Introduction

IRS Form 8379, known as the Injured Spouse Allocation, is a crucial document for couples facing financial challenges due to debts owed by one spouse. When you file taxes jointly and your spouse owes certain debts (like overdue taxes, child support, or student loans), the IRS may seize the entire tax refund to cover those obligations, leaving you spouse without your share.

This form helps protect the portion of the refund that belongs to the “injured” spouse. By completing Form 8379, you notify the IRS of your situation, allowing them to allocate the refund equitably between both spouses.

It’s important you note that this form doesn’t resolve the debt itself but safeguards the portion of the refund due to the spouse not responsible for the debt. Typically, this process takes around 11 weeks for the IRS to process after submission. Always ensure accuracy and updated guidelines when filing this form to avoid any delays or issues.

What Is IRS Form 8379: Injured Spouse Allocation

1. Purpose of Form 8379

2. Injured Spouse Definition

3. Qualifying for Allocation

4. Debt & Tax Impact

5. Required Documents

6. How to File

7. Allocation Process

8. Non-Resolution of Debt

Recap

1. Purpose of Form 8379

IRS Form 8379 serves a crucial purpose in safeguarding the portion of your tax refund when your spouse owes certain debts. By filing jointly, you and your spouse combine incomes and tax liabilities, but this also means that the IRS can withhold the entire refund to cover the debts of either spouse.

However, with Form 8379, you, as the “injured” spouse, can protect your share of the refund from being seized for your partner’s obligations. This form doesn’t absolve the debts; instead, it ensures fairness in refund allocation.

It’s pivotal you note that you need to file this form each year you face such circumstances. Form 8379 allows you to claim what’s rightfully yours, preventing financial strain caused by your spouse’s debts and enabling you to receive your portion of the tax refund.

>>>MORE: What Is IRS Publication 502?

2. Injured Spouse Definition

An “injured spouse” is determined when you file taxes jointly with your spouse but face financial setbacks due to your spouse’s outstanding debts. In this scenario, you’re not legally responsible for the debts your spouse owes.

However, without intervention, the IRS might seize the entire joint tax refund to settle these obligations. When you’re the injured spouse, Form 8379 comes into play, allowing you to reclaim your share of the refund.

It’s essential you note that being the injured spouse doesn’t absolve you from knowledge or involvement in the debt, but it ensures the part of the refund that belongs to you stays protected. This designation recognizes your right to a fair share of the refund, acknowledging that the debts aren’t yours, preserving your financial stability during tax time.

3. Qualifying for Allocation

Qualifying for the Injured Spouse Allocation via Form 8379 involves meeting specific criteria set by the IRS. You become eligible for this allocation when you’re not liable for the debts prompting the need for this form. You’ll qualify if your spouse is responsible for the outstanding obligations, like overdue taxes, child support, or federal student loans.

When you file jointly, your portion of the refund can be at risk if your spouse has such debts. However, if you’re unaware of these obligations, you may still qualify as an injured spouse. It’s crucial you note that your eligibility also relies on following IRS guidelines accurately when completing and submitting Form 8379.

4. Debt & Tax Impact

The impact of debt on your taxes can be significant when filing jointly with your spouse. If your partner owes certain debts, like unpaid taxes or overdue child support, the IRS might seize the entire refund.

This seizure could affect your share of the refund, leaving you with none or less than expected. Without Form 8379, your portion might go towards covering your spouse’s debts. This situation can lead to unexpected financial strain, especially if you rely on the refund for various expenses.

>>>PRO TIPS: 10 IRS Penalties You Want to Avoid

5. Required Documents

To file Form 8379, you primarily need your completed tax return, such as Form 1040 or Form 1040-SR. This serves as the basis for calculating your joint income and the subsequent refund allocation.

Additionally, include any supporting forms or schedules that detail income, deductions, credits, and other relevant financial information. Don’t forget to attach any documentation that substantiates your claim as the injured spouse, proving your lack of responsibility for the debts causing the allocation.

This might include proof of income, deductions, or any other relevant records that clarify your financial status separate from your spouse’s debts. Ensure all documents are accurate and up-to-date to support your claim and streamline the processing of Form 8379.

