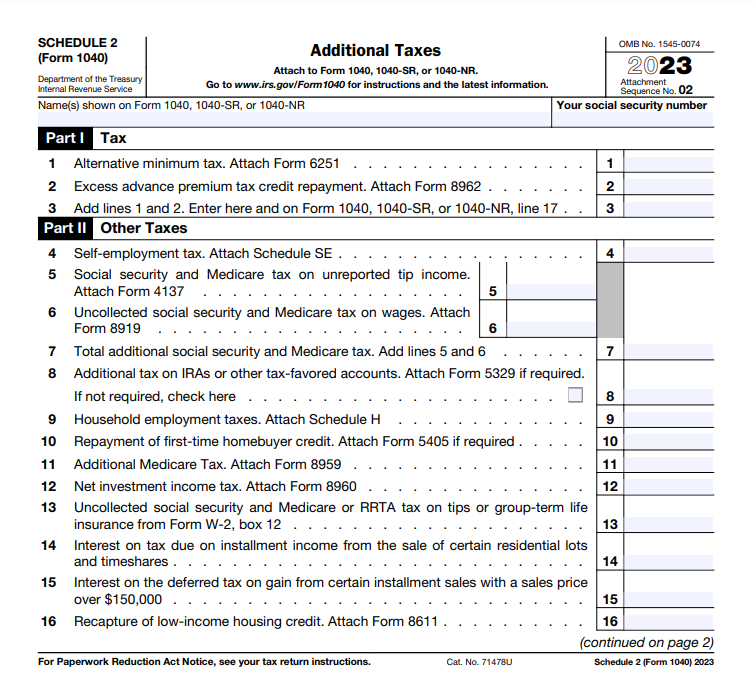

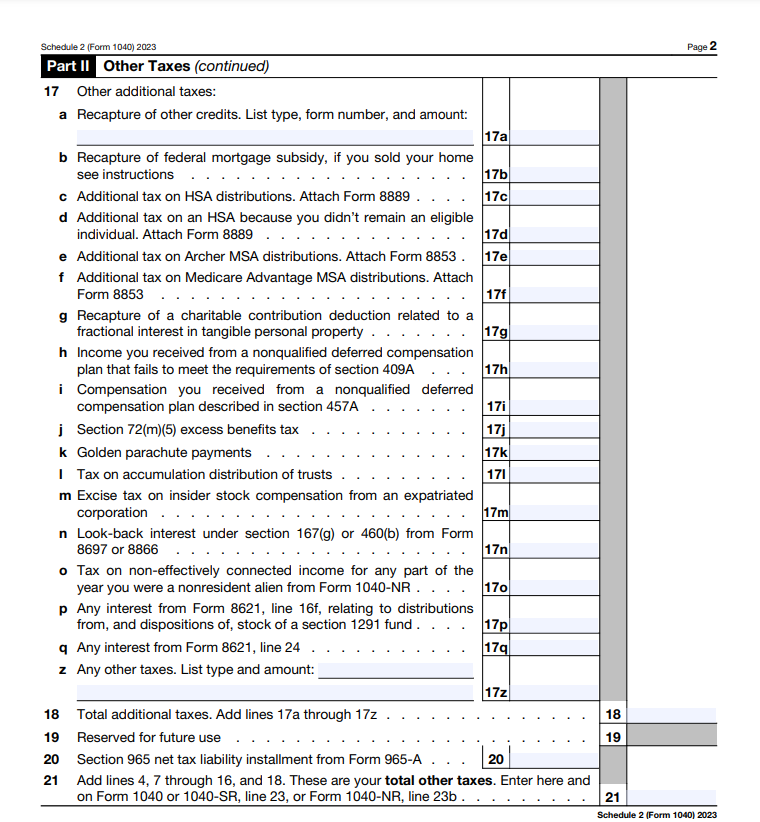

IRS Form 1040 Schedule 2 serves as an attachment to Form 1040, addressing additional taxes that aren’t covered in the main form. When you encounter specific tax situations, requiring you to report additional taxes you owe or claim certain tax credits, this schedule comes into play.

You’ll find it pertinent if you have extra taxes, like self-employment taxes or the repayment of a portion of your premium tax credit. It also includes the tax on unreported tips or on other income sources.

However, it’s essential you note that not everyone needs to file Schedule 2; it only applies to you if you are in a specific situation outlined by the IRS. Utilizing this schedule ensures a comprehensive and accurate tax filing, covering additional aspects that might not be accounted for in the standard Form 1040.

What is IRS Form 1040 Schedule 2?

- Additional Tax Reporting

- Specific Tax Situations

- Uncovered Tax Credits

- Self-employment Tax

- Repayment of Credits

- Unreported Tip Tax

- Other Income Sources

- How to File

Recap

1. Additional Tax Reporting

IRS Form 1040 Schedule 2 functions as a supplement to the main tax form, offering you a platform to report additional taxes beyond the basic framework. This schedule caters to various tax scenarios that might not find explicit coverage in the primary Form 1040.

It primarily serves as a means to include specific types of income or taxes that require separate documentation for proper reporting. You’re likely to encounter Schedule 2 if you have income sources or tax situations that fall outside the standard income categories.

It’s crucial you use this schedule accurately and diligently, ensuring a comprehensive representation of your tax obligations. When you address these specific tax aspects, it contributes to a more detailed and precise tax filing, providing the IRS with necessary supplementary information for your return.

2. Specific Tax Situations

Use IRS Form 1040 Schedule 2 to specifically address unique tax scenarios that deviate from the standard income reporting requirements. When you encounter unconventional income sources or special tax situations not covered in the main Form 1040, this schedule becomes crucial.

