Embarking on the intricate journey of tax forms may seem daunting, but nestled within the IRS paperwork is a gem of support for both employers and employees – Form 8994. Imagine a world where businesses are not only encouraged but rewarded for providing paid family and medical leave. This is precisely the essence of Form 8994, the gateway to the Employer Credit for Paid Family and Medical Leave. So, what is this form, and why should it be on your radar?

Unravel the layers of Form 8994 – discovering what it truly is, who qualifies for its benefits, and the artful dance of filing that opens the doors to a tax credit realm. It’s not just about numbers on paper; it’s about fostering a workplace that values the well-being of its employees. Delve into the narrative of Form 8994, where financial incentives meet compassionate business practices.

1. Understanding Form 8994

2. Who Qualifies for The Credit?

3. How To File Form 8994

4. Benefits And Considerations

Summary

1. Understanding Form 8994

Form 8994, a beacon within the labyrinth of tax documentation, holds a distinct role as the gateway to the Employer Credit for Paid Family and Medical Leave. At its core, Form 8994 embodies a federal tax credit initiative introduced by the Internal Revenue Service (IRS), aiming to incentivize businesses to provide financial support to employees during significant life events.

The essence of Form 8994 lies in its capacity to bridge the gap between fiscal responsibility and employee welfare. In a world where the demands of work and life often intertwine, this form stands as a testament to the recognition that employers play a pivotal role in supporting their workforce during times of family or medical necessity.

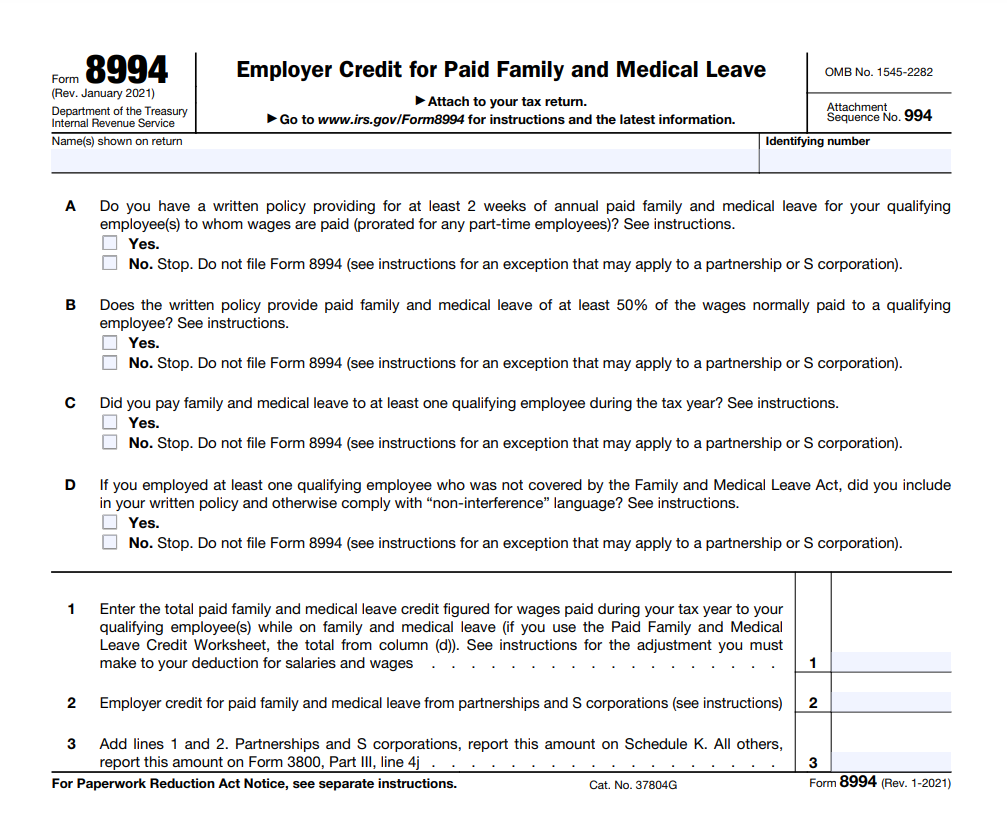

Essentially, Form 8994 requires eligible employers to articulate their commitment to employee well-being through a written leave policy. This policy should encompass provisions for at least two weeks of paid family and medical leave per year for qualifying employees. For small businesses without an existing policy, the adoption of a compliant written policy becomes the key to unlocking the benefits outlined in Form 8994.

