonprofit Reporting Tool

- Tax-exempt Organizations

- Transparency and Accountability

- Organizational Governance Details

- Publicly Available Information

- Evaluation for Donors

- Insights into Operations

- How to File

- Public Availability of IRS Form 990 and Donor Access

Recap

1. Nonprofit Reporting Tool

The IRS Form 990 is the key tool you use to understand how nonprofits function and sustain themselves. It’s a comprehensive report that allows you, as a donor, board member, or observer, to peek behind the curtains of a nonprofit’s operations.

You’ll discover a treasure trove of vital information about the organization’s finances, governance, and activities. This form serves as a vital transparency measure, revealing how the organization manages its funds, handles governance, and executes its mission.

As you navigate through the form, you’ll uncover insights into the decision-making processes, the structure of the organization, and the ways it fulfills its charitable objectives. It helps you ensure accountability, assess financial health, and comprehend the impact of your support or involvement with the nonprofit world.

2. Tax-exempt Organizations

A tax-exempt organization is an entity that is eligible for certain tax benefits because it serves a purpose considered beneficial to the public. You, as a part of a tax-exempt organization, enjoy specific privileges, such as not paying federal income tax on the money your organization receives for its activities.

The IRS Form 990 applies specifically to you if you’re involved with a tax-exempt organization, offering you a comprehensive snapshot of its operations. These organizations can include charities, religious groups, social welfare organizations, and more.

To qualify for tax-exempt status, your organization must meet certain criteria outlined by the IRS, primarily demonstrating that it operates for charitable, religious, educational, scientific, literary, or other similar purposes.

This status allows your organization to use the funds to pursue its mission without the burden of paying federal income tax, enabling you to channel more resources towards its cause.

3. Transparency and Accountability

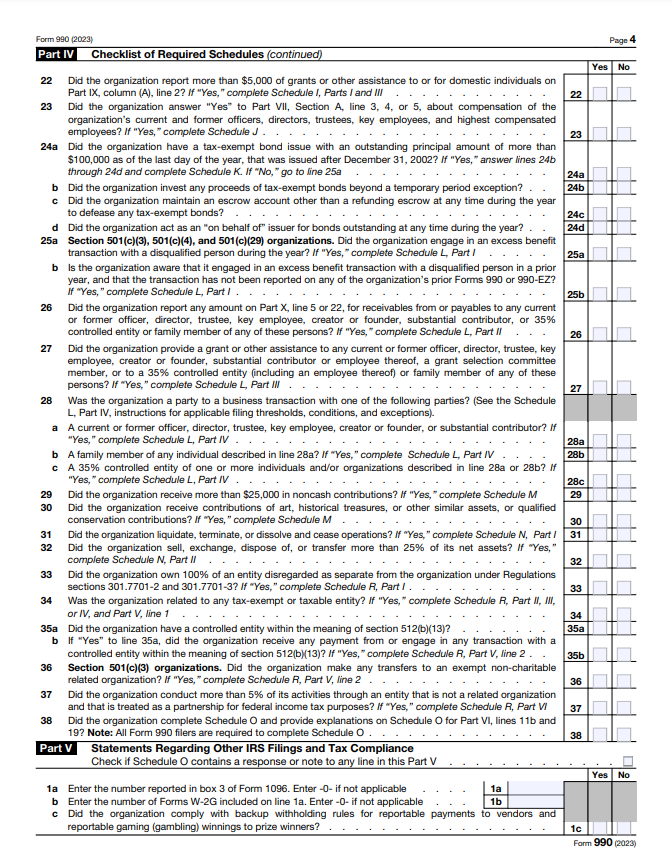

The IRS Form 990 is your gateway to ensuring transparency and accountability within tax-exempt organizations. You play a crucial role in this process by utilizing this form to access detailed information about how your or these organization(s) operate.

Through its comprehensive reporting, you gain insights into the organization’s finances, governance structure, and mission-driven activities. When you examine this document, you empower yourself to hold this organization accountable for its actions and financial decisions.

It’s your tool for understanding how funds are utilized, how leaders are compensated, and how missions are pursued. This transparency not only helps you assess the organization’s effectiveness but also fosters trust between the entity and its stakeholders, including donors, the public, and regulatory bodies.

Your engagement with the Form 990 contributes significantly to upholding the standards of transparency and accountability within the realm of tax-exempt entities.