6. How to File

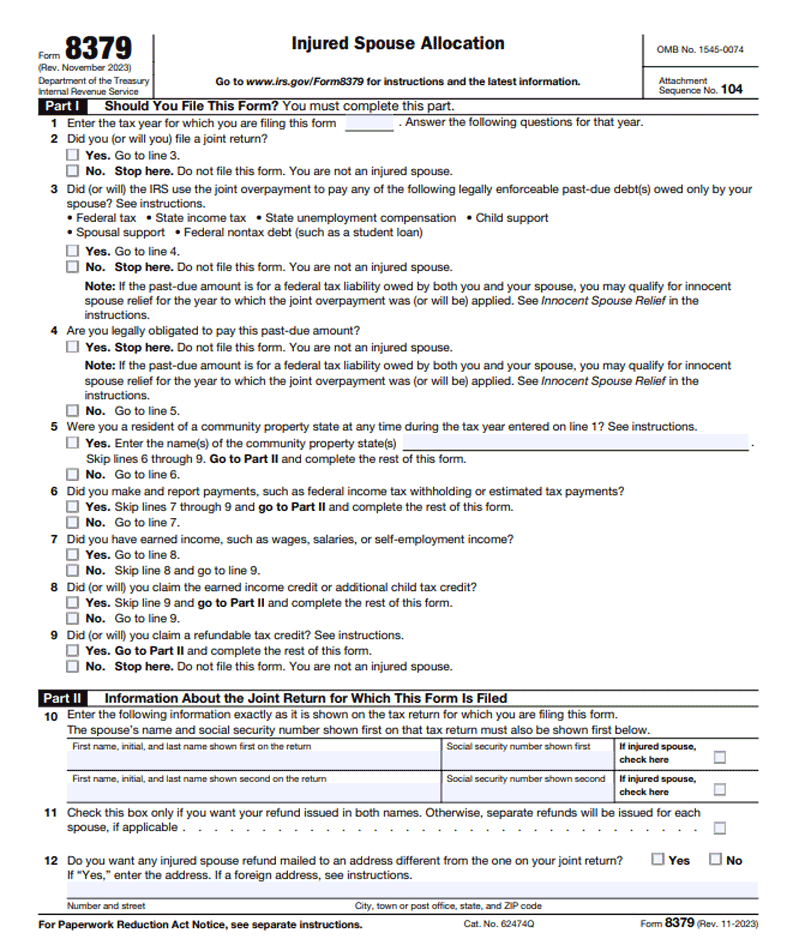

Here’s a detailed step by step process on how to file Form 8379:

- Gather Documents: Collect your completed tax return (Form 1040 or 1040-SR) and any supporting forms detailing income, deductions, and credits.

- Download Form 8379: Obtain the form from the IRS website or request it from the IRS office.

- Fill Out the Form: Complete Form 8379 accurately, providing your personal information and indicating the allocated amounts.

- Attach Supporting Documents: Include any documentation proving your status as the injured spouse, such as income records or deductions separate from the debts.

- Review Thoroughly: Double-check all your entries, ensuring accuracy and completeness to avoid delays.

- Submit the Form: Send the completed Form 8379 along with your tax return and supporting documents to the IRS.

- Wait for Processing: Be patient; processing can take around 11 weeks. Check the IRS website for updates or contact the IRS if needed.

- Keep Copies: Retain copies of all documents you submitted for your records and future reference.

>>>GET SMARTER: A Guide to Commonly-Used IRS Tax Forms

7. Allocation Process

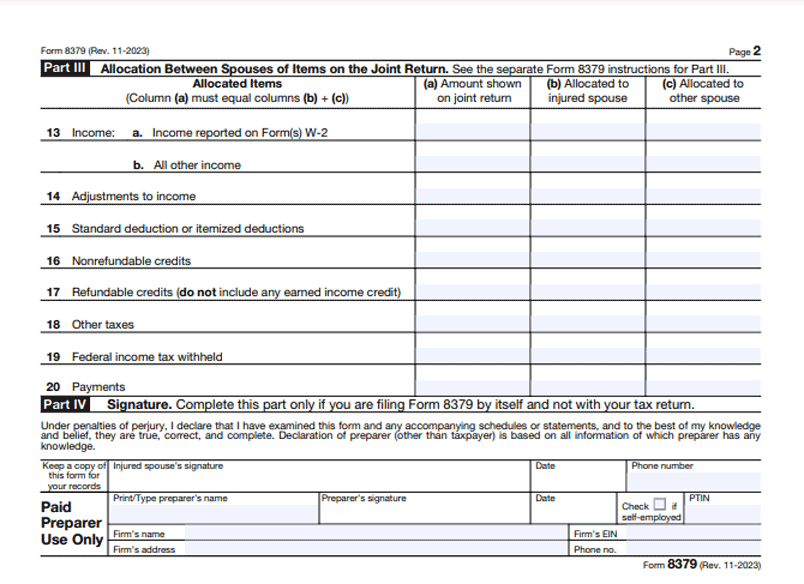

The allocation process through Form 8379 is vital to ensure fairness in refund distribution. When you file jointly but face an injured spouse situation, the IRS reviews your form to calculate the portion of the refund that belongs to you. It uses the information you provide, including your income, deductions, and credits, to determine your share.

The IRS segregates your allocation from your spouse’s debts, safeguarding your part of the refund. This process is critical as it prevents the entire refund from being used to settle debts that aren’t yours.

Through this allocation, you receive what’s rightfully yours, offering you financial stability and acknowledging your separate financial status from your spouse’s obligations. Always ensure accuracy and completeness in Form 8379 to facilitate a smooth and fair allocation process and protect your portion of the refund.

8. Non-Resolution of Debt

When you utilize Form 8379, it’s important you note that it doesn’t resolve the underlying debt issue. You might remain unaware or uninvolved in your spouse’s obligations, but filing this form won’t absolve those debts. Instead, it shields your rightful refund portion from being used to settle the debts owed solely by your spouse.

By designating yourself as the injured spouse, you’re safeguarding what belongs to you. The form’s submission doesn’t affect the responsibility for the debts, legal obligations, or the debt collection process. It solely focuses on protecting your share of the refund, emphasizing the importance of addressing and managing the debts separately from the refund allocation process.

Recap

Form 8379, the Injured Spouse Allocation, safeguards your share of the tax refund if your spouse owes certain debts. By designating yourself as the injured spouse, you protect your part of the refund from being used to settle your spouse’s obligations, ensuring fair allocation during tax time.

No Comment! Be the first one.