It caters to circumstances like your unreported tips, repayment of tax credits, or certain types of additional taxes, ensuring you properly document these elements. Using Schedule 2 allows you to delineate these specific tax components accurately, providing a more comprehensive and transparent overview of your financial obligations.

It’s important you note that not everyone will require Schedule 2; it’s typically for individuals with distinct tax situations, making it an essential tool to ensure meticulous and precise tax filing. You may consult the IRS guidelines or a tax professional to determine whether your circumstances warrant the use of Schedule 2 for your tax return.

3. Uncovered Tax Credits

If you have specific tax credits that aren’t fully covered by the primary Form 1040, utilize Schedule 2. It’s designed to address those additional tax credits which require separate documentation or reporting beyond what the main form accommodates.

This means if you have tax credits beyond the typical ones like the earned income credit or child tax credit, Schedule 2 becomes a crucial tool. It allows you to itemize these less common tax credits, ensuring you properly account for it in your tax return. Using this schedule ensures a detailed and accurate representation of your entitled tax credits, enhancing the completeness of your filing.

Remember, while many standard tax credits find a place on Form 1040, those falling outside this scope often find a home on Schedule 2, making it an essential addition for a comprehensive tax return. Always verify your eligibility and consult relevant tax guidance to leverage this schedule effectively.

>>>PRO TIPS: Form 1099-K Decoded for the Self-Employed

4. Self-employment Tax

IRS Form 1040 Schedule 2 tackles self-employment taxes, a crucial aspect for you if you work for yourself. If you’re self-employed, you’re responsible for both the employee and employer portions of Social Security and Medicare taxes.

Schedule 2 provides a space for you to detail these self-employment taxes separately, ensuring accurate reporting. If you earn income through freelancing, contracting, or running your own business, you’ll likely encounter self-employment taxes. This schedule assists you to precisely document and calculate these taxes, allowing you to factor them into your overall tax liability.

Don’t forget that accurate reporting of your self-employment taxes on Schedule 2 ensures compliance with IRS regulations, leading to a comprehensive and precise tax filing that reflects your complete financial situation. Make sure you stay informed about the specific tax rules regarding self-employment income.

5. Repayment of Credits

You need Form 1040 Schedule 2 to address the repayment of certain tax credits that require additional attention in your tax filing. When you’ve previously claimed certain credits but circumstances change, necessitating the repayment, this schedule becomes essential.

For instance, if you received an advance payment of the Premium Tax Credit but had changes in your income or family situation, leading to a repayment obligation, Schedule 2 helps you document and report this adjustment. It’s a crucial component in ensuring that you account for any required repayments in your tax return.

By utilizing this schedule, you’re able to transparently report and manage your repayment obligations, maintaining compliance with IRS regulations. Remember, accurately detailing these repayments on Schedule 2 is vital for a precise and complete tax filing, reflecting any changes affecting your previously claimed tax credits.

6. Unreported Tip Tax

Don’t forget to report all unreported tips you receive in your line of work on Form 1040 Schedule 2. When you earn tips that weren’t reported to your employer, you’re still responsible for paying taxes on that income. Schedule 2 allows you to properly document and report these unreported tips, ensuring compliance with IRS regulations.

It provides you with a designated space to calculate and include this income accurately in your tax return. Remember, whether you work in the service industry, hospitality, or any other field where tips are a part of your income, accurately reporting these unreported tips on Schedule 2 is crucial for a precise and complete tax filing.

7. Other Income Sources

There are various income sources beyond the standard wages or salaries that you may need to report on IRS Form 1040 Schedule 2. When you receive income from sources other than your regular job, such as freelance work, rental properties, investments, or royalties, you may need to use Schedule 2.

It’s crucial because these additional income streams might not fit neatly into the categories covered by the main Form 1040. This schedule allows you to accurately report and document these diverse income sources, ensuring comprehensive tax compliance.

Whether you earn income from a side gig, receive dividends from your investments, or collect rental income, make sure you accurately detail these sources on Schedule 2 as it is vital for a complete tax filing.

8. How to File

Use the steps below to file Form 1040 Schedule 2 accurately:

- Gather Information: Collect necessary documents detailing additional income, taxes you owe, or specific tax credits beyond Form 1040.

- Download Form: Access IRS Form 1040 Schedule 2 from the IRS website or use tax software supporting this form.

- Fill in Details: Enter accurate information regarding your additional taxes, credits, or income in the designated sections.

- Double-Check Entries: Review each entry meticulously to ensure accuracy and completeness.

- Attach to Form 1040: Once completed, attach Schedule 2 to your Form 1040 before you submit.

- Submit Electronically or Mail: If you’re filing electronically, follow your tax software’s prompts. For paper filing, send your Form 1040 along with Schedule 2 to the IRS.

- Keep a Copy: Retain a copy of your filled Schedule 2 for your records.

- Payment if Owed: If Schedule 2 indicates additional taxes you owe, ensure payment accompanies your filing or arrange for payment according to IRS guidelines.

>>>GET SMARTER: Form 5498-ESA: What It Is, How to File It

Recap

IRS Form 1040 Schedule 2 supplements Form 1040, allowing you to address additional tax aspects like unreported tips, unique tax credits, self-employment taxes, and diverse income sources. It provides you with a platform to accurately report these elements, ensuring a thorough and precise tax return, especially for specific financial circumstances not covered in the main form.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. . For comprehensive tax, legal or financial advice, always contact a qualified professional in your area. S’witty Kiwi assumes no liability for actions taken in reliance upon the information contained herein.

No Comment! Be the first one.