>>>PRO TIPS: Form 1099-K Decoded for the Self-Employed

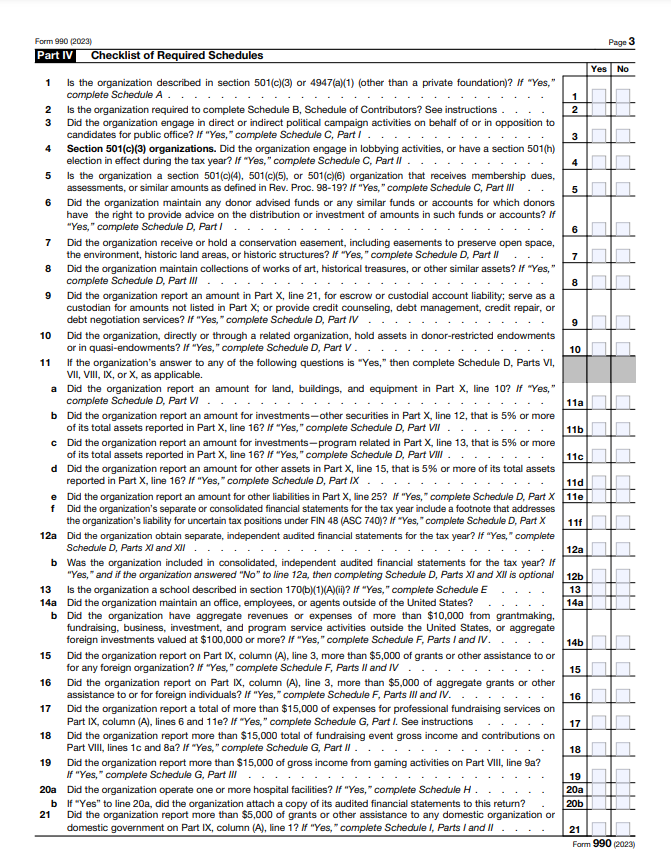

4. Organizational Governance Details

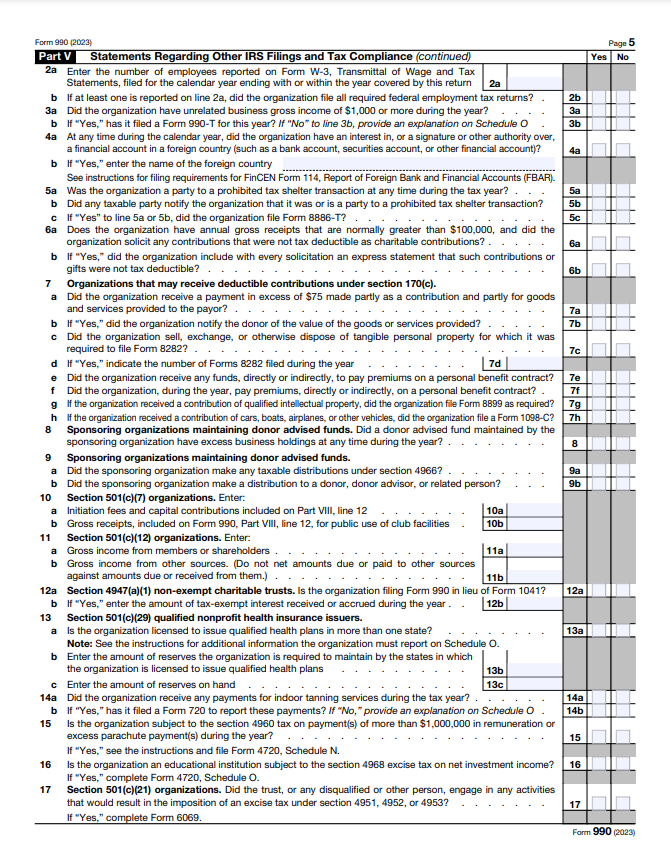

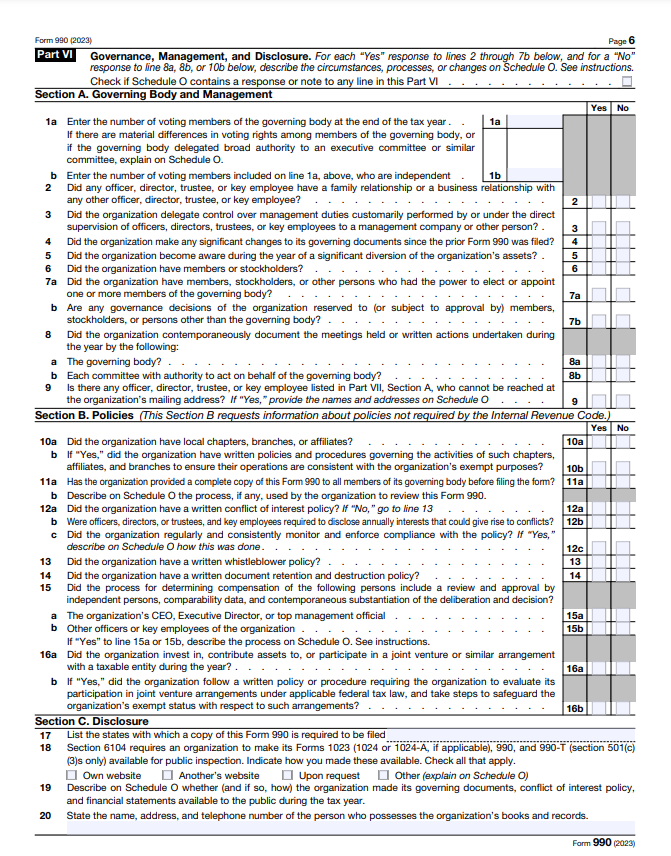

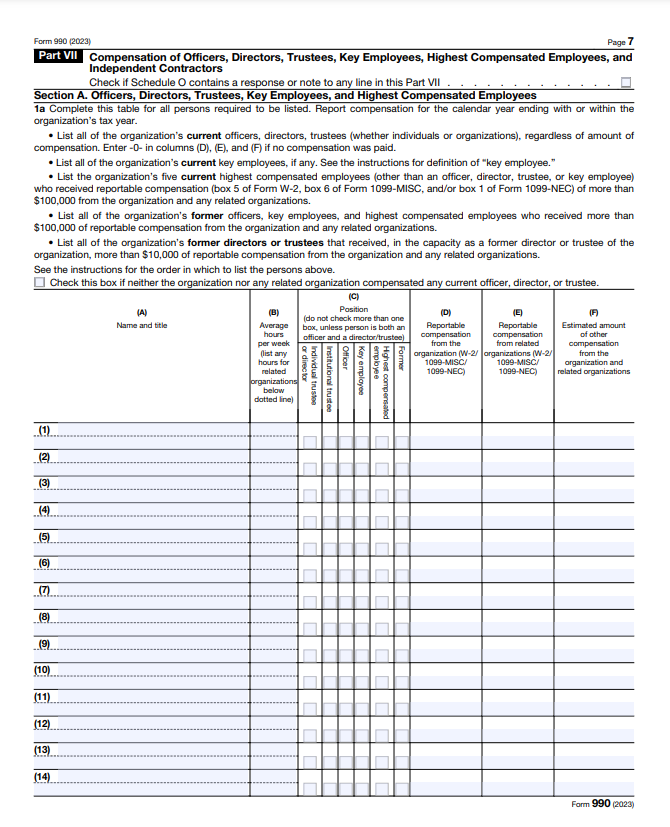

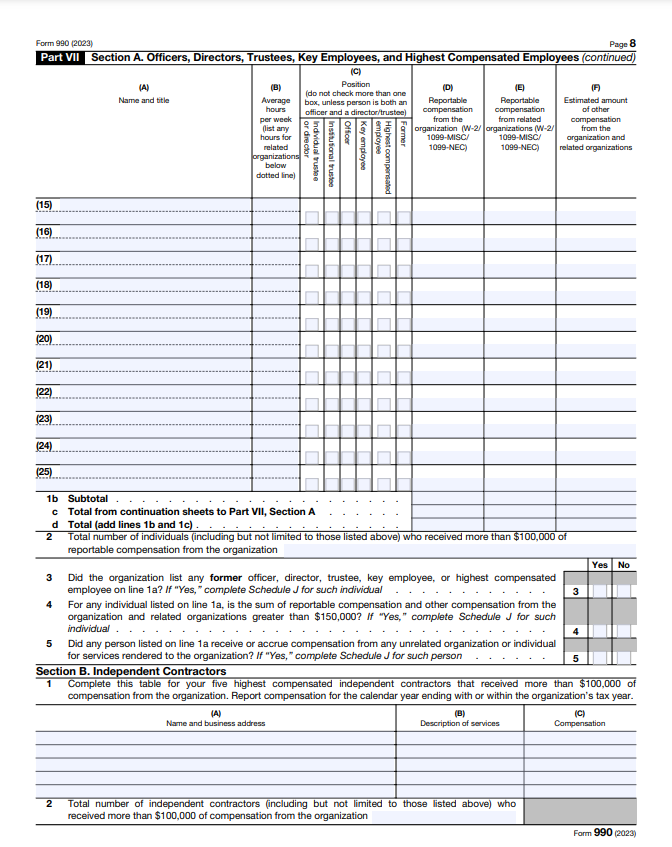

Through IRS Form 990, you gain valuable insights into how your organization is managed and overseen. It details the composition of the board, roles, and compensation.

As you navigate through the Form 990, you’ll uncover information about key decision-makers, individual responsibilities, and potential conflicts of interest. This report empowers you to evaluate how effectively your organization is governed, ensuring it operates in alignment with its mission.

Additionally, it sheds light on policies and procedures in place to prevent mismanagement or misuse of resources, reinforcing the integrity and credibility of the entity.

5. Publicly Available Information

Be aware that IRS Form 990 is a vital resource that is publicly available and it provides you with information about tax-exempt organizations. When you’re curious or considering involvement with a nonprofit, this form becomes your go-to tool.

