It’s crucial you understand Form W-4 when considering your take-home pay. This form determines the amount of federal income tax that will be withheld from your paycheck. It directly impacts your financial well-being by influencing the money you bring home after taxes.

By accurately filling out the Form W-4, you can tailor the withholding to your specific situation, ensuring you neither owe a large amount nor receive a significant refund during tax season. The form considers various elements like marital status, dependents, additional income, and deductions.

Each detail influences the calculation, directly impacting the dollars you take home. This guide will equip you with important information about your Form W-4 so you can manage your finances efficiently and ensure you have a reliable understanding of how your take-home pay is determined.

Form W-4 and Your Take-Home Pay:

- W-4 Purpose: Tax Withholding

- Marital Status Impact

- Dependents and Deductions

- Income Adjustments

- Tailoring Tax Withholding

- Filling Out W-4 Accurately

- Calculation Precision Matters

- Tax Efficiency Strategies

Recap

1. W-4 Purpose: Tax Withholding

The Form W-4 serves a vital role in determining how much tax is withheld from your paycheck. It’s not just a routine document but a tool that directly impacts the money you take home. When you fill it out accurately, you essentially tailor how much federal income tax is deducted from each paycheck.

Why does this matter? Well, it directly influences your take-home pay, ensuring you don’t owe a hefty sum at tax time or receive an unexpectedly large refund. It considers your filing status, dependents, additional income, and potential deductions, making sure the withholding aligns with your situation.

2. Marital Status Impact

Your marital status plays a pivotal role in determining how much tax is withheld from your paycheck through the Form W-4. It’s not just a personal detail; it significantly impacts your take-home pay.

When you indicate your marital status on this form, you affect the amount of federal income tax that gets deducted. Whether you’re single, married filing jointly, or married filing separately, your status directly influences how your earnings are taxed.

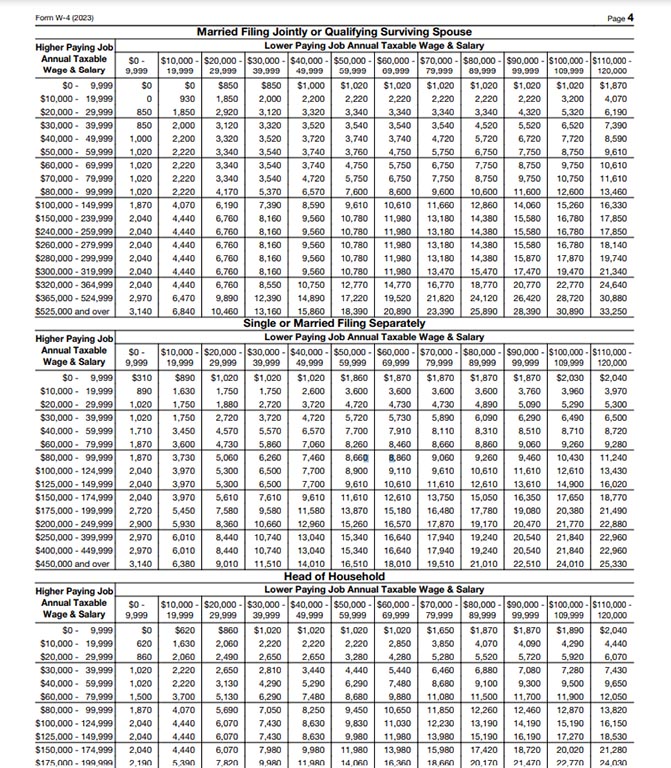

For instance, choosing ‘married’ typically results in lower tax withholding compared to ‘single.’ So, make sure you understand this impact as it allows you to accurately represent your status on the W-4, ensuring your withholding aligns with your circumstances. It’s a key detail that contributes to the precision of your take-home pay calculation.

3. Dependents and Deductions

When it comes to your Form W-4, the number of dependents and deductions you claim directly shapes the tax withheld from your paycheck. This isn’t just about numbers; it’s about influencing how much of your income goes toward taxes.

