Form 5405, Repayment of the First-Time Homebuyer Credit, is an IRS tax form used to report the disposition or change in use of a main home for which the first-time homebuyer tax credit was claimed, as well as calculate the amount of credit that must be repaid.

The first-time homebuyer credit was a refundable tax credit established in 2008 for qualifying home purchases, providing up to $7,500 as an interest-free loan that had to be repaid over 15 years.

The credit enabled many first-time homebuyers to purchase a home during the housing crisis. However, it came with the stipulation that if the home were sold or stopped being used as the taxpayer’s main residence within 36 months of purchase, the full credit amount would need to be repaid.

While the first-time homebuyer credit program ended and is no longer available, repayment obligations still apply for homes purchased in 2008. Repayment on the 15-year schedule continues until 2024 when the loans are fully repaid.

Who Must File Form 5405:

File IRS Form 5405 with your annual income tax return if you claimed the first-time homebuyer credit in 2008 and sold or stopped using the home in the current tax year. Exceptions exist for specific cases like home destruction, divorce settlement transfers, or the death of the credit claimant.

When You Need to File Form 5405:

You must file Form 5405 along with your annual income tax return for the specific tax year in which you sold or stopped using the home as your main residence after having claimed the first-time homebuyer credit in 2008. This serves to officially notify the IRS of the change in status and allow calculation and repayment of any amounts owed.

For example, if you claimed the $7,500 first-time homebuyer credit for purchasing a home in 2008 and then sold that home in 2023, you would need to complete Form 5405 and file it with your 2023 tax return letting the IRS know of the sale. This would also calculate your repayment liability for the 2023 tax year based on sale of the home.

Key Repayment Rules for Form 5405:

When filling out Form 5405, consider essential rules for repayment. Repay the total original credit amount over 15 years in equal annual installments until fully paid. If the home is sold at a loss or no gain, repayment is limited to the gain only. Repayment waivers apply if the homeowner dies or meets specific exceptions. If the home is sold to a relative, full repayment is required regardless of the loss amount. Continuous use as the main home mandates annual repayment.

SUMMARY

- Determine if You Need to File Form 5405

- Provide Basic Taxpayer Information

- Explain Home Sale or Disposition

- Calculate Repayment Amount Owed

- Complete Gain/Loss Worksheet

- File Completed Form 5405 with Tax Return

Recap

1. Determine if You Need to File Form 5405

To file form 5405, determine if you need to file it. You need to complete and attach form 5405 if you claimed the first-time homebuyer credit in 2008 and no longer used that home as your main residence during 2023, either due to sale or other disposition.

>>>MORE: Form W-4 and Your Take-Home Pay

2. Provide Basic Taxpayer Information

To fill in 5405, enter your taxpayer information. Enter your full name and Social Security Number at the top of Form 5405. If married and filing separately, you and your spouse will each complete a separate Form 5405

