If you want to claim tax benefits related to education expenses, Form 8917 is a crucial IRS document designed for this purpose. This form holds the key to potentially reduce your tax burden, but it is essential you understand it.

Form 8917 allows you to deduct qualified educational expenses, which can make a significant financial difference. To benefit from it, you must first ensure your eligibility and gather the necessary documentation. Also, filling out Form 8917 accurately is of utmost importance; even a small mistake can have financial consequences.

So, in this guide, you will understand the significance of Form 8917 and how to file it, ensuring you maximize your education-related tax benefits.

Form 8917: What It Is, How to File It:

- Purpose and Usage

- Tax Burden Reduction

- Eligibility Requirements

- Qualified Expenses

- Refundable vs. Non-Refundable Credits

- Required Documentation

- Filing Process

- Deadline and Timing

- Penalties for Errors

- Tax Professional Help

Recap

1. Purpose and Usage

The purpose of Form 8917 is to report educational expenses related to the American Opportunity Credit and Lifetime Learning Credit on your federal tax return. You use this form to claim these credits, which can help offset the cost of higher education.

To ensure accurate reporting, you must provide essential details regarding qualified expenses and student enrollment. Keep in mind that this is a tax-related document, so precise information is crucial.

2. Tax Burden Reduction

Form 8917 offers you a unique way to reduce your tax burden. If you fill out this form correctly, you take advantage of the American Opportunity Credit and the Lifetime Learning Credit, which directly decrease the amount of income tax you owe.

The American Opportunity Credit, for instance, provides you with up to $2,500 in tax credits for eligible education expenses during the first four years of college. The Lifetime Learning Credit offers you up to $2,000 for qualified education costs beyond the first four years.

Utilize Form 8917 and potentially save a significant amount of money on your tax bill while you invest in your education or that of your family members. It’s a reliable way to alleviate your tax burden when you’re eligible for these credits.

3. Eligibility Requirements

Before you file Form 8917 to claim educational tax credits or benefits, ensure you meet the following requirements:

- Make sure you are the taxpayer, spouse, or a dependent who incurred qualified education expenses.

- Verify that you have attended an eligible educational institution, defined by the IRS, for the year you’re claiming the credit.

- Ensure that you have received a Form 1098-T from your educational institution, which reports your qualified tuition and related expenses.

- Confirm that you’re not filing as “Married Filing Separately” if you wish to claim the American Opportunity Credit. This means that if you’re married and want to claim educational credits, it’s typically best you file jointly with your spouse on your tax return to be eligible for those credits. This filing status is “Married Filing Jointly.”

- Make sure you meet the income limitations set by the IRS, as these vary based on the credit you’re claiming.

- Keep records of your expenses, as it is essential for calculating the credit accurately.

- Verify the eligibility of the educational expenses you intend to claim, ensuring it meets IRS criteria.

- Take note of any other education benefits you may have received, as these may affect your eligibility and the amount of credit you can claim.

>>>PRO TIPS: Federal Tax Credit for Residential Solar Energy

4. Qualified Expenses

Form 8917 allows you to claim educational tax credits for various qualified expenses, which include:

- Tuition and fees required for enrollment

- Course materials like textbooks and supplies

- Expenses for a student activity fee

- Equipment and technology essential for coursework

- Costs for room and board if the student is at least half-time

- Health fees that are mandatory for students

- Expenses for special needs services

- Interest on student loans under certain conditions

5. Refundable vs. Non-Refundable Credits

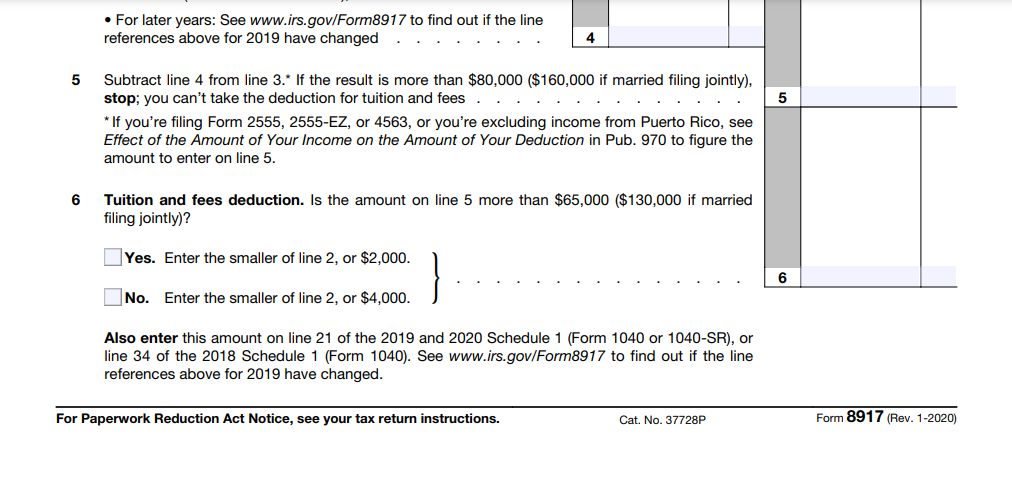

Understand the crucial difference between refundable and non-refundable tax credits when claiming education benefits on Form 8917. Refundable credits, like the American Opportunity Credit, can reduce your tax liability to zero, and if the credit exceeds your taxes, you may receive a refund for the remaining amount.

In contrast, non-refundable credits, such as the Lifetime Learning Credit, can only reduce your tax liability to zero; you won’t receive a refund if the credit exceeds your taxes. It’s essential you know which type you’re eligible for and how it affects your financial outcome. Accurate knowledge empowers you to maximize your education-related tax benefits and make informed financial decisions.

