When it comes to tax-filing season, it’s essential to be familiar with the various forms and documents that may impact your tax return. One such form, the IRS Form 5498, plays a crucial role in reporting contributions made to specific types of retirement accounts.

1. What Is IRS Form 5498?

2. What Are the Key Components of IRS Form 5498?

3. Why IRS Form 5498 Matters

4. Who Needs to Pay Attention to IRS Form 5498?

5. How to Report with Form 5498

Recap

1. What Is IRS Form 5498?

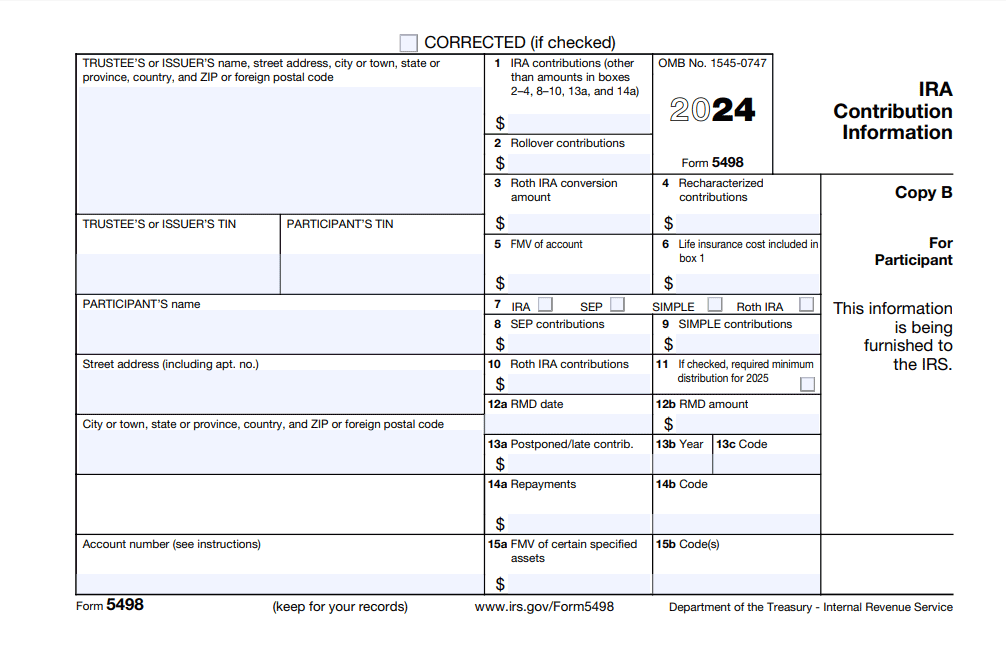

Delve into IRS Form 5498, officially called “IRA Contribution Information.” This document plays a pivotal role in reporting contributions made to various Individual Retirement Arrangements (IRAs), encompassing traditional IRAs, Roth IRAs, SEP-IRAs, and SIMPLE IRAs. The responsibility of handing out Form 5498 falls on the shoulders of financial institutions – be it banks, credit unions, or brokerage firms.

Now, what’s inside this form? It’s like a detailed report card for your retirement account, highlighting contributions made throughout the tax year, along with any rollovers, recharacterizations, and details about the fair market value of your holdings. Essentially, it’s your comprehensive financial snapshot that not only you get a copy of but also makes its way to the IRS. Consider it the paperwork that ensures everyone’s on the same page when it comes to your retirement savings game.

2. What Are the Key Components of IRS Form 5498?

Account Holder Information

In this section, you’re expected to provide crucial personal details such as your name, address, and either your Social Security number or taxpayer identification number. These specifics are essential to ensure the form corresponds accurately to you. Your cooperation in furnishing this information is vital, as it helps maintain the integrity of the process and secures your account.

Account Details

This section focuses on providing comprehensive information about your IRA account, covering the type of IRA (be it traditional, Roth, SEP, or SIMPLE), your unique account number, and the specific financial institution responsible for managing your account. So, take a moment to verify and provide these key details to guarantee the precision and completeness of your Form 5498. Your attention to these particulars will contribute to a smoother tax filing process and better financial management overall.

Contribution Information

At the core of IRS Form 5498 is the comprehensive detail of contributions made to your Individual Retirement Arrangement (IRA) throughout the tax year. This encompasses not only regular contributions but also catch-up contributions allocated for individuals aged 50 and above. Furthermore, it encompasses any excess contributions made, providing a complete overview of the annual financial activity within your IRA.

Fair Market Value (FMV)

Fair Market Value (FMV): Within this critical section, the “Fair Market Value (FMV)” not only reports the current worth of your IRA at the close of the tax year but serves as a key indicator of the overall health of your retirement savings. By detailing the fair market value, you gain a comprehensive understanding of the financial standing of your IRA.

This figure is essential for strategic financial planning, as it reflects the market valuation of your investments and informs decisions on potential adjustments to your retirement portfolio. A precise and up-to-date FMV is crucial for maintaining a clear financial picture and making informed choices to secure your financial future.