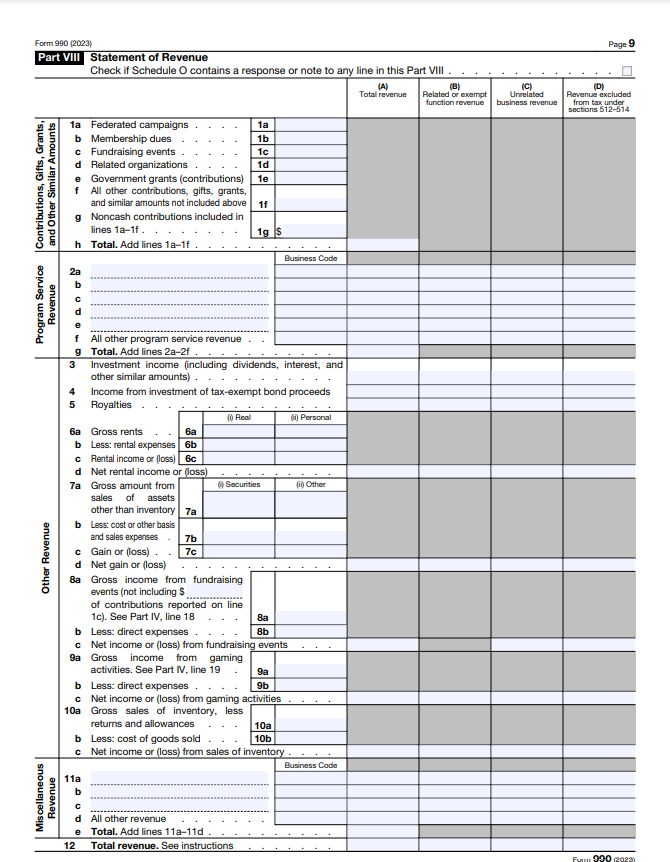

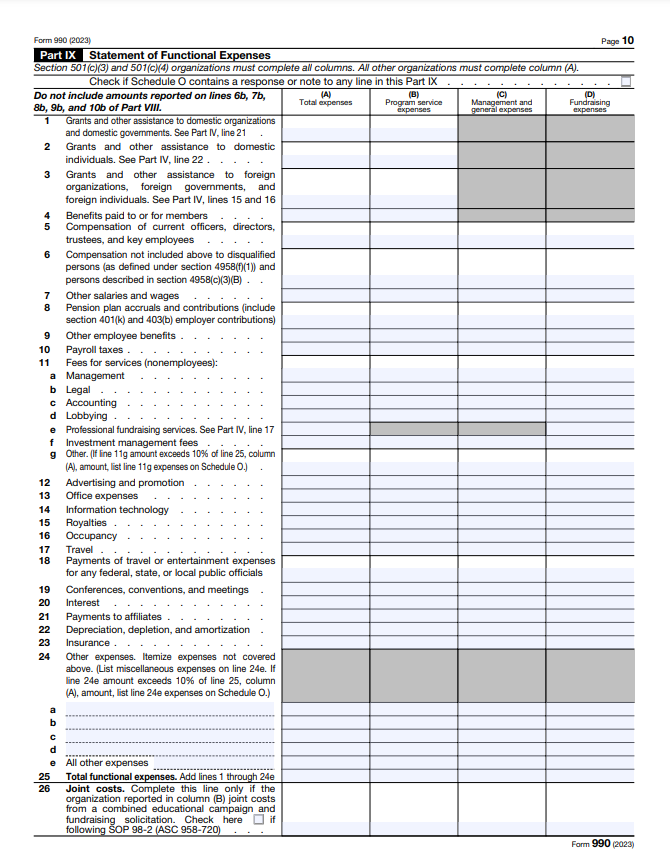

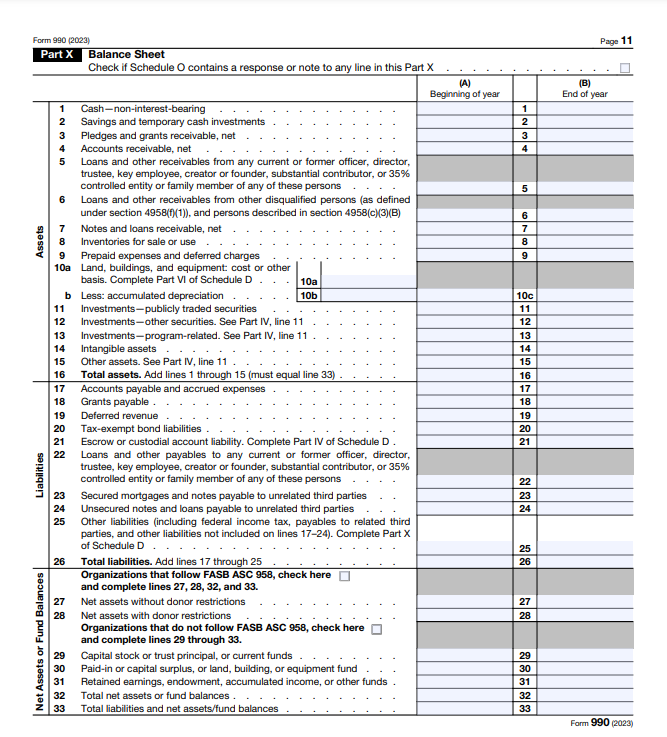

It offers you a detailed look into an organization’s finances, activities, and governance practices, allowing you to make informed decisions. Through this document, you’ll access data about revenue, expenses, key individuals’ salaries, and even details about the organization’s mission.

If you are interested in understanding the impact and credibility of nonprofits, this information empowers you to assess the accountability and effectiveness.

Moreover, this public accessibility promotes transparency, enabling donors, stakeholders, and the general public to scrutinize how these tax-exempt entities operate, ensuring it upholds its mission and remains trustworthy in the eyes of the public.

6. Evaluation for Donors

If you’re a donor, the IRS Form 990 serves as a crucial evaluation tool for you when considering supporting a nonprofit organization. It’s your gateway to understand the financial health, governance, and mission alignment of the organizations you intend to support.

Through this form, you gain insights into how effectively the organization manages its funds, the allocation of resources, and the impact of its programs. By reviewing the Form 990, you can assess whether your contributions will be utilized efficiently and in alignment with the organization’s stated objectives.

This evaluation helps you make informed decisions about where to direct your donations, ensuring these organizations have the most significant impact and contribute to causes that resonate with your values and philanthropic goals. Your engagement with this document enables you to support trustworthy and impactful organizations.

