Our Verdict

U.S. Bank is a national bank headquartered in Minneapolis, Minnesota, with over 3,000 branches in 26 states across the United States. U.S Bank has branches in 26 states: Arkansas, Arizona, California, Colorado, Iowa, Idaho, Illinois, Indiana, Kansas, Kentucky, Minnesota, Missouri, Montana, North Carolina, North Dakota, Nebraska, New Mexico, Nevada, Ohio, Oregon, South Dakota, Tennessee, Utah, Washington, Wisconsin and Wyoming.

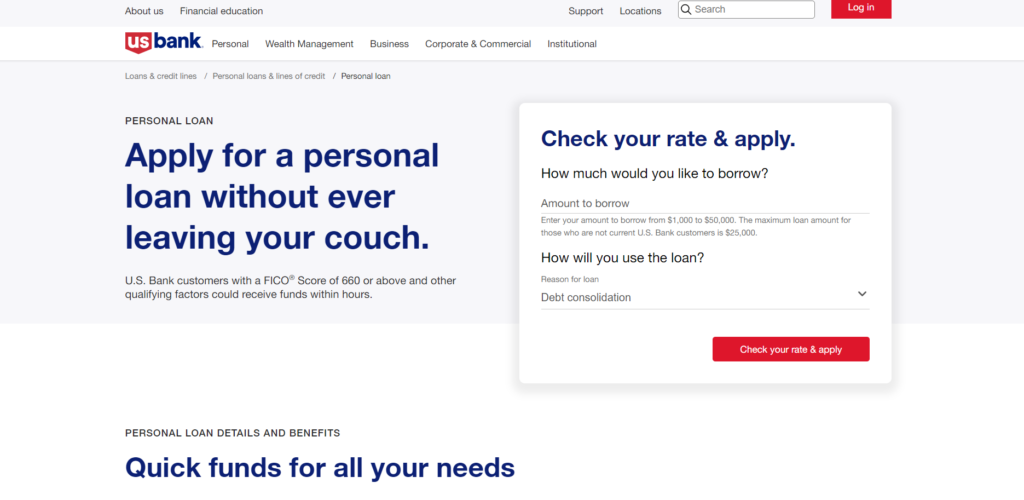

U.S. Bank also provides a wide range of financial products and services, including checking and savings accounts, online and mobile banking services mortgages, and credit cards. U.S. Bank is a reputable financial institution that provides customers with competitive interest rates and a quick online application process.

The official website for U.S. Bank is www.usbank.com.

Pros

- US Bank offers wide range of financial products and services.

- US Bank offers competitive interest rates on its products.

- US Bank doesn’t charge origination fees or prepayment penalties on its personal loans.

- US Bank provides a rewards program with its credit cards.

Cons

- Higher interest rates

- Lengthy application process

- Limited state availability

- Lower loan limits for non-U.S. Bank checking accounts

Who This Product Is Best For

U.S. Bank is best for individuals who:

- Need a smaller loan amount

- Value personalized customer service

- Want to finance a home project

- Have a checking account with U.S. Bank

- Want wide range of loan options

Who This Product Isn't Right For

Individuals who may not find U.S. Bank to be the best option are those who:

- Need a fast application process and quick funding

- Don’t meet the strict eligibility requirements

- Have poor credit scores

- Want lower interest rates

What This Product Offers

U.S. Bank Simple Loan: This is a short-term, unsecured loan that can be used for emergency expenses, such as car repairs or medical bills. This loan has a fixed fee rather than an interest rate.

Auto Loans: These are loans specifically designed for purchasing a new or used car.

Home Improvement Loans: These loans can help fund renovation or improvement projects, such as adding a new room, installing new windows, or upgrading a kitchen or bathroom.

Vacations: You can use personal loans to fund a dream vacation, whether it’s a trip around the world or a weekend getaway. With a personal loan, you can cover the cost of flights, hotels, rental cars, and other expenses.

