Introduction

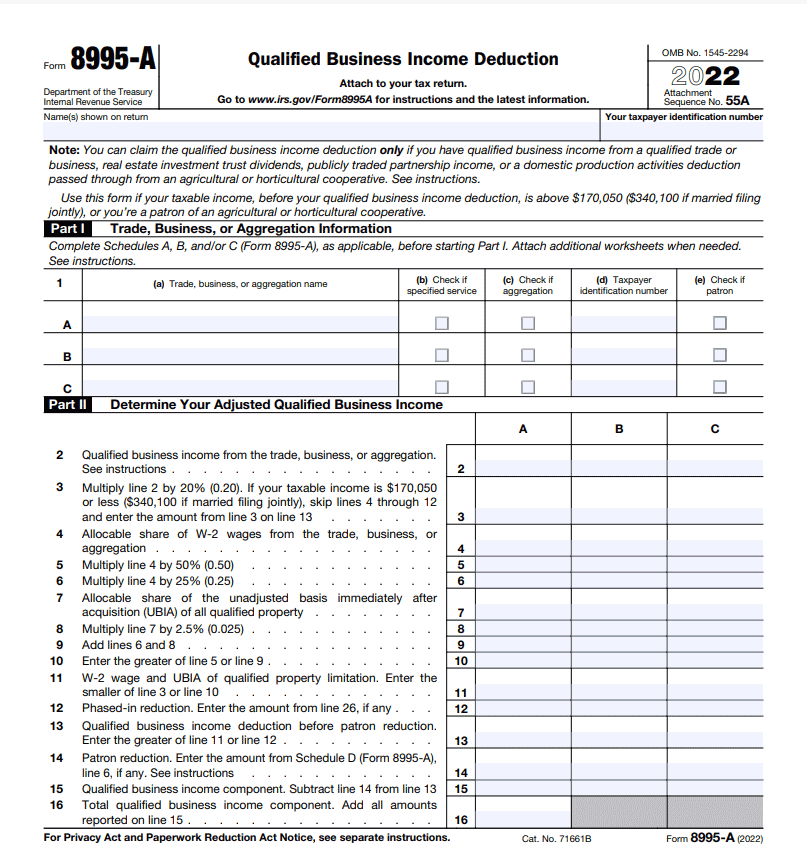

Form 8995-A is an essential IRS document for certain businesses and individuals filing taxes. You need this form if you have qualified business income deductions from partnerships, S corporations, or rental real estate.

Take note that Form 8995-A is specifically for larger businesses or if you have more complex tax situations, including when your business income exceeds the threshold specified for Form 8995. It deals with more detailed computations and allocations related to multiple businesses or activities that generate QBI.

In essence, the choice between Form 8995 and Form 8995-A depends on the complexity of your tax situation and the nature of your income-generating activities. When preparing your taxes, make sure you understand and correctly file Form 8995-A to ensure compliance with IRS regulations.

Form 8995-A: What It Is, How to File It:

1. IRS Tax Form 8995-A

2. Business Income Deduction

3. Eligibility Criteria

4. Documents Required

5. Calculating Deduction

6. How to File

7. Recent Form Revisions

8. Avoiding Errors

Recap

1. IRS Tax Form 8995-A

Form 8995-A is an IRS tax form that caters to complex tax scenarios, especially for larger businesses or those surpassing the income threshold set for Form 8995. When considering this form, ensure your business income exceeds the specified threshold or involves intricate tax situations.

To file it correctly, make sure you read the specific guidelines outlined by the IRS. Keep in mind that this form requires precise financial records and computations related to multiple businesses or activities generating Qualified Business Income (QBI).

Verify your eligibility, as it’s crucial for accurate filing. Recent revisions might have altered the form’s requirements, so it is essential you stay updated with the latest IRS guidelines. Filling out Form 8995-A accurately maximizes your deductions while ensuring compliance with IRS regulations, contributing to effective tax management.

