Our Verdict

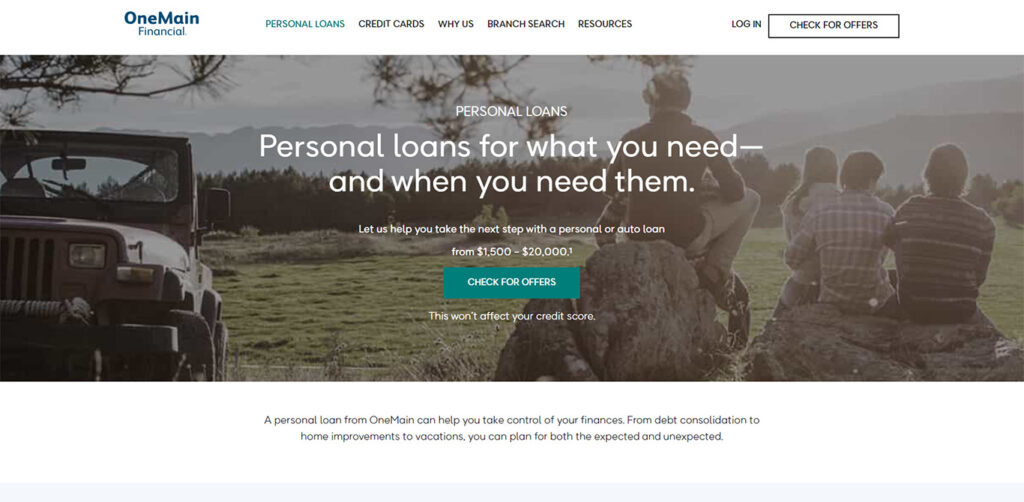

When considering personal loans, be sure to check out OneMain Financial. With OneMain Financial, you can get loans ranging from $1,500 to $20,000 with repayment terms from 24 to 60 months. For secured loans, they accept collateral such as a car title or savings account.

Visit their user-friendly website to access loan applications, payment options, and frequently asked questions. They have over 1,500 branches across 44 states in the US for in-person consultations.

But don’t stop there. Be sure to compare rates and terms from multiple lenders to find the best fit for your financial needs. And as always, read customer reviews and do your research before choosing a lender.

Visit OneMain’s website at www.onemainfinancial.com or give them a call at 1-800-961-5577 for more information.

Pros

- Offers personal loans ranging from $1,500 to $20,000

- Provides secured loans with collateral options

- Operates in 44 states with over 1,500 branches available for in-person consultations

- User-friendly website with loan applications, payment options, and frequently asked questions

Cons

- Interest rates can be high, particularly for those with lower credit scores

- Limited online options for loan applications and customer service

- Secured loans put collateral at risk in the event of default

- Personal loan amounts are lower compared to some other lenders

Who This Product Is Best For

OneMain personal loan may be best suited for individuals who:

- Need to borrow a smaller amount of money, as OneMain offers loans starting at $1,500.

- Prefer the option of in-person consultations and access to physical branches.

- Are comfortable offering collateral for a secured loan option.

- Need a simple and straightforward loan application process.

Who This Product Isn't Right For

OneMain personal loan may not be the best fit for individuals who:

- Need a larger loan amount

- Don’t have collateral for secured loans

- Want a longer repayment term

- Prefer an entirely online lending experience

What This Product Offers

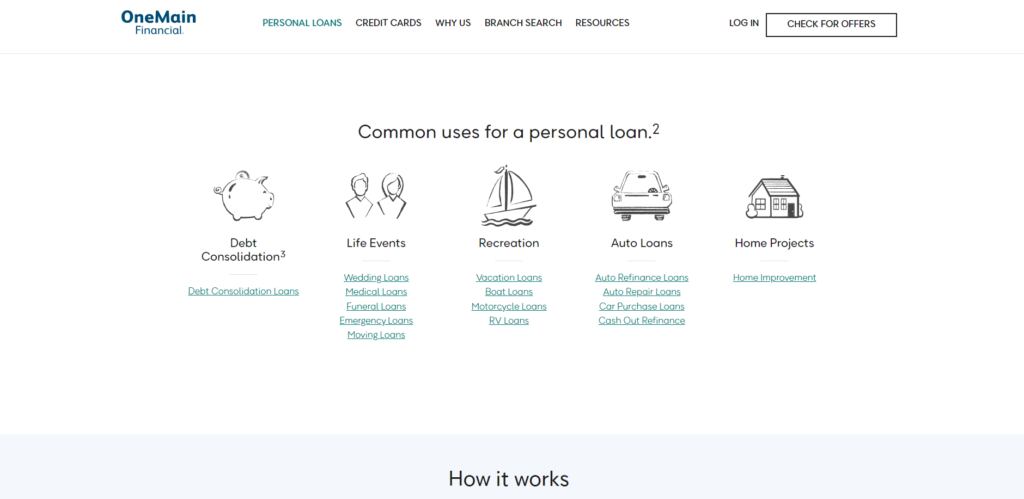

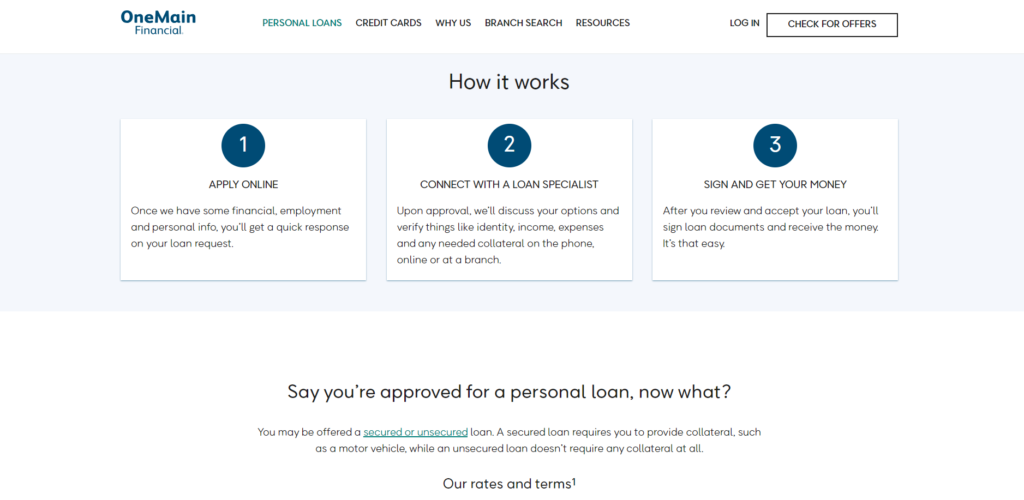

Secured personal loans: If you are looking for lower interest rates, OneMain offers secured personal loans that require collateral, such as a car title or savings account. However, make sure you can afford the payments, as defaulting on payments could result in losing your collateral.

Unsecured personal loans: Apply for an unsecured personal loan from OneMain by filling out an online application or visiting a branch in-person. These loans are based on your creditworthiness and don’t require collateral.

Product Details

Secured personal loans

OneMain offers secured personal loans with loan amounts ranging from $1,500 to $25,000, with repayment terms of 24 to 60 months. The APR on these loans also varies based on factors such as creditworthiness and loan term, but typically ranges from 14.74% to 35.99%.

Keep in mind that OneMain may charge an origination fee for secured personal loans, which can range from 1% to 10% of the loan amount depending on your creditworthiness and other factors. This fee is deducted from the loan proceeds and can impact the overall cost of the loan.

Unsecured personal loans

If you’re in need of an unsecured personal loan, OneMain may be a convenient option for you. With loan amounts ranging from $1,500 to $20,000 and flexible repayment terms, you can find a loan that suits your financial needs. However, keep in mind that the interest rates on these loans can be higher for those with lower credit scores. It’s always a good idea to compare rates and terms from multiple lenders to ensure you’re getting the best deal possible.

Loan Amount | $1,500 to $20,000 |

APR | 18.00% to 35.99% |

Repayment Terms | 24 to 60 months |

Origination Fee | 1% to 10% |

Late Payment Fee | 1.5% to 15% |

Where This Product Stands Out

Simplify debt consolidation: Simplify your debt repayment process with OneMain Financial’s direct payment option. Have your loan funds sent directly to your other high-interest debt creditors for added convenience. Remember to monitor your accounts until they’re fully paid off, as it can take up to 15 days for funds to transfer to some creditors.

Access to physical branches: If you prefer to speak to a loan officer in person, OneMain has branches in all 44 states where it offers personal loans. While it’s possible to get a loan without visiting a branch, if you feel more comfortable interacting with someone face-to-face, you have the option to do so at a OneMain branch.

Take control of your payment schedule: With OneMain Financial, you have the power to choose your payment date at the time of loan agreement and can adjust it twice throughout the loan term. This is a valuable feature that allows you to adapt to changes in your income and expenses, such as starting a new job or receiving pay on a different schedule. Don’t hesitate to take advantage of this flexibility to make managing your loan payments more convenient.