Personal Lines of Credit: Personal lines of credit are a type of credit that allow you to access funds up to a predetermined limit on an as-needed basis. These credit lines have flexible repayment terms and variable interest rates.

Medical bills: Personal loans can help cover unexpected medical bills, which can be a significant burden on a household budget. Whether it’s a costly emergency room visit or ongoing medical treatment, a personal loan can provide the funds needed to pay for medical expenses.

Debt consolidation: One of the most common uses of personal loans is to consolidate high-interest debt. By taking out a personal loan, you can combine multiple debts into a single loan with a lower interest rate and a more manageable payment.

Product Details

U.S. Bank Simple Loan

The U.S. Bank Simple Loan is an emergency loan product offered to U.S. Bank customers with a personal checking account and a recurring direct deposit. The loan allows customers to borrow up to $1,000 to cover unexpected expenses, such as a car repair or medical bill. You can make loan repayment through automatic payments over three months, and there are no prepayment penalties if you choose to pay the loan off early.

It’s important to note that the U.S. Bank Simple Loan has fees of $6 for every $100 borrowed, which can add up quickly. As a result, it’s recommended that you use this loan as a last resort and explore other loan options, such as personal loans or credit cards, before taking out a Simple Loan.

Home Improvement Loan

The Home Improvement Personal Loan offered by U.S. Bank is a type of personal loan that is specifically designed to help you finance home renovation projects or other home-related expenses. You can use the loan for a variety of home improvement purposes, such as adding a new room, upgrading a kitchen or bathroom, or installing new windows or doors.

The loan is available to both existing U.S. Bank checking account customers and non-customers. Existing customers who qualify can borrow up to $50,000, while non-customers can borrow up to $25,000. The loan terms range from 12 to 60 months, with a fixed interest rate for the life of the loan.

U.S. Bank Personal Loan Details

U.S. Bank offers personal loans with loan amounts ranging from $1,000 to $50,000 for customers with a U.S. Bank checking account, and up to $25,000 for non-customers or customers based in California and Nevada. Loan terms range from 12 to 60 months for all customers. The APR ranges from 8.74% to 21.24%, with a 0.50% discount for borrowers enrolled in autopay. U.S. Bank does not charge origination fees, prepayment penalties, or fees for early payment. However, there is a late fee of $10 if payment is five days past due.

Where This Product Stands Out

Quick Funding

Get your personal loan funded on the same day with U.S. Bank, subject to approval by a certain time. This feature can benefit you in times of emergencies, covering your unexpected expenses without waiting for long processing times. However, eligibility for same-day funding may vary based on factors like creditworthiness, income, and loan amount. Before applying, read and review the terms and conditions carefully, as there may be additional fees or requirements associated with same-day funding.

No Prepayment Penalty Fees

Enjoy the flexibility of paying off your U.S. Bank personal loan early without any prepayment penalty fees. Take advantage of this feature to save money on interest charges and potentially reduce the overall cost of borrowing. Remember to review the terms and conditions carefully before applying and keep in mind that you may still need to pay any outstanding interest or fees that have accrued up to the date of prepayment.

Lower Interest Rates for Autopay

To save on interest charges, enroll in automatic payments (autopay) with U.S. Bank to receive a 0.50% interest rate discount. The discount is automatically applied, ensuring timely payments and potentially improving your credit score. By enrolling in autopay, you can save over $200 in interest charges on a $10,000 personal loan with a 3-year term. However, check if the autopay discount is available for your loan product and state, and carefully review the loan terms and conditions before applying.

No Origination Fees

Avoid origination fees with U.S. Bank’s personal loans. Other lenders may charge fees from 1% to 8% of the loan amount, but U.S. Bank doesn’t charge any origination fees. Save hundreds of dollars by receiving the full loan amount without paying any fees upfront. Remember to review the loan’s terms and conditions for other applicable fees such as late fees.

Where This Product Falls Short

No Prequalification Process

Consider eligibility requirements before applying for a U.S. Bank personal loan as U.S. Bank don’t offer a prequalification process, making it harder to know if you’re eligible without impacting your credit score. Be aware that a formal application may result in a hard credit inquiry, which can temporarily lower your credit score and make it harder to secure other forms of credit in the future.

