Introduction

Thinking about getting yourself a Discover credit card? Awesome choice! Discover offers fantastic benefits, like cash back rewards, free access to your FICO® Score access, and excellent customer service. But before you dive in, here is a quick rundown of the steps to get your hands on that shiny new card.

To get a Discover credit card

- Know Discover Credit Card Options and Benefits

- Confirm Your Eligibility

- Review Your Credit Score

- Understand Your Credit Score Requirements

- Compile Relevant Documents

- Request Your Discover Credit Card Preference

- Maximize Your Approval Chances

Recap

Educative, right? Keep reading.

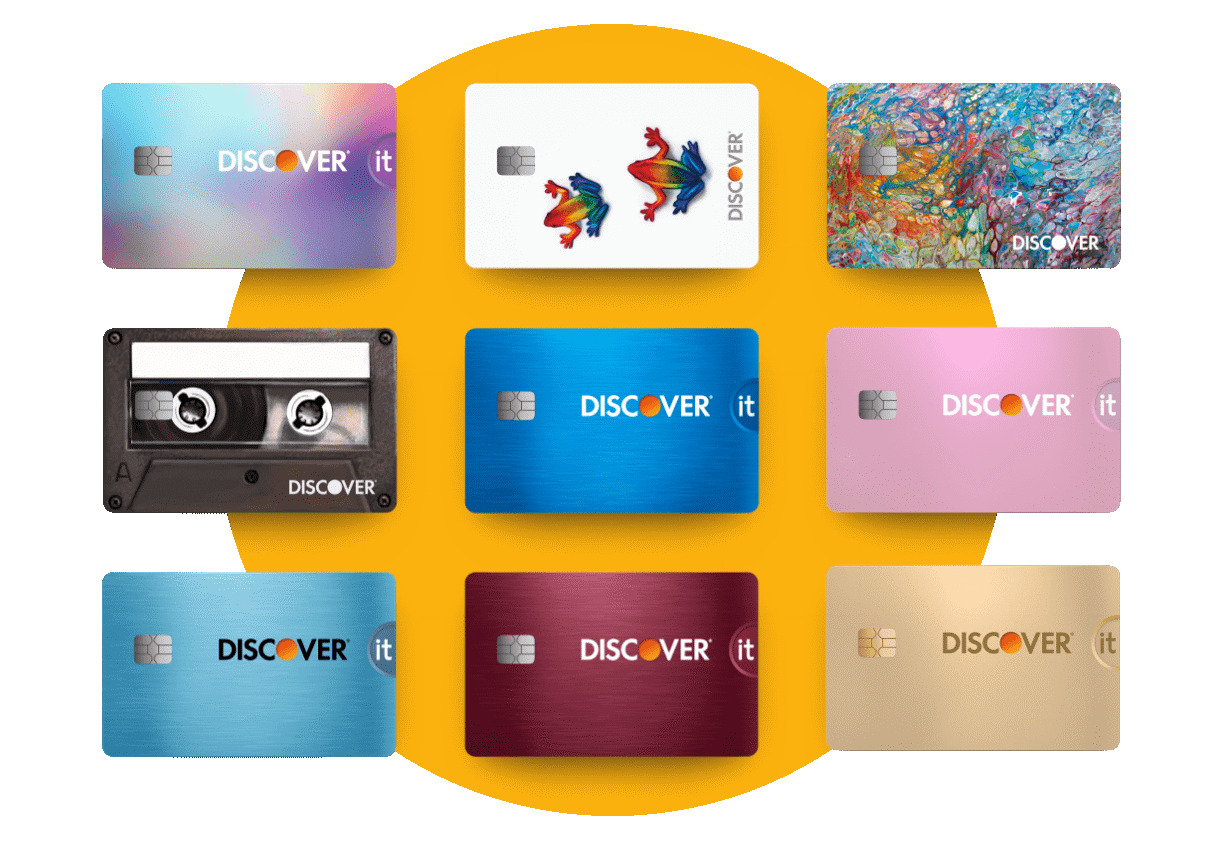

1. Know Discover Credit Card Options and Benefits

To secure a Discover credit card, know Discover credit card options and benefits.

Cash Back Credit Card

Earn cash back on everyday purchases, up to the quarterly maximum. Enjoy automatic cash-back matching in the first year.

Travel Credit Card

Earn miles on every dollar you spend, redeemable for travel purchases or cash. Get automatic miles matching in the first year.

Student Cash Back

Get cash back on everyday purchases up to the maximum limit every three months.

Student Gas & Restaurants

Earn cashback on gas stations and restaurants (up to $1,000/quarter).

Secured Credit Card

Build or rebuild credit with responsible use. Start with a refundable deposit ($200 minimum) and earn cash back on all purchases.

