Feeling financially derailed by tax season? Hold the brakes! Form 8900, the Qualified Railroad Track Maintenance Credit, could be your express ticket to a smoother tax ride. Confused by the fine print? Don’t sweat it. This guide will demystify the process, leaving you clear-headed and ready to claim your potential refund.

What is this credit? Think of it as a reward for keeping those railroad tracks humming – a tax break for responsible maintenance. Buckle up for a clear, concise journey through Form 8900. You’ll be navigating your tax return like a seasoned engineer in no time, ready to claim your well-deserved railroad refund.

- Unravel the complexities of Form 8900

- Explore the Benefits of Qualified Railroad Track Maintenance Credit

- Discover who qualifies for the credit.

- Follow a Step-by-Step Filing Process

- Explore strategies to maximize your Qualified Railroad Track Maintenance Credit.

- Understand Any Unique Circumstances or Special Cases Related to Filing for This Credit.

Ready? Let’s roll

1. Unravel the complexities of Form 8900

Unravel the complexities of Form 8900 in the context of the Qualified Railroad Track Maintenance Credit. Begin by delving into the intricacies of this tax document, breaking down each section with precision. Understand the specific information required and how it contributes to claiming the credit effectively.

Form 8900 is a tax form that you need to fill out if you want to claim the railroad track maintenance credit (RTMC) for the year. The RTMC is a tax benefit that helps you reduce your tax liability by paying for the maintenance of the tracks that you use to transport goods or passengers.

Remember, clarity is key. Equip yourself with the insights needed to decipher Form 8900 seamlessly, ensuring accuracy in your filing. By unraveling the complexities of this form, you pave the way for a smoother and more informed process, setting the stage for successful qualification and claiming of the Qualified Railroad Track Maintenance Credit.

>>>MORE: Form 945: What It Is, How to File It

2. Explore the Benefits of Qualified Railroad Track Maintenance Credit

Take the time to uncover the nuances of this credit, recognizing how it contributes to your overall financial well-being.

The qualified railroad track maintenance credit (RTMC) is a tax benefit that can help you save money on your taxes if you are involved in the railroad industry. The RTMC allows you to deduct a percentage of your expenses for maintaining the tracks that you use to transport goods or passengers.

Some of the benefits of the RTMC are:

It can reduce your taxable income and lower your tax liability. Also, it can increase your cash flow and profitability by incentives for track maintenance. It can support the economic development and transportation infrastructure of the country by facilitating rail freight and passenger services.

3. Discover Who Qualifies For The Credit.

Keep in mind that the credit in Form 8900 is called the railroad track maintenance credit (RTMC). It is a tax credit that you can claim if you pay or incur qualified railroad track maintenance expenditures (QRTME) during the tax year. The RTMC can reduce your taxable income by up to $3,500 per short line track mile per year or 50% of the QRTME, whichever is less.

To qualify for the RTMC, you must meet certain requirements, such as a Class II or Class III railroad, or a person who provides railroad-related services or property to a Class II or Class III railroad.

You must also pay or incur qualified railroad track maintenance expenditures (QRTME) during the year, which are expenses that are directly related to the maintenance of eligible railroad tracks. Eligible railroad track includes any track that Class II or Class III railroad use, and any track assigned to you by a Class II or Class III railroad for purposes of the credit.

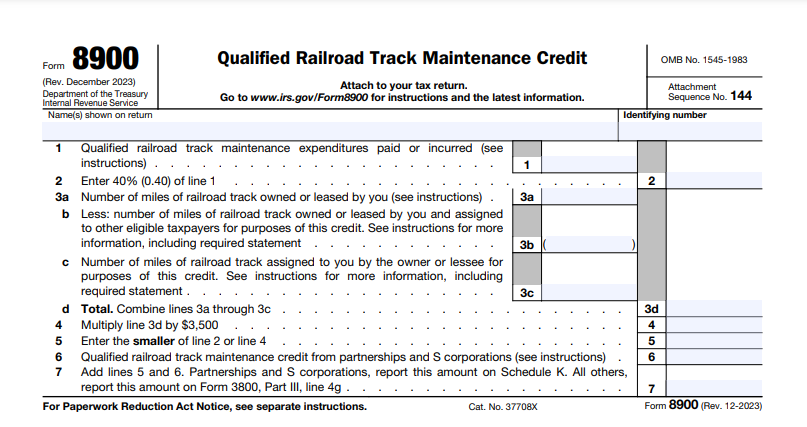

If you are an assignor of miles of eligible railroad track, you must also file Form 8900 even if you do not claim any RTMC. You must provide information about the assigned miles, the QRTME paid or assignee incurred, and any other relevant information on lines 3a through 3c of Form 8900. You can find more details and instructions on how to fill out Form 8900 on the IRS website.