When you specify the number of dependents, you’re essentially adjusting the withholding to match your financial responsibilities. Think about it: each dependent you claim typically reduces your taxable income, which in turn affects the amount withheld.

Moreover, deductions like mortgage interest or charitable contributions also impact your taxable income. These details on the W-4 aren’t just checkboxes; it is a powerful tool for shaping your tax withholding. Comprehend the significance of these elements as it empowers you to accurately reflect your financial situation on the form, ensuring a more precise calculation of your take-home pay.

4. Income Adjustments

Your income adjustments are vital when filling out the Form W-4 as it directly influences the tax withheld from your paycheck. It’s not just about your base salary; it’s about understanding how other sources of income impact your taxes.

When you accurately report additional earnings—like bonuses, interest, or freelance income—you’re essentially fine-tuning the tax withheld. How does this impact you? Well, the more income adjustments you report, the more accurately the withholding aligns with your overall earnings.

Also, don’t forget about deductions or credits related to these additional earnings—it might reduce your taxable income. Recognizing the significance of these income details empowers you to provide an accurate representation on your W-4, ensuring your take-home pay reflects your complete financial picture.

5. Tailoring Tax Withholding

Tailoring tax withholding on your Form W-4 is like customizing a suit—it’s all about getting the fit just right for your financial situation. This isn’t a one-size-fits-all scenario; it’s about tailoring the withholding to match your specific needs.

How do you do this? By providing accurate information about your income, deductions, and dependents, you essentially adjust the withholding to suit your circumstances. Think of it as fine-tuning; the more precise the details you provide, the more accurate your tax withholding becomes.

Why does it matter? Well, it ensures that the amount taken out of your paycheck for taxes closely aligns with what you owe. Understanding this customization aspect of the W-4 allows you to take control, ensuring your take-home pay reflects your financial reality as accurately as possible.

6. Filling Out W-4 Accurately

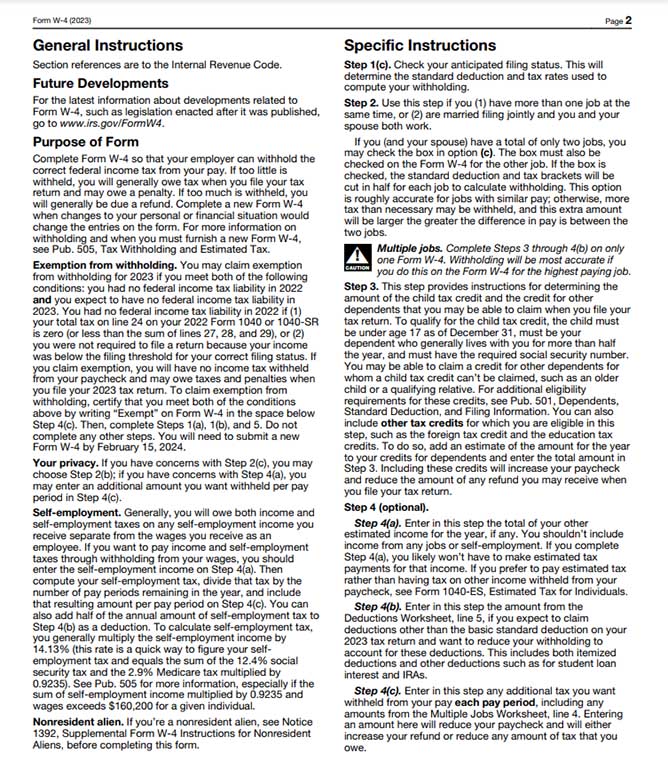

Here’s a detailed step-by-step guide on how you can accurately fill out your Form W-4:

- Obtain the Form W-4: Get the latest version of the W-4 form from your employer, the IRS website, or the HR department.

- Provide Your Personal Information: Enter your name, address, Social Security Number (SSN), and filing status (single, married filing jointly, etc.).

- Understand Filing Status: Make sure you review the definitions for each filing status and select the one that fits your situation best.

- Claim Dependents: Determine the number of dependents you’ll claim. Each dependent may impact the withholding amount.