2. Business Income Deduction

The Business Income Deduction is a pivotal aspect of Form 8995-A. It focuses on reducing your taxable income for eligible businesses. It allows you to deduct a percentage of your qualified business income from your total taxable income.

To utilize this deduction, you must have income from pass-through entities like partnerships, S corporations, or rental real estate. You need to also comprehend the mechanics of this deduction. You’ll apply it when filing your taxes, maximizing the deduction while ensuring adherence to IRS regulations.

It’s essential you accurately calculate your qualified business income, considering various factors outlined by the IRS. The deduction serves as a valuable tool for reducing your tax liabilities, making it important for your business to leverage it effectively.

3. Eligibility Criteria

Take note of the eligibility criteria for Form 8995-A as it is crucial for ensuring you meet the IRS requirements to claim the Qualified Business Income (QBI) deduction. To qualify, your business income must surpass the threshold specified for Form 8995 or involve intricate tax situations.

Knowing these criteria helps you determine if you can claim the deduction. Factors influencing eligibility also include income sources like partnerships, S corporations, or rental real estate that contribute to your QBI.

Verify your qualification to ensure accurate filing and avoid potential discrepancies with IRS regulations. Keep in mind that certain limitations might affect eligibility, so make sure you comprehend these intricacies to aid in correctly assessing your qualification for this deduction.

>>>PRO TIPS: What Is the IRS Form 990?

4. Documents Required

Depending on your type of business, you need the following documents to file Form 8995-A accurately:

- Financial Records: You need detailed financial statements showing income and expenses related to your eligible business generating Qualified Business Income (QBI).

- Partnership/S Corporation Data: Gather relevant documents from partnerships or S corporations, such as Schedule K-1, providing details of your share of income, deductions, and credits.

- Rental Real Estate Information: Compile data related to your rental real estate, including income and expenses, to accurately calculate QBI from these activities.

- Records of Qualified REIT Income: If applicable, gather information on income from qualified Real Estate Investment Trusts (REITs) contributing to your QBI.

Having these documents in order ensures accurate computations and proper reporting of your qualified business income when filing Form 8995-A.

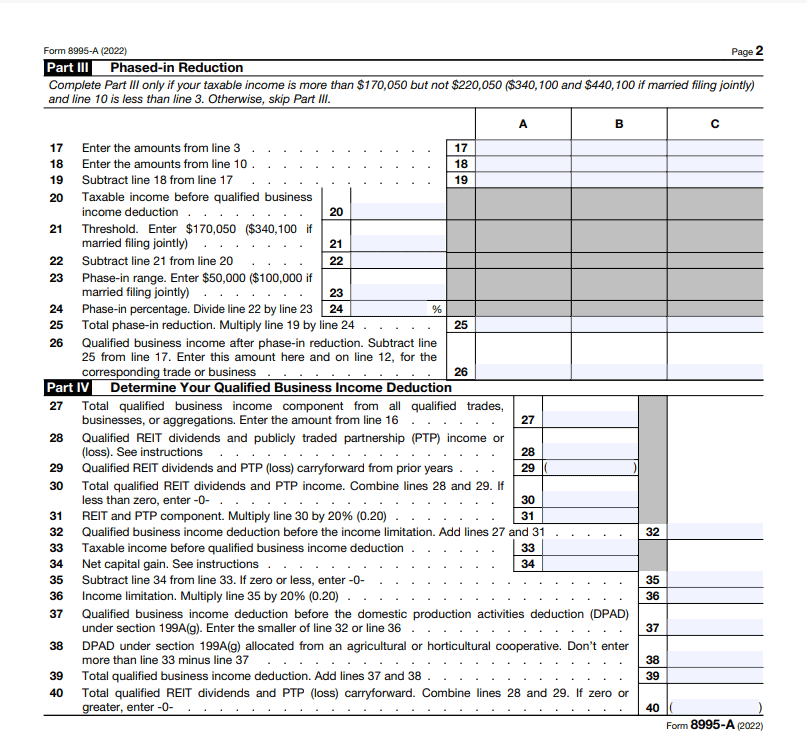

5. Calculating Deduction

Calculating your QBI deduction via Form 8995-A demands precision. Firstly, you sum up all your qualified business income (QBI) from all eligible sources, like partnerships, S corporations, rental real estate, and qualified REITs.

