Imagine standing at the edge of a vast financial jungle. The air is thick with numbers, and the trees are tall with towering stacks of paperwork. Suddenly, a path appears, winding its way through the dense undergrowth. This path is Form 1065, a beacon of order in the chaos of the tax world.

Know that Form 1065 is not just a form; it’s a story. It’s the tale of your business partnership’s journey through a fiscal year. It’s a chronicle of profits you make, losses you incur, and lessons you learn. It’s a testament to the spirit of entrepreneurship and a tribute to the tenacity of business partners.

So, strap on your boots, grab your compass, and start exploring this article as you embark on this exciting adventure. Welcome to the world of Form 1065, where every line is a step, every box is a milestone, and every filled form is a summit conquered. Dive in now to find more.

1. Know What Form1065 Is

2. How Is It Different From Form 1120 and Form 1120S?

3. Who Must File Form 1065?

4. How to File Form 1065

5. What Are the Things to Worry About While Filing Form 1065?

6. Form 1065 vs Schedule K-1

1. Know What Form1065 Is

If your business type is partnership or LLCs, think of Form 1065 as a tax form you can use to report your income, gains, losses, deductions, and credits to the IRS. Imagine you and your friends decide to start a band. You all contribute to the music, but when it comes to splitting the earnings from your concerts and album sales, things can get a bit complicated. This is where Form 1065 comes in but for businesses, not bands.

Form 1065 is like a report card for your business partnership. It’s a way to tell the U.S. government how your business performs over the years. It includes all the highs (income and gains) and lows (losses and deductions) of your business journey.

But here’s the cool part: your band (partnership) doesn’t pay taxes on its income. Instead, it “passes through” any profits or losses to its band members (partners). Each partner gets a Schedule K-1, which is like a report card for each partner’s share of the band’s income.

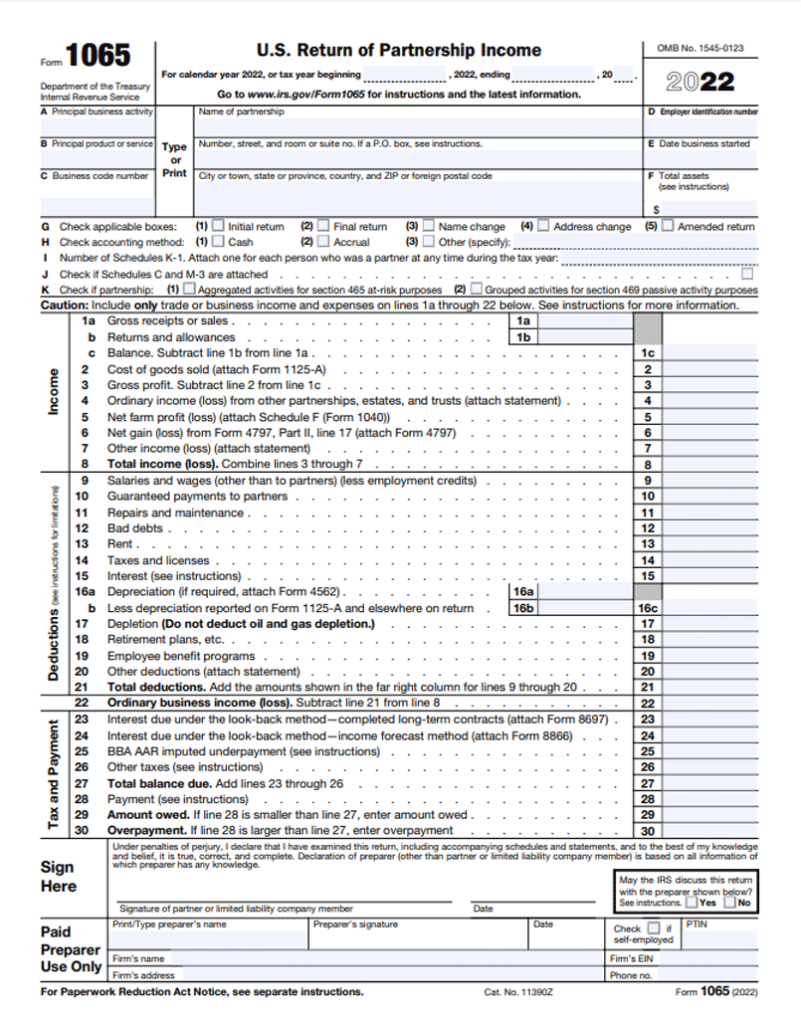

Form 1065 requires information about your principal business activity, assets, income, and how you keep track of it all.

