How would you feel if you ever had that moment when you open your pay check or a government payment, only to be hit with the surprise that your tax was not deducted and it seemly looks as though you choose to evade your payment? Of course you wouldn’t want that to happen and its better imagined. But guess what? There’s this undercover hero in the tax world called the W-4V form, and it’s about to become your new best friend.

Picture this: You’re getting unemployment benefits or maybe even some sweet Social Security income, but without tax withheld, it’s like playing a game of financial roulette, it can back fire at any time. However, that’s where the W-4V swoops in – it’s the tool that lets you decide whether you want some taxes withheld from these payments.

Think of the W-4V as your backstage pass to manage taxes on certain government payments effective. Truthfully, understanding the W-4V is like you uncover a secret shortcut through the tax jungle. With this form, you get to call the shots on how much of that income gets socked away for taxes upfront. It’s not just about avoiding a tax bombshell later – it’s about taking control of your finances and avoiding those moments where you have to ponder for long on how much you owe.

Sounds intriguing, right? Buckle up and get ready to unpack this little-known gem that could save you from those “surprise, you owe taxes” moments and put you in the driver’s seat of your tax situation.

In this article, you get to understand more about;

- What Is Form W-4V?

- What Benefit/Impact Do You Derive When Filing W-4V?

- When to File W-4V

- How to File W-4V

Recap

Ready for the adventure yet? Read on!

1. What Is Form W-4V?

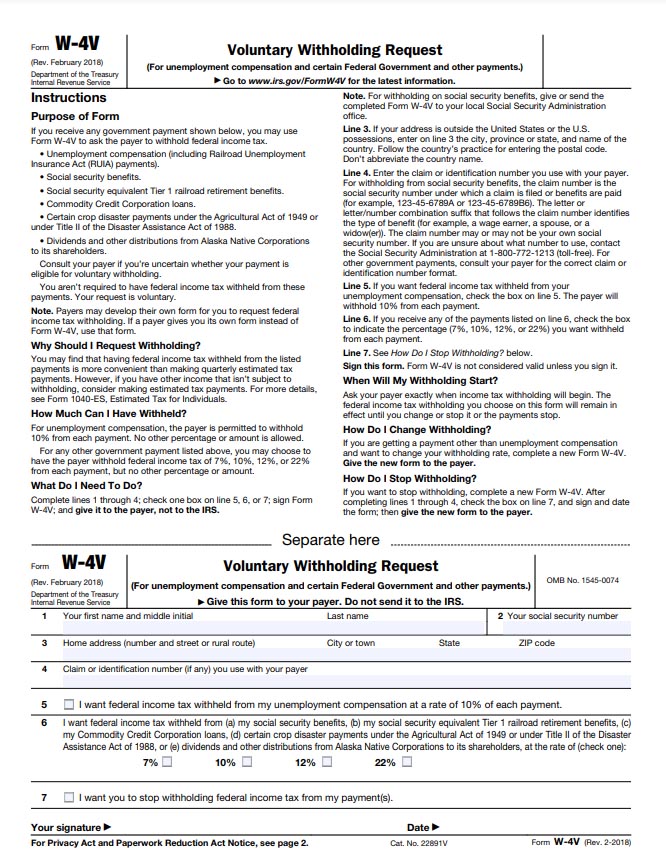

The W-4V, or Voluntary Withholding Request form, serves as your ticket to taking charge of your taxes on specific government payments. It allows individuals to voluntarily request federal income tax withholding, typically at a flat-rate percentage (often 10%, but it can vary), from payments like unemployment compensation, social security benefits, select federal payments, and more. This form acts as a proactive tool, resembling the way taxes are withheld from regular pay checks, providing individuals with the flexibility to manage your tax liabilities throughout the year and prevent a hefty tax bill when tax season rolls around.

This form empowers you to opt for voluntary tax withholding especially if you are receiving various government payments that includes unemployment compensation, Social Security benefits, certain retirement benefits, and even specific disaster-related payments. By voluntarily choosing to have federal income tax withheld, you can navigate your tax responsibilities more effectively, avoiding potential surprises and ensuring a smoother financial journey. Additionally, it’s worth noting that certain dividends and distributions from Alaska Native Corporations to shareholders also qualify for this voluntary withholding.

