Are you feeling a bit overwhelmed by tax forms and jargon? Don’t worry. Alright, imagine this: you’re navigating through the labyrinth of tax forms, feeling like you need a GPS just to find your way. Enter IRS Form 720, a beacon of clarity in the tax world. Now, you might be thinking, “What on earth is Form 720, and why should you care?” Well, buckle up, because this form isn’t just another bureaucratic hurdle; it’s your gateway to understanding and managing certain federal excise taxes.

Picture this form as your backstage pass to a concert; it grants you access to the inner workings of taxes on goods and services that often fly under the radar. Forget the mind-numbing jargon and confusing terminology that plague other tax forms. Form 720 is refreshingly straightforward, shedding light on industries like air transportation, communication, and the environment.

As you stand at this crossroads of tax paperwork, Form 720 is your compass, guiding you through the intricacies of specific excise taxes you might not even be aware of. You may likely groan at the thought of deciphering yet another form, but Form 720 breaks the mold. It’s the unsung hero of taxation, demystifying complex levies and empowering you with knowledge.

If you’re tired of swimming in a sea of confusing tax documents, Form 720 is your lifeboat. It’s not just a form; it’s your key to understanding and taking control of certain excise taxes. Stay and unravel the mystery.

To know What is IRS Form 730:

- Understand What is IRS Form 720

- What Are Excise Taxes?

- Who Needs to File IRS Form 720?

- How to Complete IRS Form 720?

