Imagine this: you’re on the tax road, navigating through the twists and turns of your return, and suddenly, there it is – Schedule B (Form 1040A or 1040). Intriguing, right? Now delve into what it is and how to conquer it.

Picture Schedule B as your financial GPS, guiding you through the realm of interest and dividend income reporting. Essentially, it’s the chapter in your tax saga where you unveil the extra earnings from your investments.

Now, why is this important? The IRS is keen on knowing about the money your investments are bringing to the table. Schedule B is like turning on a spotlight on that specific corner of your financial landscape. But fear not—it’s not as daunting as it may seem.

Filing Schedule B is akin to adding a financial dimension to your tax narrative. Got accounts racking up interest or dividends? This is where you spill the beans. It’s a pivotal part of the tax expedition, ensuring that your state government is in the loop about your financial ventures.

But how do you tackle it? It’s not rocket science, believe it. Grab your Form 1040 or 1040A, venture into Schedule B, and start jotting down those interest and dividend figures. It’s like giving your finances a moment in the tax limelight.

So, Schedule B: It’s not just about numbers; it’s about deciphering your financial narrative and ensuring the IRS is on board. Stay tuned, because exploring Schedule B is like unlocking the next level of your tax adventure. Are you ready to take the plunge?

To know what Schedule B is (1040A or 1040) and how to file it:

- Know Schedule B Purpose

- Understand Filing Requirements

- Identifying Interest Income

- Reporting Dividend Income

- Foreign Accounts and Trusts

- How to File Schedule B (1040A or 1040)

Recap

1. Know Schedule B Purpose

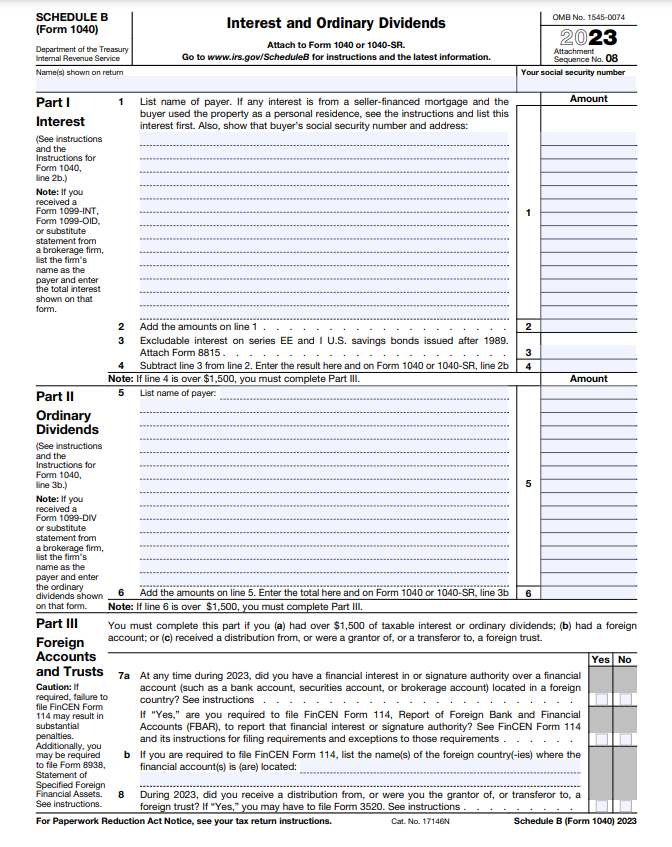

Schedule B is a tax form used to report interest and dividend income. It is attached to Form 1040A or Form 1040 when filing your federal income tax return. On Schedule B, you list the sources of your interest and dividend income, along with the respective amounts.

So, Schedule B is like the sidekick to your main tax form—either the 1040A or 1040—to help you declare interest and dividend income. Think of it as your financial report card for the interest and dividends you’ve earned throughout the year.

Here’s the lowdown on how to file it. First things first, make sure your interest and dividend information is in order—meaning, sources, and amounts. Then, slot those details into the designated sections on Schedule B.

Once you’ve played matchmaker between your money and the right Schedule B boxes, add up those amounts for both interest and dividends. The grand totals can be found way back on your main tax form, where Schedule B becomes a sort of attachment or appendix, showing the IRS that you’ve got your financial ducks in a row.

Now, keep in mind that not everyone needs to whip out Schedule B. If your interest and dividend game is below a certain threshold, you might get a pass. It’s always good to double-check the latest IRS guidelines or consult with a tax professional if you’re in doubt.

2. Understand Filing Requirements

If you receive more than $1,500 in interest or dividends, then Schedule B is your go-to. It’s like the VIP pass if you earn a bit extra on the side. Now, imagine you have foreign accounts or sweet distributions from foreign trusts—yep, Schedule B is calling your name. It’s your ticket to keeping things transparent with the IRS.

And here’s a heads-up: if there’s a tax bill coming your way due to early distributions, excess contributions, or any tax-related hiccups linked to special tax-favored accounts, Schedule B is your ally. It’s the paperwork superhero that helps you navigate these twists and turns.

So, if any of these scenarios hit close to home, don’t sweat it—just grab Schedule B and tackle it head-on. It’s your tool to show the IRS that you’re on top of your financial game.