Remember, tax forms can be as tricky as a complex guitar solo, so it’s always a good idea to jam with a tax professional if you need help. Rock on!

>>>MORE: What Is Form 720?

2. How Is It Different From Form 1120 and Form 1120S?

Understand that different types of businesses use different tax forms in the US. Don’t forget that you can only use Form 1065 if your business type is partnership or LLCs. On the other hand, Form 1120 is for C corporations, and Form 1120S is for S corporations. The main difference is how these businesses pay taxes on their income.

If you are into partnerships or LLCs, you are to report the tax on your personal tax return using ScheduleK-1. Meanwhile, if you run an S corporation, you are to pay tax at the corporate level and also on the dividends you distribute to your shareholders. However, know that you don’t have to pay taxes if you run an S corporation business. You only have to pass your profits and losses to your shareholders who report them on their respective personal tax returns.

Choosing the right form for your business depends on various factors, such as the number and type of owners, the distribution of profits, the tax rates, and the legal protection.

3. Who Must File Form 1065?

To qualify for Form 1065, check if you meet any of the following criteria:

- You are a domestic partnership that conducts business or has income in the U.S.

- You are a foreign partnership that conducts business or has income in the U.S., or has a U.S. partner.

- You are a nonprofit religious organization that the tax law exempts from paying tax under section 501 (d) of the Internal Revenue Code.

4. How to File Form 1065

To file Form 1065, you need to follow these steps:

- Gather the financial records of your partnership or LLC, such as income statements, balance sheets, bank statements, receipts, invoices, etc.

- Download Form 1065 and its instructions from the IRS website or use a tax software that supports this form. E.g. TurboTax.

- Fill out the required information on Form 1065, such as the name, address, and EIN of your partnership or LLC, the type of entity, the accounting method, the principal business activity, etc.

- Report the income and expenses of your partnership or LLC on page 1 of Form 1065, using the appropriate lines and codes. Calculate the ordinary business income (loss) on line 22.

