Are you a dedicated employee serving in the uniformed services? If so, you may be eligible for a valuable tax credit through Form 8932 – the Credit for Employer Differential Wage Payments. This credit is specifically designed to provide financial support for individuals who experience a decrease in income due to military service.

Read this article to know what Form 8932 entails, who qualifies for this credit, and provide you with a step-by-step guide on how to accurately file the form. By understanding the ins and outs of this credit, you can make the most of this opportunity to alleviate the financial impact of your service.

Form 8932, Credit for Employer Differential Wage Payments: What It Is, Who Qualifies, How to File:

- Understanding Form 8932

- Qualifying for the Credit

- Filing Form 8932

1. Understanding Form 8932

What is Form 8932?

Form 8932 is a tax form used by employers to claim the credit for employer differential wage payments. This credit is specifically designed to provide financial relief to employers who continue to pay wages to employees called to active duty in the uniformed services.

When an employee is called to serve in the military, their absence from work can create financial strain on both the employee and the employer. However, the credit for employer differential wage payments, which can be claimed using Form 8932, helps alleviate this burden by providing employers with a tax credit.

Why is Form 8932 Important?

Form 8932 is important for employers as it offers several benefits, including potential tax savings. By claiming this credit, employers can offset a portion of the wages paid to employees who are on active duty. This credit can help reduce the overall tax liability of the employer, resulting in cost savings and increased financial flexibility.

Additionally, the credit for employer differential wage payments plays a crucial role in supporting employees who serve in the military. It ensures that these employees receive fair compensation for their service by bridging the gap between their regular wages and the amount they would have earned if not in the military. This can help alleviate financial stress for these employees and their families during active duty.

By taking advantage of Form 8932 and claiming the credit for employer differential wage payments, employers demonstrate their commitment to supporting their employees’ military service. It not only serves as a financial relief for employers but also acknowledges and appreciates the sacrifices made by employees who serve in the uniformed services.

Benefits of Form 8932

Form 8932 offers a tax credit of 20% to eligible employers for qualified differential wage payments made to qualified employees. This credit can be carried forward for up to 20 years if not utilized in the current tax year.

Supporting employees in uniformed services or on active duty through eligible differential wage payments can boost employee loyalty, morale, and productivity, ultimately enhancing your business’s financial performance.

2. Qualifying for the Credit

Who Qualifies for the Credit?

To qualify for the credit for employer differential wage payments using Form 8932, both for-profit and nonprofit employers may be eligible, subject to certain conditions. This means that companies of various types can take advantage of this credit, provided they meet the necessary requirements.

For-profit employers must have employees who are called to active duty in the uniformed services and continue to pay wages to these employees during their military service. Nonprofit employers, on the other hand, must meet the same criteria, but with an additional condition. They must also have a written plan in place that provides differential wage payments to eligible employees.

To qualify for the tax credit, employers must have a written plan in place that provides eligible differential wage payments. Additionally, the employer must have had less than 50 employees on average during the prior tax year. Qualified employees for this credit include those in the uniformed services or on active duty. Eligible differential wage payments refer to wages that exceed what qualified employees would have received from the employer during their service period.

What are Differential Wage Payments?

Differential wage payments refer to the difference between an employee’s regular wages and the amount they would have received from their employer while on active duty in the uniformed services. In simpler terms, it is the compensation that bridges the gap between the employee’s military pay and their regular wages.

These payments can include various forms of compensation, such as salary, bonuses, and other benefits that the employee would have received if they were not on active duty. By providing differential wage payments, employers ensure that their employees do not face a significant financial loss during their military service and receive fair compensation for their service.

Requirements for Qualifying Employees

To be eligible for differential wage payments, employees must meet certain criteria. These criteria are established and protected by the Uniformed Services Employment and Reemployment Rights Act (USERRA). This act safeguards the rights of employees who serve in the uniformed services and establishes guidelines for their employment and reemployment.

Employees must have been called to active duty in the uniformed services, which include the Army, Navy, Air Force, Marine Corps, Coast Guard, and the commissioned corps of the Public Health Service. They must also provide their employer with proper notice of their military service and ensure that their period of service does not exceed certain limits specified by law.

Additionally, employees must typically have a reasonable expectation of reemployment following their military service. This means that they must have a job with the employer before their military service and intend to return to that job after completing their service.