>>>PRO TIPS: Federal Tax Credit for Residential Solar Energy

3. Identifying Interest Income

To accurately report your interest income, you should compile essential documents. Begin by collecting your bank statements, which detail transactions and interest earned. Additionally, gather 1099-INT forms provided by financial institutions, as these specifically outline interest income. Any relevant documentation showcasing the interest you accrued over the year is crucial for a comprehensive report.

Your primary focus should be on Schedule B, where you consolidate this information. This section demands a meticulous approach; ensure that the total interest amount is accurately entered. By adhering to these steps, you not only fulfill reporting requirements but also present a clear and transparent financial picture.

Remember, the IRS places significance on accuracy and completeness in income reporting. Therefore, attentiveness to detail and organization in assembling these documents can facilitate a smoother process. By following these guidelines, you demonstrate a commitment to financial responsibility, aligning with the standards set forth by tax regulations. This ensures that your reporting is both professional and in compliance with the necessary protocols.

4. Reporting Dividend Income

In managing your financial affairs, you need to address dividend income with precision. You must report your dividend income on Schedule B, a pivotal step akin to the reporting of interest income. To navigate this, compile all pertinent documents, primarily the 1099-DIV forms and any additional statements furnished by financial institutions disclosing your dividend earnings. These documents serve as the bedrock for accurate reporting on Schedule B.

As you delve into this process, direct attention to detail ensures a seamless and error-free reporting mechanism. The imperative is to enter the total dividend income meticulously on Schedule B, as this form serves as the nexus for detailing such financial transactions. Your guarantee guarantees compliance and accuracy, safeguarding against potential discrepancies.

By adhering to these procedural guidelines, you fortify your financial reporting framework, aligning it with regulatory requirements. This conscientious handling of dividend income encapsulates a comprehensive financial responsibility, underscoring the significance of methodical record-keeping. In essence, you are empowered to navigate the nuances of dividend reporting confidently, fostering financial transparency and compliance within the purview of Schedule B.

>>>GET SMARTER: Form 8917: What It Is, How to File It

5. Foreign Accounts and Trusts

In disclosing foreign financial involvement, acknowledge any vested interest or role in foreign accounts on Schedule B. This step ensures a comprehensive representation of your financial landscape. If there are distributions from foreign trusts that came your way, the form mandates the provision of pertinent details. This process aligns with regulatory requirements, underscoring the significance of accurate and transparent reporting.

By adhering to these guidelines, you not only fulfill regulatory obligations but also contribute to the integrity of your financial disclosures. Addressing such matters with precision exhibits a commitment to compliance and responsible financial stewardship. Your participation in this documentation process facilitates a clear understanding of your financial activities, fostering trust and transparency.

In essence, this protocol emphasizes the necessity of meticulous reporting on Schedule B, embodying a commitment to compliance and financial transparency. Your conscientiousness toward these requirements showcases a dedication to sound financial practices and regulatory adherence.

6. How to File Schedule B (1040A or 1040)

When filing your tax return, adhere to specific steps for Schedule B. To begin, attach Schedule B to either your Form 1040A or Form 1040, serving as a vital supplement to your federal income tax submission. This seamless integration streamlines the filing process, ensuring a comprehensive overview of your financial transactions.

Maintaining precision during form completion is paramount. Oversight or mistakes in the information provided on Schedule B can trigger audit requests or cause delays in processing. Your attention to detail not only fosters a smooth filing experience but also mitigates potential complications down the road.

As you navigate through the form, bear in mind the significance of retaining all supporting documents. These documents act as a safeguard for your financial history, serving as a reference point if needed. This not only aligns with best practices but also with the standards required for tax compliance.

When filing Schedule B, ensure that you choose the appropriate filing status based on your individual situation. The options include single, married filing jointly, married filing separately, head of household, and qualifying widow(er).

Attaching Schedule B correctly and accurately and completing the form is a pivotal aspect of your tax responsibilities. By following these guidelines diligently, you contribute to a seamless filing process and establish a solid foundation for financial transparency.

Recap

Schedule B is the go-to document for reporting interest and dividend income. It’s your financial diary, noting the extra cash that’s quietly accumulating in your accounts. Filing it correctly ensures you’re in harmony with the IRS, avoiding any off-key moments in your tax return.

List every source of interest and dividends with precision; the IRS appreciates your thoroughness. Be aware of the income thresholds that trigger the need for filing Schedule B. Missing this can be a costly oversight.

Ensure your bank and investment institutions send you the correct tax documents. Accuracy is your backstage pass to a smooth filing. If you cashed in savings bonds, it belong on Schedule B. It’s a key note in your financial melody. If you have foreign accounts, take note—Schedule B requires additional disclosure. It’s like a special solo in your tax performance.

Know your dividends and differentiate between qualified and non-qualified dividends; each has its own tax implications, creating a nuanced melody in your financial composition.

Don’t be fashionably late with your filing; timely submission avoids the dissonance of penalties.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. . For comprehensive tax, legal or financial advice, always contact a qualified professional in your area. S’witty Kiwi assumes no liability for actions taken in reliance upon the information contained herein.

No Comment! Be the first one.