Then, factor in any potential adjustments or limitations set by the IRS, like the type of business or activity generating QBI and any applicable thresholds. You should also consider other deductions or credits that might affect the QBI deduction.

The deduction amount is generally a percentage of your QBI, depending on your income level and the nature of your business. Ensure accuracy in computing any allocated deductions from multiple businesses or activities.

Verify that your calculations comply with the IRS guidelines to maximize the deduction without inaccuracies. Make sure you take note of the specific computation rules and regulations outlined by the IRS so you can accurately calculate your QBI deduction on Form 8995-A.

>>>GET SMARTER: Form 1095-B: Does Your Company Need to File It?

6. How to File

Here is a detailed step by step process on how to file Form 8995-A:

- Gather Records: Collect financial statements and documents related to your eligible businesses generating Qualified Business Income (QBI).

- Understand Guidelines: Familiarize yourself with IRS rules and regulations governing Form 8995-A and the QBI deduction.

- Calculate QBI: Sum up your QBI from partnerships, S corporations, rental real estate, and qualified REITs, considering adjustments and limitations.

- Compute QBI Deduction: Determine the QBI deduction by applying the relevant percentage to your calculated Qualified Business Income (QBI) based on IRS guidelines on Form 8995-A.

- Complete Form 8995-A: Accurately fill in the form, providing all required information about your QBI and deductions.

- Double-Check Accuracy: Review the form meticulously to ensure your calculations and entries align with IRS guidelines.

- Submit with Your Tax Return: Attach Form 8995-A to your tax return, accurately reflecting your QBI deduction claim.

- Keep Records: Retain copies of all filed documents and supporting records for future reference or in case of an IRS inquiry.

Make sure you complete these steps systematically as it ensures accurate filing of Form 8995-A and maximizes your QBI deduction while complying with IRS regulations.

7. Recent Form Revisions

Be aware of the recent revisions to Form 8995-A because it is crucial for claiming your QBI deduction effectively. These updates typically involve changes to eligibility criteria or calculation methods for the Qualified Business Income (QBI) deduction.

Recent revisions might include alterations to income thresholds, limitations on specific types of businesses or activities, or adjustments to calculation formulas. Make sure you stay informed about these revisions to ensure you’re using the most updated version of the form, reducing the chances of errors in your filing.

The IRS periodically updates forms to align with tax law changes or to provide you with more clarity. Checking for updates ensures you’re following the latest guidelines, avoiding potential penalties or miscalculations.

8. Avoiding Errors

Take note of these tips as it will help you avoid errors when filing Form 8995-A:

- Fill in Accurate Entries: Input accurate income figures for each income-generating activity.

- Prevent Missing Documentation: Include all necessary supporting schedules and documents.

- Consider All Income Sources: Ensure you account for all eligible sources of income.

- Ensure Consistency Across Documents: Match data accurately between forms and supporting records.

- Understand IRS Regulations: Avoid misinterpreting rules governing different income types.

- Clarify Thresholds and Limitations: Comprehend income thresholds and limitations correctly.

- File Timely: Submit on time to evade penalties or interest charges.

Recap

You need Form 8995-A if your business has complex tax situations or your business income surpasses the Form 8995 thresholds. To file it accurately, gather financial records, understand IRS rules, and calculate Qualified Business Income (QBI) deduction meticulously. Make sure you stay updated on recent form revisions to ensure precise tax filings and maximize deductions.

No Comment! Be the first one.