>>>PRO TIPS: Form 1095-B: What It Is, How to File

3. Filing Form 8932

Gathering Required Information

Before you begin filling out Form 8932, it’s important to gather all the necessary information to ensure a smooth and accurate filing process. Here’s a checklist of the key details you’ll need:

- Personal Information: Provide your full name, Social Security Number, and contact information. It’s essential to double-check this information for accuracy.

- Employer Information: Include the name, address, and Employer Identification Number (EIN) of the employer who provided the differential wage payments. This information can typically be found on your W-2 form or by contacting your employer’s HR department.

- Differential Wage Payments: Determine the total amount of differential wage payments you received during your military service. This information should be provided by your employer or can be calculated based on your pay stubs or other relevant documents.

Completing the Form

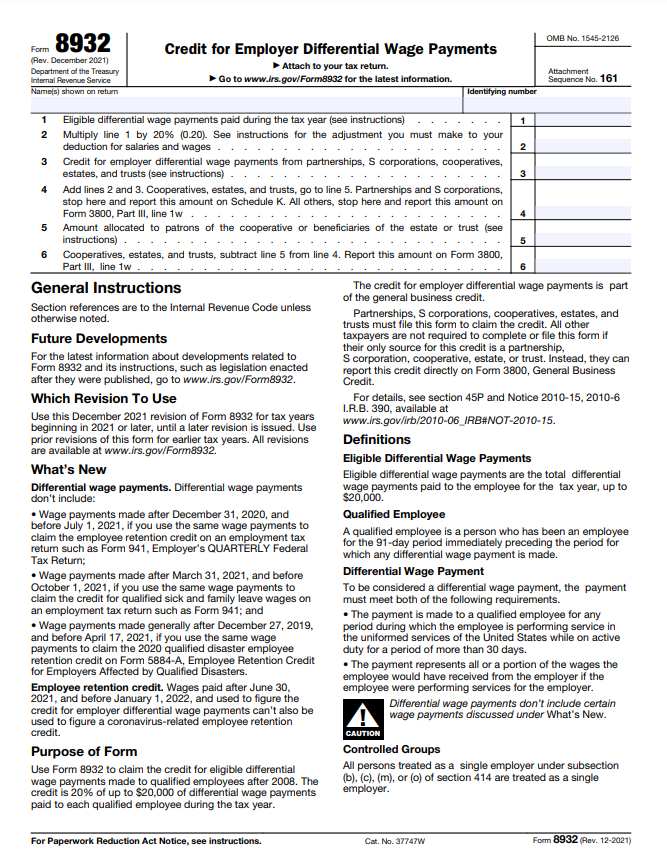

Now that you have all the necessary information, consider the following steps of Form 8932 to ensure accurate completion:

- Enter your personal information, including your name, Social Security Number, and contact details.

- Provide the employer information, including the name, address, and EIN of the employer who provided the differential wage payments.

- Calculate the total amount of differential wage payments you received during your military service and enter it in the appropriate field.

- Sign and date the form to certify the accuracy of the information provided.

- Pay close attention to Line 6, where you’ll enter the total amount of differential wage payments received. Make sure to double-check all the information you’ve entered to avoid any errors.

Supporting Documentation

In some cases, you may need to attach supporting documentation to your Form 8932. This can include your military orders, which verify your active-duty status, or any other relevant documents that substantiate the differential wage payments you received. Keep these documents in a safe place and attach them securely to your filed form.

Filing and Deadlines

You have two options for filing Form 8932: electronic filing or mailing a paper copy. Electronic filing is generally faster and more convenient, but if you prefer to mail a paper copy, make sure to send it to the appropriate IRS address.

The deadline for filing Form 8932 generally coincides with your individual income tax return deadline. However, it’s important to double-check the current year’s filing due dates as they may vary. Timely submission is crucial, as failing to meet the deadline may result in penalties or the loss of potential credits.

>>>GET SMARTER: Can I Convert My LLC to an S-Corp When Filing My Tax Return?

Conclusion

The purpose of Form 8932 is to provide financial relief to employers who pay wages to employees called to active duty in the uniformed services. It also explored the eligibility criteria for employers to claim the credit and the requirements for qualifying employees.

Lastly, a detailed guide on how to gather the necessary information and complete Form 8932 accurately, along with options for filing and submission, was provided. By understanding and utilizing this form, employers can support their employees during military service and potentially save on taxes.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. . For comprehensive tax, legal or financial advice, always contact a qualified professional in your area. S’witty Kiwi assumes no liability for actions taken in reliance upon the information contained herein.

No Comment! Be the first one.