A transformative tax credit that not only benefits businesses but also champions the well-being of employees. Enter Form 8994, the key to unlocking the Employer Credit for Paid Family and Medical Leave.

In this conversational journey, unravel the mysteries of what this form entails, who gets to tap into its advantages, and the straightforward steps to file for a credit that goes beyond numbers, resonating with the essence of work-life balance.

So, embark on a dialogue about Form 8994 – demystifying its significance, exploring the qualifications that make it accessible, and seamlessly navigating the filing process to ensure your business thrives while putting your employees first.

1. Understanding Form 8994

2. Who qualifies for the credit?

3. Understanding the credit calculation

4. Steps to file Form 8994

Summary

1. Understanding Form 8994

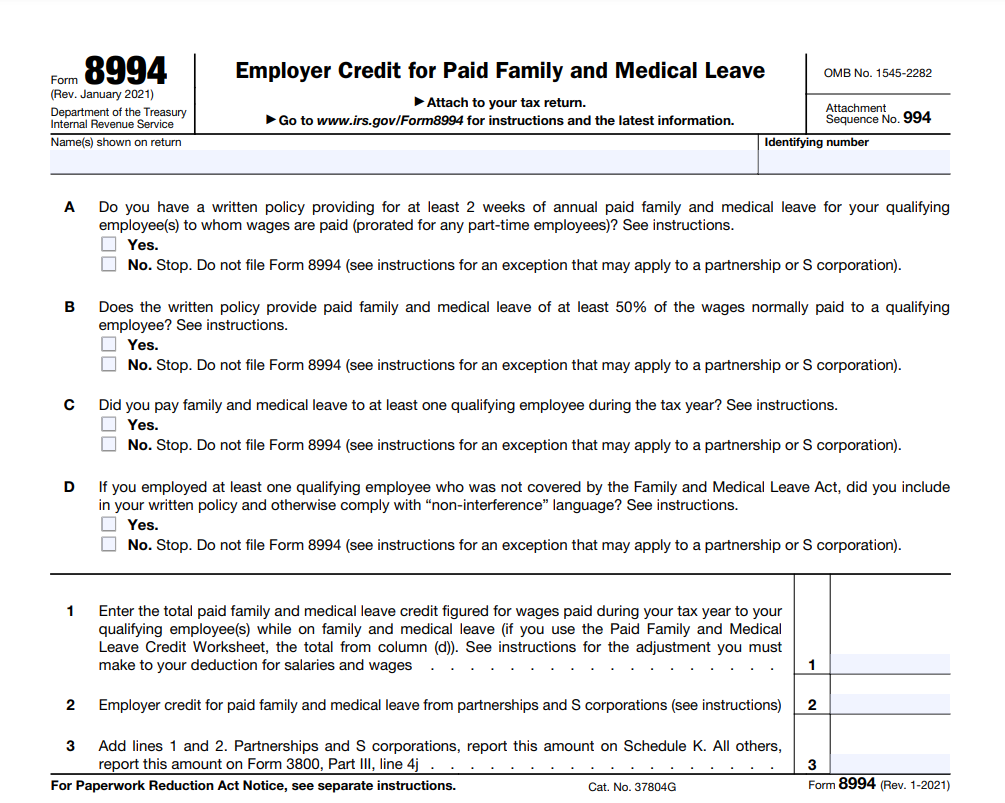

Form 8994 serves as the vehicle for employers to claim the tax credit. It’s crucial for businesses to comprehend the intricacies of this form to ensure compliance with IRS regulations. The credit is calculated based on a percentage of wages paid to qualifying employees while they are on family or medical leave.

2. Who Qualifies for the Credit?

Qualifying for the Employer Credit for Paid Family and Medical Leave, as associated with Form 8994, involves meeting specific criteria. Here are key considerations regarding who qualifies for this tax credit:

Written Leave Policy:

Employers must have a written policy in place that outlines their paid family and medical leave program. This policy should cover the duration and terms of the leave provided.

Minimum Leave Duration:

The policy must offer at least two weeks of annual paid family and medical leave to qualifying employees. This duration is a crucial threshold for eligibility.