Limited Loan Amounts

Consider other lenders if you need to borrow more than $50,000, as U.S. Bank’s personal loan limit may not be sufficient. Remember that the amount you are approved for will depend on factors such as your creditworthiness, income, and debt-to-income ratio. If you need to borrow a larger sum of money, you may want to consider other types of loans, such as a home equity loan or line of credit, which may offer higher loan amounts at competitive interest rates. Keep in mind, however, that using home equity as collateral for a loan can be risky, so it’s important to weigh the pros and cons carefully.

Limited Availability

Keep in mind that U.S. Bank personal loans are not available in all states. This means that you may not be eligible to apply for a loan due to the limited reach of U.S. Bank’s operations or licensing restrictions. If you reside in states where U.S. Bank personal loans are not available, it’s important to consider alternative lenders or loan products.

How to Qualify for This Product

You must already be a customer of U.S. Bank in order to be eligible for any of their personal lending products. It will be better if you have a checking account because it allows you access to all of the loan features.

U.S. Bank operates mostly in the Midwest and in 25 states. If a local branch is close to where you reside, you can create a checking account there or online.

You should make sure that you have good credit and enough income to cover the cost of the loan before applying as U.S. Bank withholds some eligibility requirements, such as the minimum credit score it will accept to grant you a loan. You must have a credit score of at least 660 to be eligible for a personal loan from U.S. Bank, but the lowest rates almost certainly require a score of at least 720.

No specific requirements for income are listed by U.S. Bank. The amount of money you can borrow and the interest rate you’ll pay depend in part on your income.

How to Apply for This Product

U.S. Bank representatives did not disclose any specific information regarding the application requirements for their personal loans. Instead, U.S. Bank indicated that the requirements may vary depending on the applicant’s situation and suggested that interested applicants speak with a U.S. Bank personal loan banker to learn more. However, as with most personal loan applications, there are certain standard documents that applicants should expect to provide, along with any additional requirements specific to the lender:

- Name

- Address

- Date of birth

- Proof of identity, such as a driver’s license

- Social Security number

- Annual income

- Proof of income, such as bank statements

- Verification of employment

Alternative to This Product

SoFi

With a co-signer who pushes your application into the super-prime category, SoFi is suitable for those with decent or excellent credit. You may receive a reduced rate and no costs due to your excellent score. You can get up to $100,000 loan—it also includes unemployment insurance.

LightStream

With loans up to $100,000 at incredibly low rates and no fees, LightStream is comparable to SoFi in many ways. To qualify for the greatest offers, you must have excellent credit or a stellar co-signer. Your credit score will suffer slightly when you apply because it is owned by a bank (Truist, previously SunTrust).

Bank of America

Bank of America offers personal loans with fixed interest rates, flexible repayment terms, and loan amounts up to $100,000. The bank also offers a discount for existing customers.

Customer Reviews

With more than 300 reviews, U.S. Bank has a rating of 1.3 out of 5 stars on TrustPilot. Numerous customer reviews criticize U.S. Bank for its subpar customer support. Therefore, use caution when interpreting these evaluations. These ratings apply to the entire U.S. Bank, not just its personal loan division.

Methodology

We reviewed *this product* based on 20 data points in the categories of loan details, loan costs, eligibility and accessibility, customer experience and the application process. We rated *this product* based on the weighting assigned to each category:

- Loan cost: 35%

- Loan details: 25%

- Customer experience: 20%

- Eligibility and accessibility: 10%

- Application process: 10%

Within each major category, we also considered several characteristics, including available loan amounts, repayment terms and applicable fees. We also looked at minimum credit score and time in business requirements and the geographic availability of the lender. Finally, we evaluated *this product* customer support tools, borrower perks and features that simplify the borrowing process—like online applications, prequalification options and mobile apps.

No Comment! Be the first one.