Embarking on the journey of self-employment is a thrilling venture, but amidst the freedom and flexibility, there’s a pocket of perplexity – taxes. Yet, fear not, for there’s a beacon of financial relief in the form of deducting health insurance premiums.

Imagine a world where being your own boss not only means charting your course but also entails some strategic tax maneuvers. Unravel the simplicity and significance of deducting health insurance premiums when you’re proudly self-employed – because, in this tax tale, empowerment takes center stage. Dive into the art of balancing entrepreneurship and financial savvy.

1. Understanding the basics: self-employed health insurance deduction

2. Eligible health insurance plans

3. Calculating the deduction

4. Limited deductions for long-term care insurance premiums

5. Additional considerations and tips

Summary

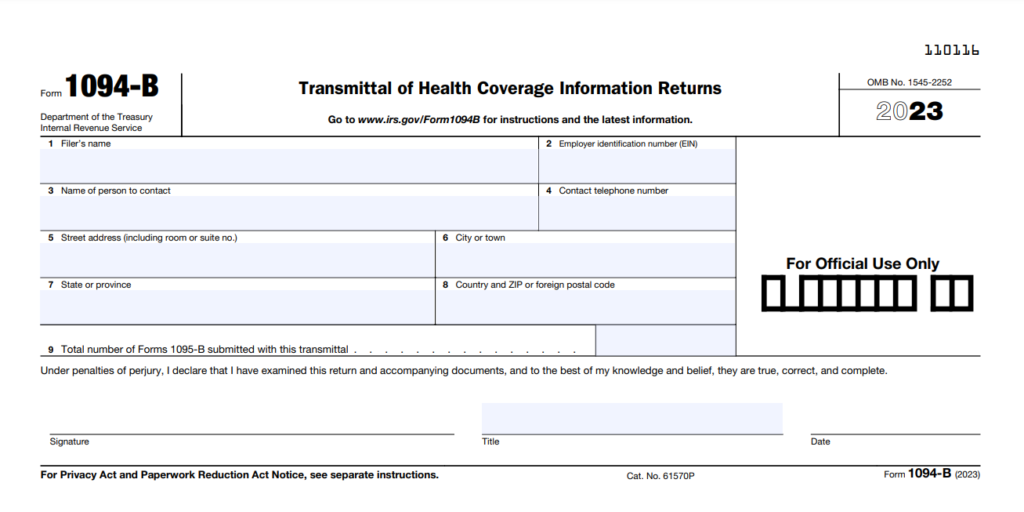

1. What Is Form 1094-B and its Purpose

Form 1094-B: Transmittal of Health Coverage Information Returns, is a crucial document in the corridors of healthcare reporting. Its primary purpose is to serve as a cover sheet that accompanies the submission of your health coverage information returns, specifically Form 1095-B, to the Internal Revenue Service (IRS).

Your insurance provider (self-insured employers, and other entities that provide minimum essential health coverage) files Form 1094-B. By compiling and transmitting this information, Form 1094-B assists the IRS in tracking and enforcing your mandate, ensuring compliance with the Affordable Care Act (ACA), and facilitating the verification of your eligibility for premium tax credits.

>>>MORE: Tax Deductions for Diabetes

2. Who Must File Form 1094-B

File Form 1094-B if you run an entity that’s responsible for providing minimum essential health coverage. This includes insurance providers, self-insured employers, and other organizations that offer health coverage to individuals. As an employer, you’re subject to the employer mandate—which applies to those with 50 or more full-time equivalent employees—and must also file this form.

Additionally, government agencies administering government-sponsored health coverage programs also need to submit Form 1094-B. The filing obligation helps the Internal Revenue Service (IRS) monitor compliance with the Affordable Care Act (ACA), enabling it to assess penalties for non-compliance and ensuring accurate reporting of individuals’ health coverage.

3. Necessary Information for Filing Form 1094-B

When filing Form 1094-B, provide essential information to accurately report health coverage details to the Internal Revenue Service (IRS). This includes your name, employer identification number (EIN), address, and contact information.

