Introduction

Schedule J, Income Averaging for Farmers and Fishermen, is a tax provision that allows you as an eligible farmer or fisherman to average your income over a specific number of years. By doing this, you can potentially reduce your tax liability in years of higher income by averaging it with lower-earning years.

This provision acknowledges the fluctuating nature of income in these professions. It’s important you note that not all individuals in these fields qualify; there are specific criteria set by the IRS that determine eligibility.

Schedule J considers the challenges these professions face due to market fluctuations, weather conditions, and other unpredictable factors impacting income. It’s a method designed to provide you with financial stability by smoothing out the tax burden over a span of years.

What Is Schedule J: Income Averaging for Farmers and Fishermen:

1. Tax Provision Purpose

2. Eligibility Criteria

3. Income Averaging Method

4. Averaging Years Allowed

5. Required Documents

6. Calculating Your Income

7. How to File

8. Farmer-Fisherman Benefits

Recap

1. Tax Provision Purpose

The purpose of Schedule J, Income Averaging for Farmers and Fishermen, revolves around acknowledging the unpredictable nature of these professions. By permitting income averaging, you can potentially ease the tax burden during high-income years, aligning with the fluctuating income common in farming and fishing.

This provision helps you stabilize your tax obligations, ensuring a fairer representation of your overall earnings. It’s designed to counter the year-to-year income volatility that stems from various factors like market conditions and weather fluctuations.

When you use this provision, you smooth out your tax liability, preventing an unfairly heavy tax load in exceptional earning years. This enables you to maintain a more consistent tax responsibility, supporting your financial stability across the span of your career.

>>>MORE: What Are Tax Schedules?

2. Eligibility Criteria

Eligibility criteria for Schedule J cater specifically to individuals engaged in farming or fishing professions. To qualify, you, as a farmer or fisherman, need to derive at least two-thirds of your total income from these occupations over the averaging years.

Additionally, the IRS mandates that you must have had a relatively constant or a rising income for at least three of the preceding five tax years. Moreover, you should not have used any other income averaging method in those years.

It’s essential you note that certain entities, like corporations or partnerships, do not meet the criteria for Schedule J. These guidelines aim to ensure that those benefiting from income averaging genuinely belong to the farming or fishing sectors and have experienced the income fluctuations characteristic of these industries.

3.Income Averaging Method

The income averaging method under Schedule J allows you, as a farmer or fisherman, to smooth out your tax liabilities by calculating your taxable income over a specified number of years. This process involves averaging your current year’s income with previous years’ earnings, typically spanning three to five years.

By doing so, you can potentially reduce the tax impact of significant spikes in your annual income, ensuring a fairer representation of your overall financial standing. This method considers the fluctuating nature of income in farming and fishing, acknowledging that these professions often face unpredictable market conditions and weather-related challenges impacting your yearly earnings.

Implementing income averaging provides you with a more balanced approach to taxation, aligning your tax liability more accurately with your average income across multiple years, thus offering you greater financial stability. Always consult with a tax professional for guidance on how to utilize this method effectively and in compliance with current tax laws.

4. Averaging Years Allowed

The averaging years permitted under Schedule J for income averaging typically span three to five consecutive tax years. This duration allows you, as a farmer or fisherman, to even out your income fluctuations by considering a longer-term view of your earnings.

The IRS guidelines specify that you can choose between the three to five-year range, providing you with flexibility in determining the most beneficial time frame for your specific circumstances. This approach enables you to account for the variability inherent in your profession more effectively.

Selecting the appropriate averaging years requires careful consideration of your income trends and any exceptional years within the chosen span. Make sure you adhere to the IRS guidelines and verify the latest updates regarding the permissible duration for averaging years to ensure accurate compliance and optimal tax planning.