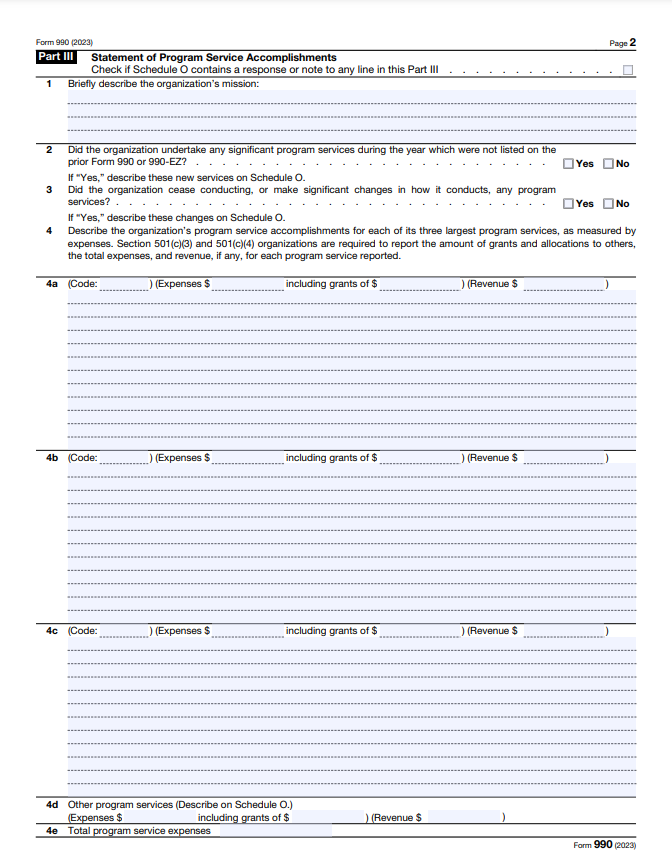

7. Insights into Operations

The IRS Form 990 offers you an invaluable glimpse into the inner workings of a tax-exempt organization. Through this form, you access detailed insights into how the organization functions on a day-to-day basis.

You’ll find information about its programs, expenses, and revenue sources, allowing you to grasp the scale and impact of its operations. As you delve into the document, you’ll uncover specifics about its activities, partnerships, and initiatives.

It’s your tool to comprehend the depth of its outreach, the communities it serves, and the extent of its contributions. By reviewing this form, you gain a comprehensive understanding of how the organization operates, enabling you to assess its efficiency, effectiveness, and the alignment of its actions with its stated mission.

8. How to File

Here’s a detailed step-by-step process on how your tax-exempt organization can file Form 990:

- Gather Information: You start by collecting detailed financial records, including income, expenses, and organizational details.

- Choose the Correct Form: Depending on your organization’s size and revenue, select the appropriate version of Form 990 (990-N, 990-EZ, or 990).

- Review Requirements: Familiarize yourself with the form’s instructions, ensuring you understand all the necessary information and schedules.

- Complete the Form: Provide accurate details about your organization’s finances, activities, governance, and compliance with tax regulations.

- Attach Schedules: If required, include additional schedules that provide specific details about your organization’s operations or finances.

- Review for Accuracy: Check the completed form thoroughly to ensure all information is accurate and complete.

- Submit Electronically or Mail: File the completed form (including all schedules) electronically or mail it to the designated IRS address.

- Keep Records: Retain a copy of the filed Form 990 and all supporting documents for your organization’s records.

- Meet Deadlines: Make sure you file by the due date to avoid penalties or late fees.

- Follow-Up and Maintain Compliance: Monitor for any follow-up communication from the IRS and stay updated on future filing requirements to maintain compliance with regulations.

9. Public Availability of IRS Form 990 and Donor Access

As a tax-exempt organization, you ensure IRS Form 990 is publicly accessible by law. You achieve this by making the form available at your organization’s office or by providing copies upon request. Moreover, you can post it on your organization’s website or share it with online databases that compile such documents.

As a donor, accessing this information is relatively straightforward. You can visit the organization’s office and request a copy, check its website for downloadable versions, or explore databases dedicated to hosting nonprofit filings, such as the IRS’s Exempt Organizations Select Check tool or other nonprofit watchdog websites.

This accessibility allows you, as a donor, to scrutinize the organization’s financial health, governance, and overall transparency, aiding you in making informed decisions about supporting its cause.

>>>GET SMARTER: What is IRS Form 1040 Schedule 2?

Recap

You need the IRS Form 990 to understand a tax-exempt organization. It’s your essential tool for diving into its finances, governance, and activities. As you explore this form, you gain insights crucial for evaluating its transparency, financial health, and impact before you support it as a donor or get involved as a member.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. . For comprehensive tax, legal or financial advice, always contact a qualified professional in your area. S’witty Kiwi assumes no liability for actions taken in reliance upon the information contained herein.

No Comment! Be the first one.