Minimum Wage Payment:

During the leave period, employees must be paid at least 50% of their normal wages. This minimum payment requirement is a core element of eligibility for the credit.

Qualifying Reasons for Leave:

The leave must be provided for specific qualifying reasons, including but not limited to:

Birth of a child and care of the newborn.

Adoption of a child.

Serious health conditions affecting the employee.

Care for a spouse, child, or parent with a serious health condition.

Qualifying exigencies related to a family member’s military service.

Employment Status:

Employees must be employed for a specified period to be eligible for the credit. Typically, only employees who have worked for the employer for at least one year and whose compensation does not exceed a certain threshold qualify.

3. Understanding the Credit Calculation

Understanding the calculation of the Employer Credit for Paid Family and Medical Leave, as outlined in Form 8994, involves considering several key factors:

Percentage of Wages Paid:

The credit is calculated based on a percentage of wages paid to qualifying employees during their family or medical leave.

The percentage ranges from 12.5% to 25%, depending on the percentage of normal wages paid during the leave period.

Qualifying Leave Duration:

The credit applies to qualifying leave periods, which typically involve specific family or medical situations outlined by the IRS.

The maximum duration for which the credit can be claimed for any employee is 12 weeks.

Paid Leave Policy:

To be eligible for the credit, employers must have a written policy in place that provides at least two weeks of annual paid family and medical leave.

The leave must be paid at a rate of at least 50% of the employee’s normal wages.

Calculation Example:

Suppose an employee takes eight weeks of qualified family or medical leave, during which they receive 60% of their normal wages.

If the applicable credit rate is 20%, the calculation would be: 8 weeks × 60% wages × 20% credit rate.

Maximum Credit:

While the credit is a percentage of qualifying wages, there is a limit on the total credit that can be claimed for any employee. This maximum duration is 12 weeks.

It’s important for employers to carefully review the IRS guidelines and instructions for Form 8994 to ensure accurate calculation and compliance. Additionally, keeping thorough records of employee leave, payment details, and adherence to the written leave policy is crucial for supporting the credit calculation during tax filing.

>>>PRO TIPS: Charitable Contributions: Everything You Must Know

4. Steps to File Form 8994

Filing Form 8994 involves a series of steps to ensure accurate reporting and adherence to IRS guidelines:

Collect Necessary Information:

Gather information about your paid leave policy, including the duration and rate of paid leave, as well as details about qualifying reasons for leave.

Complete Form 8994:

Carefully fill out the form, providing accurate details about your business and the paid leave policy. Ensure that the information aligns with the records you have kept regarding employee leave.

Include Form with Business Tax Return:

Attach Form 8994 to your business tax return when filing. This is typically done with the annual tax return filing, and the credit will be factored into the overall tax liability calculation.

Review IRS Instructions:

Refer to the IRS instructions for Form 8994 to ensure that you’ve followed all guidelines and provided the necessary information. This step is crucial to avoid potential discrepancies that could lead to issues with your tax filing.

Consider Professional Guidance:

If navigating tax forms feels overwhelming, consider seeking professional assistance. A tax professional can provide guidance tailored to your business, ensuring accurate completion of Form 8994 and compliance with tax regulations.

>>>GET SMARTER: Can I Convert My LLC to an S-Corp When Filing My Tax Return?

Summary

Form 8994 stands as a testament to the evolving landscape of workplace dynamics, recognizing the need for businesses to actively contribute to the well-being of their employees. By providing a structured avenue for employers to claim the credit, the IRS encourages a culture of support and understanding within the professional sphere.

As businesses navigate the complexities of Form 8994, it is essential to view this process not merely as a tax-related obligation but as an opportunity to reinforce the commitment to the holistic welfare of the workforce. Through adherence to the eligibility criteria, accurate filing, and a genuine dedication to employee well-being, businesses can not only benefit from the tax credit but also cultivate an environment that fosters loyalty, productivity, and a sense of community among their employees.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. . For comprehensive tax, legal or financial advice, always contact a qualified professional in your area. S’witty Kiwi assumes no liability for actions taken in reliance upon the information contained herein.

No Comment! Be the first one.