- Information Required

- Electronic Filing Options

- Penalties for Non-Compliance

Recap

1. Understand What is IRS Form 720

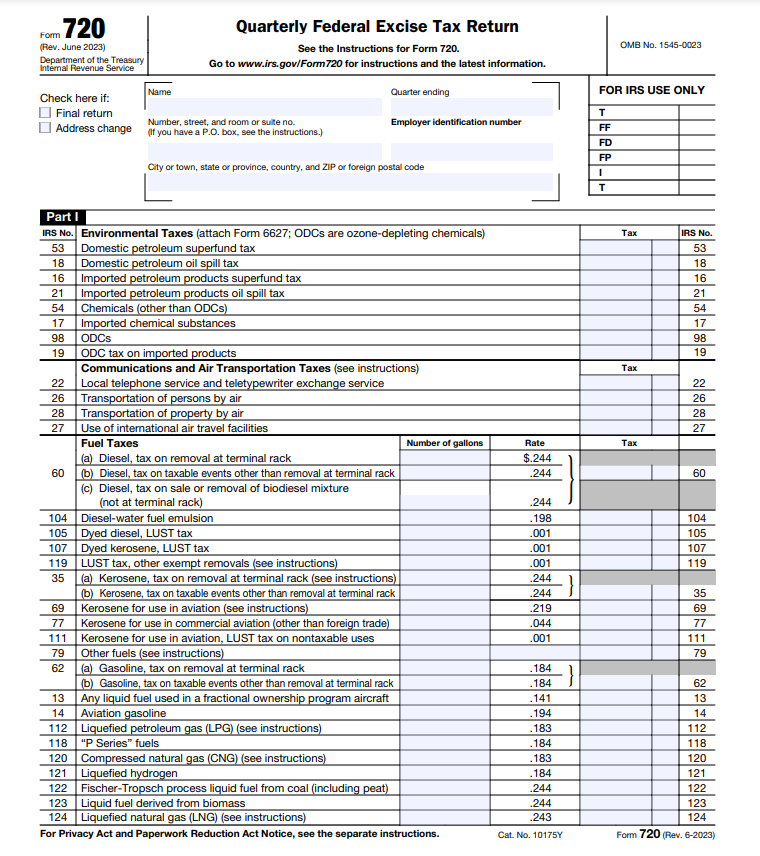

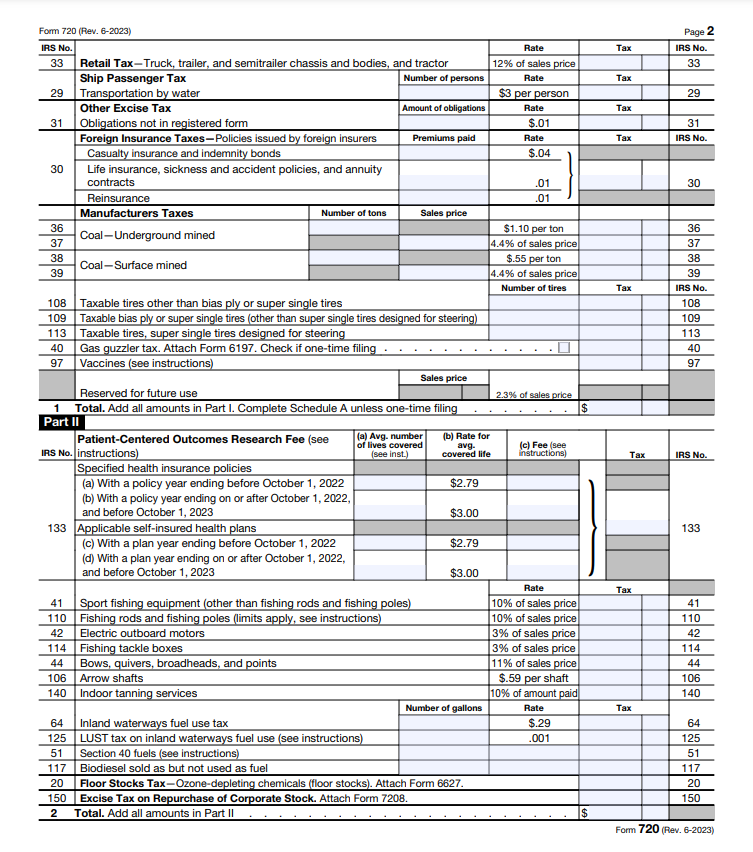

The IRS Form 720 is an official document used to report and pay federal excise taxes. It consists of various parts and schedules, each corresponding to specific categories of excise taxes. As a business owner or an individual engaged in specific industries, understanding and appropriately completing Form 720 is essential for compliance with IRS regulations.

This form is not a routine encounter for individual taxpayers; however, it holds significance for businesses involved in certain industries or activities. By addressing excise taxes, Form 720 ensures that the IRS is informed about these specialized tax obligations. Whether your business deals with fuel, environmental taxes, or other excisable products or services, accurately completing Form 720 is crucial for you to maintain regulatory compliance and avoid potential penalties. Therefore, familiarize yourself with the details of Form 720 and ensure its proper submission to meet your tax obligations effectively.

2. What Are Excise Taxes?

Excise taxes are levies on specific goods and services—things like fuel, tires, alcohol, or even indoor tanning services. Picture them as targeted fees imposed by the government. Now, here’s the nitty-gritty: these taxes are typically embedded in the product or service cost, and it’s the business owner’s responsibility to collect and remit these dues. That’s where Form 720 steps into the picture, playing the crucial role of ensuring that the right excise taxes are accounted for and handed over to the government.

So, why does Form 720 matter to you? Well, if you’re in the business of dealing with these goods or services, it’s your golden ticket to compliance. Filling out this form isn’t just paperwork; it’s your way of telling the government that you got your tax responsibilities covered. It’s the tool that keeps you on the right side of the law and ensures the smooth flow of your operations without any unwanted tax hiccups. Stay sharp with Form 720, and you may be cruising through the realm of excise taxes without a worry in the world.

>>>PRO TIPS: Federal Tax Credit for Residential Solar Energy

3. Who Needs to File IRS Form 720?

Form 720 is an important document for businesses entrusted with the collection and submission of excise taxes. Not every business falls under the obligation to submit this form; rather, it specifically pertains to certain industries. If your business operates in sectors like tobacco, alcohol, firearms, air transportation, or engages in specific fuel-related activities, then you need to file Form 720.

In essence, this form is tailored for enterprises involved in activities that attract excise taxes. This includes businesses manufacturing or dealing in products like tobacco, alcoholic beverages, firearms, or those operating in air transportation. Additionally, businesses engaged in specific fuel-related endeavors fall within the purview of Form 720. By understanding your industry’s alignment with these categories, you can confidently ascertain whether your business necessitates the completion and submission of Form 720. Stay informed and ensure compliance, because failure to do so may result in consequences for businesses within these specified sectors.

