Form 8933, the Carbon Dioxide Sequestration Credit, is imperative for you if your business engages in activities involving the capture and secure storage of carbon dioxide emissions during industrial processes. You need this form to claim the carbon dioxide sequestration credit, which is a tax incentive that rewards you for capturing and storing qualified carbon oxide from industrial sources or the atmosphere. This form is not merely a regulatory requirement but a strategic financial tool. By filing Form 8933, your eligible business can leverage tax incentives, effectively reducing its federal income tax liability.

Beyond being a powerful incentive to cut federal income tax, filing this form showcases a commitment to sustainability and compliance with IRS regulations. It’s not just about the numbers; it’s about contributing to a greener future. If you aim to navigate this eco-friendly terrain, consulting with a tax professional ensures you’re not only claiming the credit but doing so in harmony with the latest IRS guidelines.

The article throws more light on what Form 8933 is all about and helps you understand the eligibility criteria and filing procedures.

By following this article, you are able to take advantage of this valuable tax benefit and support the environmental and economic goals of the country.

Details on Form 8933, Carbon Dioxide Sequestration Credit encompass:

- What it is

- Who Qualifies for it

- How to File it

Want to learn more? Continue reading!

1. What it is

To file Form 8933, Carbon Dioxide Sequestration Credit, know what it entails.