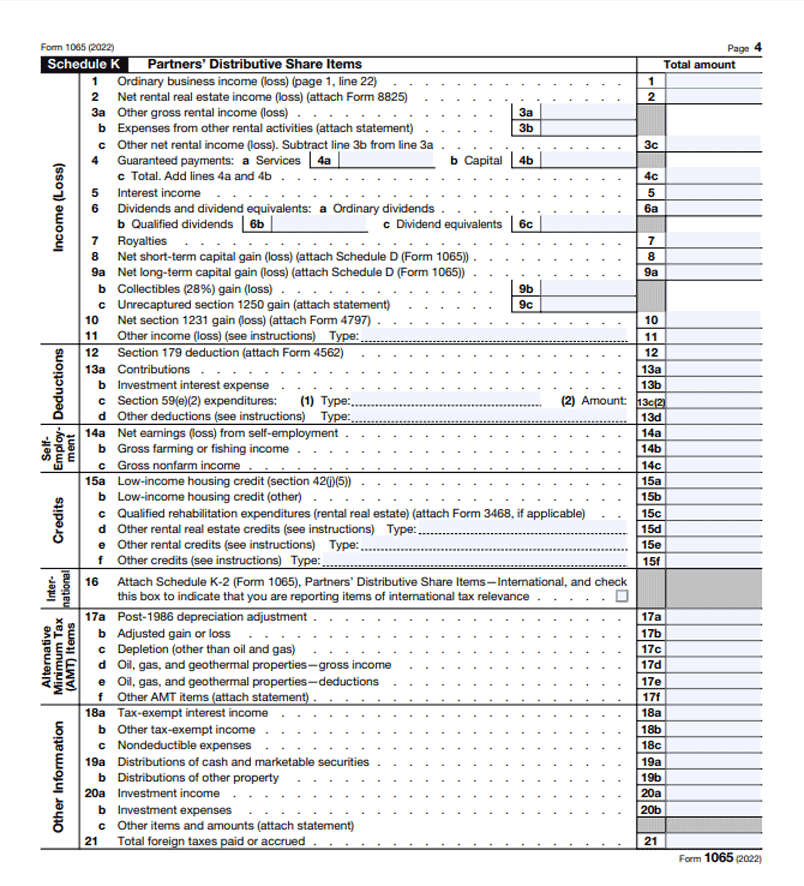

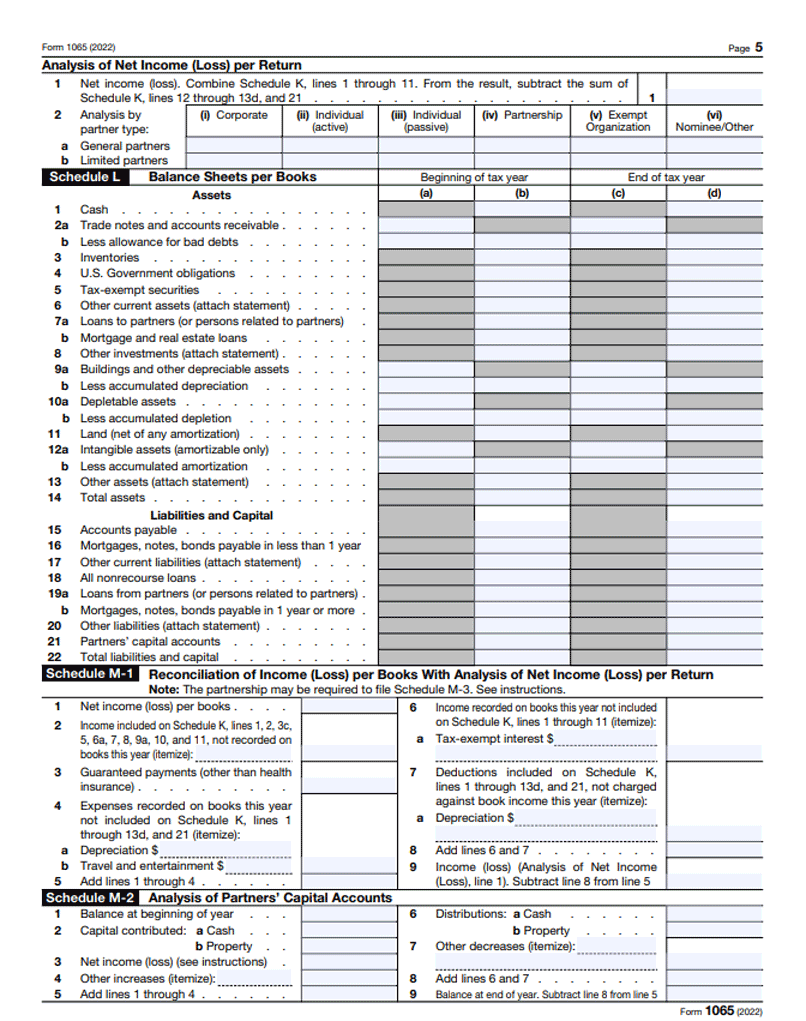

- Complete Schedule K on page 4 of Form 1065 to report the total income, deductions, credits, and other items of your partnership or LLC.

- Complete Schedule L on page 5 of Form 1065 to report the assets, liabilities, and capital of your partnership or LLC at the beginning and end of the tax year. You may also need to complete Schedule M-1 and M-2 to reconcile the book income and capital accounts of your partnership or LLC with the tax income and capital accounts reported on Form 1065.

- Prepare a separate Schedule K-1 for each partner or member of your partnership or LLC, using the information from Schedule K and the partnership agreement.

- File Form 1065 electronically or by mail by the 15th day of the third month following the end of the tax year. If you need more time, you can request an automatic six-month extension by filing Form 7004 before the due date of Form 1065.