4. How to Complete IRS Form 720?

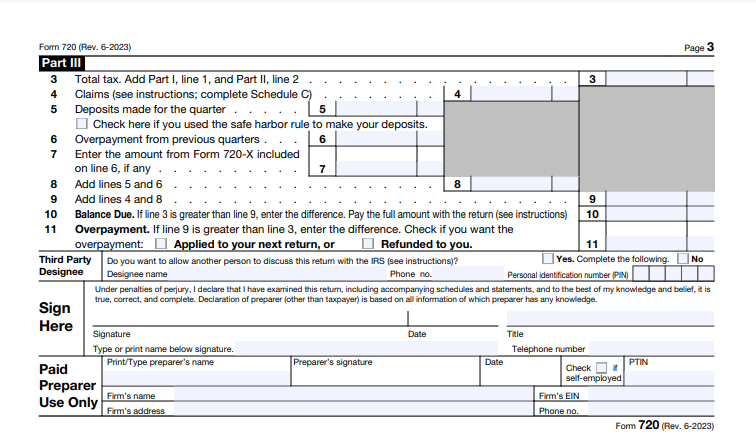

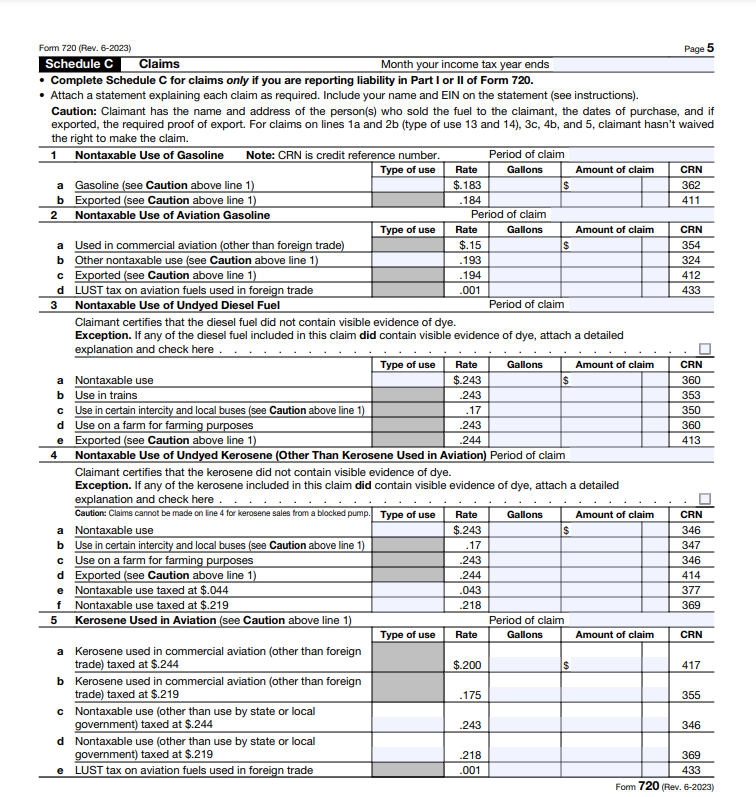

To successfully complete Form 720, start by furnishing details about your business and the particular excise taxes you’re responsible for. Identify the activity or product subjected to the tax, specify the quantity or basis used to calculate the tax amount, and summarize the total tax for each category.

Ensure precision throughout this process, emphasizing the importance of maintaining meticulous records. This diligence is crucial in preventing potential penalties or complications. Think of it as a comprehensive snapshot of your business’s tax obligations. By following these steps diligently, you not only fulfill regulatory requirements but also safeguard against future issues. Remember, the accuracy of Form 720 is paramount, offering a smooth and compliant path for your specific business needs.

>>>GET SMARTER: Form 8917: What It Is, How to File It

5. Information Required

Form 720 is a detailed narrative of your financial engagement with excise taxes, from the broad strokes of your taxpayer information down to the intricate details of each taxable transaction.

Follow the information required to complete your IRS Form 720, which includes:

Taxpayer Information

Begin with the basics: provide your name, address, and Taxpayer Identification Number (TIN). This sets the foundation, ensuring the form is associated with the correct taxpayer.

Quarterly Tax Liability

Here, you’re quantifying your financial responsibility. Report the total amount of taxes you owe for the specific quarter. It’s a snapshot of your quarterly financial contribution to the specified excise taxes.