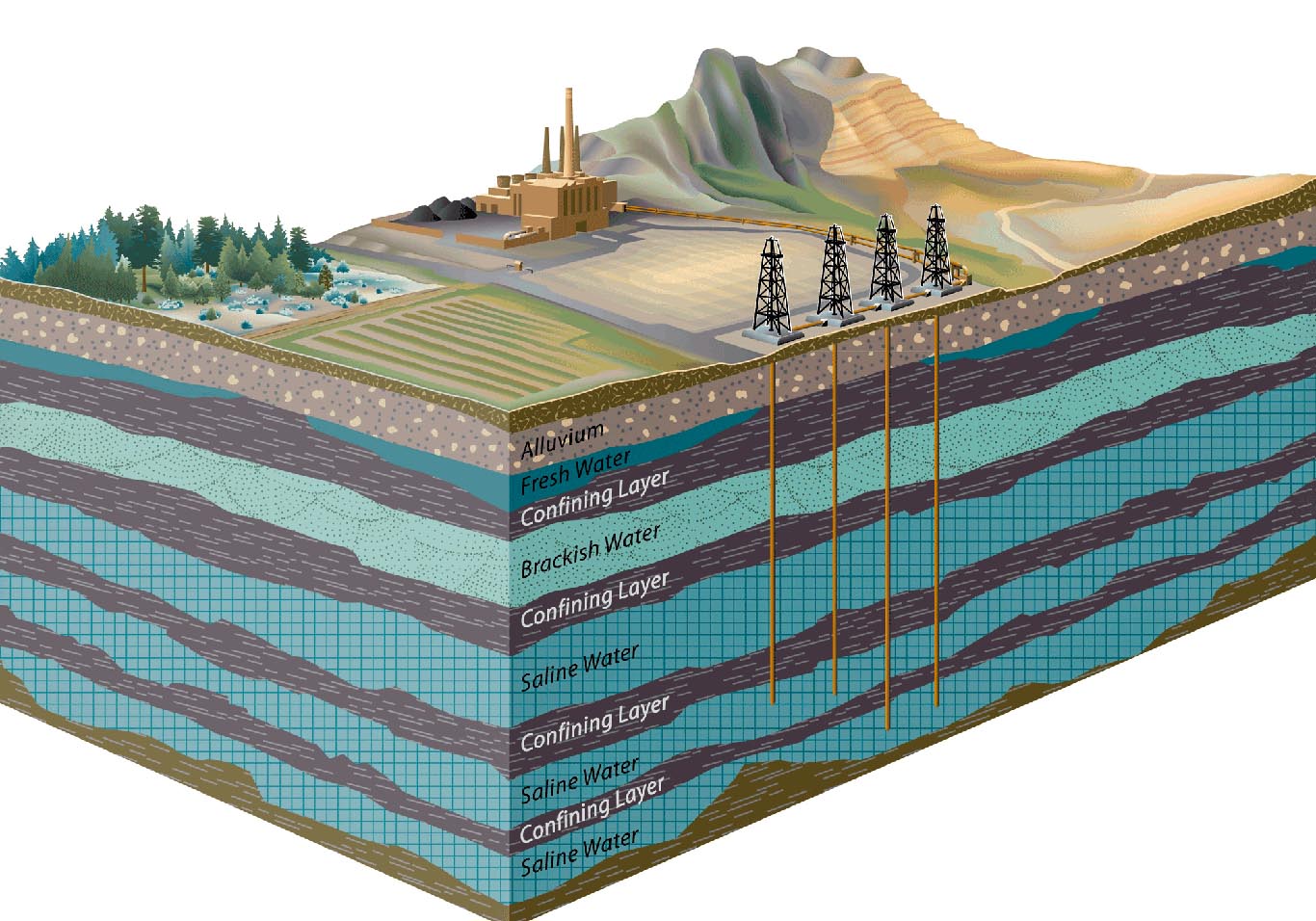

Carbon dioxide sequestration involves the capture and storage of carbon dioxide (CO2) from industrial sources or the atmosphere, effectively mitigating its impact on global warming. The carbon dioxide sequestration credit is a tax incentive that provides rewards to you as a taxpayer if you capture and dispose of qualified carbon oxide in secure geological storage, use it as a tertiary injectant in an enhanced oil or natural gas recovery project, or utilize it in certain ways that lead to permanent removal from the atmosphere.

Form 8933 is an IRS form that allows eligible businesses to claim a tax credit for the secure capture and long-term storage of carbon dioxide emissions. This credit is part of the government’s efforts to incentivize the reduction of greenhouse gas emissions and promote environmental responsibility.

2. Who Qualifies for it

To fill out Form 8933 in application for Carbon Dioxide Sequestration Credit, know who is eligible to claim it.

To claim the carbon dioxide sequestration credit, ensure you meet the following criteria:

- Capture qualified carbon oxide from a qualified facility and dispose of it in secure geological storage, use it as a tertiary injectant in an enhanced oil or natural gas recovery project, or utilize it in certain ways that result in permanent removal from the atmosphere.

- Qualified carbon oxide means any carbon dioxide (CO2) or carbon monoxide (CO) from an industrial source or the atmosphere that goes into the atmosphere as an industrial emission or through the burning of fuel in a trade or business.

- Qualified facility describes your personally owned industrial facility as a taxpayer, if it captures qualified carbon oxide using carbon capture equipment that was first put to use at that facility on or after February 9, 2018.

- Secure geological storage includes storing certified carbon oxide in deep saline formations, oil and gas reservoirs, or unminable coal seams that meet EPA or DOI long-term storage standards.

- Tertiary injectant means any qualified carbon oxide that you inject into an oil or natural gas reservoir to increase the recovery of oil or natural gas.

- Utilization refers to the various ways in which qualified carbon oxide can be put to use, such as in the production of chemicals, plastics, cement, or algae. These applications not only result in the permanent removal of carbon oxide from the atmosphere but also help to displace carbon oxide rather than emit it.

- Begin the construction of the qualified facility and the carbon capture equipment by December 31, 2025, and place them in service within a reasonable period of time.

- Capture at least 500,000 metric tons of qualified carbon oxide during the tax year at each qualified facility.

- Pay or incur the wages for the construction, installation, and operation of the qualified facility and the carbon capture equipment at rates not less than the prevailing wage rate for the locality where the work is going on and provide qualified apprenticeship programs for the workers.

- Lower the credit amount by a certain percentage based on how much carbon dioxide you or someone else stops capturing, dumping, or using during the recapture period. This is the five-year period that starts on the date that the taxpayer first captures qualified carbon dioxide.