>>>MORE: How to Pay Off ChexSystems

2. Confirm Your Eligibility

To procure a Discover credit card, confirm your eligibility.

To meet the requirements for a Discover credit card, you must:

- Be at least 18 years of age

- Have a U.S. address.

- Possess a valid Social Security number.

- Demonstrate that you have your source of income.

- Have a U.S. bank account.

- Maintain a good credit score (670 or above) for most cards, except for the secured and student cards.

- Show proof of enrollment in a college or university if you are applying for a student card.

- Provide a refundable security deposit of at least $200 if you are requesting a secured card.

Discover offers a convenient way to check if you’re fit for a credit card on its website, with no impact on your credit score. Take advantage of this opportunity to see which card you qualify for, along with its interest rates and terms.

Remember, pre-approval is not a guarantee of approval, so don’t forget to submit a formal application to apply for your Discover credit card.

3. Review Your Credit Score

To get a Discover credit card, review your credit score.

Check your credit history and score. Your credit score is a crucial factor to determine your suitability for a Discover credit card. It reflects your credit rating and depends on various factors, including your payment history, credit usage, credit history length, types of credit, and new credit inquiries.

Check your FICO score with the three major credit bureaus (Equifax, TransUnion, and Experian) and make complaints if you notice any inaccuracies in your credit report. Discover uses the FICO® Score 8 model, which ranges from 300 to 850, to assess your credit reputation.

4. Understand Your Credit Score Requirements

To obtain a Discover credit card, understand your credit score requirements.

The minimum credit score you need for a Discover credit card varies depending on the type of card you’re interested in.

To qualify for most Discover cards, like Discover it® Cash Back, you need a good or excellent credit score (670+). If your score is below 640, consider the Discover it® Secured Credit Card with a minimum $200 refundable security deposit as your credit limit.

Use Discover’s pre-qualification tool to check eligibility without hurting your credit score, but approval depends on factors like income, payment history, and credit utilization. Choose wisely for your credit situation and financial goals.

5. Compile Relevant Documents

To acquire a Discover credit card, compile relevant documents.

You need to gather some important documents and information. Make sure you have the following ready:

- Your full name, Social Security number, birth date, and address

- Details about your annual income and your current employer

- Proof of your enrollment in a college or university, if you’re a student applying for a student card

- Security deposit of at least $200 (refundable), for a secured card application.

>>>PRO TIP: How to Check Your Credit Score

6. Request Your Discover Credit Card Preference

To snag a Discover credit card, request your Discover credit card preference.

Apply through:

Online Application

Go to the Discover website, pick your card option, and fill out the online form with your personal and financial information. Remember to read and agree to the terms and give authorization for a credit inquiry. Hit submit and get an instant decision. If you get an endorsement, review the offer details, and if you like it, accept it. Your shiny new card arrives in your mailbox within 7 to 10 business days.

Discover Mobile App

Want even more convenience? Download the Discover app from the App Store or Google Play. Sign in or create an account, select your card, and tap “Apply Now.” Fill out the form and consent to the credit examination. You get an instant decision and see all the offer details. Review it carefully, and if it suits you, accept it. Your new card is on its way in 7 to 10 business days.

Physically at a Local Branch

If you’re near a branch, drop by and chat with a friendly representative. Bring your ID, proof of income, and address. Fill out the application form and submit it. You get a quick decision and see your offer details. Examine it, and if it works for you, accept it. You get your card within 7 to 10 business days.

You can check your application status online or give Discover’s customer service a call to confirm.

7. Maximize Your Approval Chances

To receive a Discover credit card, maximize your approval chances.

To boost your chances of getting a Discover credit card approval:

Choose the Right Card

First, pick the perfect card that matches your needs and credit profile. If your credit score isn’t top-notch, consider the Discover It® Secured card. For travel rewards, go with the Discover It® Miles card.

Check Pre-Approval Status

You save time and stress when you check if you’re pre-approved. Use Discover’s online tool or watch out for an invitation in your mailbox. It doesn’t affect your credit score!

Apply with a Strong Credit Score

Make sure your credit score is in top shape before you seek a Discover credit card. Avoid applying when you have a low score due to late payments, high balances, or too many inquiries.

Improve Debt-to-Income Ratio

Lower your debt and boost your income to improve your chances. Clear current debts, increase your income with a raise or side hustle and show you can handle credit card payments.

Be Honest and Responsive

Give accurate and complete information when you apply. Be quick and responsive. Show that you’re reliable and trustworthy.

Recap

To get a Discover credit card, explore its benefits and eligibility, review your credit score, understand your credit score requirements, and compile relevant documents. Apply online, via the app, or in person, then choose the right card for your needs. Consider pre-approval and be honest during the process. Relish the rewards of a Discover credit card.

No Comment! Be the first one.