Quick funding: Get fast funding with OneMain Financial, which offers instant loan approval and typically disburses funds within one to two business days. While some lenders offer same-day funding, it’s common for most personal loans to take a day or two for funds to become available. Apply for a loan with OneMain and get the funds you need quickly.

Where This Product Falls Short

No discounts on interest rates: To put it simply, OneMain Financial doesn’t offer any rate discounts, which is something to consider when comparing lenders. While some lenders may offer rate discounts for setting up automatic payments or using the direct payment feature on debt consolidation loans, OneMain doesn’t have such offers available. This is something to keep in mind while considering different personal loan options.

Limited online options: If you prefer to manage your loans online, OneMain Financial’s digital tools and resources may be limited compared to other lenders. Although the lender provides an online loan application, you may want to explore other lenders if online options are a top priority.

Origination fees: Take note that OneMain Financial may charge an origination fee for personal loans that can go as high as 10% of the loan amount, which could affect the total cost of the loan. Be aware that this fee may be more expensive than what other lenders charge.

High interest rates: Be aware that OneMain Financial’s interest rates can be considerably high, with rates ranging from 18% to 35.99%, based on your creditworthiness and other factors, despite offering both secured and unsecured personal loans.

How to Qualify for This Product

To qualify for a personal loan with OneMain Financial, you must meet certain criteria. Here are some general requirements:

Age: You must be at least 18 years old.

Residence: You must be a resident of one of the 44 states where OneMain Financial offers loans.

Income: You must have a verifiable source of income.

Credit history: OneMain Financial considers applicants with all credit types, but a good credit score can help you qualify for a lower interest rate.

Collateral: To qualify for a secured personal loan, you must have collateral that meets OneMain’s requirements.

Keep in mind that meeting these requirements does not guarantee approval, as OneMain Financial will also consider other factors when evaluating your application.

How to Apply for This Product

You can apply for a personal loan from OneMain Financial online or in person at one of their branch locations. Here are the steps to apply:

- Visit OneMain Financial’s website or go to a branch location to start your application.

- Provide your personal information, such as your name, address, and Social Security number.

- Enter your employment information, including your employer’s name, your job title, and your income.

- Choose the loan amount and term that you want.

- Submit your application and wait for a decision.

- If approved, review the loan offer and sign the loan agreement.

- Provide any additional documentation that OneMain requests, such as proof of income or identification.

Keep in mind that the exact application process may vary depending on your location and the loan product you’re applying for. It’s always a good idea to review the specific requirements and documentation needed before applying.

Alternative to This Product

Discover: Discover offers personal loans ranging from $2,500 to $35,000 with interest rates starting at 6.99%. Repayment terms are between three to seven years. Discover does not charge any origination fees, prepayment fees, or late fees. Discover operates in all states except Iowa, Maine, and North Dakota.

Avant: Avant offers personal loans ranging from $2,000 to $35,000 with interest rates starting at 9.95%. Repayment terms are between two to five years. Avant charges an administration fee of up to 4.75% of the loan amount, and late fees may apply. Avant operates in all states except Colorado, Iowa, Vermont, and West Virginia.

LendingClub: LendingClub offers personal loans ranging from $1,000 to $40,000 with interest rates starting at 6.95%. Repayment terms are between three to five years. LendingClub charges an origination fee of up to 6% of the loan amount, and late fees may apply. LendingClub operates in all states except Iowa.

Customer Reviews

OneMain Financial has mixed reviews on different websites, with a 3.1 out of 5 rating on the Better Business Bureau (BBB) and a higher rating of 4.8 out of 5 on Trustpilot. It can be challenging to evaluate the company’s overall performance since it has physical branches located in different areas. It’s always a good idea to do your own research and read customer reviews from multiple sources before making a decision about a lender.

Methodology

We reviewed this product based on 20 data points in the categories of loan details, loan costs, eligibility and accessibility,

customer experience and the application process. We rated *this product* based on the weighting assigned to each category:

- Loan cost: 35%

- Loan details: 25%

- Customer experience: 20%

- Eligibility and accessibility: 10%

- Application process: 10%

Within each major category, we also considered several characteristics, including available loan amounts, repayment terms and applicable fees. We also looked at minimum credit score and time in business requirements and the geographic availability of the lender. Finally, we evaluated *this product* customer support tools, borrower perks and features that simplify the borrowing process—like online applications, prequalification options and mobile apps.

No Comment! Be the first one.