- Pay any taxes that you owe as a partner or member of the partnership or LLC, such as self-employment tax, estimated tax, or withholding tax, using the appropriate forms and methods. You must also report your share of the partnership or LLC income and deductions on your personal tax return, using Schedule E and the information from Schedule K-1.

>>>PRO TIPS: What Is IRS Form 8379: Injured Spouse Allocation

5. What Are the Things to Worry About While Filing Form 1065?

Be aware that filing Form 1065 can be a challenging task for many partnerships and LLCs. Here are some of the things you need to worry about while filing Form 1065:

- Accuracy: Make sure that all the information you provide on Form 1065 and its schedules is correct and complete. Any errors or omissions can result in penalties, audits, or adjustments by the IRS. Double-check your financial records, business code number, employer identification number, partner information, and income and expense allocations before filing Form 1065.

- Timeliness: File Form 1065 by the due date, which is usually the 15th day of the third month following the end of your tax year. For calendar year partnerships, the due date is March 15. If you miss the deadline, you may face late filing penalties, interest charges, or loss of deductions and credits. You can request an automatic six-month extension by filing Form 7004 before the due date of Form 1065, but you still need to pay any taxes that you owe on time.

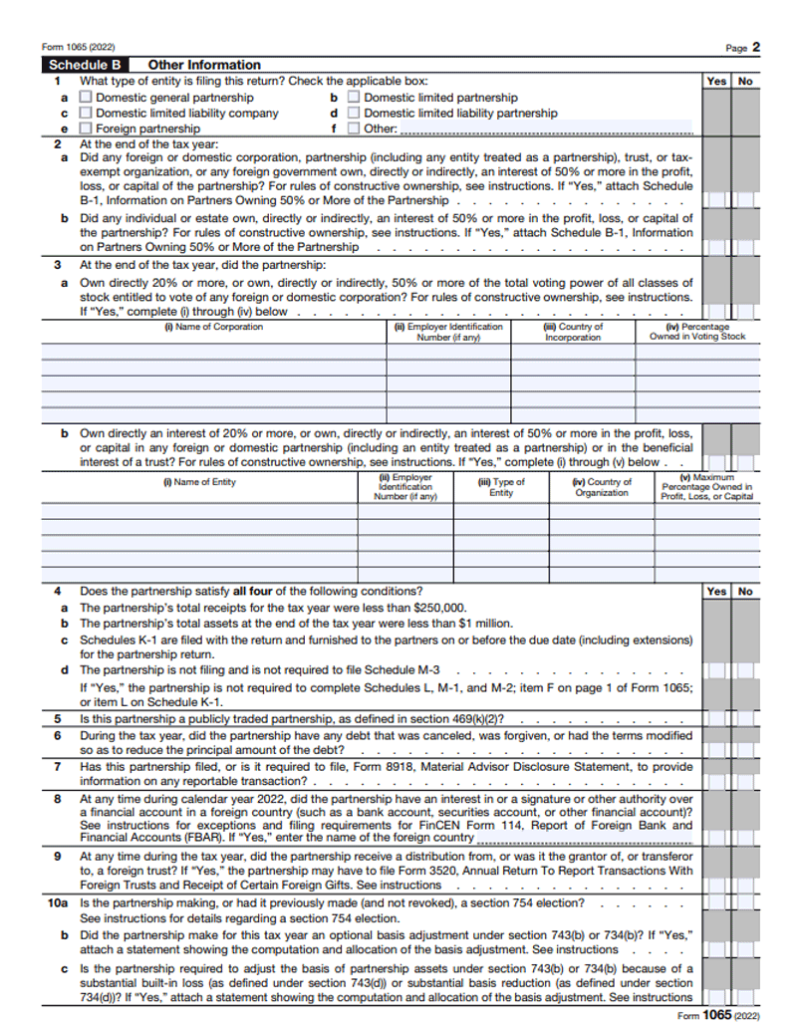

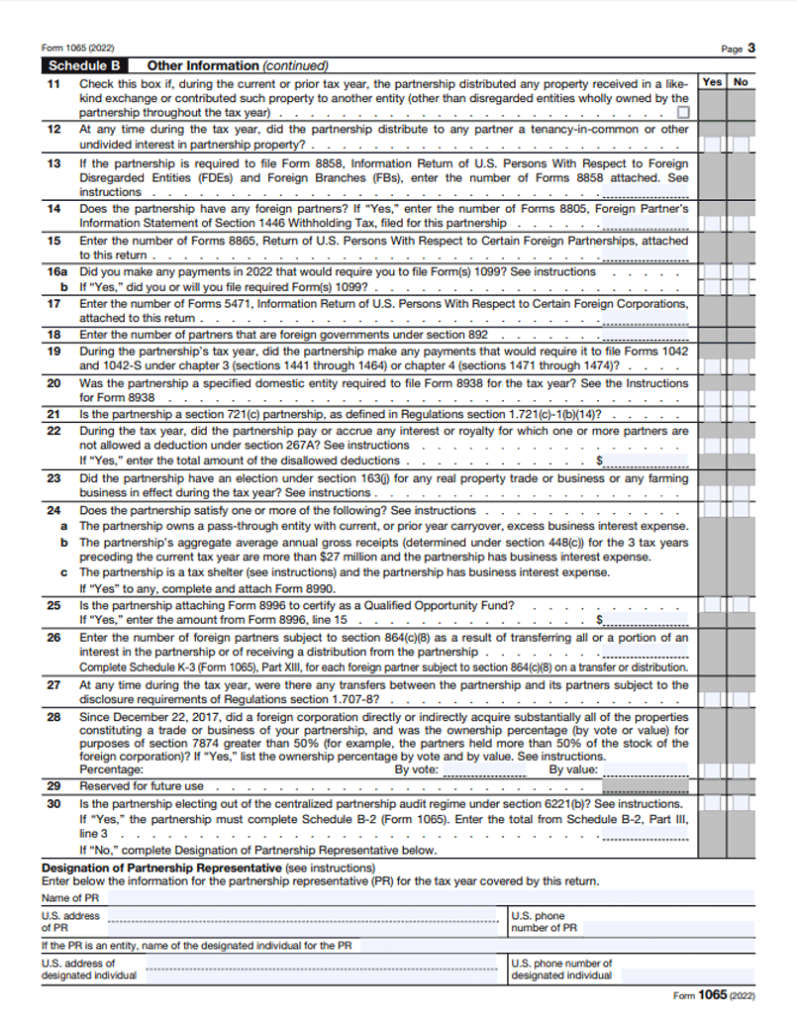

- Complexity: Comply with the complex tax rules and regulations that apply to partnerships and LLCs. Depending on the nature and activities of your business, you may need to file additional forms and schedules with Form 1065, such as Schedule K-2, Schedule K-3, Schedule M-3, Form 8865, Form 8918, etc.