2. What benefit/Impact do you derive when you file W-4V?

Filing a W-4V (Voluntary Withholding Request) form offers several benefits and impacts for you receiving specific government payments:

- Control over Tax Obligations: By filing a W-4V, you gain control over your tax situation on various government payments. You can choose to have federal income tax withheld from payments such as unemployment compensation, social security benefits, and certain retirement benefits. This control allows for proactive management of tax liabilities throughout the year.

- Prevention of Tax Debts: Opting for voluntary withholding through a W-4V can help you prevent owing a significant amount in taxes at the end of the year. Withholding taxes from these payments ensures that a portion of the income is set aside for taxes, reducing the risk of facing a large tax bill when filing a tax return.

- Budgeting and Financial Planning: Voluntary withholding aids in budgeting for taxes. It enables you to plan and set aside funds for your tax liabilities, providing a clearer picture of your finances and ensuring you’re not caught off guard by unexpected tax obligations.

- Avoidance of Underpayment Penalties: Filing a W-4V helps you to meet tax obligations throughout the year. By doing so, you can potentially avoid underpayment penalties imposed by the IRS for not paying enough tax during the tax year.

- Peace of Mind and Reduced Stress: Knowing that a portion of taxes is being withheld upfront can alleviate stress related to tax planning and financial uncertainty. It offers you indescribable peace of mind, making the tax-filing process smoother and more predictable.

Ultimately, filing a W-4V allows individuals to actively manage your tax responsibilities, ensuring a more predictable and manageable tax situation while offering financial stability and peace of mind throughout the year.

>>>PRO TIPS: Form 1099-Q: What It Is, How to File It

3. When to file W-4V?

It’s best to file the W-4V form as soon as you start receiving eligible government payments to ensure taxes are withheld from the beginning. However, you can submit the form at any time during the receipt of these payments to start or change withholding.

4. How to file W-4V?

- Obtain the Form: You can find the W-4V form on the IRS website or request it from the agency responsible for providing your payments.

- Complete the Form: Fill in your personal information accurately, including your name, address, Social Security number, the specific type of payment for which you’re requesting withholding, and the percentage of withholding you want (usually 10%).

- Sign and Submit: Once completed, sign the form and send it to the appropriate payer, such as the agency or institution providing the payments. Ensure you keep a copy for your records.

- Review and Update: Circumstances might change, so it’s essential to review your withholding preferences periodically. If needed, you can file a new W-4V form with updated information or revised withholding percentages.

>>>GET SMARTER: Form 8917: What It Is, How to File It

Recap

Form W-4V is a simple and effective way to manage your tax liability. By voluntarily withholding federal income tax from your government payments, you can avoid a large tax bill at the end of the year and ensure that you’re meeting your tax obligations. If you’re receiving any of the payments listed above, consider filing Form W-4V to take advantage of this valuable tool.

Whether you’re a freelancer, retiree, or someone receiving government payments, understanding and utilizing the W-4V can contribute to a more stable and manageable approach to handling taxes.

The W-4V form might seem like a small piece in the vast puzzle of taxes, but its impact is substantial. By empowering you to choose voluntary federal income tax withholding from specific government payments, it offers a sense of control and foresight in managing tax obligations. This proactive approach not only helps you in avoiding potential tax debts and underpayment penalties but also assists in budgeting for taxes and easing financial stress.

Filing a W-4V isn’t merely about filling out a form; it’s a strategic step towards a more predictable and manageable tax journey. It grants individuals the authority to navigate their tax responsibilities, providing peace of mind and financial stability throughout the year.

Ultimately, understanding and utilizing the W-4V can be a vital tool in achieving financial control and ensuring a smoother tax experience. So, consider wielding the power of the W-4V to steer your tax future and gain greater confidence in managing your finances.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. . For comprehensive tax, legal or financial advice, always contact a qualified professional in your area. S’witty Kiwi assumes no liability for actions taken in reliance upon the information contained herein.

No Comment! Be the first one.