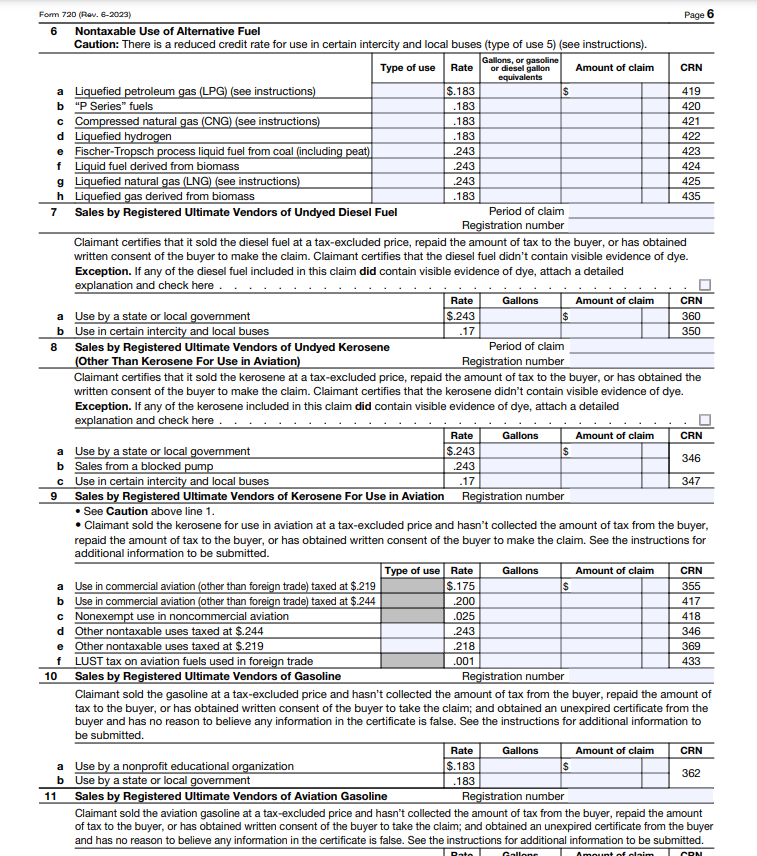

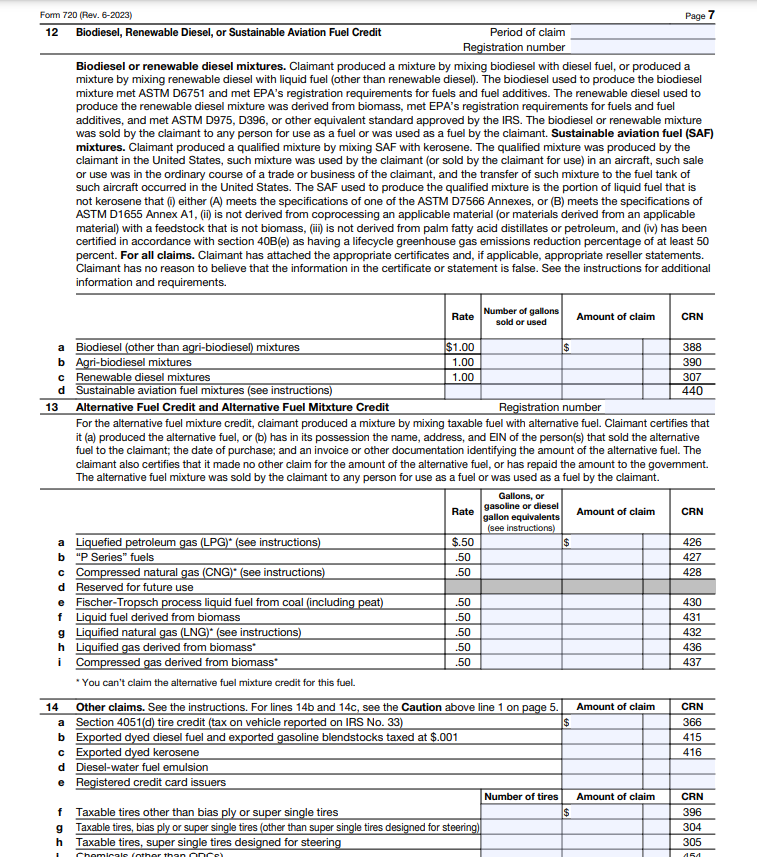

Excise Tax Categories

Imagine this as the chapters in a book. Different schedules within Form 720 correspond to specific categories of excise taxes. These categories may include air transportation, fuel, and more. You’re essentially categorizing your tax obligations for clarity and accuracy.

Taxable Transactions

Drill down further. This is where you get into the nitty-gritty. Report the specific details of each taxable transaction within the allocated excise tax category. It’s about providing a detailed record of your financial interactions that fall under the umbrella of excise taxes.