- Consistency: Maintain consistency in your accounting method, reporting period, and treatment of items between Form 1065 and your partners’ or members’ personal tax returns.

6. Form 1065 vs Schedule K-1

Bear in mind that Form 1065 and Schedule K-1 are two related but distinct tax forms for partnerships and LLCs. They have different purposes and audiences, and understanding their differences can help you file your taxes correctly and avoid penalties.

Form 1065 is the main tax form for partnerships and LLCs. Use it to show the total income, expenses, credits, and deductions of your business entity for the tax year. File Form 1065 with the IRS but remember that partnership or LLCs doesn’t pay the taxes itself.

Schedule K-1 is a supplementary tax form you must file as the member of the partnership or LLC. It shows your share of the income, expenses, credits, deductions, and international tax items of the entity. The dichotomy you need to know between Form 1065 and Schedule K-1 is that Form 1065 is an informational return for the entity, while Schedule K-1 is a tax return for the individual. Form 1065 is filed with the IRS, while Schedule K-1 is filed with the partner or member.

Recap

Remember Form 1065 is an important tax form for partnerships and LLCs that shows the income and deductions of the business entity and its owners. By filing Form 1065 correctly and on time, you can avoid penalties, audits, and adjustments by the IRS and ensure that your partners or members report their share of income and deductions accurately.

No Comment! Be the first one.