Rollovers and Transfers

This section encapsulates crucial details about any rollovers or transfers that occurred between your retirement accounts throughout the tax year. It serves as a valuable record, allowing you to monitor the dynamic movement of funds within the intricate landscape of your retirement savings.

By providing insights into these financial transactions, the form ensures a comprehensive overview of your wealth management strategy, helping you make informed decisions about the mobility and consolidation of assets across various retirement accounts.

Recharacterizations

Understand that this section outlines detailed information about any contributions that were recharacterized during the tax year, involving the conversion of funds from one type of IRA to another. Here, you’ll find a comprehensive record of these transactions, shedding light on the specifics of the recharacterization process.

Whether you shifted contributions between traditional and Roth IRAs for tax advantages or adjusted your retirement strategy, this section provides a clear snapshot of these financial manoeuvres.

Required Minimum Distributions (RMDs)

If you’re at the age where you need to take mandatory minimum distributions, this part of the form tells you the exact amount you must withdraw to meet IRS regulations. The calculation considers factors like your account balance and life expectancy, ensuring accurate reporting and compliance.

It’s essential to pay attention to these details to avoid penalties and stay in line with the tax rules governing retirement accounts. This section directly guides you on the necessary steps for managing your withdrawals as mandated by the IRS.

>>>PRO TIPS: A Guide to Commonly-Used IRS Tax Forms

3. Why IRS Form 5498 Matters

Tax Reporting

IRS Form 5498 plays a crucial role for you. It’s not just another form—it’s your key to accurate tax reporting. This form delivers vital information to the IRS, detailing contributions and the fair market value of your retirement accounts. This ensures that you’re on the right side of tax regulations, contributing to a seamless and compliant tax-filing process. So, pay close attention to the details on Form 5498; it’s your ally in maintaining financial transparency and fulfilling your tax obligations accurately.

Verification of Contributions

It’s crucial to recognize that Form 5498 serves as more than just a tax document—it’s a powerful tool for you to cross-check and verify your contributions. By leveraging the information provided on this form, taxpayers can meticulously compare the reported contributions with their own records. This step is of paramount importance in ensuring accuracy and consistency, helping you avoids discrepancies in your tax filings.

Whether it’s confirming regular contributions, catch-up contributions, or assessing the impact of recharacterizations, using Form 5498 for verification empowers you to confidently align your records with the information reported to the IRS, promoting a hassle-free and precise tax-filing experience.

RMD Compliance

Pay close attention to this section if you’re dealing with required minimum distributions (RMDs). Form 5498 is your ally in ensuring RMD compliance. It provides clear guidance, indicating the required distribution amount to meet IRS obligations. Neglecting these mandatory withdrawals can result in penalties, so it’s crucial to use the details in this section to stay on track. By following the guidance of Form 5498, you not only fulfil your regulatory requirements but also safeguard your financial well-being.

4. Who Needs to Pay Attention to IRS Form 5498?

IRA Holders

If you’re contributing to traditional or Roth IRAs, take a moment to go through Form 5498. It’s on you to ensure the reported contributions align accurately with your records. Your careful review of this form is key to guaranteeing the precision of the reported information. By doing so, you play a crucial role in maintaining the integrity of your financial records and ensuring a smooth tax-filing experience. So, don’t overlook it—your diligent scrutiny ensures your IRA contributions are accurately represented.

Financial Institutions

Institutions such as banks, credit unions, etc. that manage retirement accounts are responsible for filing Form 5498 with the IRS and providing a copy to the account holder.

Tax Professionals

Tax preparers need to consider the information on Form 5498 when helping clients with their tax returns, especially those with retirement accounts.

>>>GET SMARTER: California State Taxes: 2023 Update

5. How to Report with Form 5498

To report with IRS Form 5498, kick-start the process by receiving the form from your financial institution by May 31st of the tax year. Dive into the details, actively reviewing personal information, contribution amounts, and transaction data. While the form itself won’t be submitted with your tax return, harness the insights it provides to actively complete the relevant sections of your tax forms.

If you’ve made contributions, actively report them, distinguishing between tax-deductible contributions for traditional IRAs and after-tax Roth IRA contributions. Actively use the information to determine and fulfil Required Minimum Distributions (RMDs) if applicable, steering clear of potential penalties. For any rollovers or transfers, actively report these transactions on your tax return to maintain transparency.

If excess contributions are flagged, take active steps to address and resolve the issue promptly. Keep records actively organized, holding onto a copy of Form 5498 and related documentation for future tax filings and tracking your dynamic retirement account activity over time.

Recap

While IRS Form 5498 may not be a household name, its role in the tax reporting process is significant. If you have any retirement accounts, ensure you understand the information presented on this form as it is essential for accurate tax filing and compliance with IRS regulations. As tax laws evolve, staying informed about the purpose and importance of forms like IRS Form 5498 is crucial for financial well-being and peace of mind during tax season.

No Comment! Be the first one.