- Consider Extra Withholding: If you anticipate additional income not subject to withholding (like interest, dividends, or a second job), consider requesting extra withholding.

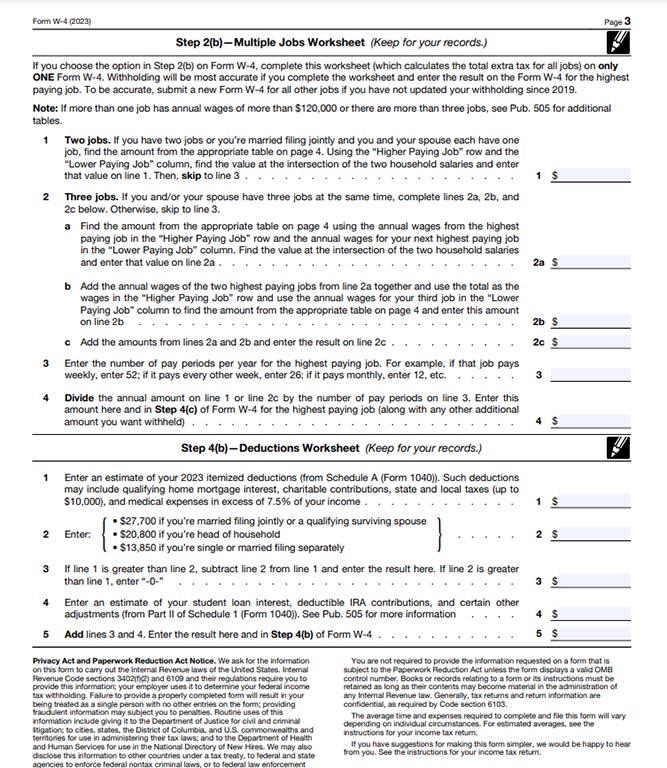

- Use the Deductions Worksheet: If applicable, complete this section to factor in deductions such as mortgage interest or charitable contributions.

- Multiple Jobs or Spouse’s Income: If you have multiple jobs or a working spouse, use the Two-Earners/Multiple Jobs Worksheet to adjust withholding.

- Review for Accuracy: Double-check all entries for accuracy before finalizing the form.

- Sign and Date the Form: Your W-4 is not valid without your signature and the date.

- Submit to Your Employer: Hand in the completed form to your employer’s HR or payroll department. The HR will use your details to calculate your withholding accurately.

Remember, the accuracy of your W-4 directly impacts the amount of tax withheld from your paycheck, so take the time to ensure all information is correct based on your financial situation.

7. Calculation Precision Matters

The precision of your Form W-4 calculation profoundly affects the money you take home. It’s not just about filling in numbers; it’s about making sure those numbers accurately represent your financial situation.

Why does this matter? Because every detail—each allowance, dependent, or deduction—affects how much tax is withheld from your paycheck. When you get these numbers right, your take-home pay becomes more aligned with what you actually owe in taxes.

Missing even a single detail could result in either too much or too little withheld, impacting your financial stability. That’s why being meticulous in your W-4 calculation matters; it ensures your take-home pay reflects your true tax obligations, giving you more control over your finances.

>>>GET SMARTER: Form 5498-ESA: What It Is, How to File It

8. Tax Efficiency Strategies

Utilize these tax efficiency strategies when filling out your Form W-4:

- Maximize allowances for accurate withholding

- Consider deductions to reduce your taxable income

- Account for multiple jobs or your spouse’s income

- Review and update W-4 regularly

- Adjust withholdings with life changes

- Plan for additional income sources

- Seek professional tax advice if uncertain

Recap

Understand your Form W-4 because it directly impacts your take-home pay. It’s not just paperwork; it’s about fine-tuning tax withholding. Make sure you provide accurate details about your dependents, income, and deductions to ensure precise withholding, aligning your paycheck with your tax obligations. Stay informed and update as needed to manage your finances effectively.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. . For comprehensive tax, legal or financial advice, always contact a qualified professional in your area. S’witty Kiwi assumes no liability for actions taken in reliance upon the information contained herein.

No Comment! Be the first one.