If you’re a business owner seeking financial flexibility and tailored benefits, exploring the Kinecta business credit cards can be a game-changer for your enterprise. The Kinecta business credit cards offer a range of features designed to streamline your financial management, enhance spending control, and unlock rewards that align with your business needs.

In this guide, you’re going to delve into the application process, key features, and advantages of the Kinecta business credit cards, empowering you to make the right choice that aligns with your company’s financial objectives.

How to Get a Kinecta Business Credit Card

1. Understand the Kinecta Business Credit Cards

2. Explore Eligibility Criteria

3. Know the Application Process

4. Pay Attention to Your Credit Score

5. Learn Tips for Responsible Credit Card Usage

1. Understand the Kinecta Business Credit Cards

To get a Kinecta business credit card, know different business credit cards the financial institution offers.

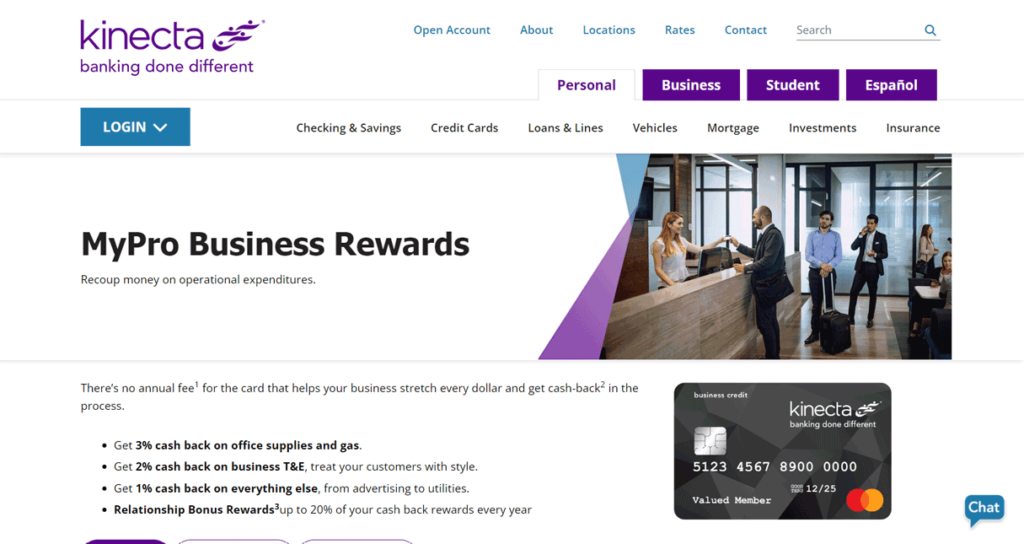

- MyPro Business Rewards: This business credit card gives you cash-back rewards on common business expenses, such as office supplies, gas, and travel. There is no annual fee, and you can earn up to 20% annual relationship bonus based on your Kinecta membership and services. You can also enjoy benefits such as mobile phone protection, car rental insurance, and contactless technology.

- MyPower Business Credit Card: This Kinecta business credit card has no fees and low interest rates, making it a great option for you if you want to save money and control your spending. There are no fees for annual, late, balance transfer, cash advance, or foreign transactions. You can also access features such as online banking, digital wallet compatibility, and debt cancellation protection.

>>>MORE: How to Get a Kinecta Credit Card

2. Explore Eligibility Criteria

To obtain a Kinecta credit union business credit card, explore the eligibility criteria which necessitate that you must:

- Be a Kinecta member or eligible to become one. Kinecta membership is open to anyone who lives, works, worships, or attends school in selected areas of California, as well as the person’s immediate family members.

- Have a business you register and operate in the United States, and provide proof of business address, such as utility bills or tenancy agreements.

- Possess a good credit history and a sufficient income level to repay your credit card debt. Kinecta checks your personal and business credit scores, income statements, and tax returns to evaluate your creditworthiness.

- Be at least 18 years old (19 in AL and NE) and have the authority to borrow on behalf of your business.

3. Know the Application Process

To receive a Kinecta business credit card, know the application process. Applying for a Kinecta business credit card is straightforward. To start,

- Fill the business credit card application form and provide your business information, such as legal name, address, phone, email, tax ID, revenue, etc.

- Provide proof of residency and income, such as a driver’s license, utility bill, lease agreement, pay stub, tax return, or letter from your employer.

- Pay a membership fee of $5.00 if you’re not yet a member.

- Submit your application online or in person and wait for a credit approval decision.

Pay attention to detail and provide every information you need while filling the application form online. All you need to do is:

- Go to the Kinecta MyPro Business Rewards page and click on the Apply Now button.

- Log in to your Kinecta online banking account or enroll as a new member.

- Fill out the business credit card application form with your business information, such as legal name, address, phone, email, tax ID, revenue, etc. You can download a PDF version of the form for reference.

- Upload or attach the required documents, such as proof of residency and income, membership fee receipt, etc.

- Review and submit your application and wait for a credit approval decision.

You can also apply in person at a Kinecta branch or by phone at 800.854.9846. For more information, you can visit the Kinecta FAQ page or contact the financial institution’s customer service.

>>>PRO TIPS: Best Kinecta Credit Cards

4. Pay Attention to Your Credit Score

To get a Kinecta business credit card, pay attention to your credit score. Your credit score serves as a crucial factor in determining your creditworthiness and influences the terms and conditions of the credit card offer. A higher credit score generally enhances your chances of approval and can qualify you for more favorable interest rates and credit limits.

It’s essential to regularly monitor your credit report, address any discrepancies, and take proactive steps to improve your score if need be. A strong credit profile not only increases the likelihood of approval for the Kinecta business credit card but also positions you to leverage the business credit card’s features and benefits more effectively for your business needs.

5. Learn Tips for Responsible Credit Card Usage

To apply for a Kinecta business credit card, learn tips for responsible credit card usage. Mastering tips for responsible credit card usage is important to maintaining financial health and maximizing the benefits of your Kinecta business credit card. First and foremost, strive to pay your bills on time to avoid late fees and negative impacts on your credit score. Keep a close eye on your spending, staying within your budget to prevent accumulating excessive debt.

Regularly review your credit card statements to identify any unauthorized charges and track your expenses. It’s wise to pay more than the minimum amount due to reduce interest costs and pay off balances promptly. Additionally, be cautious with cash advances and consider the long-term financial implications of each purchase. By adopting responsible credit card habits, you can build a positive credit history, enjoy the perks of your card, and secure a solid financial foundation for your business.

>>>GET SMARTER: Best Kinecta Business Credit Cards

Recap

To successfully acquire a Kinecta business credit card, start by gaining a comprehensive understanding of its features and benefits. Next, explore the eligibility criteria, ensuring your business meets the necessary requirements, including legal status, revenue, and Kinecta membership. Familiarize yourself with the application process, providing essential documentation like business address proof.

Pay meticulous attention to your credit score, as it plays a pivotal role in approval and influences card terms. Lastly, incorporate responsible credit card habits, such as timely payments, staying within budget, and vigilant monitoring, to maximize the advantages of your Kinecta business credit card and foster a positive financial outlook for your business.

No Comment! Be the first one.