Additionally, the form requires details about the total number of Forms 1095-B transmitted, the name and TIN (Taxpayer Identification Number) of the responsible individual, and information about the coverage you provide, such as the type of coverage and the months the form covers. Accurate and complete data is important for the IRS to assess compliance with the Affordable Care Act (ACA) and to verify individuals’ eligibility for premium tax credits.

4. Form 1094-B Filing Deadlines

To file Form 1094-B smoothly without any complications, adhere strictly to the deadline the IRS sets. Generally, the deadline for paper filing is at the end of February following the tax year, while electronic filing extends the deadline to the end of March.

It’s important to note that these deadlines can be subject to change, and you need to be current about any updates from the Internal Revenue Service (IRS). Late submissions can result in penalties, so timely and accurate filing is essential to ensure compliance with the Affordable Care Act (ACA) requirements and avoid potential financial repercussions.

5. Penalties for Non-Compliance

Penalties for non-compliance when filing Form 1094-B can be significant and help to encourage timely and accurate reporting of health coverage information. Failure to file the form by the specified deadline or providing incomplete or inaccurate information can result in penalties the Internal Revenue Service (IRS) imposes. These penalties can vary based on the severity of the violation but are generally a factor of a per-return or per-statement basis.

If your entity fails to comply with the Affordable Care Act (ACA) reporting requirements, you set yourself up for financial consequences, making it crucial for you to meet the deadlines and ensure the accuracy of the information you submit to avoid potential penalties.

6. Instructions for Completing the Form

Completing Form 1094-B involves following detailed instructions the Internal Revenue Service (IRS) provides. You need to accurately fill in information such as your name, employer identification number (EIN), and contact details. The form requires the total number of Forms 1095-B you transmit, along with specific details about the individuals the form covers, including their names and Taxpayer Identification Numbers (TINs).

You must also provide information about the type of coverage you offer and the months it affects. The instructions guide you through the process of ensuring that the form is complete, accurate, and in compliance with the Affordable Care Act (ACA) regulations, emphasizing the importance of thoroughness and attention to detail in reporting health coverage information.

>>>GET SMARTER: Energy Tax Credit: Which Home Improvements Qualify?

What to Watch Out For

- Verify information accuracy: Double-check all details, including the entity’s name, employer identification number (EIN), and contact information, ensuring accuracy to prevent potential errors in reporting.

- Adhere to filing deadlines: Stay vigilant regarding submission deadlines, whether filing on paper or electronically, to avoid penalties associated with late or incomplete filings.

- Provide complete individual details: Ensure comprehensive information about covered individuals, including their names and Taxpayer Identification Numbers (TINs), to meet reporting requirements and facilitate accurate identification of individuals eligible for premium tax credits.

- Stay informed about regulatory changes: Keep abreast of any updates or changes in reporting requirements and guidelines issued by the Internal Revenue Service (IRS) to ensure continued compliance with the Affordable Care Act (ACA) and avoid potential penalties for non-compliance.

Recap

Form 1094-B: Transmittal of Health Coverage Information Returns, plays a crucial role in healthcare reporting. Its primary purpose is to accompany individual health coverage information returns when you submit to the IRS. If you fall under entities such as insurance providers, self-insured employers, and those offering minimum essential health coverage, you’re under obligations to file Form 1094-B.

Filing requires essential information, such as your name, EIN, and comprehensive details about individuals you cover. Adherence to specific filing deadlines is crucial to avoid penalties, and accurate completion of the form is vital to comply with Affordable Care Act (ACA) regulations. Failure to comply can result in penalties the IRS imposes, emphasizing the importance of vigilance, accuracy, and staying up-to-date about regulatory changes in the healthcare reporting landscape.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. . For comprehensive tax, legal or financial advice, always contact a qualified professional in your area. S’witty Kiwi assumes no liability for actions taken in reliance upon the information contained herein.

No Comment! Be the first one.