4. Follow a Step-by-Step Filing Process

If you are a railroad company or a person who transports or provides services to a railroad, you may be eligible to claim a tax credit for the costs of maintaining your railroad track. This credit is known as the qualified railroad track maintenance credit (RTMC) and it can reduce your taxable income by up to $3,500 per mile of eligible track per year.

To claim this credit, you need to file Form 8900 with your tax return. This form asks for information about the miles of eligible tracks assigned to you by the railroad, the amount of qualified track maintenance expenditures (QRTME) paid, and any other relevant details. You can find Form 8900 and its instructions on the IRS website.

Filing Form 8900 is not very complicated, but it does require some attention to detail. You need to make sure that you have all the necessary documents and records to support your claim, such as invoices, receipts, contracts, agreements, etc. You also need to follow the rules and limitations for claiming this credit, such as the safe harbor rule for assignments of miles of eligible track. If you have any questions or doubts about how to file Form 8900 or how much credit you can claim, you should consult a tax professional or contact the IRS for guidance.

5. Explore Strategies to Maximize Your Qualified Railroad Track Maintenance Credit.

One of the benefits of claiming the qualified railroad track maintenance credit (RTMC) is that it can lower your taxable income and save you money on taxes. However, to maximize this credit, you need to follow some strategies when filing Form 8900 and reporting your qualified railroad track maintenance expenditures (QRTME).

Firstly, keep track of the miles of eligible track the railroad assigns to you. You need to report the number of miles assigned to you on line 3b of Form 8900. You can use a logbook, a spreadsheet, or any other method that works for you to record this information.

Also, document your QRTME paid or incurred during the year. You need to provide evidence that you paid or incurred QRTME for the eligible track assigned to you. This can include invoices, receipts, contracts, agreements, etc. You should keep copies of these documents for at least three years in case of an audit.

6. Understand Any Unique Circumstances or Special Cases Related to Filing for This Credit

Don’t forget that filing for the qualified railroad track maintenance credit (RTMC) can be a complex and challenging process, especially if you have any unique circumstances or special cases that affect your eligibility or amount of credit. Here are some examples of such situations and how to deal with them:

- If you are a Class I railroad, you may have different rules and limitations for claiming the RTMC than other eligible taxpayers. For example, you must report the miles of eligible track the railroad on line 3b of Form 8900 assigned to you, even if you do not claim any RTMC. You also must follow the safe harbor rule for assignments of miles of eligible track, which requires that you enter into a written agreement with the assignor no later than March 19, 2020, and that the agreement is effective as of the close of the tax year in which it is entered into. You can find more information about Class I railroads and their RTMC requirements on the IRS website.

- If you are a partner or S corporation that provides railroad-related services or property to a Class II or Class III railroad, you may be able to claim the RTMC indirectly through your assignor. However, you must file Form 8900 to report your share of the QRTME paid during the tax year. You must also provide information about your relationship with your assignor and your share of the QRTME on lines 4a through 4c of Form 8900. You can find more information about indirect claims on line 4g in Part III of Form 3800.

>>>GET SMARTER: Form 5498-ESA: What It Is, How to File It

Recap

To demystify Form 8900, unlock its secrets. Dive into the perks of the Qualified Railroad Track Maintenance Credit— it’s not just a credit; it’s a financial game-changer. Identify your eligibility; this credit might be tailor-made for you.

Navigate filing seamlessly with a step-by-step guide. Optimize your credit claim with savvy strategies. Address unique cases intelligently. Your journey starts now – unravel, explore, discover, follow, maximize, understand, and stay informed for financial success.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. . For comprehensive tax, legal or financial advice, always contact a qualified professional in your area. S’witty Kiwi assumes no liability for actions taken in reliance upon the information contained herein.

No Comment! Be the first one.