Imagine your small business as a bustling hub of innovation, where every decision you make echoes in the rhythm of progress. Now, picture the IRS stepping in, not as a daunting presence demanding your dues but as a collaborator, offering a helping hand in your quest to provide a secure future for your employees.

That’s where Form 8881, the unsung hero of small businesses, comes into play – a ticket to unlocking a tax credit for the courageous entrepreneurs delving into the world of pension plans. So, pull up a chair and unravel the tale of Form 8881 – what it is, who gets a golden ticket to its benefits, and the roadmap to filing that could transform the financial landscape of your business.

1. Understanding Form 8881

2. Who Qualifies for This Credit?

3. Range Of Eligible Retirement Plans

4. Deciphering The Filing Process

5. Additional Insights and Tips

Summary

1. Understanding Form 8881

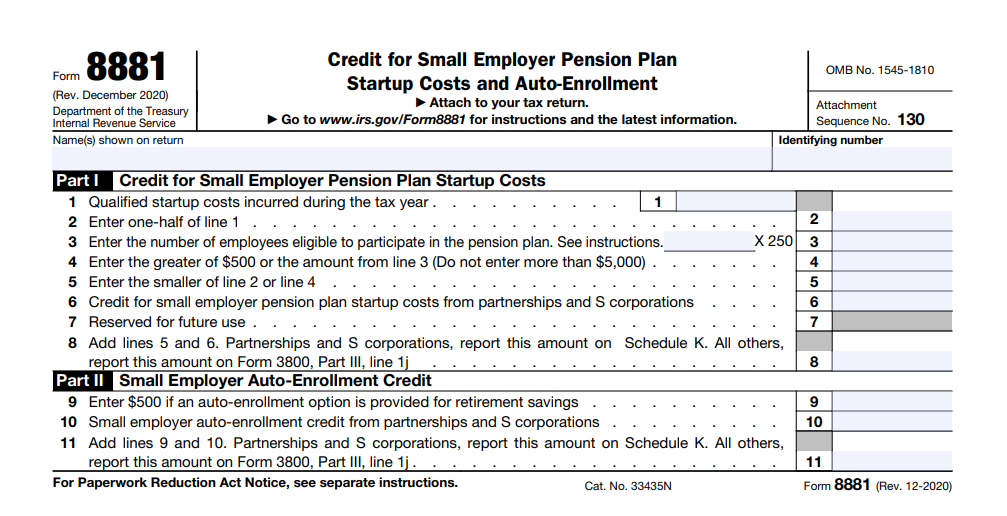

Form 8881 is more than just a tax document; it’s a gateway for small businesses to unlock financial benefits while investing in their employees’ future. This form, titled “Credit for Small Employer Pension Plan Startup Costs,” provides a tax credit for businesses venturing into the realm of retirement plans. To grasp its significance, consider it as the IRS acknowledging and rewarding the efforts of small business owners committed to ensuring their employees’ financial well-being.

Understanding Form 8881 involves recognizing your eligibility – having 100 or fewer employees, each with at least $5,000 in compensation, and either initiating a qualified retirement plan or having been without one for the past three tax years. Once eligible, the form guides you through a straightforward process: gather evidence of startup and administrative costs, input basic business information, calculate the credit, and attach supporting documents.

In essence, Form 8881 is a tool that transforms the complexity of retirement plan contributions into a tangible benefit. It embodies a collaborative effort between small businesses and the IRS, fostering a culture of financial responsibility and employee care.

2. Who Qualifies for This Credit?

The allure of Form 8881, the “Credit for Small Employer Pension Plan Startup Costs,” beckons to a specific group of ambitious business owners ready to make a positive impact on their employees’ financial futures. To qualify for this credit, a business must embody the essence of a small enterprise, having 100 or fewer employees. Each of these employees must have received a minimum of $5,000 in compensation during the previous tax year.

Furthermore, eligibility extends to businesses either embarking on the establishment of a qualified retirement plan or those with the courage to rekindle this financial flame after a hiatus of three tax years. In essence, Form 8881 is a beacon for the small business owner who recognizes the significance of providing retirement benefits and is willing to take the leap.

3. Range Of Eligible Retirement Plans

The beauty of Form 8881 lies in its flexibility, recognizing that businesses have unique needs when it comes to retirement plans. Eligible for this small employer pension plan startup costs credit are a diverse array of retirement plans, offering businesses the freedom to choose what aligns best with their goals.

Whether you’re inclined towards a Simplified Employee Pension (SEP) plan, a straightforward and cost-effective choice, or the Savings Incentive Match Plan for Employees of Small Employers (SIMPLE) plan, designed for ease of administration, Form 8881 extends its benefits. But that’s not all – traditional defined benefit or defined contribution plans, the stalwarts of retirement planning, also fall within the ambit of eligibility.

>>>PRO TIPS: Form 1099-Q: What It Is, How to File It

4. Deciphering The Filing Process

Confirm Your Eligibility

Before diving into the paperwork, ensure that your business qualifies for the credit. Check that you have 100 or fewer employees, each receiving at least $5,000 in compensation, and that your business is either initiating a qualified retirement plan or hasn’t had one in the past three tax years.

Gather Necessary Documents

Collect all relevant documentation to support your claim. This includes records of startup and administrative costs associated with your qualified retirement plan. Think of this step as assembling the evidence needed to validate your credit.

Obtain Form 8881

You can download Form 8881 from the IRS website or obtain a physical copy from your tax advisor. Familiarize yourself with the form and its instructions to understand what information is required.

Provide Basic Business Information

Fill out the basic details about your business on Form 8881. This includes your employer identification number (EIN), business name, and tax year. This information helps the IRS identify your business and process your credit application.

Calculate the Credit

Follow the instructions on Form 8881 to calculate the credit. Input the necessary figures based on your eligible startup and administrative costs. The form provides guidance on the specific calculations required, making it a systematic process.

Document Your Claims

To substantiate your claims, attach all supporting documents, such as receipts, invoices, and any other relevant paperwork. This step is crucial for proving the legitimacy of the costs you’re claiming on the form.

Attach to Your Tax Return

Once Form 8881 is completed and all supporting documents are in order, attach it to your regular business tax return. This is usually done when filing your annual tax return. It’s like bundling everything together before presenting it to the IRS.

Submit Your Tax Return

File your business tax return, including Form 8881, by the applicable deadline. Ensure that all information is accurate and consistent with your supporting documents. This can often be done electronically or by mailing a physical copy, depending on your preference and the IRS guidelines.

Keep Copies for Your Records

After submitting your tax return, keep copies of Form 8881 and all supporting documents for your records. This documentation is essential in case of any inquiries from the IRS or for future reference.

5. Additional Insights and Tips

The credit has its limits – it covers 50% of your qualified startup costs, up to a maximum of $500 per year for the first three years of your plan. It’s a nice perk, but it’s good to know the boundaries.

If you don’t use the entire credit in one go, no worries – you can carry the leftovers to the next tax year. It’s like saving a piece of cake for later.

>>>GET SMARTER: Form 8917: What It Is, How to File It

Summary

Form 8881 is not just another IRS form; it’s an opportunity. It’s the IRS acknowledging that being a small business taking care of your employees’ financial future deserves a little financial boost.

By understanding who qualifies, what types of retirement plans are eligible, and navigating the filing process step by step, you’re not just filling out paperwork – you’re actively investing in the future, both for your business and the people who drive its success. Cheers to planning for a financially secure tomorrow!

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. . For comprehensive tax, legal or financial advice, always contact a qualified professional in your area. S’witty Kiwi assumes no liability for actions taken in reliance upon the information contained herein.

No Comment! Be the first one.