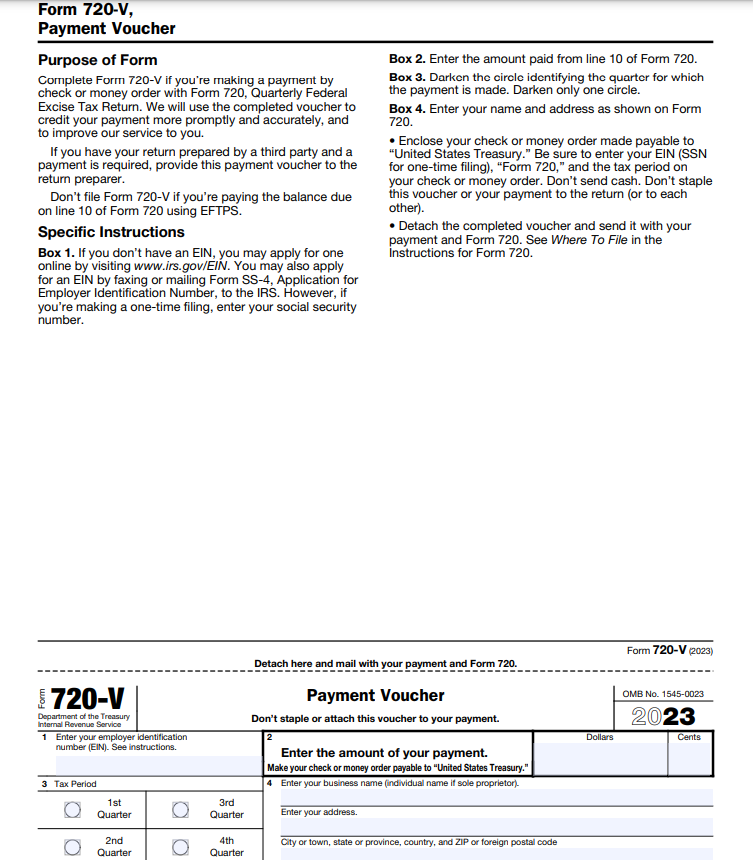

6. Electronic Filing Options

When addressing your tax responsibilities, use the advantages of electronic filing to file Form 720. Utilizing the IRS e-file system not only proves convenient but also ensures a secure and expedited processing experience. This method minimizes error risks and provides immediate confirmation of your submission.

Remember that the IRS Form 720 is a quarterly federal excise tax return. The deadline for filing this form depends on the specific quarter, which includes:

- For the first quarter (January–March): April 30th

- For the second quarter (April–June): July 31st

- For the third quarter (July–September): October 31st

- For the fourth quarter (October–December): January 31st of the following year

7. Penalties for Non-Compliance

Neglecting to submit Form 720 or meeting excise tax deadlines may lead to penalties enforced by the IRS. The severity of these penalties hinges on factors like the outstanding tax amount, the rationale behind non-compliance, and whether the lapse is considered willful or non-willful. To sidestep potential penalties or legal repercussions, promptly complete the form and settle the tax obligations.

Note that the IRS takes a serious stance on timely submissions and payments, emphasizing the significance of adhering to these obligations. Failure to comply not only jeopardizes financial repercussions but also opens the door to legal consequences. Therefore, if you are required to file Form 720, timely and accurate completion is not just a bureaucratic formality; it’s a strategic move to safeguard against avoidable consequences.

By ensuring your engagement with Form 720, you not only fulfill regulatory obligations but also shield yourself from the intricacies of penalties and legal entanglements. Remember, your timely action is the linchpin to navigating the landscape of excise taxes without encountering unnecessary setbacks.

Recap

IRS Form 720 is a quarterly federal excise tax return used to report and pay various federal excise taxes. You must file it by specific deadlines, including information such as taxpayer details, tax liability, excise tax categories, and taxable transactions. Any individual, business, or organization engaged in activities subject to federal excise taxes may be required to file Form 720. Keeping accurate records and filing on time are essential in ensuring compliance with IRS regulations.

By understanding who needs to file this form, what excise taxes are, the deadlines and filing options, and the potential penalties for non-compliance, you may be better prepared to fulfill your tax obligations and avoid any unwanted complications. Consult with a tax professional or the IRS directly if you have specific questions or require further guidance. Stay informed, stay compliant, and tackle tax season with confidence!

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. . For comprehensive tax, legal or financial advice, always contact a qualified professional in your area. S’witty Kiwi assumes no liability for actions taken in reliance upon the information contained herein.

No Comment! Be the first one.