By providing a mechanism for employers to claim a tax credit based on wages paid during family and medical leave, Form 8994 transforms the tax landscape into a realm where financial incentives align with compassionate business practices. It is not merely a bureaucratic formality; it represents a conscious effort to cultivate workplaces that prioritize the holistic needs of employees.

In essence, Form 8994 is more than just a document; it symbolizes a commitment to balancing the scales between the demands of business and the well-being of the workforce. It intertwines the narrative of financial responsibility with a compassionate understanding of the human element within the corporate landscape.

2. Who Qualifies for the Credit?

Eligible Employers:

To qualify for the credit, employers must have a written policy in place that meets IRS requirements. This policy should provide at least two weeks of paid family and medical leave per year to all qualifying full-time employees, with prorated benefits for part-time employees. Small businesses without a pre-existing policy can also qualify if they adopt a written policy that complies with the necessary guidelines.

Qualifying. Employees:

Employees must meet certain criteria to be eligible for paid family and medical leave benefits. They should have been employed for at least one year, and their compensation during the preceding year should not exceed a specified threshold. Additionally, qualifying employees must be entitled to at least two weeks of paid family and medical leave annually under the employer’s policy.

It’s essential for both employers and employees to thoroughly understand and meet these eligibility requirements to take advantage of the credit provided by Form 8994.

3. How to File Form 8994

Filing Form 8994 involves a systematic process that ensures accurate reporting of paid family and medical leave credits. Here is a step-by-step guide on how to file Form 8994:

Establish Eligibility:

The eligibility criteria for filing Form 8994, the Employer Credit for Paid Family and Medical Leave, involve specific requirements for both employers and employees:

Eligible Employers:

Written Leave Policy: Employers must have a written policy in place that meets IRS standards. This policy should provide at least two weeks of paid family and medical leave per year to all qualifying full-time employees. Part-time employees should receive prorated benefits.

Adoption of Policy:

Small businesses without an existing policy can also qualify if they adopt a written policy that aligns with the necessary guidelines.

Qualifying Employees:

Tenure and Compensation: Employees seeking benefits must have been employed for at least one year. Additionally, their compensation during the preceding year should not exceed a specified threshold.

Entitlement to Leave:

Qualifying employees must be entitled to at least two weeks of paid family and medical leave annually under the employer’s policy.

Gather Information:

Collect all relevant information needed for the form, including the total wages paid to employees on family and medical leave and the total number of hours of leave taken by qualifying employees.

Complete the Form:

Fill out all sections of Form 8994 accurately. This includes providing details about the employer, the written leave policy, and the wages paid to qualifying employees during the tax year. Take care to enter information precisely to avoid any discrepancies.

Attach Supporting Documentation:

It’s crucial to attach supporting documentation to validate the information provided on the form. This includes a copy of the written leave policy and records of wages paid during family and medical leave.

Submit with Tax Return:

Include Form 8994 with your business’s annual tax return. Submitting the form with the tax return ensures that the credit is properly applied.

By following these steps, employers can streamline the filing process for Form 8994 and maximize the benefits of the Employer Credit for Paid Family and Medical Leave. Additionally, maintaining thorough documentation is essential to support the legitimacy of the claimed credits during any potential IRS audits.

>>>PRO TIPS: Charitable Contributions: Everything You Must Know

4. Benefits and Considerations

Financial Incentive:

The Employer Credit for Paid Family and Medical Leave serves as a financial incentive for businesses to implement or enhance their paid leave policies. This can contribute to improved employee satisfaction and retention.

Compliance and Documentation:

To benefit from the credit, employers must comply with the IRS requirements and maintain proper documentation. This includes having a written policy, accurate record-keeping, and adherence to the specified criteria.

Impact on Employees:

Employees gain from this initiative through access to paid leave during significant life events, promoting work-life balance and overall well-being.

>>>GET SMARTER: Business Tax Cheat Sheet on IRS Forms, Schedules and Resources

Summary

Form 8994 stands as a testament to the government’s recognition of the importance of supporting employees during crucial times in their lives. By offering a tax credit to employers who provide paid family and medical leave, the IRS aims to create a more compassionate and supportive work environment. As businesses navigate the complexities of tax compliance, understanding and utilizing Form 8994 can lead to mutual benefits for both employers and employees.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. . For comprehensive tax, legal or financial advice, always contact a qualified professional in your area. S’witty Kiwi assumes no liability for actions taken in reliance upon the information contained herein.

No Comment! Be the first one.