>>>PRO TIPS: The Self-Employment Tax

5. Required Documents

Here’s a breakdown of the documents you need to file Schedule J:

- Income Records: Gather sales receipts, income statements, or invoices showcasing your earnings from farming or fishing. These documents substantiate your income sources within these professions.

- Expense Documentation: Maintain records of your farming or fishing expenses, including equipment costs, operational expenses, or rent payments. These documents aid in accurately calculating your net income.

- Tax-Related Forms: Keep track of tax forms you receive like 1099s, demonstrating income you earn from farming or fishing. These forms validate the income you report and ensure compliance with tax obligations.

- Previous Averaging Methods: Document any other income-averaging methods you used in past years, if applicable. This helps prevent overlap or misuse of income-averaging provisions and ensures accurate filing in compliance with IRS guidelines.

6. Calculating Your Income

Calculating on Schedule J involves averaging your income from farming or fishing over consecutive years. Add the total income you earned in each year within the chosen averaging period.

For example, if you earned $30,000, $35,000, and $40,000 in three consecutive years, sum them ($30,000 + $35,000 + $40,000 = $105,000). Then, divide this total by the number of years (in this case, three) to get the average income ($105,000 ÷ 3 = $35,000).

This $35,000 represents your average income for those three years. Repeat this process for the entire averaging period you choose (typically three to five years) to calculate your average income accurately for Schedule J.