6. Required Documentation

Your eligibility for education tax benefits with Form 8917 relies on proper documentation. Prepare the following records for a successful claim:

- Collect and attach Form 1098-T from your educational institution. It shows the qualified expenses you paid and any scholarships or grants you received.

- Retain receipts for course materials, textbooks, and supplies to prove eligibility for these expenses.

- Maintain records of your room and board payments, if applicable, especially if you’re at least a half-time student.

- Keep documentation of any special needs services or equipment costs you incur for educational purposes.

- Retain proof of interest you paid on student loans that meet IRS requirements. This supports your claim for the student loan interest deduction.

7. Filing Process

To file Form 8917 accurately:

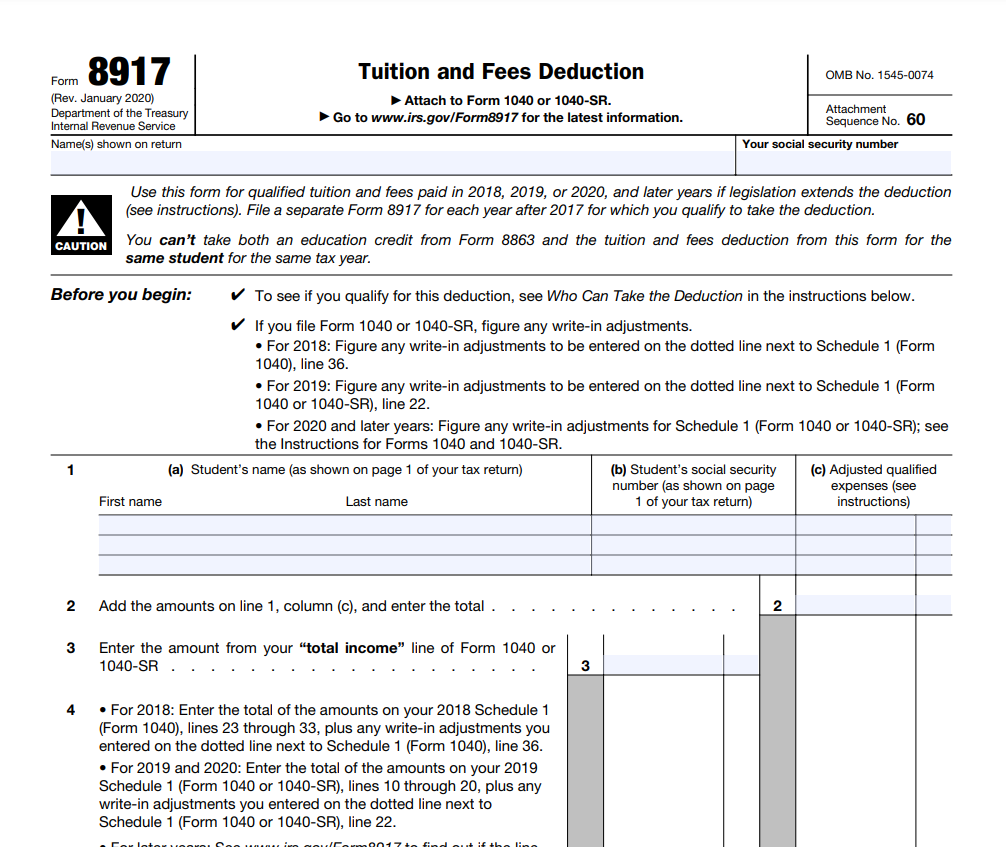

- Obtain the Form: Visit the IRS website to download the current Form 8917.

- Fill Out the Form: Provide accurate and honest information in all required sections.

- Attach Supporting Documents: Include receipts and records that validate your educational expenses.

- Review the Form: Double-check for errors or missing information on your completed Form 8917.

- Submit Form 8917 with Your Tax Return: Include it when you file your annual tax return by the due date.

- Maintain Copies for Your Records: Keep copies of all forms and documents for your personal tax records.

8. Deadline and Timing

File and submit Form 8917 on time with your annual tax return to maximize educational tax benefits. Most often, the IRS deadline coincides with the tax return due date, commonly April 15. If you need extra time, get an extension for your tax return, but remember it doesn’t extend your payment deadline.

Filing early expedite your tax credit, especially for refunds. Ensure accuracy and timeliness, and stay updated for any changes to guarantee a reliable process.

9. Penalties for Errors

If you provide false information or make errors on Form 8917, you risk IRS penalties. Common mistakes include inaccuracies in reporting educational expenses or not attaching necessary documentation. The IRS may assess fines or disallow your education tax credits.

To avoid this, meticulously review your form and supporting records. Double-check the figures and ensure it matches your documents. Seek professional assistance if you’re uncertain about any part of the form.

Timely and precise submissions are key to avoiding penalties. Stay updated on IRS guidelines, follow instructions carefully, and keep your records organized.

10. Tax Professional Help

Seek the assistance of qualified tax professionals for Form 8917 if you’re unsure about your eligibility or have complicated financial situations. These are experts who guide you through complex tax rules and ensure accurate and reliable submissions.

Tax professionals help you identify eligible education tax benefits to maximize your credits. Also, a tax professional will review your documentation to reduce the risk of errors. Moreover, these experts keep you updated on any IRS guideline changes, ensuring compliance.

Recap

Use Form 8917 to claim education tax benefits. It eases your tax burden by reducing your eligible expenses. You must meet IRS requirements, keep records, and submit it accurately and on time. Errors can lead to penalties, so seek professional help if you are unsure about the requirements. Stay informed to maximize your tax benefits.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. . For comprehensive tax, legal or financial advice, always contact a qualified professional in your area. S’witty Kiwi assumes no liability for actions taken in reliance upon the information contained herein.

No Comment! Be the first one.