3. Explain Home Sale or Disposition

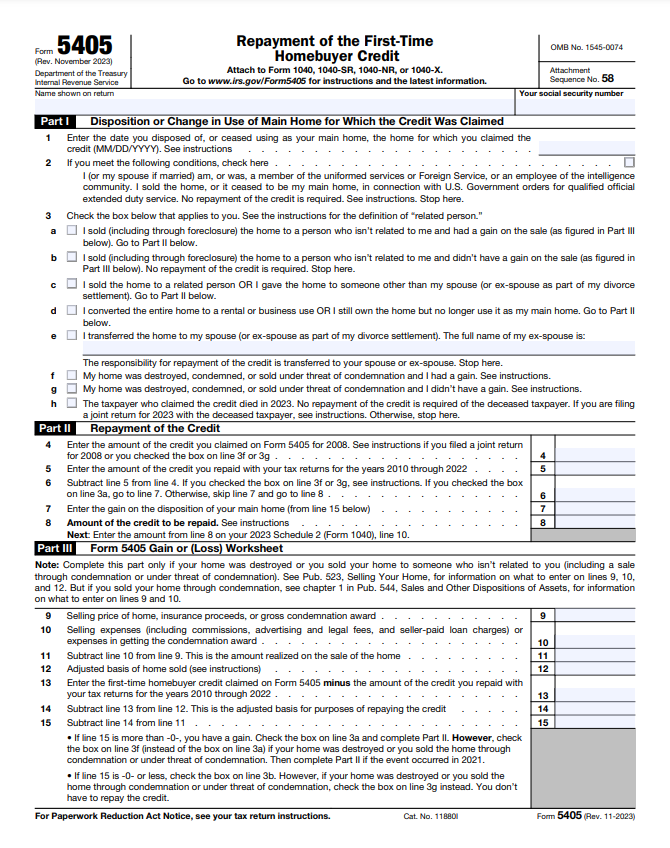

To complete form 5405, explain the home sale or disposition in part I. In Part I, you must provide detailed information on what happened with the home purchase for which you claimed the 2008 first-time homebuyer credit:

Part I: Disposition of Main Home Details

- Line 1 (Date Home Usage Changed): Enter date you sold the home or stopped using it as your main residence

- Line 2 (Special Exceptions): Check box if an exception applies related to military service, intelligence work, etc.

- Lines 3a-3g (Reason Home Situation Changed): Choose the applicable situation by checking the corresponding box: home was sold (3a), converted home to rental or business use (3d), home destroyed or condemned (3f or 3g), or transferred home to spouse or ex-spouse (3e).

- Line 3h (Homeowner Deceased): Check if filing jointly with deceased spouse who claimed credit

4. Calculate Repayment Amount Owed

To ensure that you’re providing accurate digits on your form 5404, calculate the repayment amount owed in part II. The exact repayment amount depends on what happened with the home:

Part II: Repayment Amount Calculation

- Line 4 (Total First-Time Homebuyer Credit Allowed): Enter total amount of credit you claimed in 2008

- Line 6 (Special Repayment Limits): Note if limits on repayment amount apply due to home sale at loss

- Line 7 (Gain on Home Sale): Enter gain calculated in Part III worksheet, if applicable

- Line 8 (Required Repayment): Calculate minimum installment repayment required for 2023

5. Complete Gain/Loss Worksheet

To finish up with form 5405, complete your gains and losses in part III. If you sold the home to an unrelated person, you must complete the gain/loss worksheet in part III to calculate and limit repayment to the actual gain on sale, if lower than remaining credit owed.

Key items in the worksheet include:

Part III: Gain or Loss on Sale of Home

- Lines 12-15 (Worksheet to Calculate Gain on Sale): Compute and enter gain or loss to limit repayment if home sold

6. File Completed Form 5405 with Tax Return

The finished Form 5405 must be included along with your annual income tax return for the year in which the home situation changed to trigger repayment requirements. This notifies the IRS and allows proper reflection of repayment liabilities.

You can file Form 5405 either on paper or electronically through tax preparation software and E-file. File by April 15, 2024 if you have an outstanding balance.

>>>GET SMARTER: Form 5498-ESA: What It Is, How to File It

Recap

IRS Form 5405 deals with the repayment of the first-time homebuyer credit. The credit, initiated in 2008, provided up to $7,500 as an interest-free loan repayable over 15 years. Although the program ended, repayment obligations persist for homes purchased in 2008, continuing on a 15-year schedule until 2024.

To file Form 5405, assess if you claimed the credit in 2008 and no longer use the home as your main residence in the current tax year. Provide basic taxpayer information, explain the home sale or disposition, calculate the repayment amount owed, and file the completed form with your annual income tax return.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. . For comprehensive tax, legal or financial advice, always contact a qualified professional in your area. S’witty Kiwi assumes no liability for actions taken in reliance upon the information contained herein.

No Comment! Be the first one.