>>>GET SMARTER: Schedule B (Form 1040A or 1040): What It Is, How to File It

7. How to File

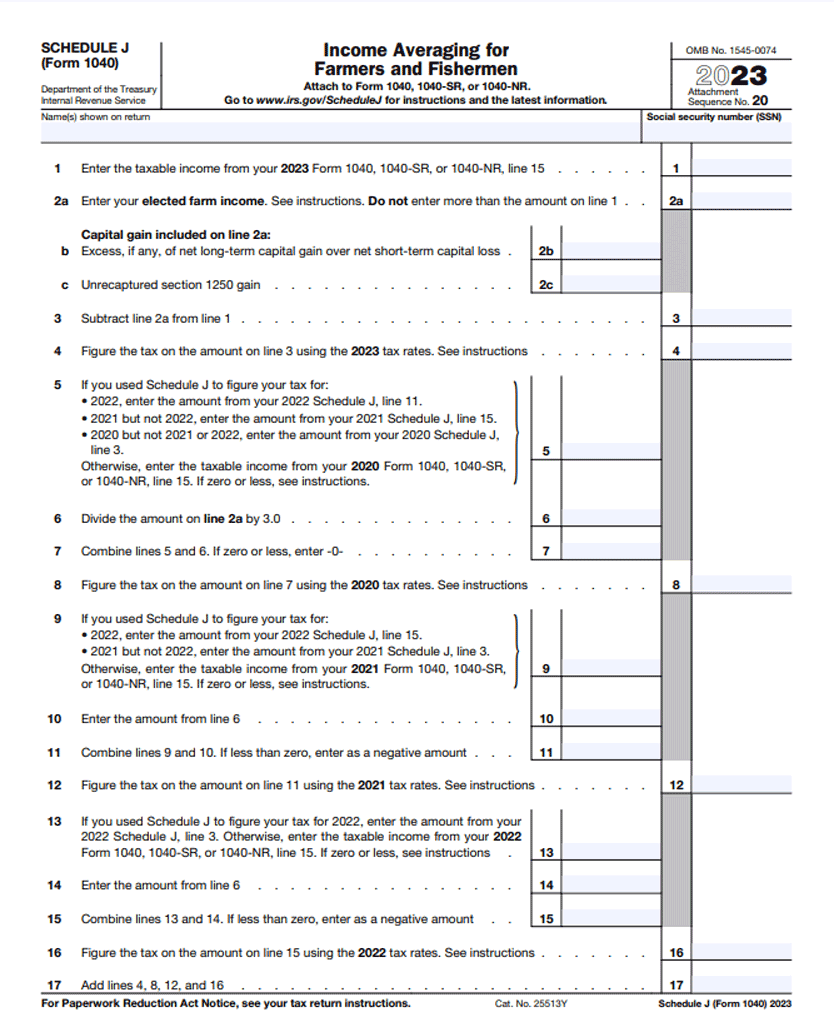

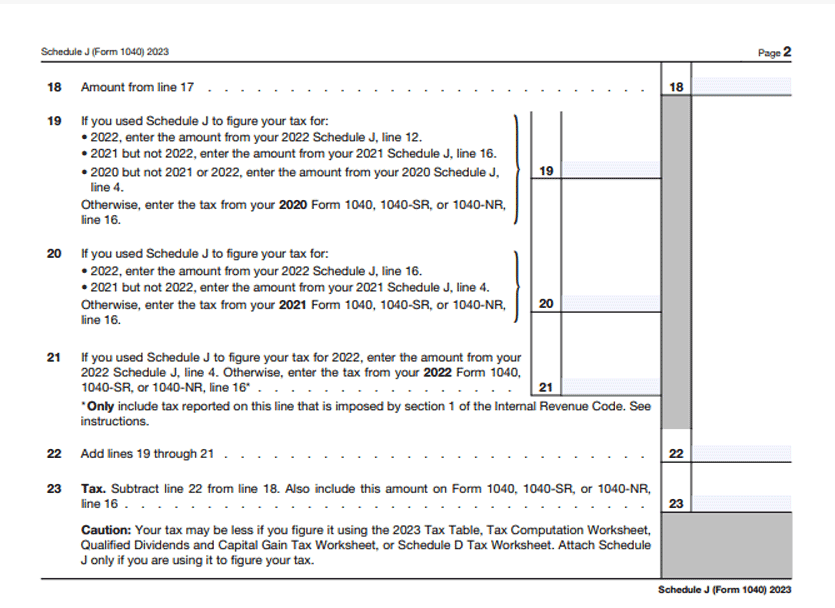

As a farmer or fisherman, you can file Schedule J using the steps below:

- Confirm Your Eligibility: Ensure you meet the IRS criteria, primarily earning income from farming or fishing professions.

- Attach Schedule J: Add Schedule J to your tax return, indicating your choice to use income averaging for your farming or fishing income.

- Calculate Averaging Years: Calculate your income for three to five consecutive years, considering them for averaging purposes.

- Complete Schedule J: Fill out Schedule J accurately. Make sure you detail your income sources and calculate your income average for the period you choose.

- Review for Accuracy: Verify all information you entered on Schedule J for accuracy and compliance with IRS guidelines.

- Include in Your Tax Return: Submit your tax return to the IRS, ensuring you include Schedule J.

- Maintain Records: Keep comprehensive records of your farming or fishing income and expenses, including a copy of the filed Schedule J for future reference.

8. Farmer-Fisherman Benefits

The benefits of Schedule J’s income averaging for farmers and fishermen revolve around providing financial stability and fairness in taxation. By utilizing this provision, you, as a farmer or fisherman, can mitigate the impact of fluctuating incomes on your taxes.

It ensures that in years of significantly higher earnings due to exceptional circumstances, such as a bumper crop or exceptional catch, your tax burden won’t skyrocket disproportionately. This method smoothes out your tax liabilities over several years, preventing undue strain on your finances during abundant years and maintaining a fair tax payment over time.

Essentially, it serves as a safeguard against the unpredictability inherent in farming and fishing, offering you a more consistent and balanced approach to tax obligations, thereby supporting your long-term financial stability and planning.

Recap

Schedule J allows you, as an eligible farmer or fisherman, to average your income over three to five years, smoothing out fluctuations caused by market shifts or weather conditions. It eases your tax burden by providing you with a fairer representation of your income, but not everyone in these professions qualifies. Verify eligibility and understand the IRS guidelines for accurate filing.

No Comment! Be the first one.