- Choose under section 45Q(f)(9) of the Internal Revenue Code to let someone else claim the credit for the qualified carbon oxide that you capture and that other person then gets rid of, uses, or puts to use; or you can get the credit from someone else who captures the qualified carbon oxide and gives it to you to get rid of, uses, or puts to use.

Take a look at these examples and scenarios to understand how the eligibility criteria and the credit amount vary depending on the type of facility and the use of carbon oxide.

- Example 1: You own and operate a coal-fired power plant that captures 1 million metric tons of CO2 per year using carbon capture equipment that was placed in service in 2020. You dispose of the CO2 in a deep saline formation that meets the EPA requirements for secure geological storage. You pay the prevailing wage rate for the workers and provide qualified apprenticeship programs. You do not make any section 45Q (f) (9) election. You are eligible to claim the credit for the CO2 that you capture and dispose of, and the credit rate for 2022 is $50 per metric ton.

- Example 2: You own and operate a direct air capture facility that captures 600,000 metric tons of CO2 per year using carbon capture equipment that was placed in service in 2023. You use the CO2 to produce algae, which displaces the use of fossil fuels. You pay the prevailing wage rate for the workers and provide qualified apprenticeship programs. You make a section 45Q (f) (9) election to transfer the credit to the algae producer. You are eligible to claim the credit for the CO2 that you capture and utilize, and the credit rate for 2022 is $35 per metric ton. However, you cannot claim the credit yourself, but you can transfer it to the algae producer, who can claim the credit for the CO2 that they receive and utilize from you.

- Example 3: You own and operate a steel mill that captures 400,000 metric tons of CO per year using carbon capture equipment that was placed in service in 2024. You use the CO to produce methanol, which results in permanent removal of the CO from the atmosphere. You pay the prevailing wage rate for the workers and provide qualified apprenticeship programs. You do not make any section 45Q (f) (9) election. You are not eligible to claim the credit for the CO that you capture and utilize because you do not meet the minimum threshold of 500,000 metric tons of qualified carbon oxide per year at your facility.

>>>PRO TIPS: Charitable Contributions: Everything You Must Know

3. How to File it

To complete Form 8933 for the Carbon Dioxide Sequestration Credit, know what the filing entails.

Here is a step-by-step guide to filing Form 8933:

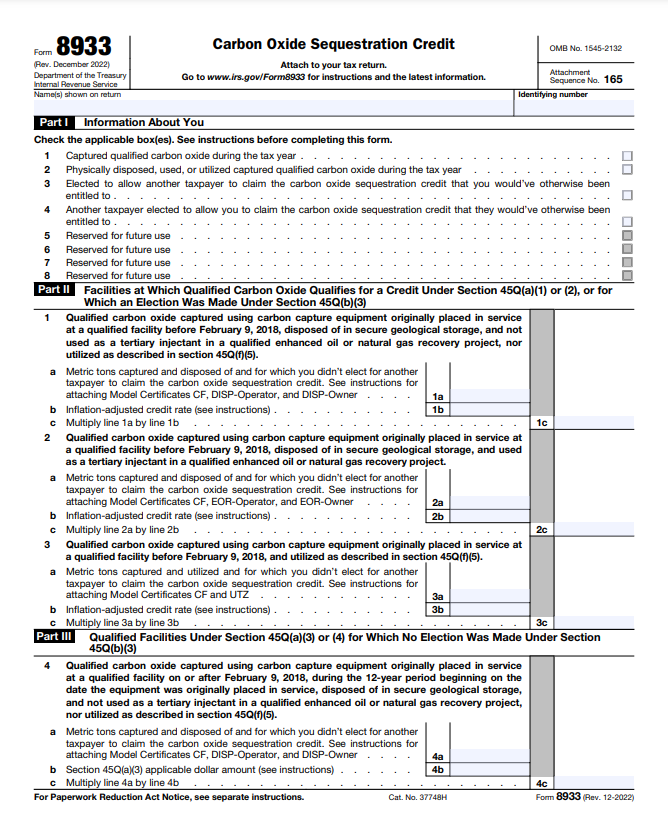

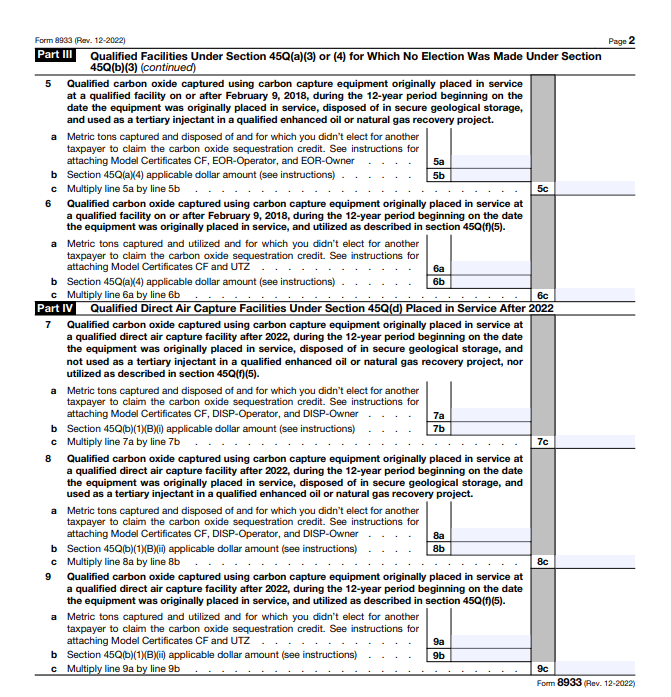

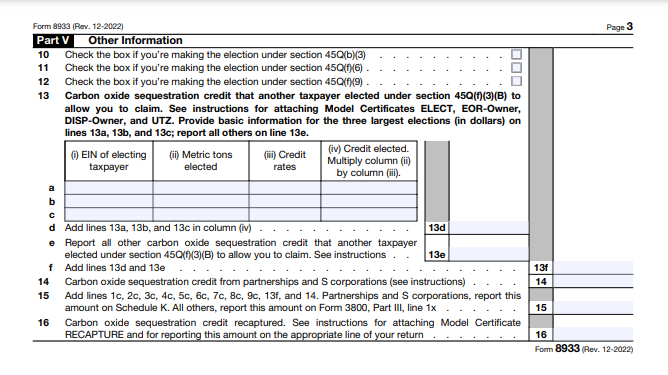

- Step 1: Complete the Income/Deductions worksheet to determine your taxable income and deductions that relate to the qualified facility and the carbon capture equipment.

- Step 2: Complete the Credit Options and Adjustments worksheet to calculate the credit amount and the credit reduction amount for the captured, disposed of, used, or utilized qualified carbon oxide in the tax year.

- Step 3: Fill out Form 8933 with the information from the worksheets and attach it to your income tax return. You also need to attach Form 3800, General Business Credit, if you have any other general business credits to claim.

- Step 4: Report the name, address, and taxpayer identification number of the person who transferred or received the credit, as well as the transmitted amount of qualified carbon oxide and credit, if you chose Section 45Q (f) (9).

>>>GET SMARTER: Business Tax Cheat Sheet on IRS Forms, Schedules and Resources

Recap

Are you renting out your home on Airbnb or FlipKey? Report your rental income to the IRS, track your expenses, and claim eligible deductions. Make sure you understand depreciation, local laws, and occupancy limits. Don’t forget to maintain your property, differentiate personal use, and explore short-term vs. long-term taxes. Lastly, consult a tax professional for expert advice.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. . For comprehensive tax, legal or financial advice, always contact a qualified professional in your area. S’witty Kiwi assumes no liability for actions taken in reliance upon the information contained herein.

No Comment! Be the first one.